Hawaii State Property Tax

Welcome to our comprehensive guide on the Hawaii State Property Tax, a critical component of the state's revenue system and a key consideration for homeowners and prospective buyers. In this expert-led exploration, we'll delve into the intricacies of Hawaii's property tax landscape, shedding light on the unique aspects that make it both complex and fascinating. As we navigate through the various sections, we'll uncover the underlying factors that influence property tax assessments, explore the calculation methodologies, and provide valuable insights into how property owners can navigate this essential financial obligation.

Understanding Hawaii’s Property Tax System

Hawaii’s property tax system stands out as a distinct and intricate mechanism, reflective of the state’s unique geography and cultural dynamics. Unlike many other states, Hawaii operates on a triennial reassessment cycle, where property values are re-evaluated every three years. This approach is designed to provide stability and predictability for homeowners while ensuring that property values remain in line with market trends.

The Office of the State Assessor plays a pivotal role in this process, overseeing the assessment and valuation of all taxable properties across the state. This includes residential, commercial, and agricultural properties, each subject to specific valuation methodologies tailored to their unique characteristics.

Key Factors Influencing Property Assessments

Several critical factors influence the assessment of property values in Hawaii. These include:

- Location and Neighborhood: The desirability of a property’s location and the overall neighborhood amenities play a significant role in determining its value.

- Market Conditions: Fluctuations in the real estate market, driven by supply and demand dynamics, directly impact property values.

- Property Characteristics: Features such as size, age, condition, and unique amenities contribute to a property’s overall valuation.

- Recent Sales: Recent sales data of comparable properties in the vicinity are often used as a benchmark for assessing the value of a specific property.

Assessment Process and Valuation Methods

The property assessment process in Hawaii involves a comprehensive review of each property’s characteristics and market trends. Assessors utilize a combination of methodologies, including:

- Cost Approach: This method estimates the property’s value by calculating the cost to replace the structure, minus depreciation, plus the value of the land.

- Sales Comparison Approach: Assessors compare the property to similar recently sold properties, adjusting for differences to determine its market value.

- Income Approach: For income-producing properties, such as rental properties or commercial spaces, the income generated by the property is a key factor in valuation.

The chosen methodology depends on the specific property type and the availability of relevant data.

Property Tax Calculation: A Step-by-Step Guide

Once the assessed value of a property is determined, the property tax calculation process begins. Hawaii’s property tax system operates on a two-tiered rate structure, with different rates applied to different property types.

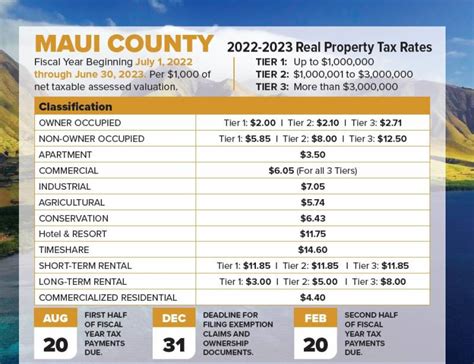

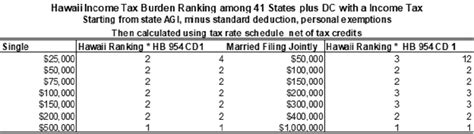

Tax Rates and Classifications

Hawaii classifies properties into various categories, including residential, commercial, and agricultural, each with its own tax rate. For instance, residential properties are further divided into owner-occupied and non-owner-occupied, with the former benefiting from a lower tax rate.

| Property Type | Tax Rate |

|---|---|

| Residential (Owner-Occupied) | 0.25% |

| Residential (Non-Owner-Occupied) | 0.35% |

| Commercial | 0.5% |

| Agricultural | 0.4% |

These rates are applied to the assessed value of the property to calculate the annual property tax liability.

Calculating Your Property Taxes

To illustrate the process, let’s consider an example. Assume you own a residential property in Hawaii with an assessed value of $500,000, and you reside in the property. Here’s how your property tax calculation would break down:

Assessed Value: $500,000

Tax Rate: 0.25%

Annual Property Tax: $500,000 x 0.0025 = $1,250

So, in this scenario, your annual property tax liability would amount to $1,250.

