Property Tax Nj

Property taxes are a significant aspect of owning a home or commercial property, and they play a crucial role in the financial landscape of any state. In New Jersey, property taxes are one of the highest in the nation, impacting both homeowners and businesses. Understanding the intricacies of property taxes in New Jersey is essential for anyone residing or investing in the state.

The Complex Landscape of Property Taxes in New Jersey

New Jersey’s property tax system is renowned for its complexity, often leaving homeowners and investors perplexed. The state’s property tax structure is influenced by a multitude of factors, including municipal budgets, school district funding, and local services provided. This intricate system results in a wide range of property tax rates across different counties and municipalities.

According to recent data, the median property tax rate in New Jersey stands at approximately 2.42% of a property's assessed value, which is significantly higher than the national average of 1.08%. This means that a homeowner with a property valued at $300,000 can expect to pay around $7,260 in annual property taxes. However, it's important to note that property tax rates can vary greatly, with some municipalities imposing rates as low as 1.7% and others as high as 3.25%.

The disparity in property tax rates is further accentuated when considering the diverse range of property values across New Jersey. For instance, in Bergen County, the median home value is approximately $450,000, while in Atlantic County, it hovers around $200,000. Consequently, homeowners in Bergen County face a substantially higher property tax burden compared to their counterparts in Atlantic County, despite the fact that the median property tax rate in both counties is relatively similar.

| County | Median Home Value | Median Property Tax Rate | Median Annual Property Tax |

|---|---|---|---|

| Bergen | $450,000 | 2.2% | $9,900 |

| Atlantic | $200,000 | 2.1% | $4,200 |

| Essex | $350,000 | 2.4% | $8,400 |

To provide a clearer picture, let's delve into a real-life example. Imagine a homeowner, Mr. Johnson, residing in Bergen County with a property valued at $500,000. Based on the median property tax rate of 2.2% in the county, Mr. Johnson can expect to pay an annual property tax of $11,000. This amount is significantly higher than the national average and even exceeds the median property tax in some states.

Factors Influencing Property Tax Rates

The property tax landscape in New Jersey is shaped by various factors, each playing a critical role in determining the final tax amount. Here’s a breakdown of some key influences:

- Municipal Budgets: Local governments rely heavily on property taxes to fund essential services such as police, fire protection, and infrastructure maintenance. Consequently, municipalities with higher expenses often impose higher property tax rates.

- School District Funding: In New Jersey, a substantial portion of property taxes is dedicated to funding local public schools. The need for adequate school funding can drive property tax rates upwards, especially in districts with high student populations or specialized educational programs.

- Local Services: The level of services provided by a municipality, such as recreational facilities, libraries, and public transportation, can impact property tax rates. Areas with more extensive services may require higher tax rates to sustain these offerings.

- Assessed Value: Property taxes are calculated based on the assessed value of a property, which is determined by the county tax assessor. This value can fluctuate due to market conditions, improvements made to the property, or reassessments conducted by the county.

Strategies for Navigating New Jersey’s Property Tax Landscape

Given the complexities and potential financial implications of property taxes in New Jersey, it’s essential to adopt strategic approaches to manage this expense effectively. Here are some key strategies to consider:

Understanding Assessment Values

The assessed value of a property is a critical factor in determining property taxes. Homeowners should carefully review their property’s assessed value to ensure accuracy. If an assessment seems unreasonable, it’s advisable to seek a reassessment or appeal the current value. This process can potentially lead to a reduction in property taxes.

Exploring Tax Abatement Programs

New Jersey offers various tax abatement programs aimed at encouraging economic development and attracting new residents. These programs often provide temporary property tax relief for homeowners or investors in specific areas or under certain conditions. It’s worthwhile to explore these options, as they can significantly reduce the overall tax burden.

Maximizing Tax Deductions

Property taxes are generally deductible on federal income tax returns, which can provide some relief to homeowners. It’s crucial to consult with a tax professional to understand the specific deductions available and ensure compliance with the latest tax regulations.

Considerations for Investors

For investors, it’s essential to thoroughly research and analyze the potential impact of property taxes on their investment strategy. New Jersey’s high property tax rates can significantly affect the cash flow and profitability of rental properties. Investors should carefully evaluate the tax implications before making any investment decisions.

Staying Informed about Tax Policy Changes

The property tax landscape in New Jersey is subject to frequent changes and updates. Staying informed about these changes is crucial for both homeowners and investors. Subscribing to relevant newsletters, following local news sources, and engaging with community forums can help keep individuals updated on any policy shifts that may impact their property tax obligations.

Conclusion

Property taxes in New Jersey present a unique challenge for homeowners and investors due to the state’s complex tax system and relatively high tax rates. By understanding the factors influencing property taxes and adopting strategic approaches, individuals can effectively manage their tax obligations and make informed financial decisions. Staying informed and actively engaging with local tax policies is key to navigating the ever-changing landscape of property taxes in New Jersey.

How are property taxes calculated in New Jersey?

+Property taxes in New Jersey are calculated based on the assessed value of a property, which is determined by the county tax assessor. The assessed value is then multiplied by the property tax rate, which varies depending on the municipality. This calculation results in the annual property tax amount that homeowners are required to pay.

What is the average property tax rate in New Jersey?

+The average property tax rate in New Jersey is approximately 2.42% of the assessed value of a property. However, it’s important to note that rates can vary significantly across different municipalities within the state.

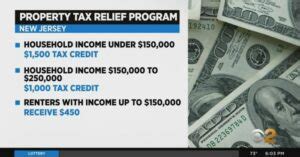

Are there any tax relief programs available for homeowners in New Jersey?

+Yes, New Jersey offers several tax relief programs for homeowners. These programs include the Homestead Benefit Program, the Senior Freeze Program, and the Farmland Assessment Program. Eligibility and benefits vary depending on the specific program and individual circumstances.

How often are property taxes reassessed in New Jersey?

+Property taxes in New Jersey are typically reassessed every year. However, some counties may conduct reassessments on a more frequent basis, such as every two or three years. It’s important for homeowners to stay informed about the reassessment schedule in their county to ensure they are aware of any potential changes to their property’s assessed value.