Tax Ref Irs Treas 310

The Internal Revenue Service (IRS) plays a crucial role in the United States tax system, ensuring that individuals and businesses comply with tax laws and regulations. Among the various forms and documents used in this complex process, Tax Ref IRS Treas 310 stands out as a significant and often misunderstood aspect of tax administration.

In this comprehensive guide, we will delve into the world of Tax Ref IRS Treas 310, exploring its purpose, functionality, and impact on taxpayers. By understanding this specific tax reference number, we can gain valuable insights into the intricate workings of the IRS and its role in maintaining fiscal responsibility.

Unraveling the Mystery: Tax Ref IRS Treas 310

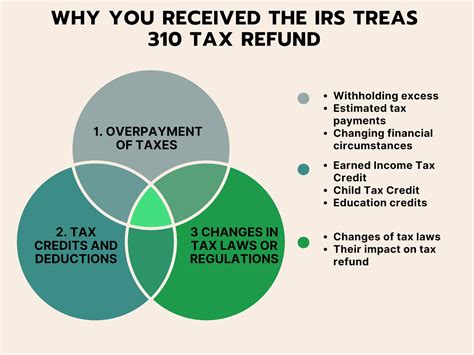

Tax Ref IRS Treas 310, or simply IRS Treas 310, is a unique identifier assigned to a specific category of tax refunds issued by the Internal Revenue Service. This reference number serves as a crucial link between the taxpayer and the IRS, providing a trackable and identifiable record for tax refund transactions.

The IRS utilizes a sophisticated system of tax reference numbers to categorize and manage various types of tax returns and refunds. IRS Treas 310 is one such number, designed to handle a specific subset of refund cases, often involving unique circumstances or specialized tax situations.

By understanding the purpose and implications of Tax Ref IRS Treas 310, taxpayers can better navigate the refund process, ensuring a smooth and timely resolution to their tax obligations. This guide aims to demystify this tax reference number, offering practical insights and expert guidance.

The Purpose and Functionality of IRS Treas 310

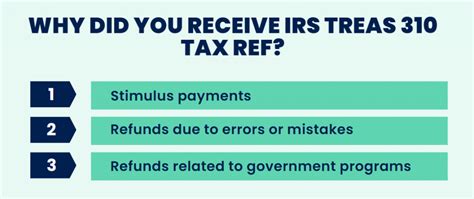

IRS Treas 310 is a specialized tax reference number, assigned to tax refunds that fall under a specific category of tax returns. These returns often involve complex tax scenarios, such as those arising from foreign earnings, certain business activities, or unique tax situations.

The primary purpose of IRS Treas 310 is to streamline the processing of these specialized tax refunds, ensuring that the IRS can efficiently handle the unique requirements associated with these cases. By categorizing these refunds separately, the IRS can allocate appropriate resources and expertise to handle the specific complexities involved.

For taxpayers, understanding that their tax refund falls under IRS Treas 310 can provide valuable insights into the expected processing time and any additional documentation or information that may be required. This knowledge empowers taxpayers to actively monitor their refund status and take appropriate actions if delays occur.

Key Characteristics of IRS Treas 310 Refunds

-

Complex Tax Scenarios: IRS Treas 310 refunds often arise from tax returns that involve intricate tax calculations, foreign tax credits, or unique business structures. These scenarios require specialized knowledge and careful review by IRS experts.

-

Extended Processing Times: Due to the complexity of the tax situations involved, IRS Treas 310 refunds may take longer to process compared to standard refunds. Taxpayers should be prepared for potential delays and plan their financial strategies accordingly.

-

Additional Documentation: In many cases, taxpayers with IRS Treas 310 refunds may need to provide additional documentation or supporting evidence to substantiate their tax claims. This could include foreign tax forms, business records, or other specialized tax documents.

By recognizing the unique characteristics of IRS Treas 310 refunds, taxpayers can proactively address any potential challenges and ensure a smoother refund process. This includes staying organized, maintaining accurate records, and seeking professional tax advice when necessary.

Real-World Examples: IRS Treas 310 in Action

To illustrate the practical implications of IRS Treas 310, let's explore a few real-world scenarios where this tax reference number comes into play.

Scenario 1: Foreign Earnings and Tax Credits

Imagine a US citizen working abroad who has significant earnings from their overseas employment. When filing their tax returns, they claim foreign tax credits to offset the taxes paid in the foreign country. In this scenario, the IRS may assign a Tax Ref IRS Treas 310 to their refund, recognizing the specialized nature of their tax situation.

The foreign tax credit system is complex, and the IRS needs to carefully review these cases to ensure compliance with international tax treaties and regulations. By assigning IRS Treas 310, the IRS can allocate the necessary resources to process these refunds efficiently, minimizing potential errors and delays.

Scenario 2: Business Activities and Tax Elections

Consider a small business owner who has elected to be taxed as an S corporation. This election involves complex tax calculations and unique reporting requirements. When filing their tax returns, they may encounter IRS Treas 310, indicating that their refund is subject to specialized processing.

S corporation tax elections require careful consideration of various factors, including income distribution, shareholder reporting, and tax obligations. By assigning IRS Treas 310, the IRS ensures that these refunds are handled by experts who understand the intricacies of S corporation taxation.