Property Tax Relief Programs in Hawaii

Hawaii recognizes the financial burden that property taxes can impose on its residents, especially those on fixed incomes. To address this, the state has implemented several property tax relief programs aimed at providing assistance to qualifying homeowners.

Circuit Breaker Credit

The Circuit Breaker Credit is a significant tax relief program designed to benefit homeowners whose property taxes exceed a certain percentage of their income. To qualify, homeowners must meet specific income and property value thresholds. The credit can provide a substantial reduction in property tax liability, making it a crucial relief measure for many Hawaii residents.

Other Tax Relief Programs

In addition to the Circuit Breaker Credit, Hawaii offers various other tax relief programs, including:

- Low-Income Homestead Credit: This program provides a credit for low-income homeowners, helping to offset the cost of property taxes.

- Senior Exemption: Senior citizens who meet certain age and income requirements may be eligible for a property tax exemption.

- Veterans’ Exemption: Hawaii offers property tax exemptions to qualifying veterans and their surviving spouses.

Navigating the Property Tax Process: Expert Tips

Understanding and managing your property tax obligations is essential for Hawaii homeowners. Here are some expert tips to navigate the process effectively:

Stay Informed

Keep yourself updated on Hawaii’s property tax laws, rates, and any changes or updates. The Office of the State Assessor provides valuable resources and guides to help homeowners understand their property tax responsibilities.

Review Your Assessment

Upon receiving your property assessment notice, carefully review the details. If you believe the assessed value is inaccurate or unfair, you have the right to appeal. The assessment process is open to public scrutiny, and homeowners can access relevant data to support their case.

Explore Tax Relief Options

Familiarize yourself with the various tax relief programs offered by Hawaii. If you meet the eligibility criteria, these programs can provide significant savings on your property tax liability.

Consider Professional Assistance

For complex properties or those with unique circumstances, seeking professional advice from a tax consultant or accountant can be beneficial. They can provide tailored guidance and ensure you’re maximizing any available tax benefits.

Future Implications and Trends

As Hawaii continues to evolve and adapt to changing economic and demographic conditions, its property tax system is likely to undergo further refinements. Here are some potential future implications and trends to watch:

Economic Growth and Property Values

Hawaii’s robust tourism industry and growing tech sector are driving economic growth, which, in turn, is influencing property values. As the state’s economy expands, property values are likely to increase, impacting tax assessments and revenue generation.

Sustainable Financing Initiatives

Hawaii has been at the forefront of sustainable financing initiatives, including the adoption of green building practices and renewable energy incentives. These initiatives not only promote environmental sustainability but also have the potential to influence property values and tax assessments.

Community Engagement and Tax Policy

Hawaii’s strong sense of community and cultural heritage often influence tax policy discussions. As the state continues to prioritize community engagement, it’s likely that property tax policies will reflect the values and needs of its diverse population.

Conclusion

Hawaii’s property tax system, with its unique assessment cycles and classification structure, presents both challenges and opportunities for homeowners. By understanding the assessment process, calculation methodologies, and available tax relief programs, Hawaii residents can effectively manage their property tax obligations. As the state’s economy and demographics evolve, staying informed and engaged with the latest developments in property tax policy will be crucial for homeowners and prospective buyers alike.

How often are property values reassessed in Hawaii?

+

Property values in Hawaii are reassessed every three years as part of the triennial reassessment cycle.

What is the difference between the owner-occupied and non-owner-occupied residential tax rates in Hawaii?

+

Owner-occupied residential properties benefit from a lower tax rate (0.25%) compared to non-owner-occupied properties (0.35%).

Are there any property tax exemptions or credits available in Hawaii?

+

Yes, Hawaii offers several tax relief programs, including the Circuit Breaker Credit, Low-Income Homestead Credit, Senior Exemption, and Veterans’ Exemption.

How can I appeal my property assessment if I believe it is inaccurate?

+

Homeowners have the right to appeal their property assessment. The process typically involves submitting an appeal form and providing supporting documentation to demonstrate why the assessment is unfair or inaccurate.

What is the role of the Office of the State Assessor in Hawaii’s property tax system?

+

The Office of the State Assessor is responsible for overseeing the assessment and valuation of all taxable properties in Hawaii. They ensure that properties are assessed fairly and accurately, and provide resources and guidance to homeowners.