Indiana Property Tax Search

Welcome to this comprehensive guide on the Indiana Property Tax Search system, an essential tool for homeowners, investors, and anyone interested in real estate in the state of Indiana. The Indiana Property Tax Search is an online platform that provides access to vital property information, tax assessments, and payment details. In this article, we will delve into the intricacies of this system, exploring its features, benefits, and how it can assist individuals in making informed decisions regarding property ownership and investments.

Understanding the Indiana Property Tax Search System

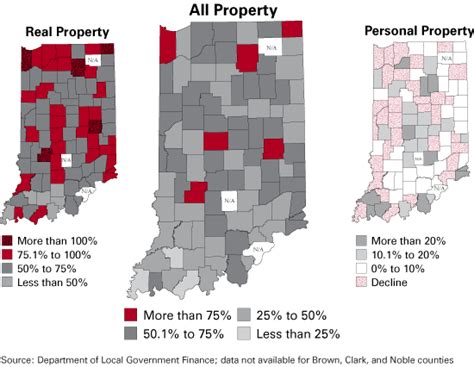

The Indiana Property Tax Search is a digital platform developed and maintained by the Indiana Department of Local Government Finance (DLGF). It serves as a centralized hub for property-related information, offering a user-friendly interface that empowers residents and stakeholders to access crucial data with ease.

This innovative system plays a pivotal role in the state's tax assessment and collection processes, ensuring transparency and efficiency. By providing access to detailed property information, it fosters a better understanding of the tax obligations associated with real estate ownership in Indiana.

Key Features of the Indiana Property Tax Search

The Indiana Property Tax Search platform boasts a range of features designed to cater to the diverse needs of its users. Here’s an overview of some of its key functionalities:

- Property Search: Users can search for properties by address, owner name, or parcel number. This comprehensive search functionality allows for quick and accurate retrieval of property details.

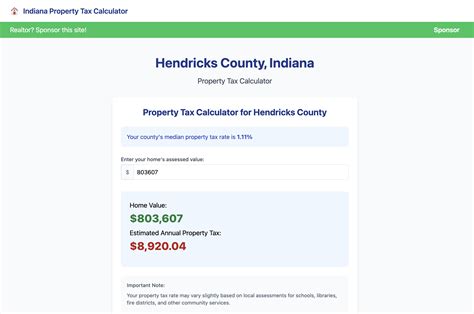

- Assessment Information: The platform provides access to detailed assessment reports, including the assessed value, taxable value, and any applicable exemptions. This information is vital for understanding a property's tax liability.

- Tax History: Property owners and interested parties can view the tax history of a specific property, including past assessments, tax rates, and payment records. This feature aids in identifying trends and potential changes over time.

- Payment Options: Indiana Property Tax Search offers a convenient online payment system, allowing users to pay their property taxes securely. It accepts various payment methods, ensuring flexibility for taxpayers.

- Tax Rate Information: The platform provides insights into tax rates applicable to different areas within Indiana. This information is essential for calculating estimated taxes and understanding the tax landscape.

- Exemptions and Credits: Users can explore the various exemptions and tax credits available in Indiana, such as the Homestead Deduction or Veteran's Exemption. This feature assists in determining eligibility and potential tax savings.

- Mapping Tools: An integrated mapping tool allows users to visually locate properties and understand their geographical context. This is particularly useful for investors and real estate professionals.

- Notices and Alerts: The system provides notification options for important dates, such as assessment notices, tax payment deadlines, and changes in tax rates. This ensures that users stay informed and avoid penalties.

These features, among others, make the Indiana Property Tax Search an invaluable resource for anyone involved in Indiana's real estate market. Whether you're a homeowner, a real estate agent, or a government official, this platform enhances transparency, accessibility, and efficiency in property tax management.

How to Utilize the Indiana Property Tax Search Effectively

To maximize the benefits of the Indiana Property Tax Search, it’s essential to understand how to navigate and utilize its various features. Here’s a step-by-step guide to help you get started:

- Access the Platform: Begin by visiting the official Indiana Property Tax Search website. Ensure you have a stable internet connection and a compatible web browser for seamless access.

- Register an Account: While not mandatory for basic searches, registering an account provides additional benefits. It allows you to save search preferences, receive alerts, and access advanced features.

- Conduct a Property Search: Utilize the search bar to enter the property's address, owner's name, or parcel number. The system will generate a list of matching properties, providing basic information and assessment details.

- Explore Property Details: Click on a specific property to access its detailed profile. Here, you'll find information such as the property's physical attributes, ownership history, assessment values, and tax information.

- Review Tax History: Navigate to the "Tax History" section to view a comprehensive timeline of tax assessments, rates, and payments. This feature is particularly useful for identifying trends and potential discrepancies.

- Calculate Estimated Taxes: Use the platform's tax rate information to estimate the property taxes you may owe. This can be done by multiplying the taxable value by the applicable tax rate for your area.

