Georgia Sales Tax Rate

Sales tax in Georgia is a critical aspect of the state's revenue system, playing a significant role in funding various public services and infrastructure projects. The sales and use tax is a state-level tax levied on the sale of goods and certain services. It is a vital revenue source for Georgia, contributing to the state's fiscal stability and economic growth.

Understanding the Georgia Sales Tax

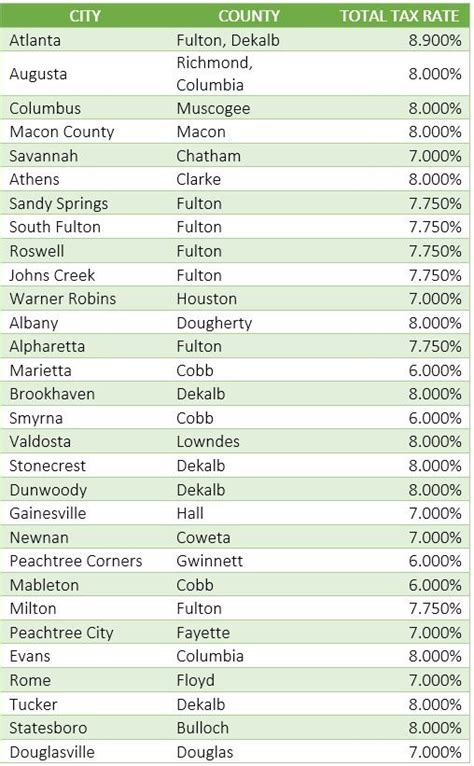

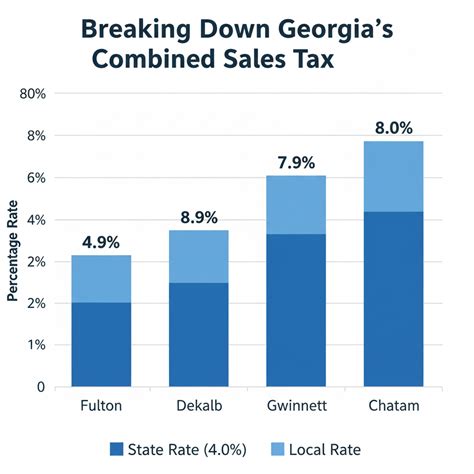

The sales tax rate in Georgia is a complex structure, varying across different localities and jurisdictions. The state sales tax is set at a standard rate of 4%, which is applicable across the state. However, local governments, counties, and municipalities can also impose additional sales taxes, creating a unique tax landscape.

The Georgia Department of Revenue oversees the administration and collection of sales taxes, ensuring compliance with state regulations. Businesses and retailers are responsible for collecting and remitting sales taxes to the state, with regular reporting and payment deadlines.

Sales Tax Exemptions and Special Considerations

While most tangible goods and certain services are subject to sales tax, there are specific exemptions and special considerations in Georgia. These include:

- Certain groceries and food items are exempt from sales tax, promoting access to essential food products.

- Prescription drugs and medical devices are also exempt, ensuring affordability for healthcare necessities.

- Some services, like legal and professional services, are not subject to sales tax.

- The state offers a Sales and Use Tax Holiday, during which specific items are exempt from sales tax, typically benefiting back-to-school shoppers.

These exemptions aim to reduce the tax burden on essential goods and services, providing relief to consumers and businesses alike.

Impact on Businesses and Consumers

The sales tax rate in Georgia has a significant impact on both businesses and consumers. For businesses, especially retailers, it influences pricing strategies, margins, and overall competitiveness. It also adds administrative complexity, requiring businesses to stay updated with tax regulations and filing requirements.

For consumers, the sales tax directly affects purchasing power and overall affordability. The varying tax rates across localities can create price disparities, impacting consumer choices and preferences. Additionally, the sales tax structure can influence online shopping behaviors, with consumers opting for out-of-state purchases to avoid higher tax rates.

