Car Sales Tax In Texas

The state of Texas is known for its vibrant car culture, with a diverse range of vehicles hitting the roads every day. When it comes to purchasing a new or used car, understanding the sales tax implications is crucial for both buyers and sellers. In this comprehensive guide, we'll delve into the specifics of car sales tax in Texas, providing you with all the information you need to navigate this essential aspect of car ownership.

Understanding the Texas Car Sales Tax

In Texas, the sales tax on vehicles is a significant consideration for buyers, as it can significantly impact the overall cost of purchasing a car. The state imposes a sales tax on all tangible personal property, including automobiles. However, it’s important to note that the sales tax rate can vary depending on several factors, such as the type of vehicle, its value, and the location of the sale.

The Texas sales tax is a percentage-based tax, which means the amount of tax you pay is calculated as a percentage of the vehicle's purchase price. The standard sales tax rate in Texas is 6.25%, but this rate can be subject to additional local taxes, resulting in a higher overall tax burden.

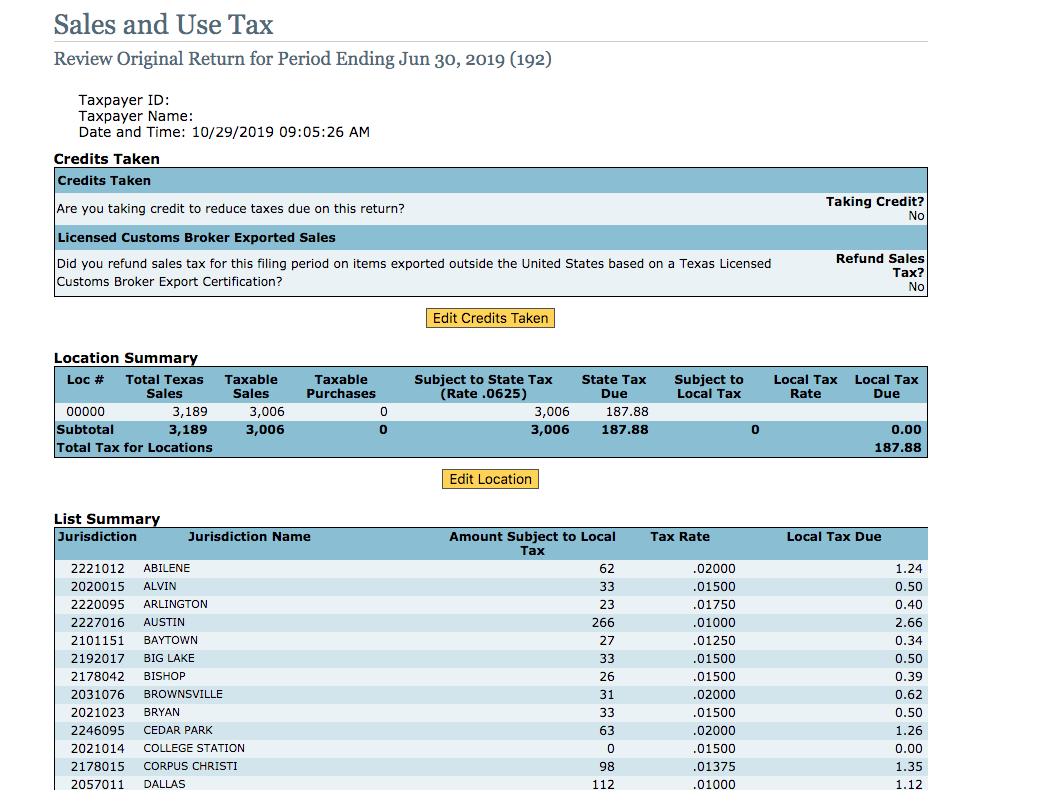

Local Tax Variations

One unique aspect of Texas car sales tax is the presence of local option taxes. Various cities and counties in Texas have the authority to impose additional sales taxes, known as local option sales taxes (LOST). These local taxes can increase the overall sales tax rate, sometimes significantly. For instance, in certain areas of the state, the total sales tax rate can exceed 8% when local option taxes are applied.

To illustrate this variation, consider the following table, which provides a glimpse at the different sales tax rates across some major cities in Texas:

| City | Sales Tax Rate |

|---|---|

| Austin | 8.25% |

| Houston | 8.25% |

| Dallas | 8.25% |

| San Antonio | 8.125% |

| Fort Worth | 8.25% |

As you can see, the sales tax rate can vary quite substantially across different regions, making it crucial for car buyers to be aware of the specific tax rates in their area.

Exemptions and Special Cases

While the standard sales tax rate applies to most vehicle purchases in Texas, there are certain exemptions and special cases to be aware of. These exceptions can provide significant savings for eligible buyers.

Disabled Veteran Exemption

Texas offers a sales tax exemption for disabled veterans. If you are a disabled veteran or a surviving spouse of a disabled veteran, you may be eligible for this exemption. To qualify, you must have a disability rating of 10% or higher and possess a valid Texas Veterans Administration (VA) Exemption Certificate. This exemption can be applied to the purchase of a new or used vehicle, saving you a considerable amount on sales tax.

