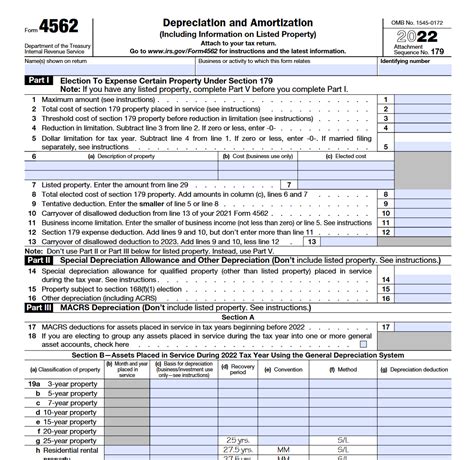

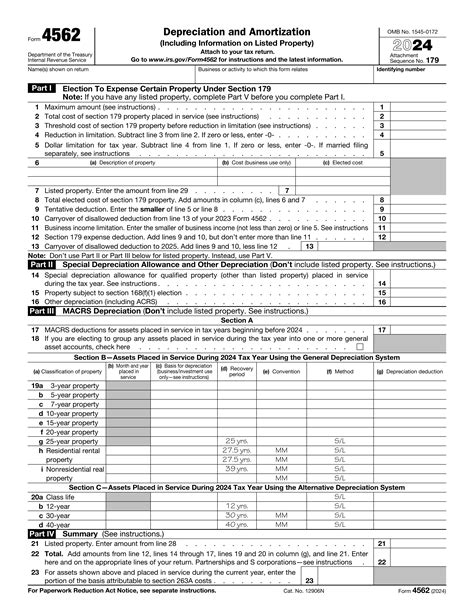

Irs Tax Form 4562

When it comes to tax matters, one of the crucial forms that businesses and individuals in the United States often encounter is the IRS Tax Form 4562. This comprehensive form plays a pivotal role in the calculation and reporting of depreciation and amortization expenses for various assets and properties. In this expert guide, we will delve deep into the intricacies of Form 4562, exploring its purpose, key sections, and the impact it has on tax filings.

Understanding the Purpose of IRS Tax Form 4562

Form 4562, officially titled “Depreciation and Amortization (Including Information on Listed Property),” is a vital component of the U.S. Internal Revenue Service’s (IRS) tax documentation. Its primary function is to assist taxpayers in accurately computing and reporting depreciation, amortization, and certain other cost recovery deductions for assets used in business or income-producing activities.

Depreciation and amortization are essential concepts in tax accounting. Depreciation allows businesses to recover the cost of tangible assets like buildings, machinery, and vehicles over their useful lives. Amortization, on the other hand, is the process of expensing the cost of intangible assets such as patents, trademarks, and goodwill over a set period.

By using Form 4562, taxpayers can claim these deductions, which reduce their taxable income and, consequently, their tax liability. It ensures that the IRS receives accurate information about the value of assets, their useful lives, and the methods used to calculate depreciation and amortization expenses.

Key Sections of IRS Tax Form 4562

Form 4562 is divided into several sections, each designed to capture specific information related to depreciation and amortization. Let’s explore some of the key sections:

Section A: General Information

This section serves as the foundation of the form, requiring taxpayers to provide basic information such as the taxpayer’s name, address, and identification number. It also includes fields for the tax year, business activity, and the type of entity filing the form.

Additionally, Section A delves into the specific depreciation methods and conventions used. Taxpayers must indicate whether they are using the Modified Accelerated Cost Recovery System (MACRS) or an alternative depreciation system. MACRS is the most common method, allowing for accelerated depreciation over specific recovery periods based on the asset's class and type.

Section B: Depreciation

Section B is where the bulk of the depreciation calculations take place. Taxpayers list each asset they are claiming depreciation for, providing details such as the asset’s description, cost or basis, date placed in service, and the applicable recovery period.

This section also includes columns for entering the depreciation deductions for the current and prior years, as well as the cumulative depreciation to date. It's important to note that taxpayers must maintain detailed records to support these calculations, as the IRS may request documentation during an audit.

Section C: Amortization

Section C focuses on amortization, which applies to intangible assets. Taxpayers list intangible assets acquired through purchase, development, or creation, providing details like the asset’s cost, useful life, and amortization method.

