Pa Gas Tax

Welcome to this comprehensive exploration of the Pennsylvania Gas Tax, a topic that impacts every motorist in the Keystone State. This article aims to shed light on the intricacies of this tax, its historical context, its impact on drivers and the state economy, and its potential future directions.

The Pennsylvania Gas Tax, a crucial component of the state's revenue generation strategy, has a rich history and a complex structure. This tax is not just a straightforward levy on fuel purchases but a dynamic system with various components and purposes. Understanding this tax is essential for both motorists and policymakers, as it influences the cost of transportation, the maintenance of infrastructure, and the overall economic landscape of the state.

The History and Evolution of the Pennsylvania Gas Tax

The Pennsylvania Gas Tax has undergone significant transformations since its inception. It was first introduced in the 1920s, a time when the automobile was rapidly gaining popularity and the need for a dedicated funding source for road construction and maintenance became apparent. The initial tax rate was modest, but it served as a critical foundation for the state’s transportation infrastructure development.

Over the decades, the tax has been adjusted multiple times to keep pace with inflation, changing fuel prices, and evolving transportation needs. Notable amendments to the tax structure include the introduction of the Oil Franchise Tax in the 1970s and the Act 89 legislation in 2013, which significantly reformed the tax system and dedicated a portion of the revenue to public transit.

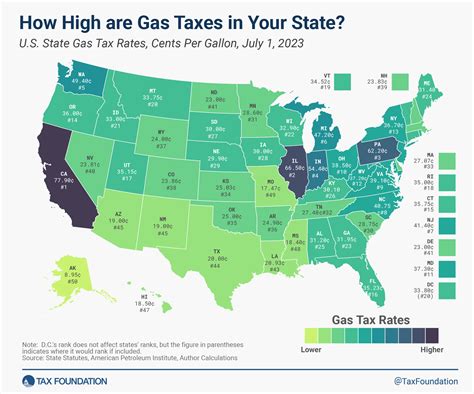

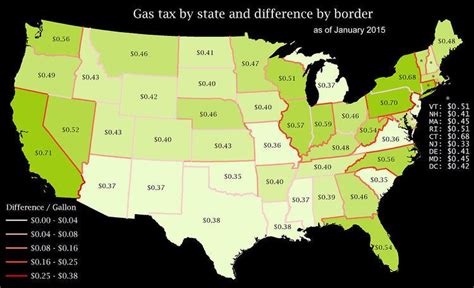

One of the most recent and significant changes was the Gas Tax overhaul in 2017. This reform, officially known as the Transportation Funding Plan, aimed to stabilize and increase funding for Pennsylvania's transportation system. It included a significant increase in the gas tax rate, making it one of the highest in the nation, and introduced new taxes on alternative fuels and electric vehicles.

How the Pennsylvania Gas Tax Works

The current Pennsylvania Gas Tax is a complex system consisting of several components. It includes a base tax rate, which is applied to every gallon of gasoline or diesel fuel sold within the state. This base rate is then supplemented by various other taxes and fees, such as the Oil Franchise Tax, the Underground Storage Tank Fee, and the Motor License Fee.

The base tax rate is subject to periodic adjustments, usually to account for inflation or to fund specific transportation projects. The Oil Franchise Tax, levied on oil companies, ensures that the tax burden is not solely on consumers. The Underground Storage Tank Fee contributes to the maintenance and cleanup of fuel storage tanks, while the Motor License Fee funds driver's license and vehicle registration services.

In addition to these taxes, Pennsylvania also levies a tax on alternative fuels and electric vehicles, a move that reflects the state's commitment to promoting cleaner energy sources while ensuring a stable revenue stream for transportation infrastructure.

Tax Rates and Calculations

The base tax rate for gasoline in Pennsylvania is currently set at 0.587</strong> per gallon, while diesel fuel is taxed at <strong>0.587 per gallon. These rates are among the highest in the nation, reflecting the state’s commitment to maintaining and improving its transportation network.

| Fuel Type | Tax Rate |

|---|---|

| Gasoline | $0.587 per gallon |

| Diesel | $0.587 per gallon |

| Alternative Fuels | Varies based on fuel type |

| Electric Vehicles | $0.00125 per mile traveled |

The tax on alternative fuels varies depending on the type of fuel. For instance, compressed natural gas is taxed at $0.30 per gasoline gallon equivalent (GGE), while liquefied natural gas is taxed at $0.24 per diesel gallon equivalent (DGE). This differentiation is intended to encourage the use of cleaner fuels while still generating revenue for transportation.

