Henrico Personal Property Tax

The Henrico County Personal Property Tax is an important consideration for residents and business owners in the county. It is a crucial aspect of the local tax system, contributing to the overall financial health and development of the community. This article aims to provide an in-depth analysis of the Henrico Personal Property Tax, exploring its intricacies, impact, and significance.

Understanding the Henrico Personal Property Tax

The Henrico County Personal Property Tax is an annual assessment levied on tangible personal property located within the county. This tax is an essential revenue source for Henrico County, enabling the provision of essential services, infrastructure development, and support for local schools and public safety initiatives.

Personal property subject to taxation in Henrico County includes vehicles such as cars, trucks, motorcycles, and recreational vehicles (RVs), as well as boats, aircraft, and business equipment. The tax is based on the assessed value of these assets, which is determined by the Henrico County Department of Finance using fair market value guidelines.

Tax Rates and Assessment Process

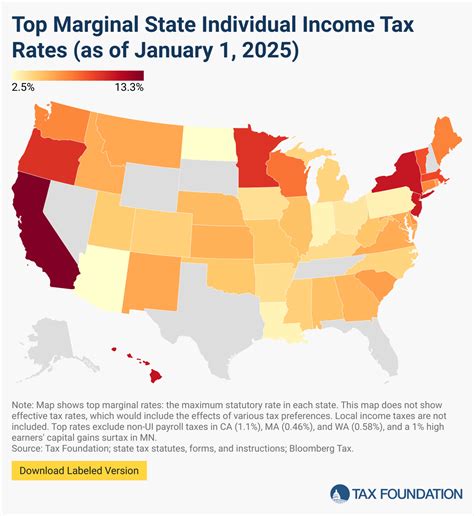

The personal property tax rate in Henrico County is established annually by the Henrico County Board of Supervisors. The rate is expressed in cents per $100 of assessed value and may vary depending on the type of property and its classification.

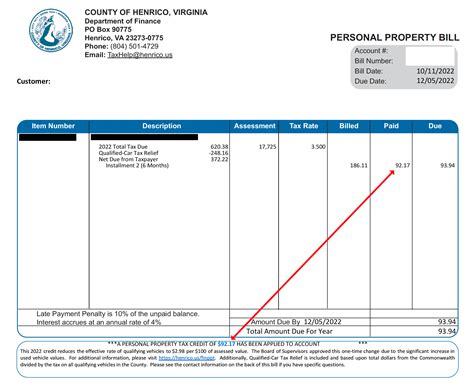

The assessment process involves several key steps. First, the Department of Finance obtains information about personal property from various sources, including registration data for vehicles and self-reporting for business equipment. This data is then used to calculate the assessed value of each property.

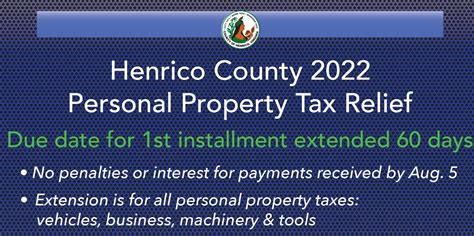

Once the assessed values are determined, the tax rate is applied to calculate the tax liability for each property owner. The tax bill is typically mailed to the property owner's address on record, and payments are due by a specified deadline, usually in early summer.

| Property Type | Assessment Rate | Tax Rate (Cents per $100) |

|---|---|---|

| Vehicles | 100% of Fair Market Value | Varies by Year |

| Boats and Aircraft | 50% of Fair Market Value | 0.82 (2023) |

| Business Equipment | 100% of Original Cost | 0.82 (2023) |

Impact and Significance

The Henrico Personal Property Tax plays a vital role in funding various aspects of the community’s infrastructure and services. Here’s a closer look at its impact and significance:

Supporting Local Services

The revenue generated from personal property taxes is allocated towards essential services that directly benefit Henrico County residents. These services include:

- Public Safety: The tax contributes to funding police, fire, and emergency medical services, ensuring the safety and well-being of the community.

- Education: A significant portion of the tax revenue goes towards supporting local schools, including maintaining facilities, hiring qualified teachers, and providing resources for students.

- Road Maintenance: Personal property taxes help fund road repairs, traffic signal upgrades, and other infrastructure projects, enhancing the county's transportation network.

- Recreation and Parks: The tax supports the development and maintenance of recreational facilities, parks, and green spaces, promoting a healthy and active lifestyle for residents.

