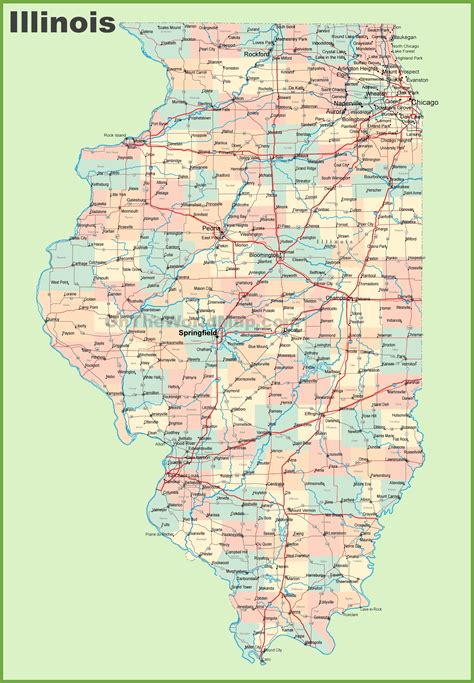

Illinois Gas Tax Increase

On January 1, 2023, Illinois witnessed a significant change in its transportation landscape with the implementation of the state's first-ever gas tax increase in nearly a decade. This increase, part of the state's new infrastructure funding law, aims to address critical needs in road repairs, bridge maintenance, and the expansion of public transit. With a rise in gas prices, Illinois residents and businesses are now navigating the impact of this policy shift, prompting a closer examination of its implications and the potential benefits it promises for the state's infrastructure.

The Illinois Gas Tax: A Historical Perspective

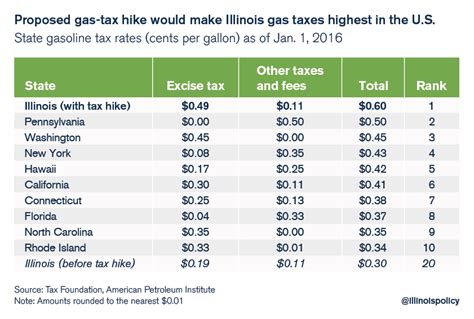

The gas tax in Illinois has long been a contentious issue, with the last increase occurring in 2008. Over the past 15 years, the state’s infrastructure has faced mounting challenges, including a $238 billion backlog in transportation projects and an alarming number of structurally deficient bridges. In response to these challenges, Governor J.B. Pritzker signed the new infrastructure funding law in August 2022, which included provisions for the gas tax hike.

The new law introduced a two-part increase in the gas tax. The first part, effective from January 1, 2023, raised the gas tax by 9 cents per gallon and the diesel tax by 14 cents per gallon. The second part, set to take effect on July 1, 2024, will further increase the gas tax by an additional 9 cents per gallon and the diesel tax by 7 cents per gallon. These increases are expected to generate approximately $2.4 billion annually for infrastructure improvements.

Impact on Illinois Residents and Businesses

The immediate effect of the gas tax increase has been felt by all Illinois drivers, with the average cost of gasoline surging to new heights. According to AAA, the average price of regular gasoline in Illinois reached 3.75 per gallon in January 2023, a significant increase from the 3.45 per gallon recorded in January 2022. This increase has naturally raised concerns among residents, especially those with longer commutes or those reliant on their vehicles for their livelihood.

For businesses, particularly those involved in transportation and logistics, the gas tax increase poses unique challenges. Companies that rely heavily on vehicle fleets, such as delivery services and construction firms, are now facing increased operational costs. This could potentially lead to adjustments in pricing strategies or the need to pass on these additional costs to consumers.

The Benefits for Illinois Infrastructure

Despite the initial backlash, the gas tax increase is a critical step towards addressing Illinois’ dire infrastructure needs. The funds generated from this increase will be channeled into various infrastructure projects across the state. These projects include road repairs and maintenance, ensuring safer and smoother commutes for Illinois residents. Additionally, the funds will support the modernization of public transit systems, making them more efficient and accessible.

