Llc Tax Deductions

When it comes to managing your business finances, understanding the various tax deductions available to Limited Liability Companies (LLCs) is crucial. LLCs, being a popular business structure, offer numerous advantages, including personal liability protection and flexibility in tax treatment. This article aims to provide an in-depth guide on LLC tax deductions, covering everything from eligible expenses to strategies for maximizing tax savings.

Navigating LLC Tax Deductions: A Comprehensive Guide

Tax deductions are an essential aspect of managing your LLC's finances, as they can significantly reduce your tax liability and boost your business's profitability. By carefully tracking and claiming eligible expenses, you can optimize your tax strategy and ensure your business operates efficiently and cost-effectively.

Understanding Eligible Expenses

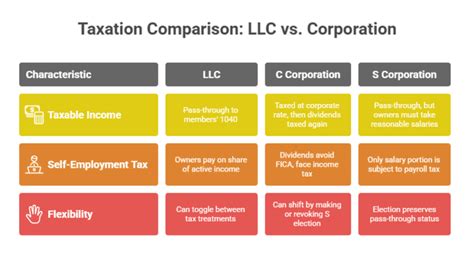

LLCs are granted the flexibility to choose their tax classification, which can impact the types of deductions available. While an LLC's default tax classification is a pass-through entity, it can also opt to be taxed as a corporation. The choice of tax classification influences the deductions you can claim, so it's crucial to understand the implications of each option.

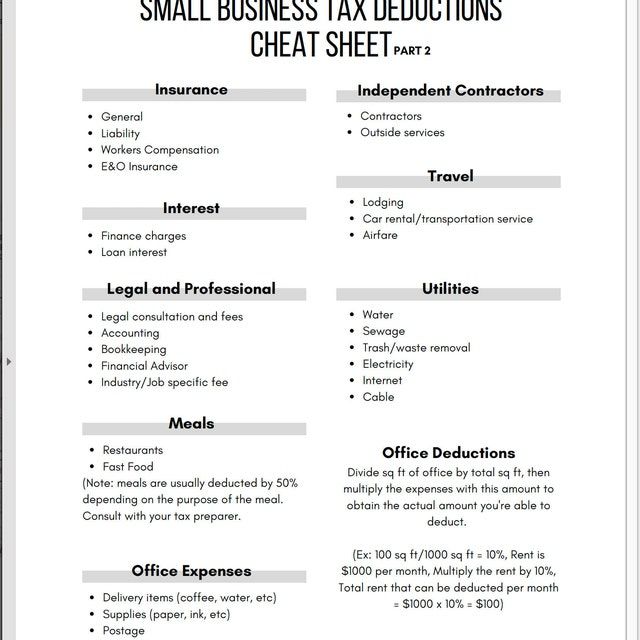

Eligible expenses for tax deductions typically include any ordinary and necessary business expenses incurred while operating your LLC. These expenses must be directly related to the business and used solely for business purposes. Some common categories of eligible expenses include:

- Business Start-up Costs: These include expenses incurred while setting up your LLC, such as legal fees, state filing fees, advertising costs, and research expenses.

- Operating Expenses: Day-to-day costs like rent, utilities, insurance, employee salaries, and office supplies are all deductible.

- Marketing and Advertising: Costs associated with promoting your business, such as website development, social media marketing, and advertising campaigns.

- Travel and Entertainment: Expenses related to business travel, including transportation, accommodation, meals, and entertainment, can be deductible if they meet certain criteria.

- Office Equipment and Supplies: The cost of purchasing or renting office equipment, furniture, and supplies can be claimed as a deduction.

- Vehicle Expenses: If you use a vehicle for business purposes, you can deduct expenses like fuel, maintenance, insurance, and lease payments.

- Education and Training: Fees for professional development courses, seminars, and training programs relevant to your business are deductible.

- Legal and Professional Services: Expenses incurred for legal advice, accounting services, and consulting fees can be claimed.

- Interest and Taxes: Interest on business loans and taxes paid, such as sales tax or property tax, are often deductible.

It's important to maintain detailed records of all expenses and ensure they are accurately categorized to support your tax deductions. The Internal Revenue Service (IRS) provides guidelines and publications to help you understand which expenses are deductible and how to properly substantiate them.

Maximizing Deductions through Strategic Planning

To optimize your LLC's tax deductions, it's beneficial to implement strategic planning and consider the following:

- Business Structure: As mentioned earlier, choosing the right tax classification for your LLC can impact your deductions. Consulting with a tax professional can help you determine the most advantageous structure for your specific business needs.

- Expense Tracking: Implement a robust expense tracking system to ensure you capture all eligible expenses. This can be done through dedicated accounting software or simple spreadsheets, but consistency is key.

- Separation of Personal and Business Finances: Maintaining clear separation between personal and business expenses is crucial. Opening a dedicated business bank account and using it exclusively for business transactions simplifies expense tracking and ensures you don't miss out on any deductions.

- Capitalizing on Business Opportunities: Stay updated on tax laws and regulations to identify new deductions or incentives that could benefit your business. For instance, certain industries may qualify for specific tax credits or deductions related to research and development or energy efficiency.