- Explore Exemptions and Credits: If you believe you may be eligible for any tax exemptions or credits, use the dedicated section to explore these options. The platform provides detailed information on eligibility criteria and application processes.

- Make Online Payments: Should you need to pay your property taxes online, navigate to the "Payments" section. Follow the instructions to securely complete the payment process using your preferred method.

- Set Up Alerts: To stay informed about important dates and changes, set up alerts and notifications. This ensures you receive timely reminders for assessment notices, tax payment deadlines, and more.

- Utilize Mapping Tools: If you're exploring multiple properties, the mapping tool can be a valuable asset. It allows you to visualize the location of properties, understand their surroundings, and make informed decisions.

By following these steps and exploring the various features of the Indiana Property Tax Search, you can efficiently manage your property tax obligations, stay informed about changes, and make well-informed real estate decisions.

Benefits of the Indiana Property Tax Search for Homeowners

The Indiana Property Tax Search platform offers a multitude of advantages to homeowners, empowering them to take control of their property tax management and make informed decisions. Here are some key benefits:

- Transparency and Accountability: The platform provides transparent access to property assessment information, ensuring homeowners understand their tax obligations. This transparency fosters accountability and trust in the tax assessment process.

- Easy Access to Property Details: Homeowners can quickly retrieve detailed information about their property, including its physical attributes, assessed value, and tax history. This information is crucial for making informed decisions regarding maintenance, improvements, and future planning.

- Identification of Tax Savings: By exploring exemptions and tax credits, homeowners can identify potential opportunities to reduce their tax burden. The platform provides clear guidelines on eligibility, allowing homeowners to maximize their tax savings.

- Convenient Online Payments: The Indiana Property Tax Search offers a secure and convenient online payment system. Homeowners can pay their taxes without the hassle of visiting government offices, saving time and effort.

- Stay Informed about Changes: The platform's notification system keeps homeowners updated on important dates and changes. This includes assessment notices, tax rate adjustments, and payment deadlines, ensuring homeowners avoid late fees and penalties.

- Understanding Property Value: Access to detailed assessment reports and tax history allows homeowners to gain insights into their property's value over time. This information is valuable for refinancing, selling, or simply understanding the financial health of their investment.

- Enhanced Decision-Making: With comprehensive property information at their fingertips, homeowners can make more informed decisions. Whether it's deciding on home improvement projects, exploring refinancing options, or evaluating the potential impact of changes in tax rates, the platform provides the data needed for effective decision-making.

In summary, the Indiana Property Tax Search is a powerful tool that puts homeowners in the driver's seat when it comes to managing their property taxes. By leveraging its features and benefits, homeowners can ensure they are compliant, save money, and make well-informed choices regarding their real estate investments.

The Role of Indiana Property Tax Search in Real Estate Transactions

The Indiana Property Tax Search platform plays a critical role in the realm of real estate transactions, providing valuable insights and information to buyers, sellers, and real estate professionals. Here’s how it influences the process:

Buyer’s Perspective

For prospective buyers, the Indiana Property Tax Search is an invaluable resource during the due diligence phase. It allows buyers to:

- Evaluate Property Value: By accessing detailed assessment reports and tax history, buyers can gain a comprehensive understanding of a property's value. This information is crucial for determining a fair purchase price and negotiating effectively.

- Identify Potential Tax Savings: Buyers can explore exemptions and tax credits available to them, helping them estimate their future tax obligations accurately. This knowledge can influence their decision to pursue a particular property.

- Assess Maintenance and Upkeep: The platform's property details section provides insights into a property's physical attributes and maintenance history. Buyers can use this information to assess the property's condition and potential repair needs.

- Understand Tax Landscape: Buyers can familiarize themselves with the tax rates applicable to the area they are considering. This knowledge helps them budget for future property taxes and understand the overall financial implications of their purchase.

Seller’s Perspective

Sellers also benefit from the Indiana Property Tax Search platform, as it:

- Enhances Property Presentation: By providing potential buyers with access to detailed property information, sellers can showcase the value and features of their property more effectively. This transparency can attract serious buyers and expedite the selling process.

- Supports Accurate Pricing: Sellers can use the assessment information and tax history to set a competitive and realistic asking price. This ensures their property is positioned appropriately in the market and avoids potential pricing discrepancies.

- Addresses Buyer Concerns: The platform's comprehensive nature allows sellers to address potential buyer concerns about tax obligations, property value, and maintenance history. This can help build trust and confidence in the selling process.

Real Estate Professionals

Real estate agents and brokers rely on the Indiana Property Tax Search platform to:

- Provide Comprehensive Listings: By incorporating property tax information into their listings, real estate professionals can offer more detailed and attractive presentations to potential buyers. This enhances their reputation and competitiveness in the market.

- Offer Expert Advice: With access to detailed property data, real estate professionals can provide valuable insights to buyers and sellers. They can guide clients through the tax assessment process, help identify potential savings, and ensure a smooth transaction.

