Dc Tax Return

In the bustling city of Washington, D.C., tax season is a critical time for residents and businesses alike. With a unique tax landscape due to its status as a federal district, D.C. taxpayers face specific challenges and opportunities when it comes to filing their returns. This comprehensive guide aims to demystify the process of filing D.C. taxes, offering insights, tips, and real-world examples to ensure a smooth and successful filing experience.

Understanding D.C. Taxes: A Unique Landscape

The District of Columbia, often referred to as D.C., presents a distinctive tax environment. As a federal district, D.C. operates under a complex tax structure that combines elements of both federal and local taxes. This duality creates a unique set of rules and regulations that taxpayers must navigate when filing their returns.

One of the key aspects of D.C. taxes is the District of Columbia Income Tax, which applies to individuals and businesses operating within the district. This tax is separate from federal income tax and is used to fund local government operations and services. Residents of D.C. are required to file both federal and D.C. income tax returns, often making the process more intricate than in other states.

Furthermore, D.C. offers various tax incentives and credits to encourage economic growth and support specific industries. These incentives can provide significant benefits to taxpayers, but they also require a thorough understanding of the eligibility criteria and application process.

Key Tax Categories in D.C.

To navigate the D.C. tax landscape effectively, it’s essential to understand the key tax categories that apply to individuals and businesses:

- Income Tax: As mentioned, D.C. has its own income tax system, with rates and brackets similar to federal income tax. Residents and businesses must calculate their taxable income and apply the appropriate tax rate.

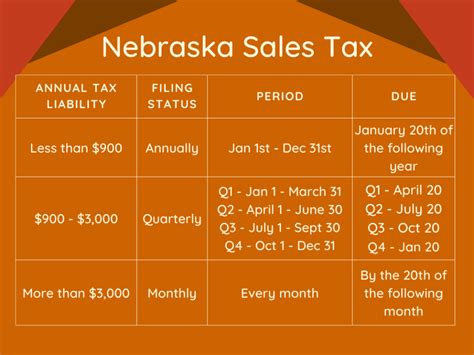

- Sales and Use Tax: D.C. imposes a sales tax on retail sales, leases, and rentals of tangible personal property, as well as certain services. The current rate is 6%, with some exemptions and special provisions.

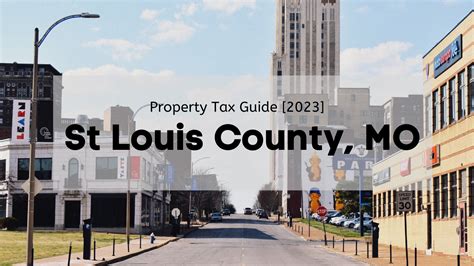

- Property Tax: Real property in D.C. is subject to an annual property tax, which is based on the assessed value of the property. The tax rate varies by jurisdiction within the district.

- Excise Taxes: D.C. levies excise taxes on specific goods and services, such as gasoline, tobacco products, and insurance premiums. These taxes are typically included in the price of the product or service.

Understanding these tax categories and their specific regulations is crucial for accurate filing and compliance with D.C. tax laws.

