Pinal County Property Tax

In the heart of Arizona lies Pinal County, a vibrant and rapidly growing region that boasts a unique blend of rural charm and urban development. As the county's population continues to expand, so does the importance of understanding the property tax landscape. Property taxes play a crucial role in funding essential services and infrastructure, making it an area of interest for both homeowners and prospective buyers.

Unraveling the Pinal County Property Tax

The property tax system in Pinal County, like many other jurisdictions, is a vital source of revenue for the local government. It contributes to the funding of schools, roads, emergency services, and other vital community amenities. The assessment and collection of property taxes are overseen by the Pinal County Assessor's Office, which ensures fairness and accuracy in the process.

Property taxes in Pinal County are determined by a combination of the assessed value of the property and the tax rate set by various taxing authorities, including the county government, school districts, and special districts. This multifaceted tax structure can sometimes make it challenging for homeowners to fully comprehend their property tax obligations.

Property Assessment and Valuation

The Pinal County Assessor's Office is responsible for appraising the value of all real property within the county. This includes land, buildings, and any improvements made to the property. The assessed value is typically based on the property's fair market value, which is determined through a comprehensive analysis of factors such as location, size, improvements, and recent sales data.

Once the assessed value is established, it is multiplied by the applicable tax rate to determine the property tax liability. It's important to note that the assessed value can change annually, as the Assessor's Office performs periodic revaluations to ensure property values remain current and accurate.

| Property Type | Assessment Ratio |

|---|---|

| Residential | 10% |

| Commercial | 16.5% |

| Agricultural | 10% (Land) 20% (Improvements) |

For instance, let's consider a residential property in Pinal County with an assessed value of $200,000. Using the assessment ratio of 10%, the property's taxable value would be $20,000. If the combined tax rate for that property is 1%, the annual property tax liability would amount to $200.

Tax Rates and Levy

The tax rate, also known as the mill rate or mill levy, is the percentage of the property's assessed value that is used to calculate the tax liability. In Pinal County, the tax rate is established by various taxing authorities, each with its own specific purpose and funding requirements.

The county government sets a tax rate to fund general operations, while school districts have their own tax rates to support educational facilities and programs. Additionally, special districts, such as fire districts or water districts, may also levy taxes to provide specific services to certain areas within the county.

| Taxing Authority | Tax Rate |

|---|---|

| Pinal County | 0.75% |

| Florence Unified School District | 1.5% |

| San Tan Valley Fire District | 0.3% |

Using the example from above, if the property with an assessed value of $200,000 is located in an area served by the Florence Unified School District and the San Tan Valley Fire District, the combined tax rate would be 2.55% (0.75% + 1.5% + 0.3%). This would result in an annual property tax liability of $5,100.

Property Tax Exemptions and Credits

Pinal County offers a range of property tax exemptions and credits to eligible homeowners, which can help reduce their overall tax liability. These exemptions and credits are designed to provide relief to specific groups, such as senior citizens, disabled individuals, and veterans.

- Senior Citizen Exemption: Property owners who are at least 65 years old and meet certain income requirements may be eligible for an exemption on a portion of their property's assessed value.

- Disabled Veteran Exemption: Qualified disabled veterans can receive an exemption on a portion of their property's assessed value, reducing their tax liability.

- Homeowner Tax Credit: This credit is available to homeowners who occupy their property as their primary residence. It provides a credit against their property tax liability, helping to offset the tax burden.

For instance, a senior citizen who qualifies for the Senior Citizen Exemption may be eligible to exempt up to $100,000 of their property's assessed value from taxation. This could result in significant savings on their annual property tax bill.

Property Tax Payment and Due Dates

Property taxes in Pinal County are typically due in two installments. The first installment is due in October, and the second installment is due in March. Property owners have the option to pay their taxes in full by the first installment due date or choose to pay in two equal installments.