Electric vehicles, which do not use traditional fuel, are taxed based on mileage. The tax rate for electric vehicles is $0.00125 per mile traveled, which is calculated annually based on odometer readings.

Impact on Motorists and the Economy

The Pennsylvania Gas Tax has a profound impact on motorists and the state economy. For drivers, the high tax rate translates to increased fuel costs, which can be a significant burden, especially for those who rely heavily on their vehicles for work or long-distance travel.

However, the tax also funds critical transportation infrastructure projects, ensuring safe and efficient roads, bridges, and public transit systems. These improvements benefit not only motorists but also businesses that rely on a well-maintained transportation network for logistics and commerce.

The economic impact of the gas tax is multifaceted. While it increases the cost of doing business for industries reliant on transportation, it also provides a steady revenue stream for the state, supporting not only transportation but also other essential services. The tax revenue contributes to the state's overall economic health and stability.

Cost Analysis for Motorists

The increased gas tax has a direct impact on the cost of fueling a vehicle. For example, a driver filling up a 15-gallon tank of gasoline would pay an additional $8.80 compared to the pre-2017 tax rates. This additional cost can add up significantly over time, especially for those with longer commutes or those who frequently drive for work.

| Fuel Type | Additional Cost per Tank (15 gallons) |

|---|---|

| Gasoline | $8.80 |

| Diesel | $8.80 |

| Alternative Fuels (CNG) | Varies based on usage |

| Electric Vehicles (annual average) | $210 |

The cost for alternative fuels and electric vehicles varies significantly based on usage. A driver of a compressed natural gas (CNG) vehicle, for instance, would pay $4.50 per GGE based on the current tax rate. Electric vehicle owners, on the other hand, pay a mileage-based tax. The average annual tax for an electric vehicle is estimated to be around $210, based on an average annual mileage of 16,500 miles.

Future Implications and Potential Reforms

The future of the Pennsylvania Gas Tax is a topic of ongoing discussion and debate. With the rapid evolution of the transportation sector, including the rise of electric vehicles and alternative fuels, the current tax structure may need to be reevaluated to ensure fairness and sustainability.

One potential future direction is a shift towards a Vehicle Miles Traveled (VMT) tax, which would replace the gas tax and tax drivers based on the actual miles traveled. This system would be more equitable for electric vehicle owners and could provide a more stable revenue stream as the state transitions towards cleaner energy sources.

Additionally, the state could consider further reforms to encourage the use of alternative fuels and electric vehicles, such as offering tax incentives or rebates. Such measures could help reduce the environmental impact of transportation while also supporting the growth of these industries.

Potential Reforms and Their Impact

Implementing a Vehicle Miles Traveled (VMT) tax could have significant implications for both motorists and the state. This system would ensure that all vehicles, regardless of their fuel type, contribute fairly to transportation funding. For instance, an average driver traveling 15,000 miles annually would pay approximately $190 under a VMT tax, which is comparable to the current tax burden for gasoline vehicles.

| Fuel Type | Current Tax Burden (annual) | Potential VMT Tax (annual) |

|---|---|---|

| Gasoline | $264 | $190 |

| Diesel | $264 | $190 |

| Alternative Fuels (CNG) | $720 | $190 |

| Electric Vehicles | $210 | $190 |

The VMT tax would also incentivize efficient driving habits, as drivers would be taxed based on actual miles traveled. This could lead to reduced congestion, lower emissions, and improved overall road safety.

Frequently Asked Questions

What is the purpose of the Pennsylvania Gas Tax?

+The Pennsylvania Gas Tax is a critical revenue source for the state’s transportation infrastructure. The funds generated from this tax are used to maintain and improve roads, bridges, and public transit systems, ensuring safe and efficient travel for motorists.

How does the Gas Tax affect electric vehicle owners?

+Electric vehicle owners are subject to a mileage-based tax, which is calculated annually based on odometer readings. The tax rate is lower compared to traditional fuel vehicles, but it ensures that electric vehicle owners contribute to transportation funding.

Are there any tax incentives for using alternative fuels in Pennsylvania?

+Currently, there are no specific tax incentives for using alternative fuels in Pennsylvania. However, the state’s tax on alternative fuels is generally lower compared to gasoline and diesel, providing an indirect incentive for their use.

How often is the Gas Tax rate adjusted in Pennsylvania?

+The Gas Tax rate in Pennsylvania is periodically adjusted, usually to account for inflation or to fund specific transportation projects. The most recent significant adjustment was in 2017, when the tax rate was increased to its current level.