Inheritance Tax Colorado

Inheritance tax, a complex and often misunderstood aspect of estate planning, varies significantly across different jurisdictions. This article will delve into the specifics of inheritance tax in the state of Colorado, exploring its unique characteristics, current laws, and the implications it holds for individuals and families navigating the estate planning process.

Understanding Inheritance Tax in Colorado

Inheritance tax, also known as estate tax or death tax, is a levy imposed by a government on the transfer of property from a deceased person’s estate to their heirs. In the United States, this tax is primarily a federal matter, with some states choosing to adopt their own inheritance tax laws. Colorado is one such state that has implemented its own inheritance tax system, which differs significantly from the federal estate tax.

The Colorado inheritance tax is a tax on the privilege of receiving property from a deceased person's estate. It is distinct from the federal estate tax, which is a tax on the transfer of the entire estate, regardless of who inherits it. In contrast, Colorado's inheritance tax is levied on the beneficiaries of the estate, and the rate varies depending on the beneficiary's relationship to the deceased.

Key Differences from Federal Estate Tax

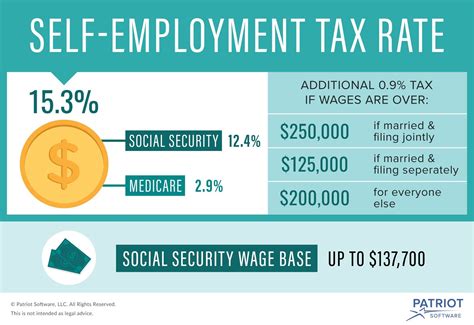

One of the most notable differences between Colorado’s inheritance tax and the federal estate tax is the exemption threshold. The federal estate tax currently applies to estates valued over $12.06 million (as of 2022), with this threshold set to rise annually due to inflation adjustments. In comparison, Colorado’s inheritance tax has a much lower exemption threshold, which can significantly impact the estates of many Coloradans.

Additionally, Colorado's inheritance tax rates are progressive, meaning they increase as the value of the inheritance rises. The tax rates are based on the beneficiary's relationship to the deceased and the amount they inherit. For example, a surviving spouse is typically exempt from inheritance tax, while children and other close relatives may face a lower tax rate than distant relatives or unrelated individuals.

Inheritance Tax Rates and Exemptions in Colorado

Colorado’s inheritance tax rates are structured in a way that provides some relief for close family members while imposing higher taxes on more distant relatives and unrelated individuals. Here is a breakdown of the current inheritance tax rates in Colorado:

| Beneficiary Relationship | Inheritance Tax Rate |

|---|---|

| Spouse | Exempt |

| Children and Grandchildren | 1.6% |

| Parents, Grandparents, Siblings, Nieces, and Nephews | 5.2% |

| Other Relatives and Unrelated Individuals | 9.6% |

It's important to note that these rates are applied to the value of the inheritance above a certain threshold, known as the exemption amount. As of 2023, the exemption amount for Colorado's inheritance tax is $50,000. This means that inheritances valued at $50,000 or less are exempt from inheritance tax, regardless of the beneficiary's relationship to the deceased.

Exemption for Farmland and Small Businesses

Colorado offers a unique exemption for farmland and small businesses. If the primary asset of the estate is farmland or a small business, and it meets certain criteria, the inheritance tax may be waived. This exemption is designed to encourage the continuation of family-owned farms and businesses within the state.

Estate Planning Strategies to Minimize Inheritance Tax

For individuals and families with estates that may be subject to Colorado’s inheritance tax, there are several strategies that can be employed to minimize the tax burden. These strategies often involve careful planning and the use of legal tools and mechanisms to restructure the estate in a tax-efficient manner.

Gift Giving and Trust Formation

One common strategy is to make gifts during one’s lifetime to reduce the size of the taxable estate. This can be particularly effective for estates that are likely to exceed the exemption threshold. By gifting assets to beneficiaries, the value of the estate can be reduced, potentially lowering the inheritance tax liability.

Another approach is to establish a trust. Trusts can be designed to minimize taxes and provide flexibility in estate planning. By placing assets into a trust, the assets may not be considered part of the taxable estate, thus reducing the inheritance tax burden. There are various types of trusts, such as irrevocable trusts and grantor trusts, each with its own tax implications and benefits.

Joint Ownership and Life Insurance

Joint ownership of assets can also be a strategy to reduce inheritance tax. When assets are owned jointly with a spouse or another individual, upon the death of one owner, the asset may pass to the surviving owner without triggering inheritance tax. This strategy is often used for primary residences and other valuable assets.

Additionally, life insurance policies can be structured to pay out to beneficiaries outside of the taxable estate. By purchasing a life insurance policy and naming beneficiaries, the proceeds can be used to cover inheritance tax liabilities or provide financial support to heirs without increasing the tax burden.

Future Outlook and Policy Considerations

The future of inheritance tax in Colorado is subject to ongoing political and economic considerations. While the state has implemented its own inheritance tax laws, there is always the possibility of changes or modifications to the current system.

Some proponents of inheritance tax argue that it promotes economic equality and prevents the concentration of wealth in a few hands. They suggest that the tax revenue generated could be used to fund public services and infrastructure, benefiting the broader community. On the other hand, critics argue that inheritance tax can discourage savings and investment, potentially hindering economic growth.

As the state's economy and demographics evolve, so too may the policies surrounding inheritance tax. Future legislation could aim to simplify the tax system, adjust exemption thresholds, or even abolish the tax altogether. Staying informed about potential changes is crucial for individuals and families engaged in estate planning in Colorado.

The Role of Professional Guidance

Given the complexity of inheritance tax laws and the potential financial implications, seeking professional guidance is highly recommended. Estate planning attorneys, financial advisors, and tax professionals can provide tailored advice and strategies based on an individual’s unique circumstances and goals.

Conclusion

Inheritance tax in Colorado is a nuanced and often overlooked aspect of estate planning. By understanding the current laws, exemption thresholds, and available strategies, individuals can make informed decisions to minimize the tax burden on their heirs. As the landscape of inheritance tax continues to evolve, staying informed and seeking professional advice is essential for effective estate planning in Colorado.

FAQ

How does Colorado’s inheritance tax compare to other states in the US?

+Colorado is one of the few states in the US that imposes an inheritance tax. Most states have abolished this tax, opting for the federal estate tax instead. Colorado’s inheritance tax is unique in that it has a lower exemption threshold and progressive tax rates based on the beneficiary’s relationship to the deceased.

Are there any exceptions or exemptions for certain types of assets in Colorado’s inheritance tax law?

+Yes, Colorado provides an exemption for farmland and small businesses. If the primary asset of the estate is farmland or a small business and it meets specific criteria, the inheritance tax may be waived. This exemption is designed to support family-owned agricultural and business operations.

What is the difference between inheritance tax and estate tax in Colorado?

+Inheritance tax in Colorado is a tax on the privilege of receiving property from a deceased person’s estate. It is levied on the beneficiaries of the estate, and the rate depends on their relationship to the deceased. Estate tax, on the other hand, is a tax on the transfer of the entire estate, regardless of who inherits it. Colorado’s estate tax is tied to the federal estate tax laws.