Taxes On Unrealized Gains

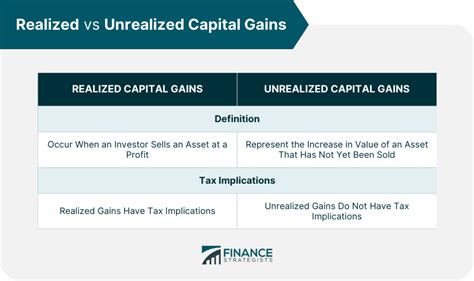

Welcome to this comprehensive guide on the complex world of taxes on unrealized gains, a topic that often confuses many investors and business owners. Unrealized gains, also known as paper gains, represent the potential profits from an investment that has increased in value but has not yet been sold. Understanding how these gains are taxed is crucial for effective financial planning and minimizing tax liabilities.

In this article, we will delve into the intricacies of taxes on unrealized gains, exploring the tax implications, legal frameworks, and strategic approaches to managing these potential profits. By the end of this guide, you'll have a clearer understanding of how to navigate the tax landscape surrounding unrealized gains and make informed decisions to optimize your financial strategy.

Understanding Unrealized Gains and Their Tax Implications

Unrealized gains are the increases in value of an asset that an investor owns but has not yet sold. These gains represent potential profits and are a key aspect of investment strategies, especially in the long term. However, it's essential to recognize that these gains are not just potential profits; they also carry potential tax liabilities.

The tax implications of unrealized gains vary depending on the type of asset, the holding period, and the jurisdiction. In most cases, unrealized gains are not subject to immediate taxation. Instead, the tax liability arises when the asset is sold or otherwise disposed of, at which point the gains become realized and taxable.

Tax Treatment of Different Asset Classes

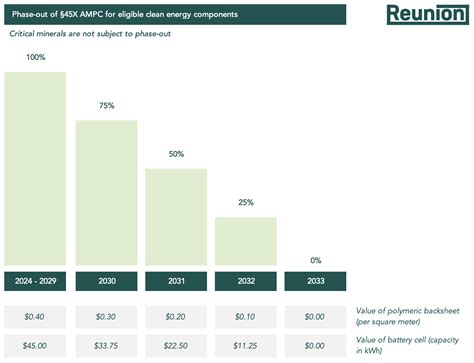

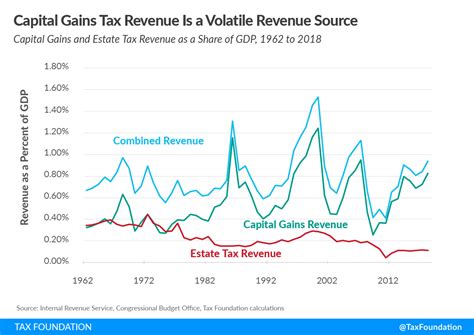

The tax treatment of unrealized gains can differ significantly across various asset classes. For instance, stocks and mutual funds are typically subject to capital gains taxes when sold. The tax rate depends on the holding period: long-term capital gains (assets held for over a year) are taxed at a lower rate than short-term gains.

On the other hand, real estate and commodities may have different tax considerations. For real estate, unrealized gains can lead to property tax increases, and when the property is sold, capital gains taxes may apply. Commodities, such as gold or oil, may be subject to specific commodity taxes or even be considered as business inventory, impacting the tax treatment.

It's crucial to understand these distinctions, as they can significantly impact an investor's overall tax liability and financial strategy.

The Role of Holding Period

The holding period, or the length of time an asset is owned, plays a pivotal role in determining the tax implications of unrealized gains. As mentioned earlier, the distinction between short-term and long-term gains is critical, especially for stocks and mutual funds.

Short-term gains, typically from assets held for a year or less, are taxed at the investor's ordinary income tax rate, which can be significantly higher than the capital gains tax rate. Long-term gains, from assets held for over a year, benefit from the lower capital gains tax rate, making long-term investment strategies more tax-efficient in many cases.

