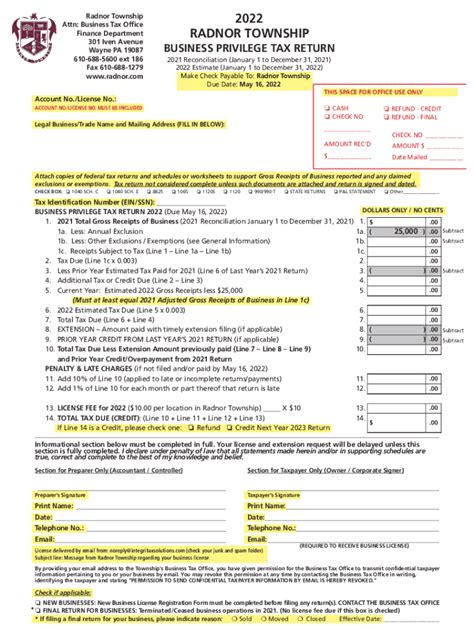

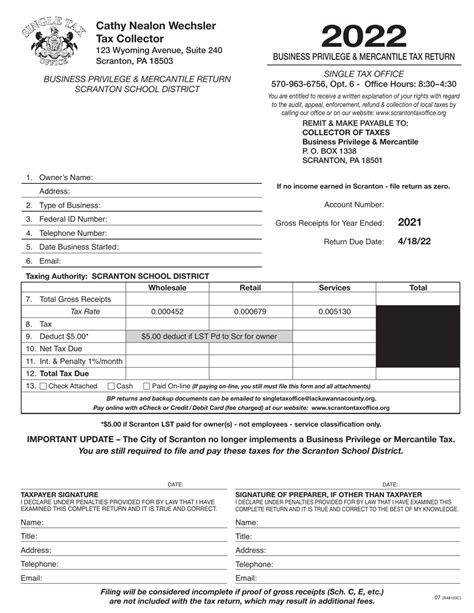

Business Privilege Tax

The Business Privilege Tax: A Comprehensive Guide for Understanding and Managing Your Business’s Tax Obligations

The Business Privilege Tax, a crucial aspect of state and local tax legislation, plays a significant role in the financial landscape of businesses operating within the United States. It is a tax levied on the privilege of conducting business within a specific jurisdiction, often used by municipalities and states to generate revenue for local infrastructure and services. Understanding this tax and its implications is vital for businesses to maintain compliance and manage their financial strategies effectively.

This article aims to provide a detailed overview of the Business Privilege Tax, its historical context, current applications, and its potential future trajectory. By delving into real-world examples, we will explore how this tax affects different types of businesses and offer practical strategies for efficient management. We will also discuss the challenges and opportunities that the Business Privilege Tax presents, ensuring that business owners and stakeholders are well-informed and prepared.

The Historical Evolution of the Business Privilege Tax

The roots of the Business Privilege Tax can be traced back to the early 20th century when states and municipalities began exploring new revenue streams to fund growing urban infrastructure and social programs. During this period, the concept of taxing the privilege of doing business emerged as a means to generate substantial revenue without directly impacting individual taxpayers.

One of the earliest and most influential examples of the Business Privilege Tax was the Mercantile License Tax, implemented in the city of Philadelphia in 1939. This tax, levied on the gross receipts of businesses, was a pioneering initiative in local taxation. It set a precedent for other municipalities to follow, offering a model for how local governments could raise revenue while maintaining a level of autonomy from state tax policies.

Over the decades, the Business Privilege Tax evolved and spread across the United States, taking on various forms and names. Some states adopted the Business and Occupation Tax, while others implemented the Gross Receipts Tax or the Business Activities Tax. These variations often reflect the unique fiscal needs and political landscapes of each jurisdiction.

Despite the diversity in terminology and structure, the core principle remained consistent: taxing the privilege of doing business to support local economies and fund essential services.

Understanding the Business Privilege Tax: A Comprehensive Overview

The Business Privilege Tax is a broad term encompassing various types of taxes levied on businesses based on their gross receipts, sales, or other measures of business activity. It is typically imposed by state and local governments, with the specific rules and rates varying widely depending on the jurisdiction.

Types of Business Privilege Taxes

- Gross Receipts Tax: This tax is levied on the total revenue generated by a business, regardless of profit or loss. It is a common form of Business Privilege Tax and is often used by states and municipalities to generate a stable revenue stream.

- Business and Occupation Tax: This tax is based on the gross proceeds of a business's activities, such as sales, manufacturing, or service provision. It is often tiered, with different rates for different industries or types of business activities.

- Business Activities Tax: This tax is a more comprehensive approach, encompassing a range of business activities and often including elements of both the Gross Receipts Tax and the Business and Occupation Tax. It is designed to capture a broader spectrum of business operations.

Key Characteristics of the Business Privilege Tax

- Base and Rate Structure: The tax base for the Business Privilege Tax can vary widely, from gross receipts to specific measures of business activity. The tax rate is often set as a percentage of the tax base, with some jurisdictions offering exemptions or credits for certain types of businesses or activities.

- Registration and Compliance: Businesses operating within a jurisdiction that imposes a Business Privilege Tax are typically required to register with the relevant tax authority. This process often involves obtaining a tax identification number and filing regular tax returns, with penalties for non-compliance.

