Mesa Sales Tax

When discussing sales tax in Mesa, Arizona, it's essential to delve into the specifics to understand how this tax affects residents, businesses, and the local economy. Mesa, a vibrant city known for its diverse culture and thriving business environment, has a unique sales tax structure that contributes significantly to its overall fiscal health.

Understanding Mesa’s Sales Tax Structure

Mesa, like many other cities in Arizona, operates under a combined sales tax system, which means that the city’s sales tax rate is composed of both state and local taxes. This combined rate applies to most tangible personal property and certain services sold at retail.

As of [current date], the sales tax rate in Mesa stands at 8.6%, which is slightly higher than the state's average sales tax rate. This rate is comprised of:

- A state tax rate of 5.6%, which is consistent across Arizona.

- A 2% city tax rate levied by the City of Mesa.

- An additional 1% tax rate designated for specific purposes, such as transportation or public safety initiatives.

The city's sales tax is applied to a broad range of goods and services, including clothing, electronics, groceries (excluding food items for home consumption), restaurant meals, and various other retail purchases. However, there are certain exemptions and special considerations, such as the exemption of sales tax on prescription drugs and certain medical devices.

Impact on Local Businesses

Mesa’s sales tax plays a crucial role in supporting the city’s infrastructure, public services, and economic development initiatives. The revenue generated from this tax contributes to funding essential city services, including police and fire departments, public schools, parks, and other vital community resources.

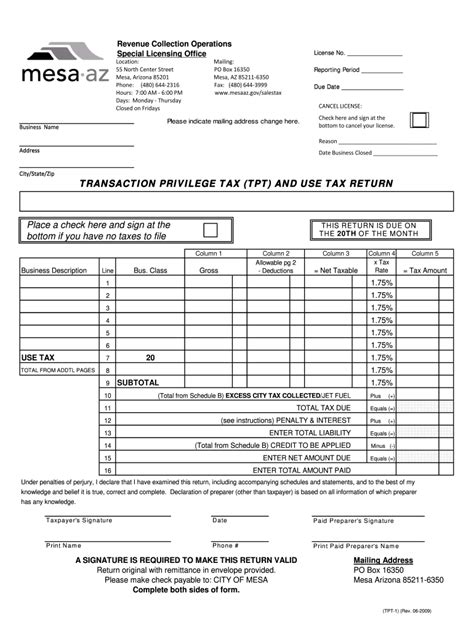

For local businesses, the sales tax can be a significant consideration when making financial plans. Businesses are responsible for collecting and remitting sales tax to the Arizona Department of Revenue, which can impact their cash flow and overall profitability. However, the city also offers various incentives and support programs to help businesses navigate these tax obligations, including tax breaks for certain industries and startups.

| Sales Tax Rate Breakdown | Rate |

|---|---|

| State Tax | 5.6% |

| City Tax | 2% |

| Additional Tax | 1% |

How Mesa Residents Navigate Sales Tax

Mesa residents are accustomed to including sales tax in their budgeting and shopping considerations. While the sales tax rate can add a significant percentage to the cost of goods and services, residents understand the necessity of this tax for maintaining their city’s infrastructure and services.

Educating residents about sales tax and its impact on their daily lives is a key aspect of civic engagement. The city often hosts community workshops and online resources to help residents understand their tax obligations and the benefits derived from these taxes.

Future Implications and Potential Changes

The future of Mesa’s sales tax structure is tied to the city’s economic growth and development plans. As the city continues to attract new businesses and residents, the sales tax base is likely to expand, potentially leading to adjustments in the tax rate or allocation of funds.

Additionally, Mesa, like other cities, must stay responsive to changes in state tax laws and policies. Any alterations to the state's sales tax rate or regulations can have a cascading effect on the city's tax structure and revenue generation.

In conclusion, Mesa's sales tax is a vital component of the city's fiscal framework, supporting its vibrant community and economic vitality. By understanding and effectively managing this tax, both residents and businesses contribute to the ongoing success and development of Mesa.

How often are sales tax rates reviewed and adjusted in Mesa?

+

Sales tax rates in Mesa are reviewed periodically, typically as part of the city’s annual budget process. Adjustments can be made based on economic conditions, infrastructure needs, and community priorities.

Are there any online tools available to help businesses calculate and manage sales tax obligations in Mesa?

+

Yes, the Arizona Department of Revenue provides online resources and tools to assist businesses in calculating and managing their sales tax obligations. These resources include tax rate lookup tools, tax guides, and online filing systems.

How does Mesa’s sales tax compare to other major cities in Arizona?

+

Mesa’s sales tax rate is slightly higher than the average rate in Arizona’s major cities. For instance, Phoenix’s sales tax rate is 8.3%, while Tucson’s is 7.3%. This difference in rates can impact consumer behavior and business competitiveness.