Prince William County Property Tax

Welcome to an in-depth exploration of Prince William County's property tax system. This article aims to provide a comprehensive understanding of the process, from assessment to payment, offering valuable insights for residents and investors alike. The county's property tax system is an essential aspect of its financial framework, impacting the lives of homeowners and the overall economic landscape.

Understanding Prince William County's Property Tax

The property tax in Prince William County is a vital revenue source for the local government, contributing to essential services such as public education, infrastructure development, and community initiatives. The assessment and collection process is governed by a set of regulations designed to ensure fairness and transparency.

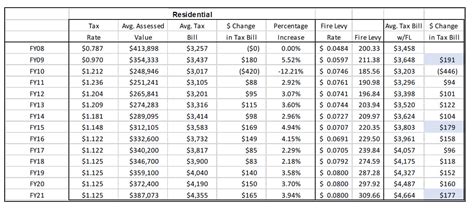

The tax rate in Prince William County is determined annually by the Board of Supervisors, who carefully consider the county's financial needs and the impact on residents. The rate is expressed as cents per $100 of assessed value, providing a straightforward calculation for property owners.

The Assessment Process

The assessment of property values is a crucial step in the property tax journey. In Prince William County, the Department of Finance's Division of Real Estate Assessment undertakes this responsibility. Assessors employ various methods, including analyzing recent sales data, considering property improvements, and conducting on-site inspections to determine accurate property values.

Property owners have the right to appeal their assessments if they believe the value assigned to their property is inaccurate. The appeals process is designed to ensure that property values are fair and equitable, and it's an important aspect of maintaining transparency in the tax system.

Property Tax Rates and Calculations

The tax rate, as mentioned, is a key factor in determining the property tax liability. The rate is applied to the assessed value of the property, with adjustments made for various factors such as homestead exemptions and any applicable tax relief programs.

Here's a simplified breakdown of the calculation:

| Tax Rate (in cents) | Assessed Value of Property | Property Tax Liability |

|---|---|---|

| 0.25 | $200,000 | $500 |

| 0.30 | $300,000 | $900 |

| 0.28 | $150,000 | $420 |

Payment Options and Deadlines

Prince William County offers several convenient payment options to cater to different preferences and needs. Property owners can choose to pay their taxes in full or opt for installment plans, ensuring flexibility and ease of payment.

The county provides an online payment portal, allowing taxpayers to make secure payments using various methods, including credit cards, e-checks, and direct transfers. This digital system simplifies the payment process and offers real-time updates on account balances.

For those who prefer traditional methods, payment by mail or in-person is also available. The county accepts checks, money orders, and even cash payments at designated locations.

Exploring Property Tax Relief Programs

Prince William County recognizes the financial burden that property taxes can place on certain groups of residents. As such, the county offers a range of tax relief programs aimed at providing assistance to eligible homeowners.

Homestead Exemption

The homestead exemption is a popular program that reduces the assessed value of a property, thereby lowering the tax liability. This exemption is particularly beneficial for homeowners who have owned and occupied their property as their primary residence for at least five consecutive years.

The homestead exemption can provide significant savings, especially for long-term residents. It's a crucial aspect of the county's strategy to make homeownership more affordable and sustainable.

Senior Citizen Tax Relief

Prince William County understands the unique challenges faced by senior citizens. The Senior Citizen Tax Relief program aims to ease the tax burden on homeowners aged 65 and above who meet certain income and residency requirements.

This program offers a reduction in property taxes, providing much-needed financial relief to older residents. It's an essential component of the county's commitment to supporting its aging population.

Other Tax Relief Programs

Beyond the homestead exemption and senior citizen relief, Prince William County offers additional programs to assist residents in various circumstances. These include:

- Veterans' Relief

- Widow/Widower Relief

- Disabled Citizens' Relief

- Cold Weather Relief

Each program has specific eligibility criteria and benefits, designed to provide targeted support to those who need it most.

Navigating the Property Tax Landscape

Understanding the intricacies of Prince William County's property tax system is crucial for homeowners and investors. From assessment to payment, the process is designed to be fair, transparent, and accessible.

The county's commitment to providing various tax relief programs demonstrates its dedication to supporting its residents, especially those who may face financial challenges. These initiatives ensure that property ownership remains a viable and desirable option for a wide range of individuals and families.

For those looking to delve deeper into the world of property taxes, the Prince William County website offers a wealth of resources, including detailed guidelines, FAQs, and contact information for further assistance. It's an invaluable tool for anyone navigating the property tax landscape.

Frequently Asked Questions

When are property taxes due in Prince William County?

+Property taxes in Prince William County are due by March 31st of each year. However, taxpayers have the option to pay their taxes in two installments, with the first due by March 31st and the second by October 5th.

Can I appeal my property tax assessment?

+Yes, property owners have the right to appeal their assessments if they believe the value assigned to their property is inaccurate. The appeals process is outlined on the county’s website, providing step-by-step instructions and deadlines.

Are there any penalties for late property tax payments?

+Late payments of property taxes in Prince William County may incur penalties and interest. It’s essential to stay informed about the payment deadlines to avoid additional charges.

How can I apply for a tax relief program?

+Applications for tax relief programs are typically available online or at the Prince William County Treasurer’s Office. Each program has specific eligibility criteria and application requirements, so it’s advisable to review the guidelines carefully.

Can I pay my property taxes online?

+Yes, Prince William County offers an online payment portal for convenient and secure property tax payments. Taxpayers can use credit cards, e-checks, or direct transfers to pay their taxes online.