San Diego California Sales Tax

When it comes to understanding the sales tax landscape, it's crucial to delve into the specifics of each region. In this article, we will explore the intricacies of San Diego, California's sales tax, providing a comprehensive guide for businesses and individuals alike. With its unique tax rates and regulations, San Diego presents a complex yet fascinating system that impacts various industries and daily transactions.

Unraveling the San Diego Sales Tax

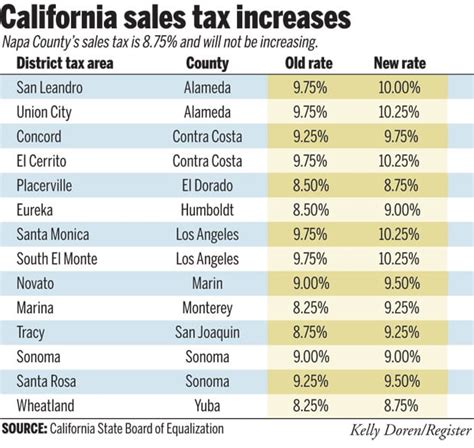

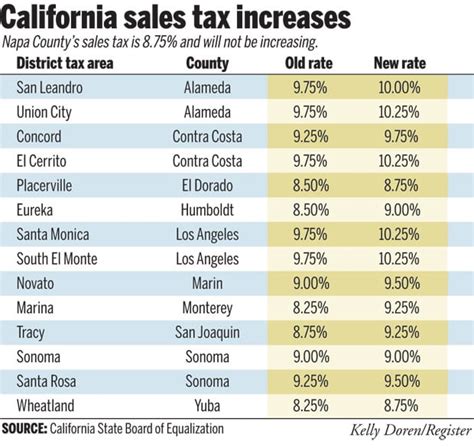

The sales tax in San Diego, California, is a multifaceted system that combines state, county, and city tax rates, resulting in a cumulative tax that applies to various goods and services. As of [current year], the sales tax rate in San Diego stands at 7.75%, which includes the state sales tax of 7.25% and an additional local sales tax of 0.50%.

However, it's important to note that this base rate can vary within the county due to special district taxes and city-specific taxes. For instance, certain areas in San Diego County may impose an extra 0.25% tax, bringing the total sales tax to 8.00% in those regions. These variations are crucial for businesses to understand, as they impact pricing strategies and compliance requirements.

The Breakdown of San Diego Sales Tax

To provide a clearer picture, let’s dissect the components of San Diego’s sales tax structure:

| Tax Type | Rate | Description |

|---|---|---|

| State Sales Tax | 7.25% | The standard sales tax rate mandated by the state of California, applicable across the state. |

| Local Sales Tax (San Diego County) | 0.50% | A county-wide tax levied by San Diego County, in addition to the state sales tax. |

| City Sales Tax (San Diego City) | Varies | Some cities within San Diego County may impose an additional city sales tax, typically around 0.25%, making the total tax higher in those areas. |

| Special District Taxes | Varies | Certain special districts within San Diego County may have their own sales tax rates, which can further add to the total tax burden. |

This breakdown illustrates the complexity of San Diego's sales tax, with various layers of taxation impacting different regions within the county. Businesses operating in multiple areas must carefully navigate these variations to ensure accurate tax collection and compliance.

Impact on Business and Consumers

The sales tax in San Diego has a direct impact on both businesses and consumers. For businesses, it affects pricing strategies, especially for those operating in multiple locations with varying tax rates. Companies must carefully calculate and display tax amounts to ensure transparency and avoid confusion among customers.

From a consumer perspective, understanding the sales tax is essential for making informed purchasing decisions. San Diego's varying tax rates can influence shopping behaviors, with consumers potentially seeking out lower-tax areas for certain purchases. This dynamic adds an extra layer of consideration when choosing where to shop.

Sales Tax Compliance and Reporting

Compliance with sales tax regulations is a critical aspect for businesses operating in San Diego. This involves accurate tax collection, proper record-keeping, and timely reporting to the appropriate tax authorities. The California Board of Equalization provides guidelines and resources to assist businesses in meeting their sales tax obligations.

