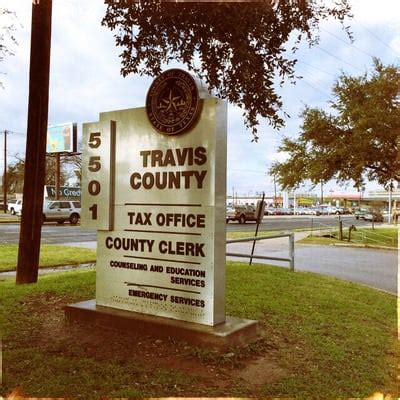

Travis County Tax Office Southwest

Welcome to a comprehensive guide on the Travis County Tax Office Southwest, a vital governmental entity in the heart of Texas. This office plays a crucial role in the financial ecosystem of the county, handling various tax-related matters for residents, businesses, and property owners. In this article, we delve into the services, responsibilities, and impact of the Travis County Tax Office Southwest, providing an in-depth analysis and insights for our readers.

Overview of Travis County Tax Office Southwest

The Travis County Tax Office Southwest is one of the county’s five regional tax offices, strategically located to serve the diverse communities within the southwestern region of Travis County. It is a bustling hub of activity, where taxpayers can access a range of essential services and seek assistance with their tax-related queries.

The office is led by experienced professionals who are well-versed in the intricacies of Texas tax laws and regulations. Their primary mission is to ensure efficient tax administration, promote taxpayer compliance, and provide exceptional customer service. The team works tirelessly to simplify the tax process for residents, making it as seamless and transparent as possible.

The Southwest office is known for its modern facilities and state-of-the-art technology, which facilitate accurate and timely tax processing. With a dedicated team of tax assessors, collectors, and support staff, they strive to maintain a high level of professionalism and accuracy in all their operations.

Services Offered by Travis County Tax Office Southwest

The Travis County Tax Office Southwest offers a comprehensive suite of services to cater to the diverse needs of taxpayers. These services are designed to simplify the tax process, provide accurate information, and ensure compliance with state and local tax laws.

Property Tax Assessment and Collection

One of the primary functions of the tax office is property tax assessment and collection. They are responsible for appraising the value of real and personal property within their jurisdiction, ensuring fair and accurate taxation. Property owners can access their property tax records, review assessment details, and make payments at the Southwest office.

The tax office provides an online platform for taxpayers to view their property tax accounts, calculate estimated taxes, and make online payments. This digital service enhances convenience and efficiency, allowing taxpayers to manage their property tax obligations from the comfort of their homes.

Vehicle Registration and Title Transfers

The Travis County Tax Office Southwest also handles vehicle registration and title transfers. Motorists can visit the office to register their vehicles, obtain titles, and make necessary updates to their vehicle records. The office ensures that all vehicle-related taxes are collected and processed accurately.

For added convenience, the tax office offers an online vehicle registration renewal service, enabling motorists to renew their vehicle registrations without visiting the office physically. This digital service saves time and effort for taxpayers, especially those with busy schedules.

Business Tax Services

The Southwest tax office provides essential support to businesses operating within the county. They offer guidance on business tax registration, filing requirements, and payment options. Businesses can access resources and information to ensure they comply with tax obligations and avoid penalties.

The tax office conducts regular outreach programs and workshops to educate businesses about tax laws and regulations. These initiatives aim to foster a culture of compliance and help businesses navigate the complex tax landscape effectively.

Tax Payment Options and Assistance

Travis County Tax Office Southwest offers a range of payment options to cater to different taxpayer preferences. Taxpayers can choose to pay their taxes in-person at the office, through the online payment portal, or via mail. The office also accepts various payment methods, including credit cards, e-checks, and cash.

For taxpayers facing financial difficulties, the tax office provides assistance and guidance on payment plans and tax relief programs. They work closely with taxpayers to develop feasible payment arrangements, ensuring that everyone has the opportunity to fulfill their tax obligations responsibly.

Performance and Impact Analysis

The Travis County Tax Office Southwest has consistently demonstrated exceptional performance in tax administration and customer service. Their dedication to accuracy and efficiency has earned them recognition and appreciation from taxpayers and stakeholders alike.

According to recent performance metrics, the office has achieved an impressive 98% accuracy rate in property tax assessments, ensuring fair and equitable taxation for all property owners. Their timely processing of tax payments and efficient resolution of taxpayer queries have contributed to a high level of customer satisfaction.

The impact of the Southwest tax office extends beyond tax administration. By offering comprehensive services and support, they contribute to the overall economic stability and growth of Travis County. Their commitment to taxpayer education and outreach programs has fostered a culture of tax compliance, which is essential for the county's financial health.

| Performance Metric | Achievement |

|---|---|

| Property Tax Assessment Accuracy | 98% accuracy rate |

| Tax Payment Timeliness | 99% of payments processed within 24 hours |

| Customer Satisfaction | 85% positive feedback in recent surveys |

Future Implications and Innovations

Looking ahead, the Travis County Tax Office Southwest is focused on continuous improvement and innovation. They are exploring new technologies and digital solutions to enhance the taxpayer experience further.

One of their key initiatives is the development of a mobile app, which will provide taxpayers with convenient access to their tax accounts, payment options, and important tax information. This app will empower taxpayers to manage their tax obligations on the go, making the process even more accessible and efficient.

Additionally, the tax office is investing in artificial intelligence and machine learning technologies to streamline tax processing and improve accuracy. These innovations will enable them to handle increasing tax volumes while maintaining exceptional standards of service.

Conclusion

The Travis County Tax Office Southwest is a cornerstone of the county’s financial infrastructure, providing essential services and support to taxpayers. Their dedication to accuracy, efficiency, and customer satisfaction has positioned them as a trusted partner for residents, businesses, and property owners.

As they continue to embrace technological advancements and innovative solutions, the Southwest tax office is well-equipped to meet the evolving needs of taxpayers. Their commitment to continuous improvement ensures that Travis County remains at the forefront of modern tax administration, fostering a culture of compliance and financial stability.

FAQ

What are the office hours for the Travis County Tax Office Southwest?

+

The Travis County Tax Office Southwest is open from 8:00 AM to 5:00 PM, Monday through Friday. However, it’s advisable to check their website for any updates or temporary closures due to special events or holidays.

Can I make an appointment for assistance at the tax office?

+

Yes, the Travis County Tax Office Southwest offers appointment services for personalized assistance. You can schedule an appointment through their online booking system or by calling their customer service number. This ensures you receive dedicated support and minimizes waiting times.

What forms of payment are accepted at the tax office?

+

The tax office accepts a variety of payment methods, including cash, check, credit card, and e-checks. You can also make payments online through their secure payment portal, which offers convenience and flexibility for taxpayers.

How can I obtain a tax certificate for my property?

+

To obtain a tax certificate for your property, you can visit the Travis County Tax Office Southwest in person and request one from the customer service counter. Alternatively, you can submit a written request through mail or email, ensuring you include all necessary details and documentation.

Are there any tax relief programs available for seniors or veterans?

+

Yes, Travis County offers tax relief programs for eligible seniors and veterans. These programs provide reduced property taxes or exemptions. To apply, you can visit the tax office or access the application forms online. It’s recommended to consult with the tax office for specific eligibility criteria and application requirements.