Georgia Vehicle Tax

When purchasing a vehicle in Georgia, understanding the tax implications is crucial for budgeting and ensuring compliance with state regulations. This comprehensive guide delves into the intricacies of the Georgia Vehicle Tax, shedding light on its calculation, payment methods, and potential exemptions to empower residents and prospective vehicle owners with the knowledge they need.

Understanding the Georgia Vehicle Tax

The Georgia Vehicle Tax, a fundamental aspect of the state’s revenue system, is levied on all vehicles registered within the state. It plays a pivotal role in funding essential public services and infrastructure projects. While the tax is mandatory for most vehicle owners, various factors, including the vehicle’s age, type, and value, influence the tax calculation.

The state of Georgia utilizes a sliding scale for vehicle tax calculations, ensuring fairness and accuracy. This scale considers the vehicle's purchase price, its age, and specific county-based tax rates. For instance, a newer vehicle with a higher purchase price may incur a higher tax, reflecting its current market value. Conversely, older vehicles, often valued at less, are subject to a lower tax rate.

Key Factors Influencing Vehicle Tax

- Vehicle Age and Value: The tax rate decreases as the vehicle ages, reflecting its depreciation. However, the specific tax rate applied also depends on the vehicle’s current value, ensuring a balanced approach to taxation.

- County-Specific Rates: Georgia allows individual counties to set their tax rates, leading to variations across the state. This decentralization ensures that local needs and circumstances are considered when determining tax rates.

- Type of Vehicle: Different vehicle types, such as cars, trucks, motorcycles, and recreational vehicles, may be subject to distinct tax rates or calculations. This differentiation acknowledges the unique characteristics and uses of each vehicle category.

| Vehicle Type | Tax Rate |

|---|---|

| Passenger Cars | 0.7% to 1.5% of the purchase price |

| Trucks | 0.8% to 1.6% of the purchase price |

| Motorcycles | 0.6% to 1.2% of the purchase price |

| Recreational Vehicles | 0.7% to 1.4% of the purchase price |

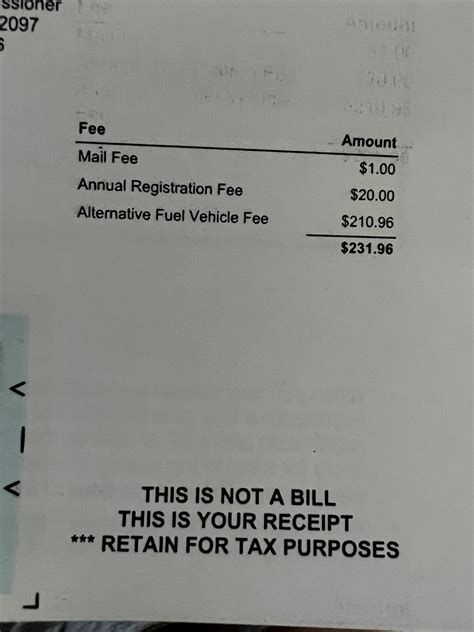

Payment Methods and Deadlines

The Georgia Vehicle Tax is typically paid annually, coinciding with the vehicle’s registration renewal. However, for newly purchased vehicles, the tax is often due within a specific timeframe, usually a few months after the purchase date.

Vehicle owners have the flexibility to choose from several payment methods, including online payment portals, mailed checks, or in-person payments at designated county tax offices. Each method offers its own advantages, such as convenience, speed, and potential for reduced processing fees.

Online Payment: A Convenient Option

The state of Georgia provides an online platform for vehicle tax payments, offering a quick and efficient way to fulfill tax obligations. This method is particularly beneficial for busy individuals who value time efficiency and the ability to manage their finances remotely.