Addressing the Backlog

One of the primary goals of the gas tax increase is to tackle the significant backlog of transportation projects in Illinois. With the additional revenue, the state can accelerate the repair and replacement of aging infrastructure, from roads and bridges to public transportation systems. This proactive approach not only enhances safety but also stimulates economic growth by creating job opportunities in the construction and transportation sectors.

Improving Public Transit

The gas tax increase also brings a ray of hope for public transit users in Illinois. The funds will be directed towards expanding and upgrading public transportation systems, making them more reliable and efficient. This includes improvements to bus routes, train services, and even the introduction of new, eco-friendly transportation options. By investing in public transit, Illinois aims to reduce traffic congestion and encourage a more sustainable mode of travel.

| Infrastructure Type | Projected Funding Allocation |

|---|---|

| Road and Bridge Repairs | $1.4 billion annually |

| Public Transit Improvements | $600 million annually |

| Other Transportation Projects | $400 million annually |

Environmental Impact

The gas tax increase also has positive environmental implications. By incentivizing the use of public transit and encouraging the development of more sustainable transportation options, Illinois is taking a step towards reducing its carbon footprint. This shift towards greener transportation methods aligns with the state’s commitment to environmental sustainability and its goals to combat climate change.

Future Outlook and Potential Challenges

As Illinois embarks on this new era of infrastructure development, several challenges and opportunities lie ahead. One of the primary concerns is the potential for inflation and the impact it could have on the state’s ability to fund these projects. Additionally, the success of the gas tax increase will depend on effective management and transparent allocation of funds to ensure that the promised infrastructure improvements are delivered.

On a positive note, the increased investment in public transit and sustainable transportation options could encourage a shift in commuting patterns, reducing traffic congestion and improving air quality. This shift could also have a positive ripple effect on the state's economy, attracting businesses and residents who value a well-maintained and efficient transportation network.

Infrastructure Investment and Economic Growth

The infusion of funds into Illinois’ infrastructure has the potential to spark significant economic growth. Large-scale infrastructure projects create a ripple effect, generating employment opportunities across various sectors. From construction workers to engineers and project managers, the demand for skilled labor will rise, leading to potential job growth and a boost in the state’s economy.

Potential Drawbacks and Considerations

However, it’s essential to acknowledge that there may be some drawbacks to the gas tax increase. For instance, the higher fuel costs could disproportionately affect lower-income households and small businesses, potentially increasing financial strain. Additionally, there’s a risk that the increased tax burden could drive some businesses to relocate, particularly those with high transportation costs.

To mitigate these potential issues, Illinois could consider implementing additional support measures, such as targeted tax incentives or financial assistance programs for small businesses and low-income households. These measures could help ease the financial burden and ensure that the benefits of improved infrastructure are accessible to all residents.

Conclusion: A Necessary Step Towards Progress

The Illinois gas tax increase is a bold move that signifies the state’s commitment to addressing its long-standing infrastructure challenges. While the immediate impact may be challenging, the long-term benefits for the state’s infrastructure, economy, and environment are significant. By investing in its transportation network, Illinois is not only improving the quality of life for its residents but also laying the groundwork for a more sustainable and prosperous future.

What was the previous gas tax rate in Illinois before the increase?

+

Before the increase, the gas tax rate in Illinois was 38.7 cents per gallon for gasoline and 44.2 cents per gallon for diesel fuel.

How will the gas tax increase be used to improve infrastructure in Illinois?

+

The funds generated from the gas tax increase will be primarily used to address the state’s $238 billion backlog in transportation projects. This includes repairing and maintaining roads, bridges, and public transit systems.

What are the potential environmental benefits of the gas tax increase?

+

The gas tax increase is expected to encourage the use of public transit and promote the development of more sustainable transportation options, which can lead to reduced carbon emissions and a positive environmental impact.

Are there any concerns or potential drawbacks to the gas tax increase?

+

Yes, some concerns include the potential for higher costs to be passed on to consumers, particularly for businesses, and the possibility of increased financial strain on lower-income households.

When will the second part of the gas tax increase take effect?

+

The second part of the gas tax increase, which includes an additional 9 cents per gallon for gasoline and 7 cents per gallon for diesel, is scheduled to take effect on July 1, 2024.