Michigan Tax

The state of Michigan, located in the Great Lakes region of the United States, has a unique tax system that plays a crucial role in its economic landscape. Michigan's tax structure encompasses various aspects, including income tax, sales tax, property tax, and other specialized taxes. Understanding Michigan's tax system is essential for individuals, businesses, and investors looking to navigate the state's financial landscape effectively.

In this comprehensive article, we delve into the intricacies of Michigan's tax system, exploring its components, rates, and implications. By analyzing real-world examples and providing expert insights, we aim to offer a thorough understanding of how Michigan's tax policies shape its economic environment and influence the lives of its residents and businesses.

Income Tax in Michigan

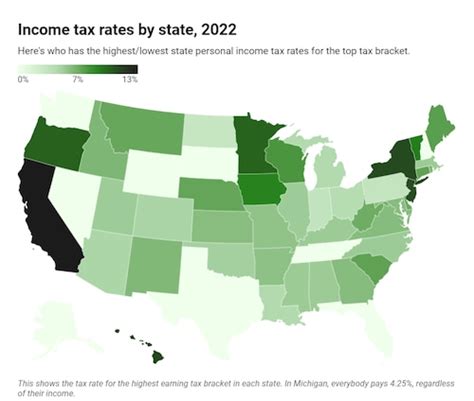

Michigan levies an income tax on its residents and nonresidents with income sourced from within the state. The state’s income tax structure is progressive, meaning tax rates increase as income levels rise. As of 2023, Michigan’s income tax rates range from 4.25% to 4.6%, depending on the taxpayer’s taxable income.

Let's consider an example to illustrate the income tax structure. Suppose a Michigan resident, Jane, has an annual taxable income of $50,000. Her income would fall within the 4.25% tax bracket, resulting in an income tax liability of $2,125.

Michigan's income tax system also offers various deductions and credits to alleviate the tax burden on individuals and businesses. For instance, the state provides a standard deduction and allows taxpayers to claim deductions for medical expenses, charitable contributions, and certain business-related expenses.

Additionally, Michigan offers tax credits to encourage specific behaviors or support certain industries. One notable credit is the Michigan Business Tax Credit, which provides tax benefits to businesses that create new jobs or invest in research and development within the state.

Michigan Income Tax Rates

| Taxable Income Bracket | Tax Rate |

|---|---|

| 0 - 3,000 | 4.25% |

| 3,001 - 5,000 | 4.3% |

| 5,001 - 10,000 | 4.35% |

| 10,001 - 50,000 | 4.4% |

| 50,001 - 100,000 | 4.5% |

| Over $100,000 | 4.6% |

Sales and Use Tax

Michigan imposes a sales and use tax on the sale of tangible personal property and certain services within the state. The general sales tax rate in Michigan is 6%, but this can vary depending on local jurisdictions, which may add additional sales tax rates.

For instance, let's consider a scenario where a customer purchases a laptop in the city of Detroit. The laptop costs $1,000, and with the general sales tax rate of 6%, the customer would pay a total of $1,060, including tax.

Michigan's sales tax also applies to certain services, such as repairs, installations, and rentals. However, there are exemptions and exclusions, particularly for essential services like healthcare and education.

It's worth noting that Michigan offers a use tax to complement its sales tax. The use tax is applicable when goods or services are purchased from out-of-state vendors and used within Michigan. This ensures that all purchases made by Michigan residents, regardless of the point of sale, are subject to taxation.

Sales Tax Rates by County

Michigan’s sales tax rates can vary by county due to local tax jurisdictions. Here are some examples of sales tax rates in different counties as of 2023:

| County | Sales Tax Rate |

|---|---|

| Wayne County (including Detroit) | 6% |

| Oakland County | 6% |

| Macomb County | 6% |

| Kalamazoo County | 7% |

| Grand Traverse County | 6% |

Property Tax in Michigan

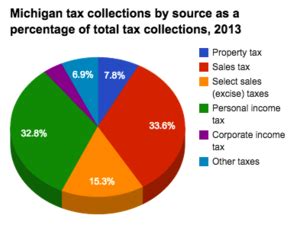

Property tax is a significant source of revenue for local governments in Michigan. The state’s property tax system is primarily administered by county governments, with rates varying across different jurisdictions.

Michigan's property tax is based on the assessed value of real estate, which includes land and improvements. The assessed value is determined by local assessors, who consider factors such as market value, location, and property characteristics.

