Washington Dc Tax Calculator

In the bustling city of Washington D.C., understanding the tax landscape is crucial for both residents and businesses alike. With a unique tax system compared to other states, the District of Columbia offers a complex yet fascinating financial ecosystem. This article aims to demystify the Washington D.C. tax calculator, providing an in-depth guide to help navigate the city's tax obligations with ease.

The Comprehensive Guide to Washington D.C.’s Tax System

Washington D.C. operates under a progressive tax structure, meaning tax rates increase as income rises. This system ensures a fair distribution of tax responsibilities among its residents. The District’s tax calculator is a vital tool for individuals and businesses to accurately determine their tax liabilities.

Individual Income Tax Rates

For individuals, Washington D.C. has a graduated income tax system with six tax brackets. The tax rates range from 4.0% to 8.75%, depending on income levels. Here’s a breakdown of the tax brackets for the current tax year:

| Tax Bracket | Tax Rate |

|---|---|

| First $10,000 | 4.0% |

| $10,001 - $40,000 | 4.75% |

| $40,001 - $60,000 | 6.5% |

| $60,001 - $100,000 | 8.25% |

| $100,001 - $350,000 | 8.5% |

| Over $350,000 | 8.75% |

These tax rates are subject to annual adjustments to account for inflation and other economic factors. It's essential for individuals to stay updated with the latest tax brackets to ensure accurate calculations.

Business Tax Calculator

Washington D.C. provides a dedicated business tax calculator to assist companies in determining their tax obligations. The calculator considers various factors, including:

- Business Type: Sole proprietorships, partnerships, and corporations are subject to different tax rates and requirements.

- Revenue: The District's business tax is based on a gross receipts tax, where the tax rate increases with higher revenue.

- Industry: Certain industries, such as hospitality and retail, may have specific tax considerations and incentives.

The business tax calculator is an invaluable resource for entrepreneurs, helping them understand their tax liabilities and make informed financial decisions. It also aids in budgeting and planning for the future.

Sales and Use Tax

Washington D.C. imposes a sales and use tax on the sale of tangible personal property and certain services. The current sales tax rate is 5.75%, while the use tax rate aligns with the sales tax rate. It’s important to note that some items, like groceries, are exempt from sales tax, while others, like alcohol and tobacco, have additional excise taxes.

The sales and use tax calculator provided by the District helps businesses and individuals calculate the tax due on purchases. This tool is particularly useful for online retailers and remote sellers, ensuring compliance with D.C.'s tax regulations.

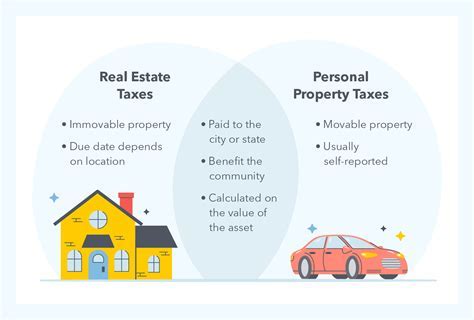

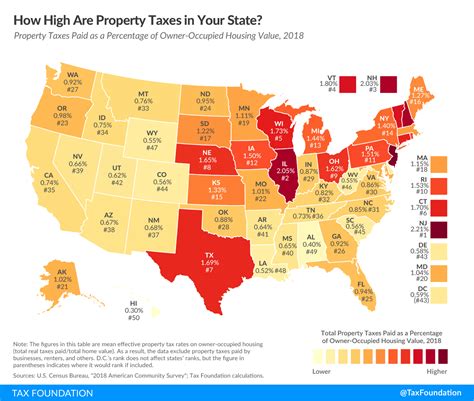

Property Tax

Real property in Washington D.C. is subject to an annual real property tax, which is calculated based on the assessed value of the property. The tax rate varies depending on the type of property and its location within the city. The District’s tax calculator for property taxes considers factors such as:

- Property Value: Higher-value properties are taxed at a higher rate.

- Property Class: Different property classes, such as residential, commercial, and industrial, have distinct tax rates.

- Homestead Deduction: Homeowners may be eligible for a homestead deduction, reducing their taxable property value.

Understanding the property tax landscape is crucial for homeowners and investors in the District, as it directly impacts their financial planning and investment strategies.

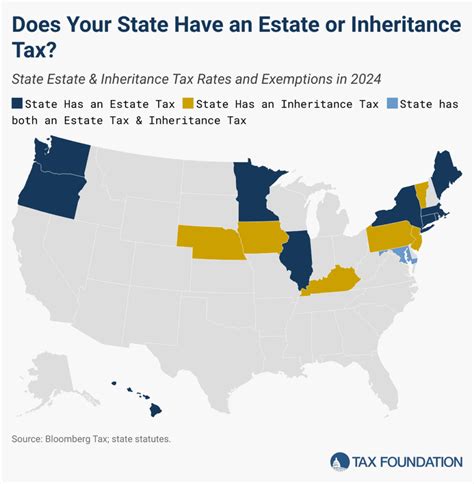

Estate and Gift Taxes

Washington D.C. imposes an estate tax on the transfer of assets upon death. The tax is calculated based on the value of the estate, with rates ranging from 0.8% to 16%. Additionally, the District has a gift tax on gifts made during a person’s lifetime, with rates mirroring the estate tax rates.

The estate and gift tax calculator assists individuals and their families in estimating the potential tax liability associated with their estates and gifts. This tool provides clarity and helps in financial planning, ensuring compliance with D.C.'s tax regulations.

The Benefits of Washington D.C.’s Tax System

While Washington D.C.’s tax system may seem complex, it offers several advantages. The progressive tax structure ensures that higher-income earners contribute proportionally more, promoting economic fairness. Additionally, the District’s tax system provides:

- Revenue for Essential Services: Tax revenues fund critical public services like education, healthcare, and infrastructure development.

- Incentives for Businesses: The District offers tax incentives for certain industries, encouraging economic growth and job creation.

- Transparency and Accountability: The tax calculator and other online tools enhance transparency, allowing residents and businesses to understand their tax obligations.

By understanding and leveraging the benefits of Washington D.C.'s tax system, individuals and businesses can make informed financial decisions, contributing to the city's vibrant economy.

Conclusion

Washington D.C.’s tax calculator is a powerful tool for residents and businesses to navigate the city’s tax landscape. From individual income taxes to business, sales, property, and estate taxes, the calculator simplifies complex tax calculations. Understanding these tax obligations is essential for financial planning and compliance.

As the District continues to thrive and evolve, its tax system remains a vital component of its economic success. By staying informed and utilizing the tax calculator, individuals and businesses can contribute to Washington D.C.'s growth while ensuring their financial well-being.

How often are the tax rates updated in Washington D.C.?+

Tax rates in Washington D.C. are typically updated annually to account for inflation and other economic factors. The District’s Office of Tax and Revenue announces any changes to tax rates, brackets, and other tax-related policies each year.

Are there any tax incentives for small businesses in Washington D.C.?+

Yes, Washington D.C. offers various tax incentives for small businesses, including tax credits for job creation, research and development, and investment in certain industries. These incentives aim to support small business growth and development within the District.

How can I access the Washington D.C. tax calculator?+

The Washington D.C. tax calculator is accessible through the District’s official website, specifically the Office of Tax and Revenue’s online portal. It provides easy-to-use tools for calculating individual and business tax liabilities.