Economic Development

The Henrico Personal Property Tax also plays a crucial role in the county’s economic development. By providing a stable revenue stream, the tax helps attract and retain businesses, contributing to job creation and economic growth. Additionally, the tax supports initiatives aimed at improving the business climate, such as infrastructure upgrades and business incentive programs.

Equitable Taxation

The assessment and tax rates in Henrico County are designed to ensure fairness and equity. The county employs a uniform assessment process, applying the same standards and guidelines to all personal property. This approach aims to distribute the tax burden equitably among property owners, promoting a sense of fairness and trust in the tax system.

Exemptions and Relief

Henrico County recognizes the financial burden that personal property taxes can impose on certain individuals and organizations. As such, the county offers various exemptions and relief programs to alleviate this burden.

Senior Citizen Exemption

Senior citizens who meet specific age and income requirements may be eligible for a partial or full exemption from personal property taxes. This exemption is designed to provide financial relief to older residents who may be on fixed incomes.

Disabled Veteran Exemption

Veterans with service-connected disabilities may be eligible for an exemption from personal property taxes on their primary residence. This exemption honors the sacrifices made by veterans and helps ensure their financial well-being.

Low-Income Relief

Henrico County offers a personal property tax relief program for low-income individuals and families. This program provides a credit against the tax liability, helping to reduce the financial burden for those who may struggle to meet their tax obligations.

Online Services and Payment Options

Henrico County understands the importance of convenience and accessibility when it comes to tax payments. The county provides a range of online services and payment options to make the process as seamless as possible.

Online Tax Payment

Residents and business owners can pay their personal property taxes online through the Henrico County Treasury website. This secure platform allows taxpayers to make payments using credit cards, debit cards, or electronic checks. The online system also provides real-time updates on tax balances and payment histories.

Mobile App

The Henrico County mobile app, available for both iOS and Android devices, offers a convenient way to access tax information and make payments on the go. Taxpayers can view their tax bills, due dates, and payment histories directly from their smartphones.

Electronic Funds Transfer (EFT)

For those who prefer automatic payments, Henrico County offers an Electronic Funds Transfer (EFT) program. Taxpayers can authorize the county to withdraw the tax amount directly from their bank account on the due date, ensuring timely payments without the need for manual transactions.

Future Implications and Initiatives

As Henrico County continues to evolve and grow, the personal property tax system is likely to adapt to meet the changing needs of the community. Here are some potential future implications and initiatives:

Tax Reform

The county may consider tax reform initiatives to ensure that the personal property tax system remains fair, efficient, and aligned with the community’s needs. This could involve reviewing assessment methodologies, exploring alternative tax structures, or adjusting tax rates to maintain a competitive business environment.

Enhanced Online Services

Henrico County is committed to improving its online services and making tax-related transactions even more accessible. Future enhancements may include expanded payment options, improved tax filing processes, and the introduction of additional digital tools to assist taxpayers.

Community Engagement

The county recognizes the importance of community engagement in the tax system. Future initiatives may involve increased outreach and education efforts to ensure that taxpayers are well-informed about their rights, responsibilities, and the impact of their tax contributions on the community.

Green Initiatives

As sustainability becomes an increasingly important focus, Henrico County may explore ways to incorporate green initiatives into the personal property tax system. This could involve offering incentives for energy-efficient vehicles or promoting the adoption of electric vehicles through tax benefits.

What happens if I miss the tax payment deadline?

+

Missing the tax payment deadline can result in late fees and penalties. It’s important to note that late payments may also impact your credit score. To avoid these consequences, it’s advisable to make timely payments or explore payment plan options with the Henrico County Treasury.

How can I estimate my personal property tax liability?

+

You can estimate your personal property tax liability by multiplying the assessed value of your property by the applicable tax rate. The assessed value is determined by the Henrico County Department of Finance, and the tax rate is set annually by the Board of Supervisors. Keep in mind that this is an estimate, and the actual tax amount may vary based on the final assessment.

Are there any ways to reduce my personal property tax burden?

+

Yes, there are several options to consider. First, ensure that you take advantage of any applicable exemptions or relief programs, such as the Senior Citizen Exemption or the Disabled Veteran Exemption. Additionally, maintaining accurate records and ensuring your property is assessed fairly can help reduce your tax liability. Finally, exploring payment plan options can make the tax payment more manageable.

How can I stay informed about changes to the personal property tax system in Henrico County?

+

The best way to stay informed is to regularly check the official Henrico County website, which provides updates and announcements related to tax changes. Additionally, subscribing to email alerts or following the county’s social media channels can ensure you receive timely notifications about any modifications to the tax system.