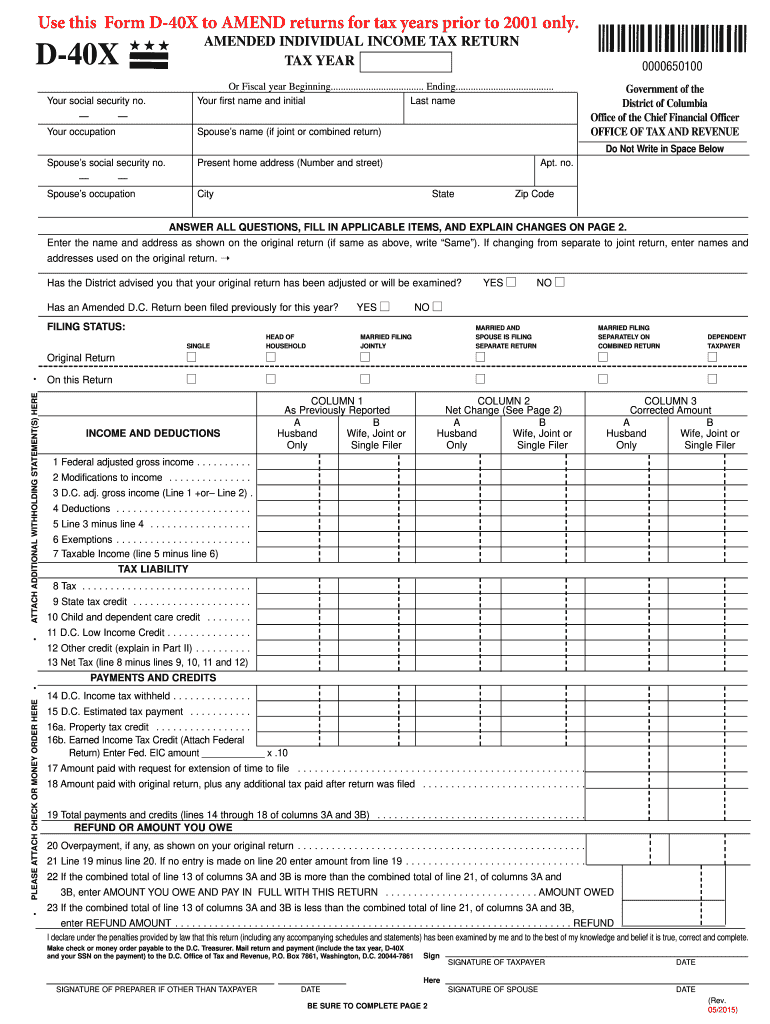

The D.C. Tax Return Process: A Step-by-Step Guide

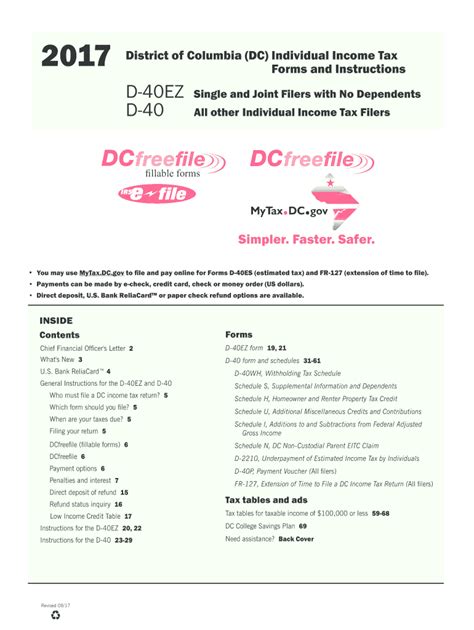

Filing a D.C. tax return can be a complex process, but with the right approach and resources, it can be streamlined and efficient. Here’s a step-by-step guide to help you navigate the process successfully:

Step 1: Gather Your Documents

Before you begin, ensure you have all the necessary documents and information. This includes your federal tax return, W-2 forms, 1099 forms, and any other income statements. For business owners, you’ll need financial records, receipts, and other relevant documentation.

Step 2: Determine Your Tax Residency

D.C. has specific residency rules that impact your tax obligations. You need to determine whether you are a resident, non-resident, or part-year resident for tax purposes. This determination affects which forms you need to file and the tax rates that apply to you.

Step 3: Choose Your Filing Method

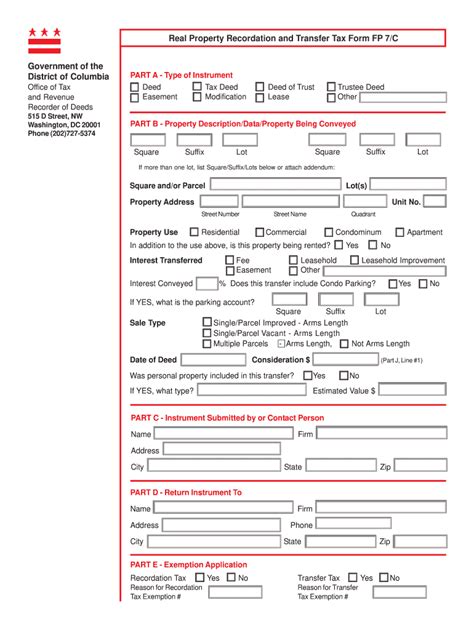

D.C. offers both electronic and paper filing options. Electronic filing is generally faster and more secure, and it’s encouraged by the District’s tax authorities. You can use tax preparation software or directly access the D.C. Office of Tax and Revenue’s online filing system.

Step 4: Calculate Your Tax Liability

Using the appropriate D.C. tax forms, calculate your taxable income and apply the relevant tax rates. Consider any deductions, credits, and incentives you may be eligible for. This step is critical to ensure you pay the correct amount of tax.

| Tax Category | Applicable Forms |

|---|---|

| Income Tax | Form 1040 DC (Individual), Form 1120 DC (Corporation) |

| Sales and Use Tax | Form FR-800 (Monthly Sales and Use Tax Return) |

| Property Tax | Form PT-100 (Property Tax Return) |

| Excise Taxes | Various forms based on the specific tax, e.g., Form FT-100 (Fuel Tax Return) |

Step 5: Prepare and File Your Return

Carefully review your calculations and ensure all information is accurate. Double-check your personal details, income figures, and any deductions or credits claimed. Once satisfied, submit your return electronically or by mail, depending on your chosen method.

Step 6: Payment Options and Refunds

If you owe taxes, you can pay online, by mail, or through a tax preparation service. D.C. offers various payment options, including credit cards, electronic funds transfer, and checks. If you are due a refund, you can typically expect it within a few weeks of filing.

Step 7: Stay Informed and Updated

Tax laws and regulations can change, so it’s essential to stay informed. Keep up with D.C. tax news and updates to ensure you’re aware of any changes that may impact your filing. The D.C. Office of Tax and Revenue provides resources and guidance to help taxpayers stay compliant.