| Sales Tax Rate | Location |

|---|---|

| 4% | Statewide (Standard Rate) |

| 8.9% | City of Atlanta |

| 8% | Gwinnett County |

| 7.5% | Fulton County |

| 6.5% | Cobb County |

| 7.5% | DeKalb County |

Sales Tax Compliance and Challenges

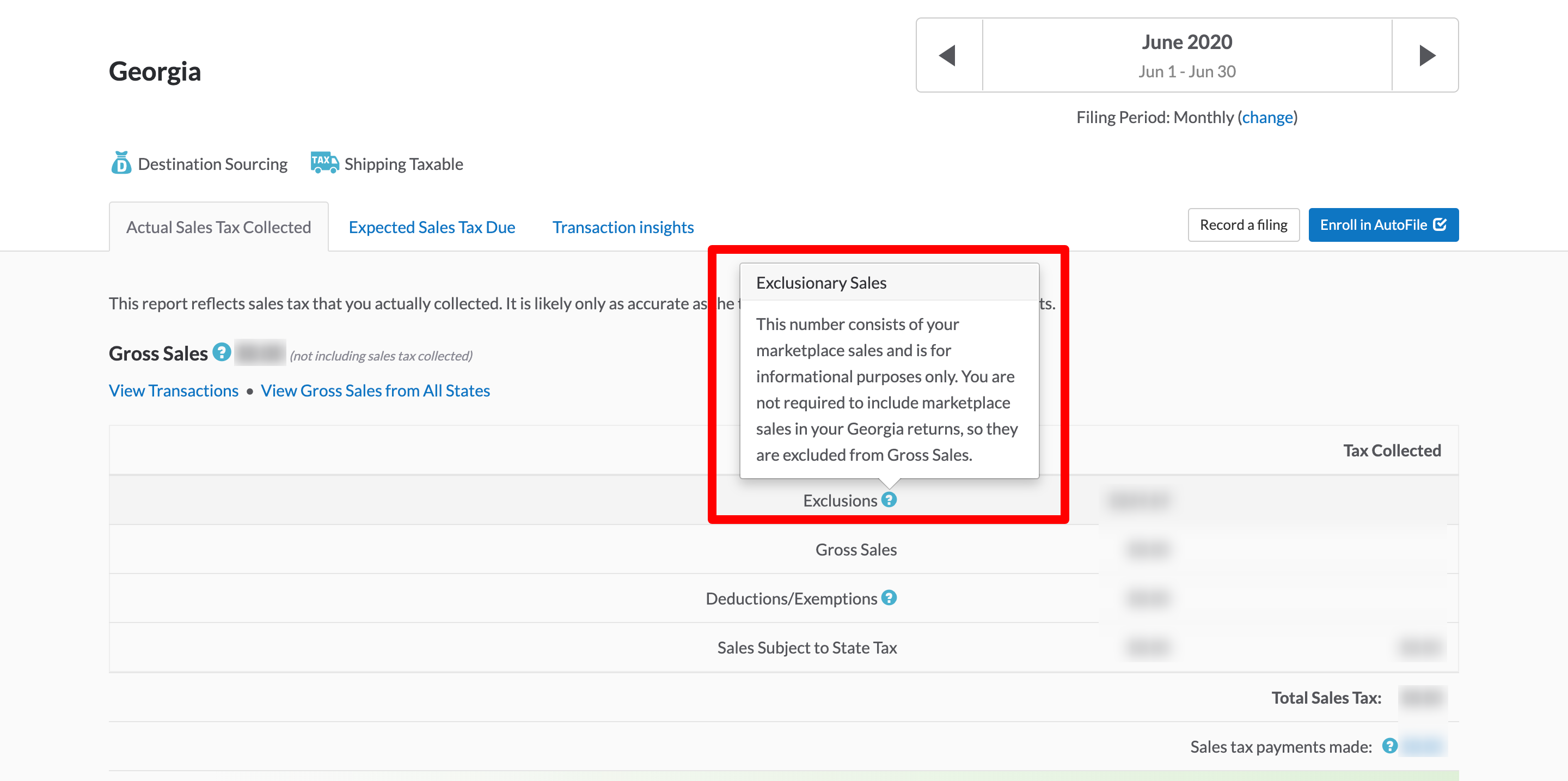

Sales tax compliance in Georgia involves a range of complexities, especially with the varying tax rates across different jurisdictions. Businesses must accurately calculate and remit sales taxes, ensuring compliance with state and local regulations. This includes proper tax registration, timely filing, and accurate reporting.

The dynamic nature of the sales tax landscape, with frequent rate changes and updates, poses challenges for businesses. Keeping up with these changes and ensuring accurate tax calculations can be a significant administrative burden, especially for small businesses with limited resources.

Technological Solutions for Compliance

To address the complexities of sales tax compliance, businesses are increasingly turning to technological solutions. Tax automation software and platforms can streamline the process, automatically calculating and applying the correct tax rates based on the customer’s location. These tools enhance accuracy, reduce manual errors, and improve overall efficiency in tax management.

Additionally, cloud-based accounting software and ERP systems offer integrated tax functionality, simplifying the tax compliance process for businesses. These solutions provide real-time visibility into tax liabilities, aiding in better financial management and strategic decision-making.

Future Trends in Sales Tax

The future of sales tax in Georgia is likely to be influenced by technological advancements and changing consumer behaviors. The rise of e-commerce and online sales presents unique challenges, with states exploring ways to tax online transactions effectively. Georgia may need to adapt its sales tax structure to keep pace with the evolving digital economy.

Furthermore, the concept of a fair and equitable sales tax is gaining traction, aiming to simplify the tax system and reduce complexities for businesses and consumers. This could involve harmonizing tax rates across localities or exploring alternative tax structures that better align with modern economic activities.

Georgia Sales Tax: A Comprehensive Guide

In conclusion, the sales tax rate in Georgia is a dynamic and multifaceted component of the state’s revenue system. It influences businesses, consumers, and the overall economic landscape. While the standard state rate provides a stable foundation, the varying local rates create a complex tax environment.

As Georgia continues to evolve, both economically and technologically, the sales tax structure will need to adapt to ensure fairness, efficiency, and compliance. By embracing technological solutions and exploring innovative tax policies, Georgia can navigate the complexities of the modern economy while maintaining a robust revenue system.

What is the current sales tax rate in Georgia for online purchases?

+The sales tax rate for online purchases in Georgia depends on the shipping address. It follows the same tax structure as in-store purchases, including the standard state rate of 4% and any applicable local taxes. Businesses selling online must ensure compliance with the relevant tax regulations.

Are there any special sales tax holidays in Georgia?

+Yes, Georgia offers a Sales and Use Tax Holiday typically during August. During this period, specific items, such as school supplies and clothing, are exempt from sales tax. This holiday aims to provide relief to consumers, especially those with back-to-school expenses.

How often do sales tax rates change in Georgia?

+Sales tax rates can change periodically, usually with budget considerations or policy changes. The state sales tax rate has remained stable at 4%, but local tax rates can fluctuate more frequently. Businesses and consumers should stay updated with the latest tax regulations to ensure compliance.