- Retirement Plans: Setting up a retirement plan for your LLC, such as a Simplified Employee Pension (SEP) IRA or a Solo 401(k), can provide significant tax advantages. Contributions to these plans are tax-deductible, and the funds grow tax-deferred until withdrawal.

- Tax Loss Harvesting: If your LLC incurs a net operating loss (NOL) in a given year, you can carry it forward to offset future profits and reduce your tax liability. This strategy can be particularly beneficial during periods of business growth or expansion.

By combining a solid understanding of eligible expenses with strategic planning, you can maximize your LLC's tax deductions and optimize your overall financial health.

Real-World Examples of LLC Tax Deductions

Let's explore some concrete examples of tax deductions that LLCs can claim to illustrate the practical application of these concepts:

| Expense Category | Eligible Expenses |

|---|---|

| Business Start-up Costs |

|

| Operating Expenses |

|

| Marketing and Advertising |

|

| Travel and Entertainment |

|

| Vehicle Expenses |

|

| Education and Training |

|

| Legal and Professional Services |

|

| Interest and Taxes |

|

These examples demonstrate the variety of expenses that LLCs can deduct to reduce their tax liability. It's essential to keep accurate records and consult tax professionals to ensure compliance with IRS regulations and maximize the benefits of these deductions.

Future Implications and Tax Strategies

As tax laws and regulations evolve, it's crucial for LLCs to stay informed and adapt their tax strategies accordingly. Here are some future implications and potential strategies to consider:

- Tax Reform and Changes: Keep a close eye on any proposed or enacted tax reforms that may impact LLCs. For instance, the Tax Cuts and Jobs Act of 2017 brought significant changes to tax rates and deductions for pass-through entities like LLCs. Understanding these changes and their implications is vital for effective tax planning.

- Pass-Through Deduction: Under the Tax Cuts and Jobs Act, a new deduction for qualified business income (QBI) was introduced for pass-through entities. This deduction allows for a reduction in taxable income for certain businesses. LLCs should evaluate their eligibility for this deduction and maximize its benefits.

- Research and Development (R&D) Tax Credits: Some industries, particularly those involved in innovative technologies or processes, may qualify for R&D tax credits. These credits can provide substantial tax savings and should be explored if applicable to your LLC's operations.

- Tax-Efficient Investment Strategies: Consider implementing tax-efficient investment strategies within your LLC. This could include investing in tax-advantaged accounts, such as a Health Savings Account (HSA) or a Self-Directed IRA, to maximize tax benefits and grow your business's assets.

- Employee Benefits and Retirement Plans: Offering comprehensive employee benefits, such as health insurance or retirement plans, can not only attract and retain top talent but also provide tax advantages for your LLC. Explore the various options available and consult with tax professionals to determine the most suitable benefits package.

By staying informed, proactive, and strategic in your tax planning, you can ensure that your LLC remains financially healthy and compliant with evolving tax regulations. Remember, tax strategies should be tailored to your specific business needs and goals, so consulting with tax professionals and staying updated on industry developments is essential.

Frequently Asked Questions (FAQ)

Can I deduct personal expenses if they are used for business purposes?

+In general, personal expenses are not deductible for tax purposes. However, if an expense has a clear business purpose and is directly related to your LLC’s operations, you may be able to deduct it. For instance, if you use your personal vehicle for business travel, you can claim a portion of the expenses as a business deduction. It’s important to maintain detailed records and separate personal and business expenses to support your deductions.

Are there any limitations on the amount of tax deductions I can claim for my LLC?

+Yes, there are certain limitations and restrictions on tax deductions for LLCs. Some deductions, such as certain business losses or charitable contributions, may be subject to specific thresholds or carryover rules. Additionally, certain expenses, like meals and entertainment, are subject to specific deduction limits. It’s crucial to consult with a tax professional to understand the specific limitations and ensure compliance with IRS regulations.

How can I maximize tax deductions for my LLC’s business travel expenses?

+To maximize tax deductions for business travel expenses, it’s essential to maintain meticulous records. Document all travel-related expenses, including transportation, accommodation, meals, and entertainment. Ensure that each expense is directly related to your business and serves a legitimate business purpose. Keep receipts, logbooks, and detailed records to support your deductions and demonstrate the business nature of the travel.

Can I deduct the cost of my home office as an LLC tax deduction?

+Yes, you may be able to deduct the cost of your home office as an LLC tax deduction if you meet certain criteria. The IRS allows a deduction for home office expenses if your home office is your principal place of business or is used exclusively for business purposes. You must also meet specific square footage and usage requirements. Consult with a tax professional to determine your eligibility and ensure accurate calculation of the deduction.

What are some common mistakes to avoid when claiming LLC tax deductions?

+When claiming LLC tax deductions, it’s important to avoid common mistakes that could lead to IRS audits or penalties. Some common mistakes to avoid include failing to keep accurate and detailed records, claiming personal expenses as business deductions, neglecting to separate business and personal finances, and overstating expenses. It’s crucial to consult with tax professionals and stay informed about IRS guidelines to ensure compliance and avoid potential issues.