Lee County Tax Collector Jobs

The Lee County Tax Collector's office is a vital public service entity that plays a significant role in the administration of various taxes and government services within Lee County, Florida. The office, led by the elected Tax Collector, is responsible for a wide range of duties that impact the lives of the county's residents and businesses. This article aims to delve into the world of the Lee County Tax Collector's office, exploring the jobs available, the qualifications required, and the impact these roles have on the community.

A Glimpse into the Lee County Tax Collector’s Office

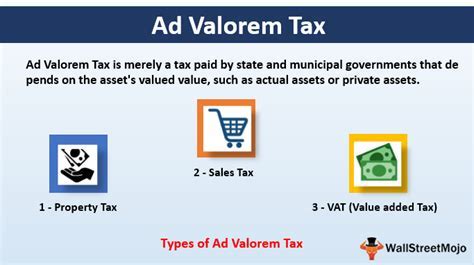

The Lee County Tax Collector’s office is a bustling hub of activity, with a diverse range of departments and functions. From the moment you step into their offices, you’re met with a team of dedicated professionals who ensure the smooth operation of various tax-related processes. The office is responsible for the efficient collection and distribution of taxes, including property taxes, vehicle registrations, and a host of other services.

One of the key roles within the office is that of the Tax Collector, an elected official who serves a vital public trust position. The Tax Collector is responsible for the overall administration and management of the office, ensuring compliance with state and local laws, and maintaining the highest standards of integrity and service.

Job Opportunities: A Diverse Range of Roles

The Lee County Tax Collector’s office offers a wide array of job opportunities, catering to individuals with varying skill sets and educational backgrounds. These jobs are not only crucial for the smooth functioning of the office but also provide a unique opportunity to serve the community.

Customer Service Representatives

Customer Service Representatives are the face of the Tax Collector’s office. These individuals interact directly with the public, providing information, assistance, and guidance on a range of tax-related matters. They are responsible for answering inquiries, processing payments, and ensuring a positive customer experience.

Qualifications: A high school diploma or equivalent is typically required, along with excellent communication skills and a customer-centric mindset. Prior experience in customer service or a related field is often preferred.

Tax Examiners and Collectors

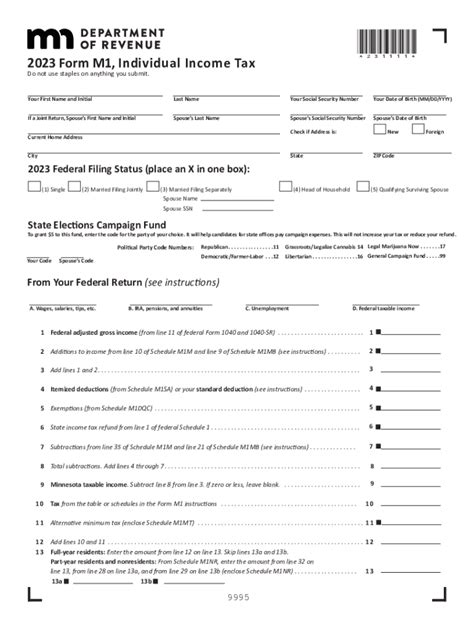

Tax Examiners and Collectors are responsible for the assessment and collection of taxes. They review tax records, identify discrepancies, and ensure accurate tax assessments. This role requires a keen eye for detail and a strong understanding of tax laws and regulations.

Qualifications: A bachelor's degree in accounting, finance, or a related field is often preferred. Prior experience in tax administration or a similar role is advantageous. Strong analytical skills and a methodical approach to work are essential.

IT Professionals

The Tax Collector’s office relies heavily on technology to manage its operations efficiently. IT professionals are responsible for maintaining and developing the office’s IT infrastructure, ensuring data security, and providing technical support to other departments.

Qualifications: A degree in computer science, information technology, or a related field is typically required. Certifications in relevant areas, such as network administration or cybersecurity, are highly valued. Strong problem-solving skills and a passion for technology are essential for this role.

Administrative Assistants

Administrative Assistants provide vital support to various departments within the Tax Collector’s office. They handle a range of tasks, including data entry, record-keeping, and general administrative duties. This role is crucial for the smooth day-to-day operations of the office.

Qualifications: A high school diploma or equivalent is usually required. Proficiency in Microsoft Office or similar software is essential. Strong organizational skills and the ability to manage multiple tasks efficiently are key attributes for this role.

Legal and Compliance Officers

Legal and Compliance Officers ensure that the Tax Collector’s office operates within the bounds of the law. They review policies and procedures, provide legal advice, and ensure compliance with state and federal regulations. This role is crucial for maintaining the integrity of the office’s operations.

Qualifications: A law degree or a background in legal studies is typically required. Prior experience in a similar role, especially in the public sector, is advantageous. Strong analytical skills and a meticulous attention to detail are essential for this position.

The Impact of These Jobs on the Community

The jobs within the Lee County Tax Collector’s office have a significant impact on the community. These professionals ensure that residents and businesses understand and fulfill their tax obligations, which in turn supports the provision of essential public services and infrastructure.

By efficiently collecting taxes, the office contributes to the county's overall financial stability, enabling the government to invest in initiatives such as road maintenance, education, and public safety. The role of the Tax Collector's office is integral to the smooth functioning of the community and its overall development.

| Department | Key Responsibilities |

|---|---|

| Customer Service | Assisting taxpayers, answering inquiries, and providing guidance on tax matters |

| Tax Assessment | Reviewing tax records, assessing property values, and ensuring accurate tax assessments |

| IT Department | Managing IT infrastructure, ensuring data security, and providing technical support |

| Administrative Support | Data entry, record-keeping, and providing general administrative support to various departments |

| Legal and Compliance | Ensuring compliance with laws and regulations, providing legal advice, and maintaining office integrity |

Conclusion

The Lee County Tax Collector’s office is a vibrant workplace, offering a diverse range of jobs that contribute significantly to the community. From customer service representatives to IT professionals, each role plays a crucial part in ensuring the efficient administration of taxes and government services. These jobs not only provide a stable career path but also the satisfaction of serving the public and contributing to the well-being of the community.

Frequently Asked Questions

What qualifications are required to work in the Tax Collector’s office?

+The qualifications required depend on the specific role. For customer service roles, a high school diploma and excellent communication skills are typically needed. Tax Examiner roles often require a bachelor’s degree in a relevant field. IT professionals are expected to have a degree in computer science or a related area. Administrative Assistants usually require a high school diploma and proficiency in office software.

How can I apply for a job at the Lee County Tax Collector’s office?

+You can apply for jobs at the Lee County Tax Collector’s office by visiting their official website, where job openings are typically listed. The application process may involve submitting a resume, covering letter, and sometimes completing an online assessment.

What are the working hours for employees in the Tax Collector’s office?

+Working hours can vary depending on the specific role and department. However, most offices operate during standard business hours, Monday to Friday. Some roles may require occasional evening or weekend work, especially during peak tax seasons.

What benefits do employees receive working at the Tax Collector’s office?

+Employees at the Lee County Tax Collector’s office enjoy a range of benefits, including competitive salaries, health insurance, paid time off, and opportunities for professional development. The office also offers a retirement plan and other benefits tailored to the needs of its employees.

How often are job opportunities updated on the Tax Collector’s website?

+Job opportunities are regularly updated on the Lee County Tax Collector’s official website. The frequency of updates can vary, but it’s advisable to check the website periodically for new openings. You can also sign up for job alerts to receive notifications when new positions become available.