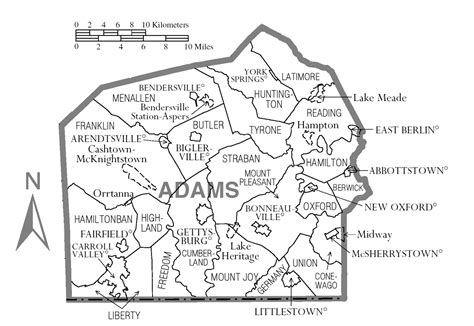

Adams County Tax Map

The Adams County Tax Map is a comprehensive and vital resource for property owners, real estate professionals, and local government officials in Adams County, Pennsylvania. This digital mapping system provides an intricate view of the county's land parcels, offering valuable insights into property boundaries, ownership, and associated tax information. With its detailed records and user-friendly interface, the Adams County Tax Map serves as an essential tool for various stakeholders, aiding in efficient property management, assessment, and planning.

Navigating the Adams County Tax Map: A Digital Journey

The Adams County Tax Map website is designed with a user-centric approach, making it accessible and intuitive for all users. The homepage provides a clean interface with a prominent search bar, allowing users to quickly locate their property by entering an address, parcel number, or owner’s name. This search functionality is a powerful tool, especially for property owners who may not have immediate access to their parcel number.

Once a search is initiated, the system generates a detailed map view of the property. This map is not just a static image but an interactive tool. Users can zoom in to examine specific features, such as building footprints, roads, and nearby landmarks. The map's transparency allows users to toggle between different layers, revealing additional information like zoning, school districts, or even environmental features.

Key Features and Benefits of the Adams County Tax Map

The Adams County Tax Map offers a wealth of features that enhance its utility for different users:

- Property Information: Each property listing provides detailed information, including ownership details, property dimensions, land use, and the property's assessed value. This data is invaluable for real estate professionals evaluating potential investments or for homeowners curious about their property's value.

- Tax Assessment Details: The map provides a transparent view of tax assessments, showing the current year's assessment, prior assessments, and any changes made. This information is critical for property owners to understand their tax obligations and for local officials to ensure fair and accurate taxation.

