What Is The Sales Tax In Colorado

In Colorado, sales tax is an essential aspect of the state's revenue system, contributing significantly to the funding of public services and infrastructure. This article delves into the specifics of Colorado's sales tax structure, rates, and its impact on consumers and businesses alike.

Understanding Colorado’s Sales Tax

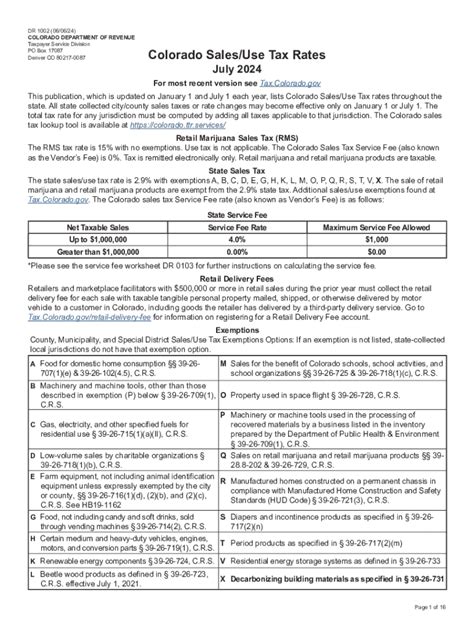

Sales tax in Colorado is a state-level tax imposed on the sale of tangible goods and some services. It is a percentage-based tax, meaning the amount of tax paid depends on the value of the item or service purchased. The state of Colorado has a complex sales tax system, with varying rates depending on the type of product, the location of the sale, and other factors.

Statewide Sales Tax Rate

As of my last update in January 2023, the statewide sales tax rate in Colorado is set at 2.9%. This is the base rate, which applies uniformly across the state. However, this is just the beginning of the story, as Colorado’s sales tax system is much more intricate than a single, flat rate.

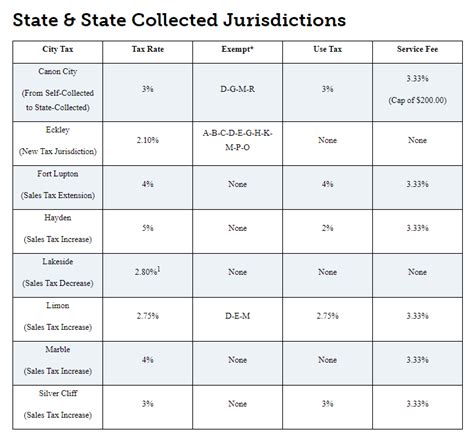

Local Sales Tax Rates

In addition to the statewide rate, Colorado allows local jurisdictions, such as cities, counties, and special districts, to impose their own sales and use taxes. These local taxes are often referred to as “local option taxes” and are added to the statewide rate. As a result, the total sales tax rate can vary significantly from one location to another within the state.

For instance, Denver, the capital city of Colorado, levies an additional 3.62% sales tax, bringing the total sales tax rate in Denver to 6.52%. On the other hand, the city of Colorado Springs has a slightly lower total sales tax rate of 6.20%, with a local tax rate of 3.30% added to the statewide base.

| Location | Statewide Rate | Local Rate | Total Rate |

|---|---|---|---|

| Denver | 2.9% | 3.62% | 6.52% |

| Colorado Springs | 2.9% | 3.30% | 6.20% |

| Aurora | 2.9% | 3.45% | 6.35% |

| Fort Collins | 2.9% | 3.50% | 6.40% |

| Boulder | 2.9% | 4.00% | 6.90% |

These local rates are often used to fund specific initiatives or projects within the community, such as transportation improvements, cultural amenities, or other public services.

Sales Tax Exemptions and Special Cases

While the sales tax system in Colorado can be complex, there are certain items and situations where sales tax is not applied. For example, many groceries, prescription drugs, and non-prepared foods are exempt from sales tax. Additionally, some services, such as medical and dental services, legal services, and certain personal services, are not subject to sales tax.

Colorado also offers tax incentives and exemptions for specific industries and businesses, particularly those that bring economic development and job creation to the state. These incentives can take the form of sales tax rebates, tax credits, or reduced tax rates.

Impact on Consumers and Businesses

The sales tax in Colorado has a direct impact on both consumers and businesses. For consumers, the varying rates can lead to significant differences in the total cost of goods and services depending on their location. This can influence consumer behavior, with some choosing to shop in areas with lower tax rates or online to avoid local sales taxes.

Businesses, especially those with multiple locations across the state, face the challenge of navigating the complex sales tax system. They must ensure compliance with both the statewide and local tax rates, which can be a significant administrative burden. Additionally, businesses may need to adjust their pricing strategies to account for the varying tax rates, especially if they operate in multiple jurisdictions.

Future Outlook and Considerations

As Colorado’s economy and population continue to grow, the state’s sales tax system will likely undergo further changes and refinements. The state may consider adjustments to the statewide rate or provide additional tax incentives to support specific industries or economic development initiatives.

Furthermore, with the rise of e-commerce and online shopping, Colorado, like many other states, will need to address the issue of collecting sales tax on online transactions, particularly from out-of-state sellers. This could lead to new regulations and policies to ensure fair competition between online and brick-and-mortar businesses and to capture lost revenue from online sales.

In conclusion, understanding Colorado's sales tax system is crucial for both consumers and businesses operating within the state. The system's complexity, with its varying rates and exemptions, requires careful consideration and planning to ensure compliance and minimize tax liabilities. As Colorado's economy evolves, so too will its sales tax structure, reflecting the state's changing needs and priorities.

Are there any special considerations for businesses collecting sales tax in Colorado?

+Yes, businesses in Colorado must obtain a sales tax license and register with the state. They are required to collect and remit sales tax on all taxable sales, including online transactions. Failure to comply can result in penalties and interest charges.

How often are sales tax rates reviewed and adjusted in Colorado?

+Sales tax rates in Colorado are generally reviewed and adjusted on an annual basis, often as part of the state’s budgetary process. However, local jurisdictions may propose and enact changes to their local tax rates more frequently, depending on their specific needs and initiatives.

What are the implications of Colorado’s sales tax system for e-commerce businesses?

+E-commerce businesses selling to Colorado residents must comply with the state’s sales tax laws, including collecting and remitting sales tax on taxable transactions. This can be particularly challenging for businesses with no physical presence in the state, as they may need to register and collect tax based on economic nexus.