Military Exemption

Active-duty military personnel stationed in Texas are also eligible for a sales tax exemption. This exemption applies to the purchase of a new or used vehicle, provided the vehicle is registered and titled in Texas. To claim this exemption, military members must present a valid military ID and complete the necessary paperwork at the time of purchase.

Trade-In Allowance

If you’re trading in your old vehicle as part of your new car purchase, you may be eligible for a trade-in allowance. This allowance can reduce the overall sales tax burden by subtracting the trade-in value from the purchase price of the new vehicle. However, it’s important to note that the trade-in allowance is subject to certain restrictions and may not be applicable in all situations.

Calculating Car Sales Tax in Texas

Calculating the sales tax on a vehicle purchase in Texas involves a straightforward process. Here’s a step-by-step guide to help you understand how it works:

- Determine the Purchase Price: Start by identifying the total purchase price of the vehicle, including any additional fees or charges.

- Identify the Applicable Tax Rate: Locate the sales tax rate for your specific region. This can be found through official government resources or by contacting your local tax office.

- Calculate the Sales Tax: Multiply the purchase price by the applicable tax rate. For example, if the purchase price is $20,000 and the tax rate is 8.25%, the sales tax would be calculated as follows: $20,000 x 0.0825 = $1,650.

- Include Local Option Taxes: If applicable, add any local option taxes to the calculated sales tax. This will give you the total sales tax amount.

- Add the Sales Tax to the Purchase Price: Finally, add the total sales tax to the purchase price to determine the overall cost of the vehicle.

Example Calculation

Let’s work through an example to better understand the process. Suppose you’re purchasing a new car in Austin, Texas, with a purchase price of $30,000. The applicable sales tax rate, including local option taxes, is 8.25%.

Sales Tax Calculation:

$30,000 x 0.0825 = $2,475

So, the total sales tax on this vehicle would be $2,475, and the overall cost of the car, including tax, would be $32,475.

Filing and Payment Process

When purchasing a vehicle in Texas, the sales tax is typically collected by the seller and remitted to the Texas Comptroller of Public Accounts. The seller is responsible for filing the necessary paperwork and paying the tax on behalf of the buyer.

If you're purchasing a vehicle from a private seller or importing a vehicle from another state, you may need to complete the tax filing and payment process yourself. In such cases, it's essential to consult with the Texas Comptroller's office or a tax professional to ensure you meet all the necessary requirements.

Future Implications and Considerations

Understanding the current car sales tax landscape in Texas is just the beginning. As a car buyer or seller, it’s essential to stay informed about potential changes and developments that could impact your future purchases.

Potential Tax Rate Changes

Tax rates in Texas, including sales tax, are subject to change. While the current rates provide a reliable framework for calculating sales tax, it’s important to stay updated on any proposed or implemented changes. Local governments may propose adjustments to local option taxes, and state-level tax rates could also be affected by legislative decisions.

Online Vehicle Sales

With the rise of e-commerce, online vehicle sales have become increasingly common. If you’re considering purchasing a car online, it’s crucial to understand the tax implications. In many cases, online vehicle sales are subject to the same sales tax rules as traditional purchases. However, the process of collecting and remitting the tax may differ, so it’s essential to clarify the tax obligations with the seller or the online platform.

Environmental Considerations

Texas, like many other states, is increasingly focusing on environmental sustainability. This shift may lead to changes in tax policies related to vehicle purchases. For example, there could be incentives or tax breaks for buyers of electric or hybrid vehicles. Staying informed about these potential developments can help you make more informed purchasing decisions.

Used Car Market

The used car market in Texas is thriving, offering buyers a wide range of options. When purchasing a used car, it’s important to understand the sales tax implications. The sales tax rate for used vehicles is typically the same as for new vehicles, but the calculation may involve different factors, such as the vehicle’s blue book value or the purchase price, depending on the transaction type.

How often do sales tax rates change in Texas?

+Sales tax rates in Texas can change annually or more frequently if there are legislative amendments. It's advisable to check the Texas Comptroller's website for the most up-to-date information on sales tax rates.

Are there any online resources to help me calculate car sales tax in Texas?

+Yes, the Texas Comptroller's website provides a sales tax calculator that can assist you in estimating the sales tax on a vehicle purchase. It takes into account both state and local taxes.

Can I negotiate the sales tax on a vehicle purchase in Texas?

+The sales tax rate is set by law and cannot be negotiated. However, you can negotiate the purchase price of the vehicle, which can indirectly impact the overall sales tax amount.

What happens if I fail to pay the sales tax on my vehicle purchase in Texas?

+Failure to pay the sales tax on a vehicle purchase can result in penalties and interest charges. It's important to ensure that the sales tax is properly paid and documented to avoid legal complications.

Are there any online platforms that can assist me in understanding and managing my car sales tax obligations in Texas?

+Yes, there are online platforms and tax management software that can guide you through the process of understanding and managing your car sales tax obligations. These tools can provide valuable insights and help ensure compliance with Texas tax laws.

In conclusion, navigating the car sales tax landscape in Texas requires a comprehensive understanding of the applicable rates, exemptions, and calculation methods. By staying informed and utilizing the resources available, you can make more informed decisions when purchasing a vehicle and ensure compliance with Texas tax regulations.