D.C. Tax Incentives and Credits: Maximizing Your Benefits

D.C. offers a range of tax incentives and credits to promote economic development, support local businesses, and encourage specific activities. Understanding these incentives can help you reduce your tax liability and contribute to the growth of the district.

Key Tax Incentives in D.C.

- Research and Development Tax Credit: Businesses engaged in research and development activities may be eligible for a tax credit of up to 6.8% of qualified research expenses. This credit can be carried forward for up to 15 years.

- Historic Preservation Tax Credit: Property owners who rehabilitate or restore historic buildings in D.C. may qualify for a tax credit of up to 20% of qualified rehabilitation expenses. This credit is intended to encourage the preservation of historic structures.

- Energy Efficiency Tax Credit: D.C. residents and businesses can claim a tax credit for the installation of energy-efficient equipment and improvements. The credit is based on the cost of eligible equipment and can be substantial.

- First-Time Homebuyer Tax Credit: First-time homebuyers in D.C. may be eligible for a tax credit of up to $5,000. This credit is designed to make homeownership more affordable and encourage residents to invest in the local housing market.

How to Claim Tax Incentives

To claim tax incentives, you must meet specific eligibility criteria and follow the proper application process. Generally, you’ll need to file additional forms or schedules with your tax return, providing detailed information about your qualifying expenses or activities. It’s essential to review the requirements and guidelines carefully to ensure you qualify and receive the full benefit of the incentive.

Real-World Example: The Impact of Tax Incentives

Consider the case of a local D.C. business, EcoTech Solutions, which specializes in sustainable technology solutions. By investing in research and development and implementing energy-efficient practices, they qualified for both the Research and Development Tax Credit and the Energy Efficiency Tax Credit. These incentives significantly reduced their tax liability, allowing them to reinvest those savings into further research and expansion.

In this example, the tax incentives not only benefited EcoTech Solutions financially but also contributed to the growth of the district's green technology sector and encouraged sustainable practices.

D.C. Tax Resources and Support

Navigating the D.C. tax landscape can be challenging, but there are resources and support available to help you through the process.

Official D.C. Tax Resources

The D.C. Office of Tax and Revenue is the primary source of information and guidance for D.C. taxpayers. Their website offers a wealth of resources, including tax forms, publications, and detailed explanations of tax laws and regulations. You can also find information on tax rates, deadlines, and payment options.

Additionally, the D.C. Office of Tax and Revenue provides taxpayer assistance through various channels, including a call center, walk-in offices, and online chat services. Their staff can answer specific questions and provide guidance on complex tax issues.

Tax Preparation Services and Professionals

For those who prefer professional assistance, there are numerous tax preparation services and certified public accountants (CPAs) in the D.C. area. These professionals can guide you through the filing process, ensure you take advantage of all available tax benefits, and help with complex tax scenarios.

Community Resources and Workshops

D.C. also offers community-based resources and workshops to assist taxpayers. These events, often organized by local government agencies or community organizations, provide free tax preparation assistance and education. They can be particularly beneficial for individuals with low to moderate incomes who may not have access to traditional tax preparation services.

Conclusion: A Smooth D.C. Tax Filing Experience

Filing your D.C. tax return may seem daunting, but with the right information and resources, it can be a straightforward and even beneficial process. By understanding the unique tax landscape of D.C., following a structured filing process, and taking advantage of available tax incentives, you can ensure a successful and rewarding tax filing experience.

Remember, staying informed, seeking professional advice when needed, and utilizing the resources available to you are key to navigating the complexities of D.C. taxes. With these tools and insights, you can approach tax season with confidence and make the most of your financial obligations and opportunities.

Frequently Asked Questions

When are D.C. tax returns due?

+

D.C. tax returns are typically due on the same date as federal tax returns, which is generally April 15th. However, this date may vary depending on the day of the week and any applicable extensions. It’s essential to check the official D.C. tax calendar for the specific deadline each year.

Can I file my D.C. tax return electronically?

+

Yes, D.C. encourages electronic filing of tax returns. You can use tax preparation software or directly access the D.C. Office of Tax and Revenue’s online filing system. Electronic filing is faster, more secure, and often comes with built-in error-checking to ensure accuracy.

Are there any tax incentives for small businesses in D.C.?

+

Absolutely! D.C. offers a range of tax incentives to support small businesses. These include the Small Business Expansion and Retention Tax Credit, which provides a credit for businesses that create or retain jobs in D.C., and the Main Street Tax Credit, which encourages investment in commercial real estate in certain areas of the district.

How can I get help with my D.C. tax return if I’m struggling to understand the process?

+

The D.C. Office of Tax and Revenue provides taxpayer assistance through various channels. You can call their toll-free number, visit their walk-in offices, or use their online chat service. Additionally, tax preparation services and CPAs can offer personalized guidance and support for complex tax situations.

What happens if I miss the D.C. tax return deadline?

+

Missing the D.C. tax return deadline can result in penalties and interest charges. It’s important to file your return as soon as possible to minimize these additional costs. If you’re unable to file by the deadline, you can request an extension, but it’s crucial to do so before the due date to avoid late filing penalties.