Florida Automobile Sales Tax

Florida, the Sunshine State, is renowned for its vibrant culture, diverse landscapes, and, of course, its love for cars. With a thriving automotive market, the Sunshine State attracts car enthusiasts and buyers alike. When it comes to purchasing a vehicle, one crucial aspect that cannot be overlooked is the sales tax. Understanding the Florida automobile sales tax is essential for anyone considering a vehicle purchase in this beautiful state.

Unraveling the Florida Automobile Sales Tax

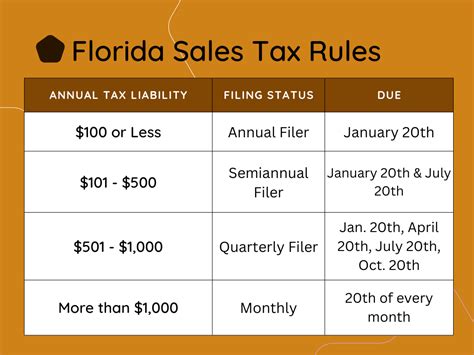

The Florida automobile sales tax is a critical component of the state's revenue system and is applied to the purchase of new and used vehicles. It is an essential consideration for both residents and visitors who wish to own a vehicle in Florida. The tax rate and its implications can significantly impact the overall cost of buying a car, making it a key factor in the decision-making process.

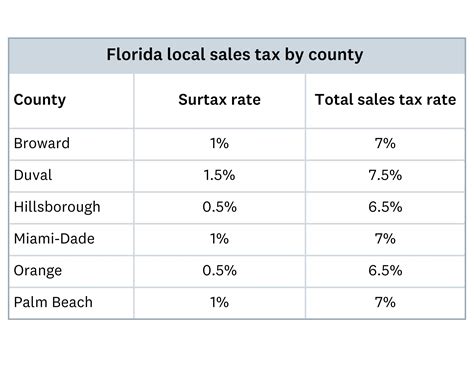

Florida's sales tax structure is unique compared to other states, offering a straightforward and transparent approach. The state imposes a uniform sales tax rate on all vehicle purchases, ensuring fairness and consistency across the state. This uniformity simplifies the process for buyers, eliminating the need to navigate varying tax rates in different counties or regions.

The Uniform Sales Tax Rate

The Florida Department of Revenue sets the sales tax rate for automobile purchases, which remains consistent statewide. As of the latest update, the sales tax rate for vehicles in Florida stands at 6.95%. This rate is applied to the total purchase price of the vehicle, including any additional fees and charges.

It's important to note that this tax rate is subject to change, and buyers should always refer to the most current information provided by the Florida Department of Revenue. Any updates or amendments to the tax rate will be officially announced, ensuring transparency and compliance for all parties involved.

Calculating the Sales Tax

To calculate the sales tax for a vehicle purchase in Florida, simply multiply the purchase price by the applicable tax rate. For example, if you are buying a car for $30,000, the sales tax would be $2,085 (6.95% of $30,000). This calculation provides a clear understanding of the additional cost associated with the purchase.

Additionally, it's worth mentioning that Florida offers a tax exemption for certain qualifying vehicles. This exemption is available for vehicles that meet specific criteria, such as those used for business purposes or purchased by individuals with disabilities. It is advisable to consult the official guidelines provided by the Florida Department of Revenue to determine eligibility for this exemption.

Impact on Vehicle Prices

The Florida automobile sales tax directly affects the final cost of a vehicle purchase. It is an additional expense that buyers need to factor into their budget. For instance, a vehicle priced at $25,000 would incur a sales tax of approximately $1,738 (6.95% of $25,000), increasing the total cost to $26,738. This impact can vary depending on the vehicle's price and the buyer's financial situation, making it crucial to consider the tax implications when planning a purchase.

| Vehicle Price | Sales Tax Rate | Estimated Sales Tax |

|---|---|---|

| $20,000 | 6.95% | $1,390 |

| $35,000 | 6.95% | $2,432.50 |

| $50,000 | 6.95% | $3,475 |

The table above illustrates the estimated sales tax for different vehicle prices based on the current tax rate. These calculations provide a clear representation of the additional cost buyers should expect when purchasing a vehicle in Florida.

