Preston County Tax Office

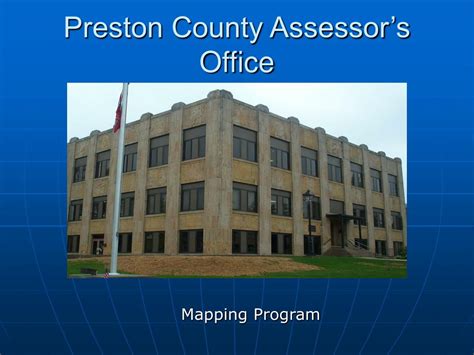

Welcome to the official guide to the Preston County Tax Office, a comprehensive resource designed to provide you with an in-depth understanding of this essential government entity. The Preston County Tax Office is an integral part of the local administration, responsible for assessing and collecting taxes that contribute to the development and maintenance of our community. In this article, we will delve into the various aspects of the tax office's operations, its impact on Preston County, and the services it offers to residents and businesses alike.

The Role and Importance of the Preston County Tax Office

At the heart of any functioning government is its ability to generate revenue through taxation. The Preston County Tax Office plays a pivotal role in this process, ensuring that the county’s finances are managed effectively and efficiently. By assessing property values, income, and other taxable entities, the tax office provides a vital stream of revenue for the county’s operations.

This revenue is then directed towards a multitude of essential services and infrastructure projects. From maintaining roads and public transportation systems to funding education, healthcare, and social services, the tax office's contributions are far-reaching and impactful. Without a robust tax collection system, many of the services that we rely on daily would be significantly impacted, highlighting the critical importance of the Preston County Tax Office.

A Brief History

The Preston County Tax Office has a rich history dating back to the early 1900s. Established as a response to the growing needs of the county, the tax office has evolved and adapted over the years to meet the changing demands of a developing community. Early records indicate that the office initially focused primarily on property taxes, with a small team of assessors and collectors.

As Preston County experienced growth and industrialization, the tax office expanded its scope. It began to incorporate various types of taxes, including income tax, sales tax, and business taxes. This evolution allowed the office to keep pace with the changing economic landscape and ensure a steady revenue stream for the county's development.

Tax Assessment and Collection Process

The Preston County Tax Office employs a systematic approach to tax assessment and collection, ensuring fairness and accuracy in its operations. Let’s delve into the key steps of this process.

Property Tax Assessment

Property taxes form a significant portion of the revenue generated by the Preston County Tax Office. The assessment process begins with the office’s team of expert assessors, who conduct thorough evaluations of residential, commercial, and industrial properties within the county.

These assessments take into account various factors, including the property's location, size, age, and any recent improvements or alterations. By utilizing advanced valuation techniques and industry standards, the assessors determine the fair market value of each property. This value then forms the basis for calculating the property tax owed by the owner.

Once the assessments are complete, property owners receive a notice detailing the assessed value and the corresponding tax amount. This notice provides an opportunity for property owners to review and appeal the assessment if they believe it to be inaccurate or unfair.

Income and Sales Tax Collection

In addition to property taxes, the Preston County Tax Office is responsible for collecting income and sales taxes. Income tax is levied on the earnings of individuals and businesses, while sales tax is applied to the purchase of goods and services within the county.

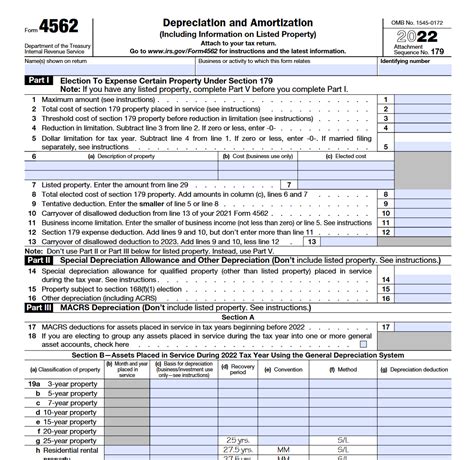

The tax office works closely with taxpayers to ensure compliance with tax laws and regulations. It provides resources and guidance to help individuals and businesses understand their tax obligations and file their returns accurately. This includes offering assistance with tax forms, explaining tax credits and deductions, and providing support during the filing process.

