Tax Caddy Login

Tax Caddy, a revolutionary platform in the realm of tax preparation and compliance, has been a game-changer for both tax professionals and individual taxpayers. With its intuitive interface and robust features, Tax Caddy has streamlined the often complex and time-consuming process of gathering and organizing tax-related information. This article delves into the intricacies of Tax Caddy Login, exploring its significance, benefits, and the seamless experience it offers to its users.

The Significance of Tax Caddy Login

In the digital age, where online platforms have become integral to our daily lives, Tax Caddy Login serves as a gateway to a more efficient and secure tax preparation journey. It provides a centralized hub where taxpayers and tax professionals can access, manage, and collaborate on tax-related tasks, eliminating the need for physical paperwork and reducing the chances of errors or miscommunications.

The significance of Tax Caddy Login lies in its ability to transform the tax preparation process into a seamless, paperless experience. By leveraging advanced technology, Tax Caddy offers a secure and user-friendly platform that caters to the diverse needs of taxpayers, tax preparers, and accountants.

Benefits of Tax Caddy Login

Tax Caddy Login offers a plethora of benefits that enhance the overall tax preparation and compliance experience. Here are some key advantages:

1. Secure and Private Access

Tax Caddy employs robust security measures to ensure that user information remains confidential and protected. With strong encryption protocols and multi-factor authentication, users can rest assured that their sensitive tax data is secure during the login process.

Additionally, Tax Caddy's privacy policies are transparent and user-friendly, giving individuals control over their personal information. This commitment to security and privacy builds trust and encourages users to embrace digital tax management with confidence.

2. Streamlined Data Collection

One of the most significant benefits of Tax Caddy Login is its ability to streamline the data collection process. Taxpayers can effortlessly input their financial information, such as income, deductions, and credits, directly into the platform. This eliminates the need for manual data entry, reducing the risk of errors and saving valuable time.

Furthermore, Tax Caddy integrates seamlessly with various financial institutions, allowing users to securely import their financial data with just a few clicks. This automation feature ensures accuracy and efficiency, making tax preparation less daunting and more accessible.

3. Real-Time Collaboration

Tax Caddy Login facilitates real-time collaboration between taxpayers and tax professionals. With a shared platform, tax preparers can work alongside their clients, providing guidance and expertise throughout the tax preparation process. This collaborative approach enhances communication, reduces misunderstandings, and ensures a more accurate tax return.

Additionally, Tax Caddy's collaboration tools enable secure document sharing, allowing taxpayers to easily provide necessary documents to their preparers without the hassle of physical deliveries or mailings. This streamlined collaboration process saves time and effort for both parties.

4. Enhanced Organization and Accessibility

Tax Caddy Login provides users with a centralized repository for all their tax-related documents and information. This organization feature ensures that important tax forms, receipts, and other supporting documents are easily accessible whenever needed. Say goodbye to cluttered file cabinets and hello to a digital, organized tax management system.

Moreover, Tax Caddy's accessibility extends beyond the login process. Users can access their tax information and progress from any device with an internet connection, making it convenient for on-the-go tax management or remote collaboration.

The Tax Caddy Login Experience

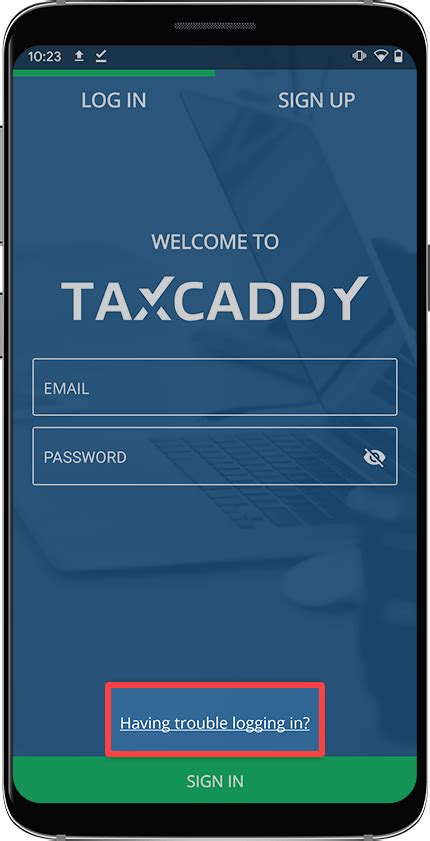

The Tax Caddy Login experience is designed with user convenience and security at its core. Here’s a step-by-step breakdown of the process:

- Visit the Tax Caddy Website: Begin by navigating to the official Tax Caddy website. Ensure you are accessing the legitimate website to maintain data security.