Businesses must also be aware of specific tax thresholds and filing requirements. Depending on their annual sales volume, they may be required to file sales tax returns periodically, ensuring they remain in good standing with the tax authorities.

Special Considerations in San Diego’s Sales Tax

San Diego’s sales tax landscape is further complicated by certain exemptions and special considerations. Here are a few key points to note:

- Certain goods and services, such as groceries and prescription medications, are exempt from sales tax in California, including San Diego. This exemption can significantly impact consumer spending patterns and business strategies.

- San Diego, like many other cities, offers tax incentives and abatements to attract businesses and stimulate economic growth. These incentives can vary by industry and location, providing opportunities for businesses to reduce their tax burden.

- The sales tax rate in San Diego may change over time due to legislative decisions and economic factors. Businesses and consumers should stay informed about any upcoming changes to ensure they are prepared for adjustments in their tax obligations or purchasing behaviors.

Navigating San Diego’s Sales Tax Challenges

For businesses operating in San Diego, effectively managing sales tax can be a complex task. Here are some strategies to navigate the challenges:

- Utilize sales tax software: Investing in robust sales tax management software can automate tax calculations, ensuring accuracy and compliance. These tools can handle varying tax rates and provide real-time updates on tax regulations.

- Implement proper tax training: Educate your staff, especially those involved in sales and accounting, about San Diego's sales tax intricacies. Ensure they understand the variations and how to apply them correctly.

- Regularly review tax rates: Stay updated on any changes to tax rates and regulations. This proactive approach helps businesses avoid surprises and ensures they remain compliant with the latest requirements.

- Engage tax professionals: For complex tax scenarios or to navigate specific challenges, consider seeking advice from tax professionals or accountants with expertise in San Diego's sales tax landscape.

Future Implications and Trends

Looking ahead, the sales tax landscape in San Diego is likely to continue evolving. Here are some potential trends and implications to consider:

- Increasing Tax Rates: As economic conditions change, there may be proposals to raise sales tax rates to fund specific initiatives or address budget shortfalls. Businesses should stay vigilant for any signs of potential rate increases.

- Expansion of Exemptions: On the other hand, there could be efforts to expand sales tax exemptions to encourage consumer spending or support specific industries. This could impact the overall tax burden for businesses and consumers alike.

- Technological Innovations: The use of technology, such as blockchain and digital tax platforms, may streamline sales tax compliance and reporting processes. Staying updated on these innovations can help businesses enhance their tax management systems.

Conclusion

San Diego’s sales tax is a dynamic and intricate system that requires careful attention from businesses and consumers alike. By understanding the variations in tax rates, exemptions, and compliance requirements, individuals and companies can navigate this complex landscape effectively. Staying informed and adapting to changes will be crucial for success in this ever-evolving tax environment.

What is the current sales tax rate in San Diego, California?

+

The current sales tax rate in San Diego, California, is 7.75% as of [current year]. This includes the state sales tax rate of 7.25% and an additional local sales tax of 0.50% imposed by San Diego County.

Are there any special district taxes in San Diego County that impact the total sales tax rate?

+

Yes, certain special districts within San Diego County may have their own sales tax rates, which can add to the total tax burden. These rates can vary, so it’s important for businesses and consumers to be aware of the specific rates in their area.

How often do sales tax rates change in San Diego, and how can businesses stay updated?

+

Sales tax rates in San Diego can change periodically due to legislative decisions or economic factors. Businesses can stay updated by regularly checking with the California Board of Equalization and local tax authorities. These entities often provide resources and notifications regarding any changes in tax rates.

Are there any sales tax exemptions in San Diego, and how do they impact businesses and consumers?

+

Yes, there are certain sales tax exemptions in San Diego, such as those for groceries and prescription medications. These exemptions can significantly impact consumer spending patterns and business strategies. Businesses must understand which items are exempt to accurately apply the sales tax.