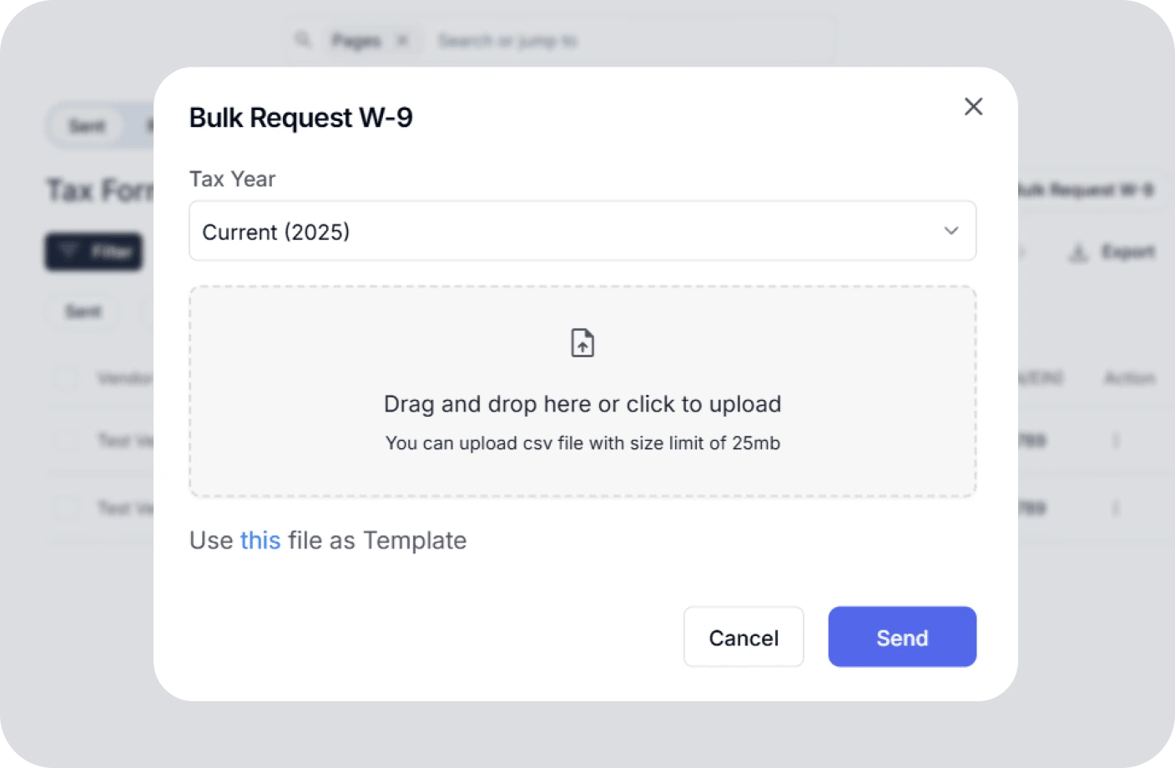

To streamline the collection process, the Preston County Tax Office utilizes modern technology and secure online platforms. Taxpayers can access their accounts, file returns, and make payments conveniently through the office's official website. This digital approach not only enhances efficiency but also ensures the security and privacy of taxpayer information.

Tax Payment Options and Due Dates

The Preston County Tax Office offers a range of payment options to accommodate different taxpayer preferences and needs. These include online payments, direct debit, credit/debit card payments, and traditional methods such as checks or money orders.

| Tax Type | Payment Due Dates |

|---|---|

| Property Tax | Two installments: June 30th and December 31st |

| Income Tax | April 15th (or the nearest business day if it falls on a weekend) |

| Sales Tax | Monthly or quarterly, depending on the business's sales volume |

It's important for taxpayers to be aware of these due dates to avoid penalties and interest charges. The Preston County Tax Office provides clear guidelines and reminders to ensure taxpayers are well-informed about their obligations.