Scenario 3: Unique Tax Situations

Some taxpayers find themselves in unique tax situations that require specialized attention. For example, individuals involved in estate planning, complex trust structures, or certain types of investment activities may encounter IRS Treas 310 when filing their tax returns.

These unique tax scenarios often involve intricate calculations, specialized tax forms, and potential audit risks. By identifying these cases with IRS Treas 310, the IRS can provide the necessary expertise and resources to process these refunds accurately and efficiently.

Expert Insights and Strategies for IRS Treas 310 Refunds

Navigating the complexities of IRS Treas 310 refunds requires a strategic approach and expert guidance. Here are some key insights and strategies to consider when dealing with this specialized tax reference number.

Stay Organized and Maintain Records

Given the complex nature of IRS Treas 310 refunds, it is crucial to stay organized and maintain detailed records. Keep track of all tax-related documents, receipts, and supporting evidence. This ensures that you have the necessary information to substantiate your tax claims and respond promptly to any IRS inquiries.

Seek Professional Tax Advice

IRS Treas 310 refunds often involve unique tax scenarios that may be beyond the scope of basic tax preparation software or DIY tax filing. Consider seeking the expertise of a certified public accountant (CPA) or tax professional who specializes in complex tax situations. They can provide valuable guidance, ensure compliance, and help you navigate the complexities of your tax refund.

Understand Processing Times and Potential Delays

As mentioned earlier, IRS Treas 310 refunds may take longer to process due to the specialized nature of the tax scenarios involved. Be prepared for potential delays and plan your financial strategies accordingly. Stay updated on the status of your refund through the IRS website or by using the IRS refund tracker tool.

Communicate with the IRS

If you have questions or concerns regarding your IRS Treas 310 refund, don't hesitate to communicate with the IRS. The IRS offers various channels for taxpayer assistance, including online resources, telephone support, and in-person assistance at Taxpayer Assistance Centers. By engaging with the IRS, you can clarify any uncertainties and potentially expedite the refund process.

The Future of IRS Treas 310: Technological Advancements and Process Improvements

As technology continues to evolve, the IRS is embracing innovative solutions to streamline its tax administration processes, including those related to IRS Treas 310 refunds. Here's a glimpse into the future of IRS Treas 310 and the potential improvements on the horizon.

Digitalization and Data Analytics

The IRS is increasingly adopting digital technologies and data analytics to enhance its tax administration capabilities. By leveraging advanced data analytics, the IRS can identify patterns, detect potential errors or fraud, and improve the efficiency of processing IRS Treas 310 refunds.

Digitalization also enables the IRS to enhance its communication channels, providing taxpayers with real-time updates and improved transparency throughout the refund process. Taxpayers can expect more efficient and secure interactions with the IRS, thanks to these technological advancements.

Improved Taxpayer Experience

The IRS recognizes the importance of a positive taxpayer experience and is working towards improving its services. This includes simplifying tax processes, enhancing taxpayer education, and providing clear and concise guidance. As the IRS continues to evolve, taxpayers can anticipate more user-friendly systems and improved accessibility.

Enhanced Security Measures

With the increasing prevalence of cyber threats, the IRS is investing in robust security measures to protect taxpayer data. By implementing advanced cybersecurity protocols, the IRS aims to safeguard sensitive information and ensure the integrity of its systems. This commitment to security is crucial for maintaining taxpayer trust and confidence in the tax administration process.

Conclusion: Navigating the Complex World of Tax Refunds

Tax Ref IRS Treas 310 serves as a crucial identifier in the complex world of tax refunds, helping the IRS manage specialized tax scenarios efficiently. By understanding the purpose and implications of this tax reference number, taxpayers can navigate the refund process with confidence and take proactive steps to ensure a smooth resolution.

As the IRS continues to embrace technological advancements and process improvements, taxpayers can anticipate a more streamlined and secure tax refund experience. By staying informed, seeking expert guidance, and embracing digital tools, taxpayers can effectively manage their tax obligations and maximize the benefits of the IRS refund system.

What does IRS Treas 310 indicate about my tax refund?

+IRS Treas 310 indicates that your tax refund falls under a specific category of refunds that require specialized processing due to complex tax scenarios. It often involves foreign earnings, certain business activities, or unique tax situations.

How long does it take for an IRS Treas 310 refund to be processed?

+Processing times for IRS Treas 310 refunds may vary, but they generally take longer compared to standard refunds due to the complex nature of the tax situations involved. Taxpayers should be prepared for potential delays and plan their finances accordingly.

Do I need to provide additional documentation for an IRS Treas 310 refund?

+Yes, taxpayers with IRS Treas 310 refunds may need to provide additional documentation or supporting evidence to substantiate their tax claims. This could include foreign tax forms, business records, or specialized tax documents.

How can I track the status of my IRS Treas 310 refund?

+You can track the status of your IRS Treas 310 refund by using the IRS refund tracker tool available on their website. Alternatively, you can call the IRS toll-free number for taxpayer assistance.

What should I do if I have questions or concerns about my IRS Treas 310 refund?

+If you have questions or concerns, you can contact the IRS through their website, telephone support, or by visiting a Taxpayer Assistance Center. They provide resources and assistance to help you navigate the refund process.