City Of Tucson Sales Tax

Welcome to an insightful exploration of the Sales Tax landscape in the vibrant city of Tucson, Arizona! In this comprehensive guide, we'll dive deep into the world of taxation, shedding light on the intricacies and impacts of the Sales Tax system within this dynamic metropolis. Get ready to uncover the economic implications, historical perspectives, and real-world applications that make Tucson's Sales Tax policy a fascinating topic of discussion.

Understanding Tucson’s Sales Tax Ecosystem

The city of Tucson, nestled in the picturesque Sonoran Desert, boasts a unique blend of cultural richness and economic vibrancy. As such, its Sales Tax structure plays a pivotal role in shaping the local economy and the daily lives of its residents. Let’s unravel the key components and implications of this essential revenue source.

A Historical Perspective

Dating back to the early 20th century, Tucson’s Sales Tax system has evolved alongside the city’s growth and changing economic landscape. Initially implemented as a means to generate revenue for essential public services, it has since become a cornerstone of the city’s fiscal strategy. The evolution of Sales Tax rates and the introduction of various tax exemptions over the years reflect the city’s commitment to balancing economic development and community needs.

Current Sales Tax Rates and Components

As of the latest updates, Tucson’s Sales Tax rate stands at 8.1%, which includes both the state and local components. This rate is comprised of a 6.6% state tax and a 1.5% local tax, with the latter dedicated to funding specific local initiatives and infrastructure projects.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 6.6% |

| Local Sales Tax | 1.5% |

It's worth noting that these rates are subject to change based on legislative decisions and can vary slightly across different jurisdictions within the city. Additionally, certain goods and services are exempt from Sales Tax, such as prescription medications and select groceries, reflecting the city's commitment to supporting essential consumer needs.

Economic Impact and Revenue Allocation

Tucson’s Sales Tax system contributes significantly to the city’s overall revenue stream, funding vital public services and infrastructure projects. The revenue generated supports education, healthcare, public safety, and local development initiatives, ensuring the city’s sustained growth and prosperity. Furthermore, the Sales Tax acts as a catalyst for economic stimulation, encouraging consumer spending and investment, thereby fostering a vibrant business climate.

Compliance and Enforcement

The Arizona Department of Revenue plays a pivotal role in administering and enforcing Sales Tax compliance within Tucson. Businesses are required to register, collect, and remit Sales Tax in a timely and accurate manner, adhering to strict guidelines and reporting protocols. Failure to comply can result in penalties and legal repercussions, underscoring the importance of understanding and adhering to the city’s Sales Tax regulations.

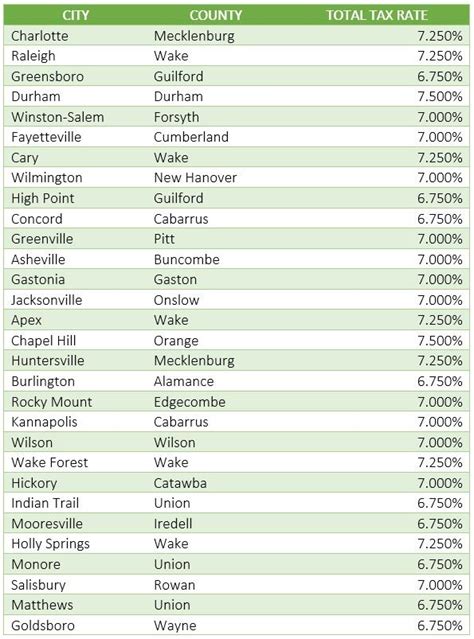

Comparative Analysis: Tucson vs. Other Cities

In comparison to other major cities across the United States, Tucson’s Sales Tax rate is relatively moderate, offering a competitive advantage for businesses and consumers alike. Cities like Chicago and Los Angeles, for instance, have higher Sales Tax rates, impacting the cost of living and doing business. Tucson’s positioning in this regard is strategic, attracting businesses and residents seeking a more affordable economic environment.

The Real-World Impact on Tucson’s Residents and Businesses

The Sales Tax in Tucson has a tangible impact on the daily lives of residents and the operational dynamics of local businesses. Let’s explore some real-world scenarios and the implications they carry.

Resident Perspective: Cost of Living and Consumption

For Tucson residents, the Sales Tax directly influences their purchasing power and overall cost of living. While the rate is competitive, it still impacts the affordability of goods and services. For instance, a 10% increase in Sales Tax could result in a substantial shift in consumer spending patterns, affecting local businesses and the overall economy.

Business Perspective: Operations and Growth

Local businesses in Tucson are directly impacted by the Sales Tax structure. While it provides a source of revenue for essential public services, it also influences operational costs and the pricing strategies of goods and services. Small businesses, in particular, navigate a delicate balance between maintaining profitability and remaining competitive within the market.

Case Study: Impact on a Local Business

Consider a hypothetical scenario involving a local Tucson bookstore, The Book Nook. The store’s owner, faced with rising overhead costs and increasing competition from online retailers, is acutely aware of the impact of Sales Tax on their operations. A slight increase in the Sales Tax rate could significantly affect their bottom line, necessitating strategic adjustments to their pricing and marketing strategies to remain viable.

Future Outlook and Potential Changes

As Tucson continues to evolve and adapt to changing economic landscapes, the future of its Sales Tax system is a topic of ongoing discussion and speculation. Let’s explore some potential scenarios and their implications.

Potential Rate Adjustments

In response to changing economic conditions or the need to fund specific initiatives, adjustments to the Sales Tax rate are a possibility. While increases could provide a boost to revenue generation, they may also impact consumer spending patterns and business operations. Conversely, reductions in Sales Tax rates could stimulate economic activity and enhance Tucson’s competitiveness.

Expanding Tax Exemptions

Expanding the scope of Sales Tax exemptions is another avenue for consideration. This could involve extending exemptions to additional goods and services, such as certain types of technology or renewable energy products, in an effort to encourage innovation and support specific industries. However, such measures require careful evaluation to ensure fiscal sustainability.

Adopting Innovative Tax Solutions

Tucson, like many cities, may explore innovative tax solutions to enhance revenue generation and improve tax compliance. This could include implementing digital tax collection platforms or adopting blockchain technology for secure and efficient tax transactions. These initiatives aim to streamline processes and reduce administrative burdens for both taxpayers and government agencies.

Frequently Asked Questions

What is the current Sales Tax rate in Tucson, Arizona?

+

As of the latest information, the Sales Tax rate in Tucson is 8.1%, which includes both state and local components.

Are there any Sales Tax exemptions in Tucson?

+

Yes, certain goods and services are exempt from Sales Tax in Tucson. This includes prescription medications and select groceries.

How does Tucson’s Sales Tax compare to other major cities in the US?

+

Tucson’s Sales Tax rate is relatively moderate compared to cities like Chicago and Los Angeles, offering a competitive advantage for businesses and consumers.

What impact does Sales Tax have on Tucson’s economy and residents?

+

Sales Tax in Tucson contributes significantly to the city’s revenue, funding essential public services. It also influences the cost of living and consumption patterns for residents and affects business operations.

How does the Arizona Department of Revenue enforce Sales Tax compliance in Tucson?

+

The Arizona Department of Revenue administers and enforces Sales Tax compliance, requiring businesses to register, collect, and remit Sales Tax accurately and timely. Non-compliance can result in penalties and legal consequences.