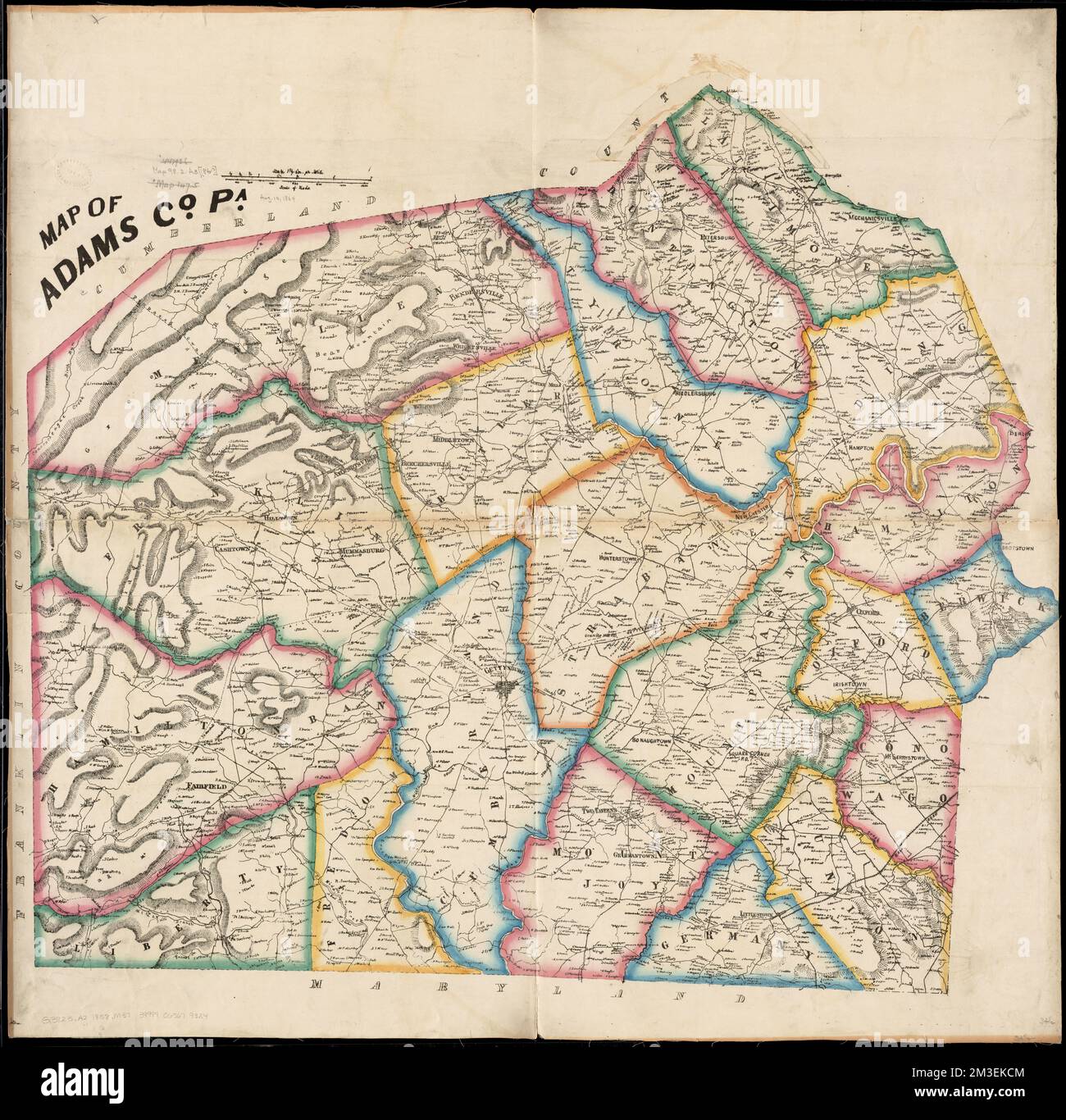

- Historical Records: The system maintains a comprehensive archive of property records, allowing users to view the evolution of a property over time. This feature is particularly useful for researchers, historians, and developers interested in the area's development and land use changes.

- GIS Integration: The Adams County Tax Map seamlessly integrates with Geographic Information Systems (GIS), providing advanced spatial analysis capabilities. This integration enables users to perform complex queries, generate customized maps, and analyze patterns and trends across the county.

- User Customization: Users can personalize their map views by selecting specific layers and data sets to display. This customization ensures that users receive the exact information they need, whether it's for planning a development project or researching a property's history.

The Impact of the Adams County Tax Map on Local Governance

The implementation of the Adams County Tax Map has had a significant impact on local governance and administration. It has streamlined the process of property assessment and tax collection, improving efficiency and reducing administrative burdens. The map’s data accuracy has led to fairer and more consistent tax assessments, fostering trust between the county and its residents.

Additionally, the map has facilitated better land use planning and zoning decisions. Local planners and officials can easily access up-to-date information on property boundaries, land use, and environmental features, aiding in the development of sustainable and well-planned communities.

| Feature | Description |

|---|---|

| Interactive Map | Users can zoom, pan, and toggle layers for a detailed view of properties. |

| Property Search | Quickly locate properties by address, parcel number, or owner's name. |

| Tax Assessment Data | Access current and historical tax assessments for accurate property valuation. |

| GIS Integration | Perform advanced spatial analysis and generate customized maps. |

Future Developments and Innovations

While the Adams County Tax Map is already a robust tool, ongoing developments aim to enhance its capabilities further. Planned upgrades include the integration of 3D modeling for a more realistic representation of properties and the implementation of AI-powered search algorithms to improve search accuracy and speed.

Additionally, the county is exploring the potential of blockchain technology to secure and streamline property transactions, ensuring a transparent and efficient process. These future developments will not only improve the user experience but also reinforce Adams County's position as a leader in innovative digital governance.

Conclusion

The Adams County Tax Map is more than just a digital map; it is a powerful tool that empowers users with knowledge and efficiency. From property owners seeking information about their land to local officials making critical land use decisions, this map has become an indispensable resource. Its impact on the county’s governance and administration cannot be overstated, and its future developments promise even greater benefits for the community.

Frequently Asked Questions

How often is the Adams County Tax Map updated with new data?

+The map is updated on a quarterly basis to ensure that property information remains current and accurate. These updates include changes in ownership, tax assessments, and any modifications to property boundaries or land use.

Can I access historical property records through the Adams County Tax Map?

+Absolutely! The map’s archival feature allows users to explore a property’s history, including past ownership, land use changes, and previous assessments. This feature is particularly useful for research and understanding a property’s evolution over time.

What are the system requirements for accessing the Adams County Tax Map online?

+The map is designed to be accessible on a wide range of devices and browsers. However, for the best user experience, it is recommended to use an updated web browser like Google Chrome, Mozilla Firefox, or Microsoft Edge. A stable internet connection is also essential for smooth map navigation and data loading.

Is there a tutorial or guide available for first-time users of the Adams County Tax Map?

+Yes, the Adams County website provides a comprehensive user guide and tutorial videos to help new users navigate the map and understand its various features. These resources are easily accessible and provide step-by-step instructions to make the map-using experience seamless.