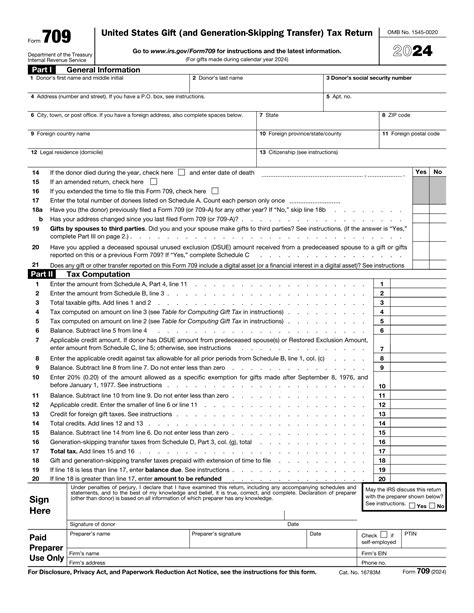

Tax Form 709

In the realm of tax regulations and financial planning, understanding the intricacies of various tax forms is crucial. Among these, the IRS Form 709, commonly known as the United States Gift (and Generation-Skipping Transfer) Tax Return, plays a significant role. This form is essential for reporting and calculating gift taxes, ensuring compliance with federal tax laws. In this comprehensive guide, we will delve into the specifics of Form 709, exploring its purpose, key components, and the process of completing it accurately.

Understanding the Purpose of Form 709

Form 709 serves as a vital tool for individuals who wish to make substantial gifts or transfers of property to others, whether it be to family members, friends, or charitable organizations. The primary objective of this form is to ensure that gift taxes are appropriately assessed and paid, maintaining fairness and transparency in the tax system. Gift taxes are imposed on the giver, not the recipient, and Form 709 provides a structured way to report these transactions accurately.

The gift tax system is designed to prevent individuals from avoiding estate taxes by giving away their wealth during their lifetime. By requiring the reporting of gifts through Form 709, the IRS can monitor and regulate these transfers, ensuring that taxpayers are not circumventing tax obligations. This form is particularly relevant for high-net-worth individuals and those engaged in complex financial planning, as it provides a legal framework for managing gift transactions.

Key Components of Form 709

Form 709 is a comprehensive document that requires detailed information about the gift transaction. Here are some of the critical components that individuals must address when completing this form:

Gift Details

This section of the form requires specific details about the gift, including the date, description, and value of the property or assets being transferred. It's essential to provide accurate and complete information to avoid potential penalties or audits.

Donor Information

The donor, or the individual making the gift, must provide their personal details, such as name, address, and taxpayer identification number. This information is crucial for the IRS to identify the taxpayer and assess the appropriate tax liability.

Recipient Information

Similarly, the recipient's information, including their name, address, and relationship to the donor, must be accurately recorded. This section helps the IRS understand the nature of the gift and its potential impact on the recipient's tax situation.

Gift Tax Computation

One of the most critical aspects of Form 709 is the calculation of gift tax. This involves determining the total value of gifts made during the year, applying any applicable exclusions or deductions, and calculating the tax liability. The form provides worksheets and instructions to guide taxpayers through this process, ensuring accuracy in their calculations.

Payments and Refunds

Once the gift tax liability is determined, the form guides taxpayers on how to make payments or request refunds. This section includes instructions on payment methods, due dates, and the necessary documentation to support any refund claims.

Completing Form 709: A Step-by-Step Guide

Completing Form 709 can be a complex process, especially for individuals who are not familiar with tax regulations. Here is a step-by-step guide to help navigate this process effectively:

Step 1: Gather Information

Before starting the form, gather all the necessary information about the gift transaction. This includes details about the property or assets being transferred, the date of the gift, and any relevant documentation supporting the value of the gift.

Step 2: Determine Gift Tax Liability

Calculate the total value of gifts made during the year, considering any exclusions or deductions that may apply. The IRS provides guidelines and worksheets to assist with this calculation. It's crucial to be precise in this step to avoid overpaying or underpaying taxes.

Step 3: Complete the Form

Using the information gathered and the calculated gift tax liability, fill out Form 709 accurately. Pay attention to the specific instructions provided for each section, ensuring that all required fields are completed.

Step 4: Sign and Submit

Once the form is completed, review it thoroughly for any errors or omissions. Sign the form, ensuring that all required signatures are in place. Submit the form to the IRS by the deadline, along with any necessary payments or supporting documentation.

FAQs about Form 709

What is the annual gift tax exclusion?

+The annual gift tax exclusion allows individuals to give a certain amount of money or property as a gift without triggering gift tax. In 2023, the exclusion amount is $16,000 per recipient. This means you can give up to $16,000 to as many people as you like without incurring gift tax.

Are there any special rules for gifts to spouses or charities?

+Yes, there are special rules for gifts to spouses and charities. Gifts to a spouse are generally not subject to gift tax, regardless of the amount, as long as the spouse is a U.S. citizen. Gifts to charities, on the other hand, may qualify for a charitable deduction, reducing the donor's taxable income.

Can I file Form 709 electronically?

+Yes, you can file Form 709 electronically through the IRS website. Electronic filing is often more convenient and provides faster processing times. However, it's important to ensure that you have the necessary software and access to e-file the form.

What happens if I don't file Form 709 when required?

+Failing to file Form 709 when required can result in penalties and interest charges. The IRS may also assess a late filing penalty, which can be up to 5% of the gift tax due for each month the form is late, up to a maximum of 25%. It's crucial to stay compliant with filing requirements to avoid these penalties.

Can I make a gift without filing Form 709 if it's below the annual exclusion amount?

+If the value of your gift is below the annual exclusion amount, you generally don't need to file Form 709. However, it's still a good idea to keep records of these gifts in case the IRS has any questions or concerns in the future. Maintaining accurate records can help demonstrate compliance with gift tax regulations.

In conclusion, Form 709 is a critical tool for reporting and managing gift transactions, ensuring compliance with federal tax laws. Understanding the purpose, key components, and completion process of this form is essential for individuals engaged in financial planning and wealth management. By following the guidelines and seeking professional advice when needed, taxpayers can navigate the complexities of gift taxes with confidence.