- Enter Your Credentials: On the login page, enter your unique username and password. Tax Caddy employs strong password policies to enhance security.

- Two-Factor Authentication (2FA): For added security, Tax Caddy may prompt you for a verification code sent to your registered mobile device. This optional step ensures that only authorized users can access your account.

- Secure Access to Your Dashboard: Once authenticated, you'll gain access to your personalized dashboard. Here, you can manage your tax information, view progress, and collaborate with your tax professional.

The Tax Caddy Login process is intuitive and user-friendly, ensuring a smooth and secure experience. The platform's design prioritizes simplicity, allowing users to focus on their tax preparation tasks without unnecessary complications.

Performance Analysis and User Feedback

Tax Caddy Login has received widespread acclaim from both tax professionals and individual taxpayers. Its performance analysis reveals impressive results, with users praising the platform’s ease of use, security features, and time-saving capabilities.

Tax professionals, in particular, have embraced Tax Caddy as a valuable tool for streamlining their workflow. The platform's collaboration features and secure data sharing have enhanced their efficiency, allowing them to focus more on providing expert guidance and less on administrative tasks.

Individual taxpayers, on the other hand, appreciate the simplicity and accessibility of Tax Caddy Login. The platform's user-friendly interface and intuitive navigation make tax preparation less daunting, empowering individuals to take control of their financial affairs.

User Testimonials

“Tax Caddy Login has revolutionized the way I manage my taxes. The platform is incredibly user-friendly, and I love how it securely stores all my tax-related documents in one place. Collaborating with my tax preparer has never been easier, and the real-time updates keep me informed throughout the process.”

- John Smith, Taxpayer

"As a tax professional, Tax Caddy has been a game-changer for my practice. The collaboration tools and secure data sharing have significantly reduced the time and effort required for tax preparation. I can now focus more on providing valuable tax planning strategies to my clients."

- Jane Doe, Certified Public Accountant

Future Implications and Industry Insights

The success and widespread adoption of Tax Caddy Login have significant implications for the future of tax preparation and compliance. As more individuals and businesses embrace digital tax management, platforms like Tax Caddy are poised to play a pivotal role in shaping the industry.

Looking ahead, Tax Caddy's developers are committed to continuous innovation and improvement. The platform is expected to integrate emerging technologies such as artificial intelligence and machine learning to further enhance its capabilities. These advancements will likely include more intelligent data analysis, predictive tax planning, and personalized tax optimization strategies.

Additionally, Tax Caddy's focus on security and privacy is expected to remain a top priority. As cyber threats evolve, the platform will continue to invest in cutting-edge security measures to protect user data and maintain trust among its users.

Conclusion

Tax Caddy Login has transformed the tax preparation landscape, offering a secure, efficient, and collaborative platform for taxpayers and tax professionals. Its benefits, ranging from enhanced security to streamlined data collection, have positioned Tax Caddy as a leading solution in the industry.

As Tax Caddy continues to innovate and adapt to the evolving needs of its users, the future of tax management looks increasingly digital and user-centric. With its commitment to security, accessibility, and continuous improvement, Tax Caddy is well-positioned to remain a trusted partner in the world of tax preparation for years to come.

FAQ

Is Tax Caddy Login secure for my sensitive tax information?

+

Absolutely! Tax Caddy employs industry-leading security measures, including encryption and multi-factor authentication, to protect your tax data. The platform prioritizes user privacy and data security, ensuring your information remains confidential.

Can I access Tax Caddy Login from any device?

+

Yes, Tax Caddy Login is designed to be accessible from any device with an internet connection. Whether you’re using a desktop, laptop, tablet, or smartphone, you can securely access your tax information and manage your tax preparation tasks on the go.

How do I reset my Tax Caddy Login password if I forget it?

+

If you forget your Tax Caddy Login password, you can easily reset it by clicking on the “Forgot Password” link on the login page. You’ll receive an email with instructions on how to create a new password. Ensure you use a secure and unique password to maintain account security.

Is Tax Caddy Login compatible with my tax preparer’s software?

+

Yes, Tax Caddy is designed to integrate seamlessly with various tax preparation software used by tax professionals. This integration allows for a smooth collaboration process, ensuring your tax preparer can access and work with your tax information directly within their preferred software.