Property Taxes Florida

Property taxes are a significant source of revenue for local governments in the state of Florida, used to fund essential services and infrastructure. Understanding how property taxes work in Florida is crucial for homeowners, investors, and anyone interested in the real estate market. This article aims to provide an in-depth analysis of property taxes in Florida, covering the calculation methods, assessment processes, and strategies to optimize tax obligations while staying compliant with state regulations.

Understanding Property Taxes in Florida

In Florida, property taxes are primarily levied on real estate properties, including homes, commercial buildings, and land. These taxes are a vital component of the state’s revenue system, contributing to the funding of local governments, schools, fire departments, emergency services, and other community services. The property tax system in Florida is decentralized, with tax rates and assessment procedures varying across different counties and municipalities.

Taxable Value Calculation

The taxable value of a property in Florida is determined through a two-step process: assessed value and taxable value. The assessed value is established by the property appraiser in each county, who considers factors such as the property’s location, size, improvements, and market conditions. This assessed value is then multiplied by an assessment ratio, which is typically 10% for homesteaded properties and 100% for non-homesteaded properties.

For homesteaded properties, there are additional exemptions and limitations that can further reduce the taxable value. The Save Our Homes amendment, for instance, caps the annual increase in assessed value for homesteaded properties at 3% or the Consumer Price Index (CPI), whichever is lower. This cap ensures that homeowners are protected from significant property tax increases, providing stability and predictability in their tax obligations.

| Assessment Ratio | Taxable Value |

|---|---|

| Homesteaded Properties: 10% | Assessed Value x 10% |

| Non-Homesteaded Properties: 100% | Assessed Value x 100% |

Tax Rate and Millage

The tax rate, also known as the millage rate, is the key factor in determining the amount of property tax owed. In Florida, the tax rate is expressed in mills, with one mill representing 1 of tax for every 1,000 of taxable value. Tax rates are set by local governments and can vary significantly across counties and municipalities. These rates are often approved by voters through referendums, ensuring that the community has a say in the tax structure.

The tax rate is applied to the taxable value of the property to calculate the annual property tax bill. For example, if a property has a taxable value of $200,000 and the tax rate is 10 mills, the annual property tax would be calculated as follows: $200,000 x 0.010 (10 mills) = $2,000.

Assessment and Appeal Process

Property owners in Florida have the right to appeal their property’s assessed value if they believe it is inaccurate or unfair. The assessment and appeal process is a crucial aspect of ensuring fairness and accuracy in the property tax system. Here’s an overview of how it works:

Property Appraisal and Assessment

Each year, property appraisers in Florida conduct a comprehensive appraisal of all real estate properties within their jurisdiction. They consider various factors, including recent sales data, market trends, and property characteristics, to determine an accurate market value for each property. This market value is then used as the basis for calculating the assessed value, which forms the foundation for property tax assessments.

Notice of Proposed Property Taxes

Property owners in Florida receive a “Notice of Proposed Property Taxes” from their county property appraiser. This notice provides important information about the property’s assessed value, the applicable assessment ratio, and the proposed taxable value. It also outlines the tax rate and the estimated annual property tax amount. This notice serves as a critical communication tool, allowing homeowners to understand their potential tax obligations and identify any discrepancies or errors.

Appealing Property Assessments

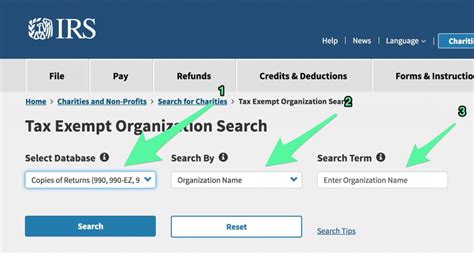

If a property owner believes that the assessed value of their property is incorrect or unfair, they have the right to appeal. The appeal process in Florida is designed to be accessible and transparent, ensuring that property owners can challenge assessments and seek a fair resolution. Here’s a step-by-step guide to the appeal process:

- Review the Notice of Proposed Property Taxes: Carefully examine the notice to identify any discrepancies or errors. Look for discrepancies in property characteristics, such as square footage, improvements, or zoning, that may impact the assessed value.

- Gather Evidence: Collect relevant documentation and evidence to support your case. This may include recent property appraisals, comparable sales data, photographs, or expert opinions. The more comprehensive your evidence, the stronger your case will be.

- File an Appeal: Contact your county's property appraiser's office to initiate the appeal process. Typically, appeals must be filed within a specific timeframe, so it's important to act promptly. The office will provide you with the necessary forms and instructions for submitting your appeal.

- Mediation or Hearing: Depending on the nature of your appeal, you may have the option to participate in a mediation session or a formal hearing. Mediation provides an opportunity to resolve the dispute through negotiation, while a hearing allows you to present your case before an independent hearing officer or board.

- Decision and Notification: After the mediation or hearing, the property appraiser's office will issue a decision on your appeal. You will receive a written notification of the outcome, which will include the new assessed value (if applicable) and any changes to your property tax obligations.