For instance, let's consider a homeowner, John, who owns a residential property in the city of Grand Rapids. The assessed value of John's property is $250,000, and the local property tax rate is 1.5%. John's annual property tax liability would amount to $3,750.

Michigan offers various property tax exemptions and credits to certain eligible individuals and organizations. For example, the state provides a Homestead Property Tax Credit to reduce the property tax burden on primary residences.

Property Tax Rates by County

Property tax rates in Michigan can vary significantly across counties. Here are some examples of residential property tax rates as of 2023:

| County | Property Tax Rate |

|---|---|

| Wayne County | 2.2% |

| Oakland County | 2.1% |

| Kent County | 1.8% |

| Ottawa County | 1.7% |

| Ingham County | 2.4% |

Other Michigan Taxes and Fees

In addition to the aforementioned taxes, Michigan imposes various other taxes and fees to generate revenue and support specific initiatives.

Intangibles Tax

Michigan levies an Intangibles Tax on certain intangible personal property, such as stocks, bonds, and notes. The tax rate for intangibles is 0.25% of the property’s value.

Use Fuel Tax

The state imposes a Use Fuel Tax on the purchase or use of fuel within Michigan. The tax rate varies depending on the type of fuel and its intended use. For example, the tax rate for gasoline is 19 cents per gallon, while diesel fuel is taxed at 15 cents per gallon.

Excise Taxes

Michigan imposes excise taxes on various goods and services, including tobacco products, alcoholic beverages, and motor vehicles. These taxes are often included in the purchase price of the goods or services and contribute to the state’s revenue.

Other Fees

Michigan also collects various fees, such as license fees, permit fees, and registration fees. These fees are typically associated with specific activities or services provided by the state or local governments.

Impact of Michigan’s Tax System

Michigan’s tax system has a significant impact on the state’s economy, influencing investment, business growth, and individual financial planning. The progressive income tax structure, coupled with incentives and credits, encourages economic development and job creation.

The sales and use tax system provides a steady revenue stream for the state and local governments, funding essential services and infrastructure projects. Property taxes, although varying by county, contribute to local government budgets, supporting schools, public safety, and community development.

Moreover, Michigan's tax system plays a crucial role in shaping the state's business environment. By offering tax incentives and credits, the state attracts businesses and investors, fostering economic growth and job opportunities. The state's competitive tax rates and targeted incentives create a favorable environment for entrepreneurship and innovation.

In conclusion, Michigan's tax system is a complex yet well-structured framework that shapes the state's economic landscape. By understanding the income tax rates, sales tax variations, property tax implications, and other specialized taxes, individuals and businesses can navigate Michigan's financial environment effectively. The state's tax policies, when coupled with incentives and credits, create a dynamic and attractive business climate, contributing to Michigan's overall economic prosperity.

What are the key differences between Michigan’s income tax and other states’ income tax systems?

+Michigan’s income tax system is progressive, with rates ranging from 4.25% to 4.6%. While this is relatively competitive compared to some states, it is important to note that other states may have different tax brackets and rates, as well as unique tax credits and deductions. It is essential to compare Michigan’s tax system with other states’ systems to make informed financial decisions.

How do I calculate my sales tax liability in Michigan?

+To calculate your sales tax liability in Michigan, you need to determine the applicable sales tax rate in your county. This rate can vary, so it’s important to check the local tax jurisdiction. Then, apply the sales tax rate to the taxable sales made within Michigan. For example, if the sales tax rate is 6%, and you made 1,000 in taxable sales, your sales tax liability would be 60.

Are there any tax incentives or credits available for businesses in Michigan?

+Yes, Michigan offers various tax incentives and credits to encourage business growth and investment. These include the Michigan Business Tax Credit, which provides tax benefits for job creation and research and development, as well as other targeted incentives for specific industries. It’s advisable to consult with tax professionals or visit the Michigan Department of Treasury’s website for detailed information on available incentives.

How often do property tax rates change in Michigan?

+Property tax rates in Michigan can change annually, as they are determined by local governments and are subject to budgetary considerations. It’s essential to stay updated with the latest property tax rates in your county to accurately assess your property tax liability. Property tax rates are typically published by local assessors or county tax offices.

What are some strategies to minimize my tax liability in Michigan?

+To minimize your tax liability in Michigan, it’s crucial to understand the state’s tax laws and take advantage of available deductions, credits, and incentives. This may include claiming the standard deduction, maximizing tax-efficient retirement contributions, and exploring business-related deductions. Consulting with a tax professional or accountant can provide personalized advice based on your specific circumstances.