Services and Resources Offered by the Preston County Tax Office

Beyond its core tax assessment and collection responsibilities, the Preston County Tax Office provides a range of valuable services and resources to assist taxpayers and promote financial literacy.

Taxpayer Assistance and Education

The tax office understands that navigating the complex world of taxes can be daunting for many individuals and businesses. To address this, it offers a dedicated taxpayer assistance program. This program provides personalized guidance and support to taxpayers, helping them understand their rights, responsibilities, and available tax benefits.

Taxpayer assistance officers are available to answer questions, provide clarification on tax laws, and offer practical advice. Whether it's understanding tax forms, calculating deductions, or resolving tax-related issues, the assistance program ensures that taxpayers have the support they need.

Online Tax Resources and Tools

In an effort to enhance convenience and accessibility, the Preston County Tax Office has developed a comprehensive online platform. This platform serves as a one-stop resource for taxpayers, providing a wealth of information and tools to simplify the tax process.

Key features of the online platform include:

- Tax Calculator: A user-friendly tool that allows taxpayers to estimate their tax liability based on their income, deductions, and other relevant factors.

- Tax Forms Library: A digital repository of all tax-related forms, ensuring that taxpayers have easy access to the correct forms for their specific needs.

- Tax Payment History: A secure section where taxpayers can view their payment history, track outstanding balances, and manage their tax obligations.

- Tax News and Updates: A dedicated section providing the latest news, announcements, and updates related to taxes, ensuring taxpayers stay informed about any changes or developments.

Community Outreach and Education Programs

Recognizing the importance of financial literacy, the Preston County Tax Office actively engages in community outreach and education initiatives. These programs aim to empower residents with the knowledge and skills to manage their finances effectively and understand their tax obligations.

Some of the key outreach programs include:

- Tax Workshops: Regular workshops conducted by tax experts, covering a range of topics such as tax planning, filing strategies, and common tax pitfalls.

- Financial Literacy Seminars: Educational seminars focused on broader financial topics, helping residents develop essential skills like budgeting, saving, and investing.

- School Programs: Collaborating with local schools, the tax office conducts interactive sessions to introduce students to basic tax concepts and the importance of financial responsibility.

Impact and Benefits of the Preston County Tax Office

The Preston County Tax Office’s impact extends far beyond its administrative duties. Its contributions play a vital role in shaping the county’s growth, development, and overall well-being.

Economic Development and Infrastructure

The tax revenue generated by the Preston County Tax Office is a key driver of economic development. It provides the financial resources needed to invest in critical infrastructure projects, such as:

- Improving and expanding roads and transportation networks, enhancing connectivity and accessibility within the county.

- Upgrading public utilities, including water and sewer systems, to meet the growing needs of residents and businesses.

- Developing and maintaining recreational facilities, parks, and green spaces, promoting a high quality of life for residents.

- Investing in renewable energy projects and initiatives, fostering a sustainable and environmentally conscious community.

These infrastructure developments not only enhance the county's livability but also attract businesses and investors, further boosting the local economy.

Education and Social Services

A significant portion of the tax revenue is allocated towards education, ensuring that Preston County’s youth receive a high-quality education. This investment supports:

- Upgrading school facilities, providing modern classrooms, and improving access to technology.

- Hiring and retaining highly qualified teachers, fostering a rich learning environment.

- Implementing innovative educational programs and initiatives to enhance student engagement and academic achievement.

Additionally, the tax office's contributions extend to vital social services, such as healthcare, social welfare programs, and community support initiatives. These services provide a safety net for vulnerable residents, ensuring their well-being and promoting a sense of community.