Similar to depreciation, amortization deductions are calculated and entered for the current and prior years, with a cumulative total maintained. Intangible assets, such as goodwill or trademarks, often have a limited useful life and must be amortized accordingly.

Section D: Listed Property and Luxury Automobiles

Section D addresses listed property, which includes certain assets that are subject to additional restrictions and limitations due to their potential personal use. This section captures information about passenger automobiles, recreational vehicles, computers, and other listed property.

For luxury automobiles, taxpayers must provide details like the vehicle's make, model, and cost, as well as the applicable depreciation limits based on the vehicle's price. These limits restrict the amount of depreciation that can be claimed in a given year, with the remaining depreciation spread over the vehicle's recovery period.

Section E: Additional Depreciation

Section E is an optional section that allows taxpayers to claim additional first-year depreciation, also known as bonus depreciation. This provision, available under certain circumstances, provides an incentive for businesses to invest in new assets by allowing a larger depreciation deduction in the first year.

Taxpayers must meet specific eligibility criteria to claim additional depreciation, and the amount is typically a percentage of the asset's cost. This section provides a space to calculate and report the additional depreciation deduction.

Performance Analysis and Real-World Examples

To illustrate the impact of Form 4562, let’s consider a hypothetical scenario involving a small business owner, Sarah, who recently acquired a new delivery van for her e-commerce business. Sarah’s van qualifies as listed property due to its potential personal use, and she needs to accurately report its depreciation.

Using Form 4562, Sarah provides the van's details in Section B, including its cost, date of acquisition, and the applicable recovery period. She calculates the depreciation deduction for the current year, taking into account the van's useful life and the MACRS depreciation method. This deduction reduces her taxable income, resulting in potential tax savings.

Additionally, Sarah claims additional first-year depreciation in Section E, as her van qualifies for the bonus depreciation provision. This allows her to further reduce her taxable income in the first year, providing a financial incentive for investing in the van.

| Asset | Cost | Depreciation Method | Depreciation Deduction (Current Year) |

|---|---|---|---|

| Delivery Van | $25,000 | MACRS 5-year property | $5,000 |

Future Implications and Expert Insights

Form 4562 and the concepts of depreciation and amortization have significant implications for businesses and taxpayers. By accurately claiming these deductions, taxpayers can optimize their tax positions and potentially reduce their tax liability.

However, it's important to note that the tax landscape is dynamic, and tax laws and regulations can change over time. Staying informed about any updates or modifications to Form 4562 and the depreciation and amortization rules is crucial for taxpayers to ensure compliance and take advantage of any new provisions or incentives.

Tax professionals and CPAs play a vital role in guiding taxpayers through the complexities of Form 4562. They can provide expert advice on the most advantageous depreciation methods, ensure accurate calculations, and assist with maintaining the necessary documentation to support the reported deductions.

Conclusion

IRS Tax Form 4562 is a critical tool for businesses and individuals to claim depreciation and amortization deductions, reducing their taxable income and potentially lowering their tax liability. By understanding the purpose and key sections of the form, taxpayers can navigate the depreciation and amortization process with confidence.

As the tax landscape evolves, staying informed and seeking expert guidance becomes increasingly important. Form 4562, with its detailed sections and precise calculations, ensures that taxpayers accurately report their depreciation and amortization expenses, contributing to a fair and efficient tax system.

What is the purpose of Form 4562?

+Form 4562 is used to calculate and report depreciation, amortization, and certain other cost recovery deductions for assets used in business or income-producing activities. It allows taxpayers to reduce their taxable income by accurately claiming these deductions.

How do I determine the depreciation method for my assets?

+The depreciation method depends on the asset’s class and type. The most common method is the Modified Accelerated Cost Recovery System (MACRS), which provides accelerated depreciation over specific recovery periods. Consult a tax professional for guidance on choosing the most suitable method for your assets.

Are there any limitations on claiming depreciation for listed property like automobiles?

+Yes, listed property, including luxury automobiles, has additional restrictions and limitations. The depreciation deduction for these assets is subject to specific limits based on the vehicle’s price and other factors. Refer to the instructions for Form 4562 and seek professional advice to ensure compliance.

Can I claim additional depreciation in the first year of asset acquisition?

+Under certain circumstances, you may be eligible to claim additional first-year depreciation, also known as bonus depreciation. This provision allows for a larger depreciation deduction in the first year of asset acquisition. Check the eligibility criteria and consult a tax expert for guidance.