Registration and Title Transfer Fees

In addition to the sales tax, buyers in Florida should be aware of the registration and title transfer fees associated with vehicle purchases. These fees are separate from the sales tax and are required to officially register and title the vehicle in the buyer's name.

The registration fee is a one-time charge based on the vehicle's weight and type. For passenger vehicles, the registration fee ranges from $8 to $10, depending on the vehicle's weight. Additionally, there is a title transfer fee of $2.50 for each title application.

It's important to budget for these additional fees when purchasing a vehicle in Florida to ensure a smooth and compliant registration process.

Tax Considerations for Out-of-State Residents

Out-of-state residents who plan to purchase a vehicle in Florida and bring it back to their home state should be aware of the tax implications. Florida requires residents to pay the sales tax on vehicles purchased in the state, regardless of their residence. This tax is due at the time of purchase and is non-negotiable.

However, many states have reciprocal agreements with Florida, allowing residents to claim a credit for the sales tax paid in Florida when registering the vehicle in their home state. It is advisable for out-of-state buyers to research and understand the tax laws and regulations of their home state to ensure compliance and avoid any unnecessary complications.

Future Implications and Tax Trends

The Florida automobile sales tax is an integral part of the state's revenue system and is likely to remain a significant consideration for vehicle buyers. While the current tax rate provides a stable and predictable environment for buyers, there is always the possibility of future adjustments.

The Florida Department of Revenue regularly reviews and assesses the state's tax structure, including the sales tax rate. Any changes or amendments to the tax rate will be officially announced, allowing buyers to plan and budget accordingly. It is essential for buyers to stay informed about any potential changes to the sales tax rate to make informed decisions.

Furthermore, the state's commitment to transparency and fairness in its tax system ensures that any amendments are applied uniformly and consistently. This approach maintains Florida's reputation as a reliable and trustworthy destination for vehicle purchases.

The Impact of Electric Vehicles

The rise of electric vehicles (EVs) and their increasing popularity present a unique challenge to the Florida automobile sales tax system. Currently, Florida does not impose a separate tax on the purchase of EVs, treating them similarly to traditional gasoline-powered vehicles. However, as the adoption of EVs continues to grow, there may be future considerations and potential changes to the tax structure.

Some states have implemented additional fees or taxes specifically for electric vehicles to offset the loss of revenue from gasoline taxes. While Florida has not yet taken such measures, it is essential for buyers to stay updated on any potential developments regarding EV-specific taxes. Understanding these potential changes can help buyers make informed decisions and plan their purchases accordingly.

Conclusion

Understanding the Florida automobile sales tax is a crucial aspect of purchasing a vehicle in the Sunshine State. The state's uniform sales tax rate provides a straightforward and transparent system, ensuring fairness and consistency for buyers. By calculating the sales tax accurately and considering additional fees and potential future changes, buyers can make well-informed decisions when acquiring a vehicle in Florida.

Staying informed about the latest tax rates, regulations, and potential developments is essential for a seamless and compliant vehicle purchase experience. Whether you are a resident or an out-of-state buyer, Florida's automobile sales tax is an important consideration that can impact your overall budget and financial planning.

What is the current sales tax rate for automobile purchases in Florida?

+As of the latest update, the sales tax rate for automobile purchases in Florida is 6.95%.

Are there any tax exemptions for vehicle purchases in Florida?

+Yes, Florida offers tax exemptions for certain qualifying vehicles. These exemptions are typically available for vehicles used for business purposes or purchased by individuals with disabilities. It is advisable to consult the official guidelines provided by the Florida Department of Revenue to determine eligibility.

What are the registration and title transfer fees associated with vehicle purchases in Florida?

+In addition to the sales tax, buyers in Florida should be aware of the registration and title transfer fees. The registration fee is based on the vehicle’s weight and type, ranging from 8 to 10 for passenger vehicles. There is also a title transfer fee of $2.50 for each title application.