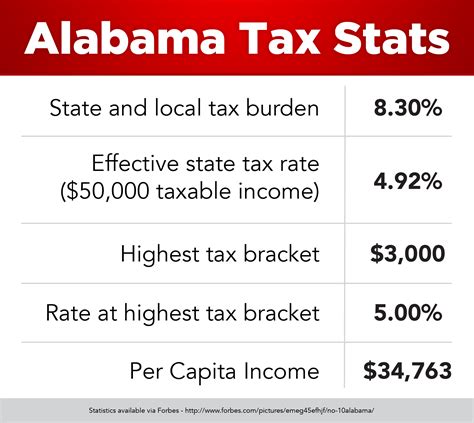

Alabama State Income Tax Rate

In the United States, each state has its own unique tax structure, including income tax rates, which can vary significantly. As of 2023, Alabama is one of the states with a progressive income tax system, meaning that the tax rate increases as your income rises. Understanding Alabama's state income tax rates is crucial for residents and businesses operating within the state, as it directly impacts their financial planning and tax obligations.

Alabama's Progressive Income Tax Structure

Alabama's income tax system consists of six tax brackets, ranging from 2% to 5% for individuals and married couples filing jointly. The tax rates and the corresponding income thresholds are updated annually to account for inflation and changes in the economy. The current tax brackets for Alabama's state income tax, effective for the 2023 tax year, are as follows:

| Tax Rate | Single Filers | Married Filing Jointly |

|---|---|---|

| 2% | $0 - $5,000 | $0 - $10,000 |

| 3% | $5,001 - $10,000 | $10,001 - $20,000 |

| 4% | $10,001 - $20,000 | $20,001 - $40,000 |

| 5% | $20,001 - $30,000 | $40,001 - $50,000 |

| 5% | $30,001 and above | $50,001 and above |

These tax brackets are applied to Alabama residents' taxable income, which is calculated after deducting any eligible exemptions, deductions, and credits. It's important to note that the state income tax rates are separate from federal income tax rates, and taxpayers may fall into different brackets for each system.

How Alabama's Tax Brackets Work

To illustrate how Alabama's tax brackets work, let's consider an example. Suppose a single filer has a taxable income of $25,000 for the year. Their tax liability would be calculated as follows:

- The first $5,000 is taxed at 2%, resulting in a tax of $100.

- The next $5,000 (from $5,001 to $10,000) is taxed at 3%, adding another $150.

- The remaining $15,000 (from $10,001 to $25,000) is taxed at 4%, which amounts to $600.

So, the total state income tax liability for this individual would be $850.

Alabama Tax Credits and Deductions

Alabama offers various tax credits and deductions that can reduce the taxable income and, consequently, the state income tax liability. These include:

- Standard Deduction: Taxpayers can opt for a standard deduction or itemize their deductions. The standard deduction amounts are adjusted annually and differ for single filers and married couples filing jointly.

- Personal Exemptions: Alabama allows personal exemptions for the taxpayer, spouse, and each dependent. These exemptions are subtracted from the taxpayer's income, reducing the taxable amount.

- Child and Dependent Care Credit: This credit is available for expenses related to child and dependent care, allowing taxpayers to offset a portion of these costs.

- Education Credits and Deductions: Alabama provides tax credits for higher education expenses, encouraging residents to pursue post-secondary education.

- Property Tax Deduction: A portion of property taxes paid on a taxpayer's primary residence may be deductible on their state income tax return.

Alabama Tax Credits for Business Owners

For business owners and entrepreneurs, Alabama offers a range of tax incentives and credits to promote economic development and job creation. These include:

- Job Creation Tax Credits: Businesses that create new jobs in Alabama may be eligible for tax credits, depending on the number of jobs created and the wages paid.

- Investment Tax Credits: Alabama provides tax credits for investments in qualified projects, including manufacturing facilities, renewable energy, and research and development.

- Sales Tax Exemptions: Certain purchases made by businesses, such as machinery and equipment, may be exempt from sales tax.

- Research and Development Tax Credits: Businesses engaged in research and development activities can benefit from tax credits, encouraging innovation and technological advancement.

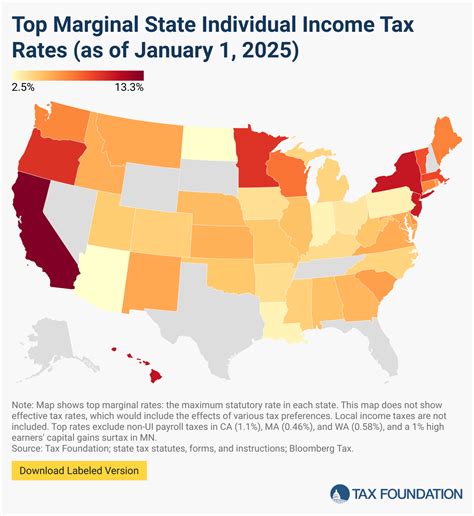

Comparison with Other States

Alabama's state income tax rates are generally considered to be moderate compared to other states. Some states, like Florida and Texas, have no state income tax, while others, like California and New York, have higher tax rates and more complex tax systems. Alabama's progressive tax structure aims to balance the tax burden across income levels, ensuring fairness for residents.

Economic Impact and Tax Policy

Alabama's tax policies, including the state income tax rates, have a significant impact on the state's economy and its attractiveness to businesses and residents. Lower tax rates can encourage economic growth, business investment, and job creation. On the other hand, higher tax rates may provide more revenue for state programs and services, such as education, healthcare, and infrastructure development.

The state's tax policy is continuously evaluated and adjusted to align with economic trends and the needs of its residents. It's important for taxpayers to stay informed about any changes to tax laws and regulations to ensure compliance and optimize their tax strategies.

Frequently Asked Questions

Are there any special tax considerations for senior citizens in Alabama?

+Yes, Alabama offers tax relief programs for senior citizens and disabled individuals. These programs can provide a deduction on their property taxes or even an exemption from certain taxes. Eligibility and specific details can be found on the Alabama Department of Revenue’s website.

How often are Alabama’s tax brackets updated?

+Alabama’s tax brackets are typically updated annually to account for inflation and changes in the cost of living. The Alabama Department of Revenue releases the updated tax rates and brackets for the upcoming tax year.

Can I file my Alabama state income tax return electronically?

+Absolutely! Alabama offers electronic filing options for both individuals and businesses. Electronic filing is secure, efficient, and often results in faster processing times compared to traditional paper returns.

What are the tax benefits for small businesses in Alabama?

+Alabama provides various tax incentives for small businesses, including tax credits for job creation, investment in infrastructure, and research and development. Additionally, certain business expenses may be deductible, such as office rent, utilities, and employee salaries.

Are there any online resources to help calculate my Alabama state income tax liability?

+Yes, the Alabama Department of Revenue provides online tax calculators and tools to assist taxpayers in estimating their state income tax liability. These resources can help individuals and businesses understand their tax obligations and plan accordingly.