The holding period can also impact the tax treatment of other assets. For instance, in the context of real estate, the length of ownership can affect the applicable capital gains tax rates and the potential for like-kind exchanges, which allow investors to defer capital gains taxes by reinvesting in similar property.

Legal and Regulatory Frameworks for Unrealized Gains Taxation

The taxation of unrealized gains is governed by a complex web of legal and regulatory frameworks, which vary by jurisdiction. Understanding these frameworks is essential for investors and business owners to comply with tax laws and make informed financial decisions.

National and Regional Tax Codes

Each country or region has its own tax code that outlines the rules for taxing various types of income, including unrealized gains. These tax codes specify the rates, holding periods, and specific conditions under which unrealized gains are taxed. For instance, the United States has a progressive tax system with varying capital gains tax rates, while countries like Germany and Japan have a more straightforward, flat tax rate for capital gains.

Understanding the nuances of these tax codes is crucial for investors with global portfolios, as they must navigate the unique tax landscapes of each jurisdiction.

Tax Treaties and International Agreements

In the globalized financial market, tax treaties and international agreements play a significant role in mitigating double taxation and promoting investment. These treaties outline the tax rules when an investor has assets or conducts business in multiple countries.

For example, the United States has tax treaties with over 60 countries, which often provide reduced tax rates on capital gains and define the conditions under which these gains are taxed in each country. These treaties can be beneficial for investors, but they also add complexity to tax planning, requiring a detailed understanding of the specific treaty provisions.

Regulatory Bodies and Compliance

Various regulatory bodies, such as the Internal Revenue Service (IRS) in the United States or HM Revenue and Customs (HMRC) in the United Kingdom, are responsible for enforcing tax laws and ensuring compliance. These bodies issue guidelines, interpret tax laws, and impose penalties for non-compliance.

Investors and business owners must stay abreast of these guidelines and regulations to avoid legal issues and potential financial penalties. This often involves working with tax professionals who specialize in the relevant jurisdiction to ensure accurate reporting and compliance.

Strategic Approaches to Managing Taxes on Unrealized Gains

Managing taxes on unrealized gains requires a strategic approach that considers both the financial goals and the tax implications. Here, we explore some strategies that investors and business owners can employ to optimize their tax positions.

Tax-Efficient Investment Strategies

One of the primary strategies for managing taxes on unrealized gains is to adopt tax-efficient investment strategies. This involves selecting investments that align with an investor's financial goals while also considering the tax implications.

For example, investing in long-term, growth-oriented assets can be more tax-efficient due to the lower capital gains tax rates applicable to long-term holdings. Additionally, investors can consider diversifying their portfolios across different asset classes, as this can help spread the tax burden and potentially reduce the overall tax liability.

Another strategy is to use tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) or 401(k)s, which defer taxes on unrealized gains until withdrawal. This can be particularly beneficial for long-term investors.

Tax Loss Harvesting

Tax loss harvesting is a strategy where investors sell assets at a loss to offset realized gains and reduce their overall tax liability. This strategy is particularly useful for investors who have both losing and winning investments in a given year.

By selling the losing investments, investors can offset the gains from their winning investments, potentially reducing their tax bill. This strategy is most effective when combined with a long-term investment plan that focuses on overall portfolio growth rather than short-term gains.

Like-Kind Exchanges and Other Tax Deferral Strategies

Like-kind exchanges, also known as 1031 exchanges, are a strategy primarily used in real estate investments. This strategy allows investors to defer capital gains taxes by reinvesting the proceeds from the sale of one property into a similar property. This can be an effective way to grow a real estate portfolio without triggering immediate tax liabilities.

Other tax deferral strategies include using installment sales, where the proceeds from the sale of an asset are received over time, or donating appreciated assets to a charity, which can provide a tax deduction while avoiding capital gains taxes.

Tax Planning and Professional Guidance

Effective tax management often requires the expertise of tax professionals who can provide tailored advice based on an investor's specific circumstances. These professionals can help investors navigate the complex web of tax laws, identify potential tax-saving opportunities, and ensure compliance with relevant regulations.