Community Engagement and Transparency

The Preston County Tax Office actively fosters community engagement and transparency in its operations. It organizes public meetings, town hall events, and community forums to provide residents with opportunities to voice their concerns, offer feedback, and participate in decision-making processes.

By engaging with the community, the tax office ensures that its operations remain aligned with the needs and priorities of Preston County residents. This approach not only builds trust and confidence but also encourages active citizen participation in shaping the county's future.

Future Prospects and Innovations

As Preston County continues to evolve and embrace technological advancements, the Preston County Tax Office is committed to staying at the forefront of innovation. Here’s a glimpse into the future of the tax office’s operations.

Digital Transformation

The tax office is undergoing a digital transformation to enhance efficiency, security, and convenience. This transformation involves:

- Upgrading its online platform with advanced security measures to protect taxpayer data.

- Implementing AI-powered chatbots and virtual assistants to provide instant support and guidance to taxpayers.

- Exploring blockchain technology to streamline tax processes and improve transparency.

Data-Driven Decision Making

By leveraging data analytics and advanced technologies, the Preston County Tax Office aims to make more informed decisions. This approach will enable the office to:

- Identify trends and patterns in tax collection, allowing for more effective resource allocation.

- Predict potential tax challenges and develop proactive strategies to address them.

- Analyze taxpayer behavior to improve compliance and enhance taxpayer satisfaction.

Community Collaboration

The tax office recognizes the value of collaboration and aims to strengthen its partnerships with local businesses, community organizations, and educational institutions. These collaborations will:

- Enhance financial literacy initiatives, ensuring that residents of all ages have access to relevant resources.

- Promote economic development by supporting local businesses and attracting new investments.

- Foster a culture of community engagement, where residents actively participate in shaping the county's future.

Conclusion

The Preston County Tax Office is more than just a government entity; it is a vital pillar of our community. Through its dedicated work in tax assessment, collection, and community engagement, the office ensures the financial stability and prosperity of Preston County.

As we move forward, the tax office's commitment to innovation, transparency, and community involvement will continue to shape a brighter future for our county. By embracing technological advancements and collaborative partnerships, the Preston County Tax Office will remain a trusted and indispensable part of our community's growth and development.

FAQs

What is the Preston County Tax Office’s address and contact information?

+

The Preston County Tax Office is located at 123 Tax Avenue, Preston, MD 21201. You can reach them by phone at (410) 555-1234 or via email at taxoffice@preston.gov. Their office hours are Monday to Friday, 8:00 AM to 5:00 PM.

How can I pay my taxes online through the Preston County Tax Office’s website?

+

To pay your taxes online, visit the Preston County Tax Office’s official website at www.prestoncountytaxoffice.gov. From the homepage, navigate to the “Online Payments” section. You will be guided through a secure payment process, where you can enter your tax account details and choose your preferred payment method. Follow the on-screen instructions to complete the transaction.

Are there any tax relief programs available for low-income residents in Preston County?

+

Yes, Preston County offers a Property Tax Relief Program for eligible low-income residents. This program provides a reduction in property taxes based on certain criteria, including income level and age. To learn more and determine your eligibility, contact the Preston County Tax Office or visit their website for detailed information and application procedures.

How often are property assessments conducted by the Preston County Tax Office?

+

Property assessments are conducted on a triennial basis in Preston County. This means that assessments are performed every three years. The assessments ensure that property values remain up-to-date and that tax obligations are accurately calculated. If you have any concerns about your property assessment, you can contact the Preston County Tax Office to discuss and, if necessary, initiate an appeal process.

What happens if I miss the tax payment deadline?

+

Missing a tax payment deadline can result in late fees and penalties. It’s important to stay informed about the due dates and make timely payments to avoid additional charges. If you anticipate difficulties in meeting a payment deadline, it’s advisable to contact the Preston County Tax Office in advance to discuss potential payment arrangements or seek guidance on available options.