- Taxable Entities: The Business Privilege Tax applies to a wide range of entities, including corporations, partnerships, sole proprietorships, and limited liability companies (LLCs). The specific entities subject to the tax and the tax rates applied may vary depending on the jurisdiction and the nature of the business.

Real-World Examples: How the Business Privilege Tax Impacts Different Businesses

Case Study: Retail Stores

Retail stores, particularly those with physical locations, are often subject to the Business Privilege Tax. For instance, consider a chain of clothing stores operating in multiple states. Each state may have its own Business Privilege Tax structure, with varying tax bases and rates. The company would need to carefully manage its tax obligations in each state, ensuring compliance with local regulations and potentially negotiating tax incentives or exemptions.

Case Study: Online Businesses

The rise of e-commerce has presented new challenges and opportunities for the Business Privilege Tax. Online businesses, which often operate across state lines, must navigate a complex web of tax regulations. For example, an online retailer selling goods nationwide may be subject to the Business Privilege Tax in each state where it has significant economic presence, even if it doesn't have a physical location there.

Case Study: Service-Based Businesses

Service-based businesses, such as consulting firms or law practices, are also impacted by the Business Privilege Tax. These businesses may be subject to the tax based on the gross receipts from their services, which can be more challenging to calculate and report than traditional sales-based businesses. Additionally, the tax may vary depending on the specific services provided and the location of the clients.

Strategies for Effective Management of the Business Privilege Tax

Stay Informed and Proactive

Keeping up-to-date with the latest changes and regulations surrounding the Business Privilege Tax is crucial. This involves monitoring tax legislation at the state and local levels, attending relevant seminars or workshops, and consulting with tax professionals who specialize in business taxes. Being proactive can help businesses anticipate and prepare for potential changes, ensuring compliance and minimizing tax liabilities.

Utilize Tax Incentives and Exemptions

Many jurisdictions offer tax incentives, credits, or exemptions to attract or support certain types of businesses. These incentives can significantly reduce a business's tax burden. For example, some states offer tax breaks for businesses that create jobs or invest in local communities. Understanding these incentives and qualifying for them can be a strategic way to manage the Business Privilege Tax.

Consider Tax Planning and Structuring

Effective tax planning can help businesses minimize their tax liabilities within the boundaries of the law. This may involve restructuring business operations to take advantage of favorable tax treatments, optimizing tax returns, or exploring tax-efficient strategies such as tax-exempt financing or tax-advantaged retirement plans. Working with experienced tax advisors can be crucial in this regard.

Challenges and Opportunities: The Future of the Business Privilege Tax

Addressing Complexity and Compliance

As businesses become more diverse and operate across multiple jurisdictions, the complexity of the Business Privilege Tax landscape increases. This can lead to challenges in compliance, especially for smaller businesses with limited resources. Simplifying tax regulations, improving guidance and education, and enhancing compliance tools can help businesses navigate this complex environment more effectively.

Exploring New Revenue Sources

With the rise of the digital economy and the increasing mobility of businesses, traditional tax bases like sales or gross receipts may become less reliable. This presents an opportunity for states and municipalities to explore new revenue sources, such as taxes on digital transactions or remote services. These new tax structures could provide a more stable and equitable revenue stream for local governments.

Ensuring Tax Fairness and Competitiveness

The Business Privilege Tax can have a significant impact on the competitiveness of businesses, particularly when different jurisdictions have varying tax rates and structures. Ensuring tax fairness and competitiveness is essential to maintaining a healthy business environment. This may involve harmonizing tax policies across states or regions, providing tax relief for specific industries, or offering incentives for businesses to locate or expand in certain areas.

Conclusion: Navigating the Business Privilege Tax Landscape

The Business Privilege Tax is a critical component of the U.S. tax system, impacting businesses of all sizes and types. Understanding its historical context, current applications, and potential future trajectory is essential for businesses to manage their tax obligations effectively. By staying informed, utilizing tax incentives, and employing strategic tax planning, businesses can navigate the complex world of Business Privilege Taxes with confidence and success.

As the business landscape continues to evolve, the Business Privilege Tax will likely undergo further changes and adaptations. Staying proactive and adaptable will be key for businesses to thrive in this dynamic environment.

What is the Business Privilege Tax?

+The Business Privilege Tax is a tax levied by state and local governments on the privilege of conducting business within a specific jurisdiction. It is often based on gross receipts, sales, or other measures of business activity.

How does the Business Privilege Tax affect my business?

+The impact of the Business Privilege Tax depends on your business’s activities, location, and tax obligations. It can increase your tax burden, especially if you operate in multiple jurisdictions with different tax rates. However, it can also provide opportunities for tax incentives and exemptions.

What are the different types of Business Privilege Taxes?

+Common types include Gross Receipts Taxes, Business and Occupation Taxes, and Business Activities Taxes. Each has its own rules, tax bases, and rates, depending on the jurisdiction.

How can I manage my Business Privilege Tax obligations effectively?

+Stay informed about tax regulations, utilize tax incentives and exemptions, and consider tax planning strategies. Consult with tax professionals to ensure compliance and optimize your tax position.