Additionally, tax planning should be an ongoing process, with regular reviews to adapt to changing tax laws and the investor's evolving financial situation. This proactive approach can help investors stay ahead of potential tax liabilities and make informed decisions to optimize their financial strategy.

The Future of Taxes on Unrealized Gains

The landscape of taxes on unrealized gains is constantly evolving, influenced by economic trends, political decisions, and technological advancements. As we look to the future, several trends and developments are worth noting.

Impact of Economic and Political Changes

Economic downturns and political shifts can significantly impact the tax landscape. For instance, during economic recessions, governments may adjust tax rates or introduce new tax policies to stimulate the economy or generate revenue. These changes can have a direct impact on the tax treatment of unrealized gains.

Additionally, political shifts can lead to changes in tax laws, as seen with the Tax Cuts and Jobs Act in the United States, which brought significant changes to the taxation of capital gains and other investment income.

The Role of Technology and Digital Assets

The rise of digital assets, such as cryptocurrencies and non-fungible tokens (NFTs), has introduced new complexities to the taxation of unrealized gains. These assets often lack clear regulatory frameworks, making tax compliance challenging. However, as these digital assets gain mainstream acceptance, regulatory bodies are likely to provide more guidance and clarity on their tax treatment.

Technology also plays a significant role in tax management, with the rise of tax software and digital tools that can help investors and business owners stay organized, track their investments, and ensure compliance with tax laws.

Potential for Tax Reform and Simplification

The complexity of tax laws, including those related to unrealized gains, often leads to calls for tax reform and simplification. While these reforms can take years to implement, they have the potential to significantly impact the tax landscape and the strategies investors employ to manage their tax liabilities.

Some proposed reforms include flattening tax rates, simplifying capital gains taxation, or even eliminating capital gains taxes altogether. While these proposals are often met with debate, they highlight the ongoing discussion around tax fairness and efficiency.

Global Trends and Harmonization

In an increasingly globalized world, there is a growing trend towards tax harmonization, particularly within regional economic blocs like the European Union (EU). Harmonization efforts aim to simplify tax rules and reduce tax competition among countries, potentially impacting the taxation of unrealized gains for international investors.

While harmonization can bring simplicity and clarity, it may also reduce the flexibility that investors currently have to optimize their tax positions across different jurisdictions.

Conclusion: Navigating the Complex World of Taxes on Unrealized Gains

Understanding and managing taxes on unrealized gains is a complex but crucial aspect of financial planning. It requires a deep understanding of tax laws, a strategic approach to investment, and often, the guidance of tax professionals.

By staying informed about the legal and regulatory frameworks, adopting tax-efficient strategies, and being proactive in tax planning, investors and business owners can navigate the complexities of unrealized gains taxation and optimize their financial outcomes.

As the tax landscape continues to evolve, staying adaptable and informed will be key to success in managing taxes on unrealized gains.

What is the difference between realized and unrealized gains?

+Realized gains refer to the profits made from selling an asset, whereas unrealized gains are the potential profits from an asset that has increased in value but has not yet been sold.

Are unrealized gains taxable?

+In most jurisdictions, unrealized gains are not immediately taxable. The tax liability arises when the asset is sold or otherwise disposed of, at which point the gains become realized and taxable.

How does the holding period impact the tax treatment of unrealized gains?

+The holding period, or the length of time an asset is owned, can significantly impact the tax treatment. For instance, long-term capital gains (assets held for over a year) often benefit from lower tax rates than short-term gains.

What strategies can be used to manage taxes on unrealized gains?

+Strategies include tax-efficient investment choices, tax loss harvesting, like-kind exchanges, and using tax-advantaged accounts. It’s also crucial to seek professional tax guidance for personalized advice.

How do tax treaties impact the taxation of unrealized gains for international investors?

+Tax treaties between countries often provide reduced tax rates on capital gains and define the conditions under which these gains are taxed in each country. This helps mitigate double taxation for international investors.