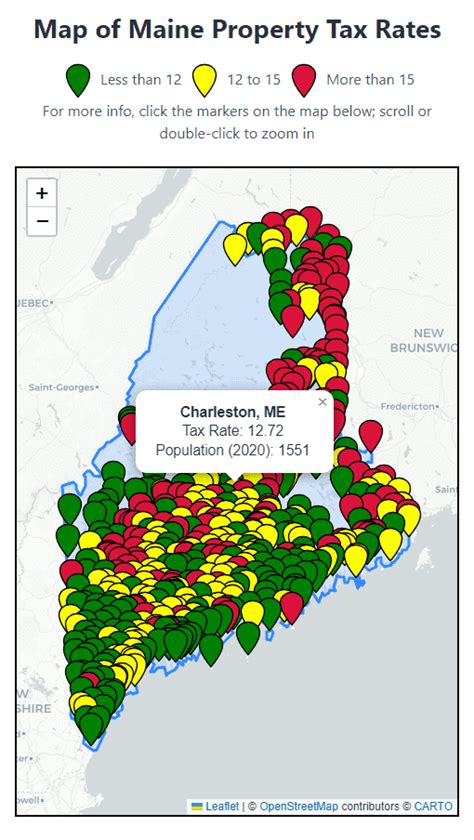

Maine Property Tax

Maine, the picturesque state known for its stunning coastline, picturesque landscapes, and vibrant communities, has a unique property tax system that plays a significant role in shaping the lives of its residents and the overall economy. The property tax, often considered a critical revenue source for local governments, funds essential services like schools, emergency response, and infrastructure maintenance. In this article, we delve into the intricacies of Maine's property tax, exploring its history, calculation methods, assessment practices, and the impact it has on property owners across the state.

A Historical Perspective on Maine’s Property Tax

The origins of Maine’s property tax system can be traced back to the early days of colonial America, where it served as a primary means of funding local governments and public services. Over the centuries, the system has evolved to accommodate the changing needs of the state and its diverse population. One notable evolution was the shift from a primarily agricultural-based economy to one driven by tourism, technology, and a diverse range of industries.

This transformation has led to a more complex assessment process, ensuring that the tax burden is distributed fairly across residential, commercial, and industrial properties. The state's commitment to transparency and equity in taxation is evident in its dedication to regular revaluation processes, ensuring that property values remain up-to-date and reflective of the dynamic real estate market.

Understanding the Mechanics of Maine’s Property Tax

At its core, Maine’s property tax is calculated based on the assessed value of a property and the tax rate set by the local municipality. This process involves a series of steps, each critical to ensuring fairness and accuracy in taxation.

Property Assessment: The First Step

Property assessment is a critical phase in the taxation process. In Maine, this task is typically handled by the local assessor’s office, which employs certified professionals trained to evaluate properties accurately. The assessment process involves a thorough examination of the property, considering factors such as location, size, condition, and recent sales of similar properties in the area. This data-driven approach ensures that the assessed value is a fair representation of the property’s market value.

To maintain transparency and accountability, Maine has established a set of guidelines and standards that assessors must adhere to. These guidelines, often updated to reflect changes in the real estate market and assessment practices, provide a uniform framework for assessment across the state.

The Role of Mill Rates in Taxation

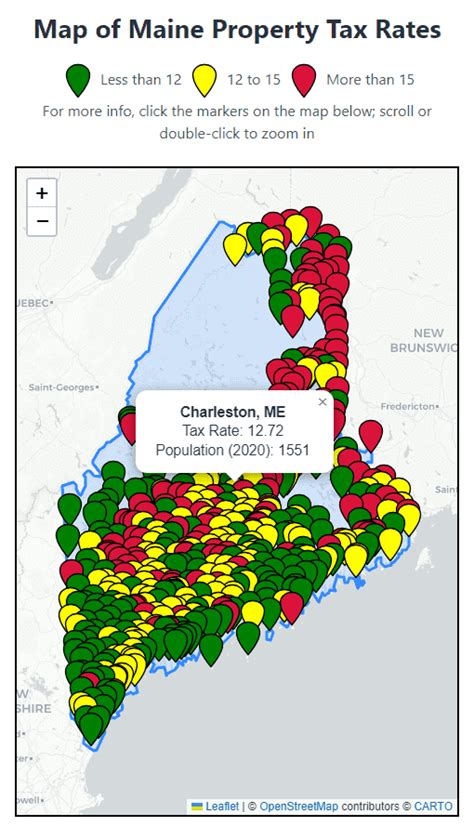

Once a property’s assessed value is determined, the next step involves applying the appropriate tax rate, known as the “mill rate.” This rate, set by the local municipality, represents the amount of tax owed per thousand dollars of assessed property value. For instance, if a property is valued at 200,000 and the mill rate is 15, the property owner would owe 3,000 in property taxes (200,000 x 0.015 = 3,000). The mill rate can vary significantly between municipalities, reflecting the diverse needs and financial realities of different communities.