Failure to pay property taxes by the due date can result in penalties and interest charges, and in extreme cases, the property may be subject to a tax lien sale.

| Installment | Due Date |

|---|---|

| First Installment | October |

| Second Installment | March |

Property owners are encouraged to keep track of their payment due dates to avoid any late fees or penalties. It's also worth noting that property tax bills are typically mailed to homeowners in August, providing them with ample time to plan their payments.

The Impact of Property Taxes on the Pinal County Community

Property taxes are a vital source of funding for the essential services and infrastructure that support the Pinal County community. They play a significant role in shaping the quality of life for residents and the overall development of the county.

Funding Education and Schools

A substantial portion of property tax revenue is dedicated to funding public education. This includes the construction and maintenance of school buildings, the hiring and training of teachers, and the provision of educational resources and programs. By investing in education, Pinal County ensures that its youth have access to quality learning environments, fostering their growth and development.

Supporting Local Infrastructure

Property taxes also contribute to the maintenance and improvement of local infrastructure. This includes the upkeep of roads and highways, ensuring safe and efficient transportation networks. Additionally, property taxes fund essential services such as emergency response, law enforcement, and public health initiatives, which are vital for the safety and well-being of the community.

Economic Development and Community Growth

The revenue generated from property taxes plays a crucial role in driving economic development and supporting community growth in Pinal County. It helps attract businesses and industries, create job opportunities, and stimulate economic activity. The infrastructure and services funded by property taxes contribute to a vibrant and thriving community, making Pinal County an attractive place to live, work, and invest.

Future Outlook and Potential Changes

As Pinal County continues to experience population growth and development, the property tax landscape may undergo changes to adapt to the evolving needs of the community. The Assessor's Office may need to reevaluate assessment methodologies and tax rates to ensure fairness and sustainability.

Furthermore, with the increasing focus on equitable development and community engagement, there may be opportunities to explore alternative funding models and tax structures that better align with the county's vision for the future. This could involve initiatives to promote affordable housing, support small businesses, and invest in sustainable infrastructure.

Conclusion

Understanding the Pinal County Property Tax is crucial for homeowners and prospective buyers alike. It provides insight into the financial obligations associated with property ownership and the role that property taxes play in supporting the community. By exploring the assessment process, tax rates, exemptions, and the impact of property taxes on essential services, residents can make informed decisions and actively participate in shaping the future of their community.

Frequently Asked Questions

How often are property assessments conducted in Pinal County?

+

Property assessments in Pinal County are conducted every two years. The Assessor’s Office performs revaluations to ensure that property values remain current and accurate.

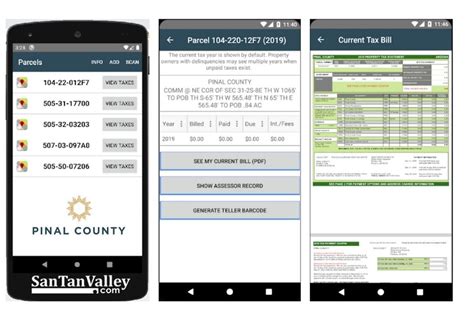

Are there any online resources to estimate property tax liability in Pinal County?

+

Yes, the Pinal County Assessor’s Office provides an online property tax estimator tool on their website. This tool allows homeowners to estimate their property tax liability based on the assessed value and tax rates applicable to their property.

Can property owners appeal their assessed value in Pinal County?

+

Absolutely! Property owners who believe their assessed value is inaccurate have the right to appeal. The Pinal County Assessor’s Office provides a detailed process for appealing property assessments, including deadlines and required documentation.

Are there any tax relief programs available for low-income homeowners in Pinal County?

+

Yes, Pinal County offers a tax relief program called the Property Tax Relief Program. This program provides a credit to low-income homeowners, helping to reduce their property tax burden. To qualify, homeowners must meet certain income and property value requirements.

How can property owners stay informed about changes to tax rates and exemptions in Pinal County?

+

Property owners can stay informed by regularly checking the Pinal County Assessor’s Office website for updates and announcements. Additionally, attending local government meetings and engaging with community organizations can provide valuable insights into potential changes and initiatives.