- Stay Informed about Market Trends: The platform's tax history and assessment data allow real estate professionals to analyze market trends and make informed predictions. This knowledge is essential for providing accurate market analyses and strategic advice to clients.

In summary, the Indiana Property Tax Search platform is a vital tool in the real estate transaction process. It empowers buyers, sellers, and real estate professionals with the information they need to make confident decisions, ensuring a more efficient and transparent marketplace.

Performance Analysis and Future Outlook

The Indiana Property Tax Search platform has demonstrated its effectiveness and efficiency in serving the state’s residents and stakeholders. Here’s an analysis of its performance and a glimpse into its future potential:

User Satisfaction and Feedback

The platform has received positive feedback from users, with many praising its user-friendly interface and comprehensive data. Homeowners, in particular, appreciate the transparency it brings to the tax assessment process, making it easier to understand and manage their obligations.

Real estate professionals have also expressed satisfaction with the platform's ability to streamline their work and provide valuable insights to their clients. The platform's integration of property tax information into the real estate ecosystem has been well-received, enhancing the overall efficiency of transactions.

Impact on Tax Collection

The Indiana Property Tax Search has contributed to improved tax collection efficiency. By providing taxpayers with a convenient and accessible platform, the state has seen increased compliance and timely tax payments. The online payment system has been particularly beneficial, offering a secure and user-friendly method for taxpayers to fulfill their obligations.

Future Enhancements and Innovations

Looking ahead, the Indiana Property Tax Search platform is poised for further enhancements and innovations. Here are some potential developments that could shape its future:

- Integration with Other Government Services: The platform could be integrated with other government services, such as permitting and licensing, to create a comprehensive digital hub for residents and businesses. This would streamline various administrative processes and save time for users.

- Advanced Data Analytics: By leveraging advanced data analytics techniques, the platform could provide more sophisticated insights to users. This could include predictive modeling for tax assessments, identifying potential errors or discrepancies, and offering personalized recommendations for tax planning.

- Mobile Optimization: With the increasing use of mobile devices, optimizing the platform for mobile accessibility could enhance user experience. This would allow users to access property tax information and perform tasks on the go, further improving convenience.

- Enhanced Security Measures: As digital platforms evolve, so do cybersecurity threats. The platform could implement advanced security measures to protect user data and ensure the integrity of the system. This would build trust and confidence among users.

- Community Engagement: The platform could foster greater community engagement by incorporating user feedback and suggestions. This could lead to the development of new features and improvements based on the needs and preferences of the user base.

In conclusion, the Indiana Property Tax Search platform has proven to be a valuable asset for Indiana's residents and stakeholders. Its performance has been commendable, and its future looks promising with potential enhancements that could further improve the user experience and streamline property tax management.

Conclusion: A Transparent and Efficient Property Tax System

The Indiana Property Tax Search platform stands as a testament to the state’s commitment to transparency and efficiency in property tax management. By providing a user-friendly, accessible platform, Indiana has empowered its residents and stakeholders to take control of their property tax obligations. The platform’s features, such as detailed property searches, assessment information, and online payments, have simplified the tax assessment and collection process, fostering a more positive experience for taxpayers.

As we've explored throughout this article, the Indiana Property Tax Search offers benefits to homeowners, real estate professionals, and buyers and sellers alike. It has revolutionized the way property tax information is accessed and utilized, leading to more informed decisions and a more efficient real estate market. The platform's positive impact on tax collection and user satisfaction highlights its success and potential for further growth and innovation.

In conclusion, the Indiana Property Tax Search platform is not just a tool for tax management; it's a catalyst for a more transparent, efficient, and prosperous real estate ecosystem in the state of Indiana. With its continuous development and enhancements, the platform is poised to remain a valuable resource for years to come.

How often are property assessments updated on the Indiana Property Tax Search platform?

+Property assessments are typically updated annually, usually around January or February. These updates reflect changes in property values and tax rates for the upcoming tax year.

Can I contest my property assessment if I believe it is inaccurate?

+Yes, if you believe your property assessment is incorrect, you have the right to appeal. The Indiana Property Tax Search platform provides information on the appeals process, including deadlines and requirements. It’s important to review the guidelines carefully and gather any necessary evidence to support your case.

Are there any penalties for late property tax payments?

+Yes, late property tax payments may incur penalties and interest. It’s crucial to stay informed about payment deadlines and make timely payments to avoid additional charges. The Indiana Property Tax Search platform provides notifications and reminders to help taxpayers stay on track.

Can I pay my property taxes in installments?

+Indiana offers a tax installment program that allows taxpayers to pay their property taxes in multiple installments. This program is designed to provide flexibility and ease the financial burden for some taxpayers. The specific details and eligibility criteria can be found on the Indiana Property Tax Search platform.

How can I stay updated on changes to tax rates and assessment practices in Indiana?

+The Indiana Property Tax Search platform provides notifications and updates on any significant changes to tax rates or assessment practices. Additionally, you can subscribe to newsletters or follow official government channels to