To make an online payment, vehicle owners need their vehicle identification number (VIN) and the exact tax amount, which can be calculated using the state's provided formula or through an online tax estimator. The process is secure and typically generates an instant receipt, ensuring a seamless transaction.

| Online Payment Advantages |

|---|

| Convenience: Accessible from anywhere with an internet connection. |

| Speed: Instant payment processing. |

| Receipt Generation: An electronic receipt is immediately available. |

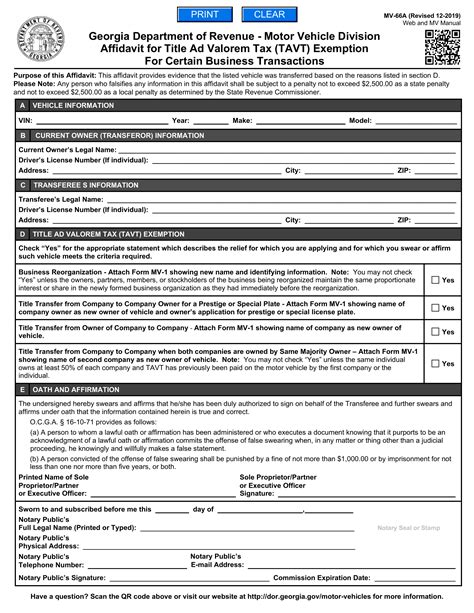

Exemptions and Special Considerations

While the Georgia Vehicle Tax is a mandatory requirement for most vehicle owners, certain circumstances and vehicle types may qualify for exemptions or reduced tax rates. Understanding these exemptions is crucial for ensuring compliance and maximizing potential savings.

Common Exemptions and Special Cases

- Active-Duty Military Personnel: Service members stationed in Georgia may be eligible for tax exemptions or reduced rates, demonstrating the state’s appreciation for their service.

- Disabled Individuals: Certain disabilities can qualify vehicle owners for reduced tax rates or exemptions, ensuring equitable treatment for those with unique needs.

- Hybrid and Electric Vehicles: To promote environmentally friendly transportation, Georgia offers tax incentives for owners of hybrid and electric vehicles, encouraging a greener future.

Additionally, specific vehicle types, such as classic cars or vehicles used exclusively for agricultural purposes, may be subject to different tax calculations or exemptions. These special considerations recognize the unique roles these vehicles play in Georgia's diverse landscape.

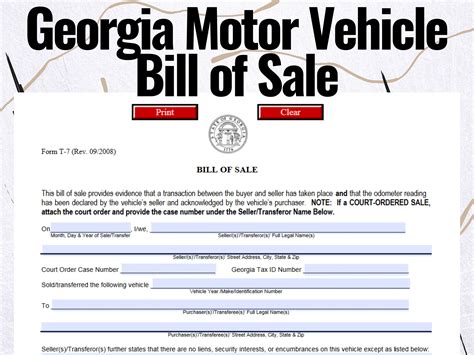

Documentation and Verification

To claim any exemptions or special considerations, vehicle owners must provide supporting documentation. This may include proof of military service, disability certification, or vehicle-specific information. Accurate and timely submission of these documents is essential to avoid penalties and ensure the correct application of any tax benefits.

How is the vehicle tax calculated in Georgia?

+The vehicle tax in Georgia is calculated using a sliding scale based on the vehicle’s purchase price, age, and county-specific tax rates. The tax rate varies between 0.6% and 1.6% depending on the vehicle type and its value.

When is the vehicle tax due in Georgia?

+The vehicle tax is typically due annually, coinciding with the vehicle’s registration renewal. For new vehicles, the tax is due within a few months of the purchase date.

What are the payment methods for the Georgia Vehicle Tax?

+Vehicle owners can choose from online payments, mailed checks, or in-person payments at county tax offices. Online payments are convenient and provide instant receipts.

Are there any exemptions or special considerations for the vehicle tax in Georgia?

+Yes, exemptions are available for active-duty military personnel, disabled individuals, and owners of hybrid or electric vehicles. Certain vehicle types, like classic cars or agricultural vehicles, may also qualify for special tax considerations.

What documentation is required to claim exemptions or special considerations?

+Vehicle owners must provide proof of eligibility, such as military service records, disability certifications, or vehicle-specific information. Accurate and timely submission of these documents is essential for claiming tax benefits.