To ensure that property owners have a clear understanding of their tax obligations, local governments often provide online tools and resources. These resources, such as property tax calculators, allow homeowners to estimate their annual tax liability based on their property's assessed value and the current mill rate.

Exemptions and Abatements: Providing Relief

Recognizing the financial burden that property taxes can place on certain individuals and organizations, Maine has implemented a range of exemptions and abatements. These provisions aim to provide relief to eligible property owners, ensuring that the tax system remains equitable and supportive of the state’s diverse population.

One common exemption is the homestead exemption, which reduces the taxable value of a primary residence for eligible homeowners. This exemption, often tied to income and residency requirements, aims to support homeowners in maintaining their properties and contributing to their communities. Other exemptions and abatements may be available for veterans, seniors, and organizations such as churches and non-profits.

The Impact of Property Taxes on Maine’s Residents

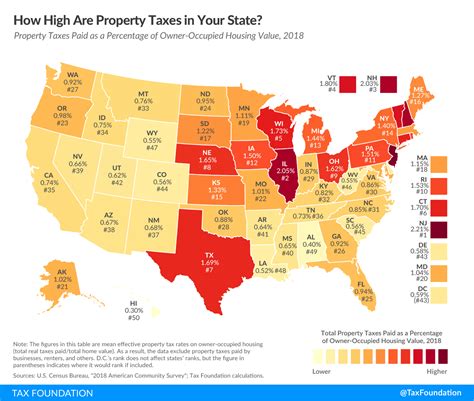

Property taxes are a significant financial obligation for homeowners and businesses in Maine. The impact of these taxes extends beyond the immediate financial burden, influencing various aspects of life in the state. For instance, property taxes play a crucial role in funding local schools, with a significant portion of the tax revenue allocated to education. This investment in education contributes to the development of a skilled workforce, which in turn attracts businesses and supports economic growth.

However, the burden of property taxes can vary significantly depending on the location and type of property. For instance, coastal communities with high property values may face a more significant tax burden compared to rural areas. This disparity often sparks debates about tax fairness and equity, leading to ongoing discussions and potential reforms to ensure that the tax system remains balanced and reflective of the state's diverse needs.

Case Study: The Experience of a Maine Homeowner

To better understand the practical implications of Maine’s property tax system, let’s consider the experience of Sarah, a hypothetical homeowner in Portland. Sarah recently purchased a single-family home in the city’s vibrant West End neighborhood. Her property, assessed at 450,000, is subject to a mill rate of 18, resulting in an annual property tax bill of 8,100 (450,000 x 0.018 = 8,100). While this amount may seem substantial, Sarah understands that her tax dollars are contributing to vital services such as the local fire department, public schools, and road maintenance.

However, Sarah is also mindful of the various exemptions and abatements available to homeowners. She explores her eligibility for the homestead exemption, which could reduce her taxable property value and alleviate some of the financial burden. Additionally, as a first-time homeowner, Sarah is relieved to discover that Maine offers several programs to support new buyers, including tax credits and deferred payment options.

The Future of Property Taxation in Maine

As Maine continues to evolve, so too must its property tax system. The state’s commitment to fairness and transparency in taxation is evident in its ongoing efforts to modernize and streamline the assessment and collection processes. One key area of focus is the utilization of technology to enhance efficiency and accuracy in property valuation.

Furthermore, Maine is actively exploring ways to distribute the tax burden more equitably across different property types and locations. This includes examining the impact of tax policies on affordable housing, small businesses, and rural communities. By fostering an open dialogue and engaging with stakeholders, the state aims to develop tax policies that support economic growth while ensuring that the tax system remains fair and sustainable.

Potential Reforms and Their Impact

Several potential reforms are being discussed to address the challenges and disparities in Maine’s property tax system. One proposal involves reevaluating the assessment process to ensure that properties are valued based on their highest and best use, rather than their current use. This approach could lead to a more equitable distribution of the tax burden, as it would reflect the true market value of properties.

Another reform under consideration is the introduction of a circuit breaker program, which would provide relief to homeowners with limited incomes by capping the amount of property tax they owe. This program, already in place in several states, aims to prevent property taxes from becoming an insurmountable financial burden for vulnerable populations.

| Property Type | Assessed Value | Mill Rate | Annual Tax |

|---|---|---|---|

| Residential (Single-Family) | $250,000 | 16 | $4,000 |

| Commercial (Office Space) | $500,000 | 20 | $10,000 |

| Industrial (Factory) | $800,000 | 18 | $14,400 |

How often are properties revalued for tax purposes in Maine?

+Properties in Maine are typically revalued every three years, although some municipalities may conduct revaluations more frequently to ensure that assessed values remain current and accurate.

Are there any online resources to estimate property taxes in Maine?

+Yes, many municipalities in Maine provide online property tax calculators on their official websites. These tools allow homeowners to estimate their annual tax liability based on their property’s assessed value and the current mill rate.

What happens if I disagree with my property’s assessed value in Maine?

+If you believe that your property’s assessed value is inaccurate, you have the right to appeal the assessment. The process typically involves submitting a formal request for review to the local assessor’s office, followed by a hearing or mediation to resolve the dispute.