Strategies for Optimizing Property Taxes

Optimizing property taxes in Florida involves a combination of understanding the assessment process, staying informed about tax exemptions and incentives, and implementing strategic planning. Here are some key strategies to consider:

Understanding the Assessment Process

Gaining a thorough understanding of the property assessment process is essential for effectively managing property taxes. Property owners should familiarize themselves with the factors that influence their property’s assessed value, such as market conditions, comparable sales data, and property improvements. By staying informed about these factors, homeowners can anticipate potential changes in their property’s value and plan accordingly.

Tax Exemptions and Incentives

Florida offers various tax exemptions and incentives to eligible property owners, which can significantly reduce their tax obligations. Some of the notable exemptions include:

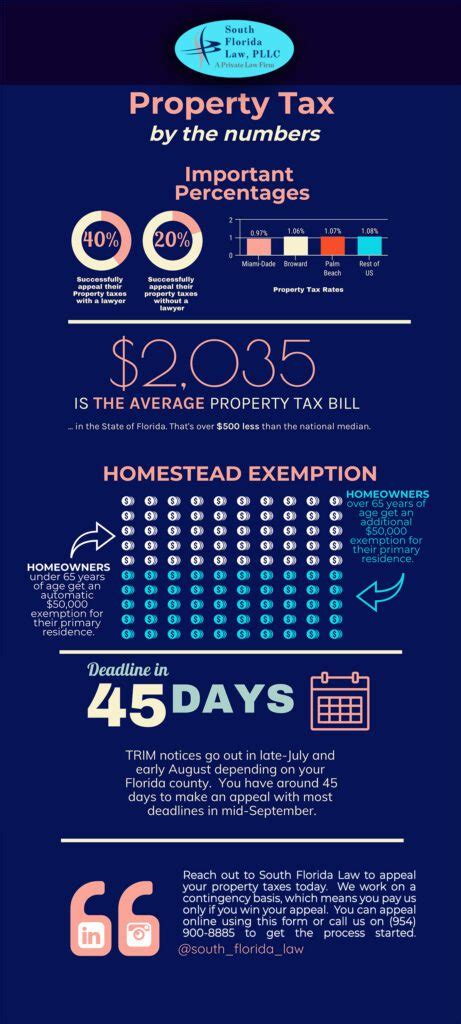

- Homestead Exemption: This exemption is available to Florida residents who own and occupy their primary residence. It provides a significant reduction in the assessed value of the property, resulting in lower property taxes. The exemption can be claimed by filing an application with the county property appraiser's office.

- Senior Citizen Exemption: Florida residents aged 65 or older may be eligible for an additional exemption, which further reduces the assessed value of their homestead property. This exemption is designed to provide financial relief to senior citizens, making property ownership more affordable.

- Disabled Veteran Exemption: Veterans with service-connected disabilities may qualify for an exemption on their homestead property. This exemption is intended to support veterans and their families by reducing the financial burden of property ownership.

Additionally, Florida offers a range of other exemptions and incentives, such as the agricultural exemption for farmland, the low-income senior exemption, and the widow/widower exemption. It's crucial for property owners to stay informed about these opportunities and consult with tax professionals to determine their eligibility and maximize their tax benefits.

Strategic Property Improvements

When considering property improvements, such as renovations or additions, it’s important to assess the potential impact on property taxes. While improvements can enhance the value and appeal of a property, they may also lead to an increase in the assessed value, resulting in higher property taxes. To optimize tax obligations, property owners should carefully plan and budget for improvements, considering the potential tax implications.

Tax Deferral Programs

Florida offers several tax deferral programs to assist eligible homeowners with their property tax obligations. These programs are designed to provide financial relief to low-income seniors, disabled individuals, and certain veterans. By deferring property taxes, eligible homeowners can reduce their financial burden and maintain their property ownership.

Consulting with Tax Professionals

Navigating the complexities of property taxes in Florida can be challenging, especially for individuals who are new to the state or have unique circumstances. Consulting with tax professionals, such as certified public accountants (CPAs) or property tax consultants, can provide valuable insights and guidance. These professionals can help property owners understand their tax obligations, explore potential exemptions and incentives, and develop strategic plans to optimize their tax positions.

Future Implications and Potential Reforms

The property tax system in Florida is subject to ongoing discussions and potential reforms. As the state’s population continues to grow and property values fluctuate, there is a need to ensure that the tax system remains fair, equitable, and sustainable. Here are some key considerations and potential reforms on the horizon:

Fairness and Equity Concerns

One of the primary concerns surrounding Florida’s property tax system is ensuring fairness and equity among property owners. While the state’s tax structure, including the Save Our Homes amendment, provides stability for homeowners, it has also led to disparities in tax obligations between long-term residents and new property owners. As a result, there are ongoing discussions about finding a balance between protecting long-term residents and ensuring that new homeowners are not disproportionately burdened by property taxes.

Assessment Reform Proposals

To address fairness concerns and improve the accuracy of property assessments, there have been proposals for assessment reform in Florida. These proposals aim to modernize the assessment process by incorporating more advanced valuation methods, such as automated valuation models (AVMs) and machine learning algorithms. By leveraging technology and data-driven approaches, the goal is to enhance the efficiency and accuracy of property appraisals, leading to more equitable tax assessments.

Tax Relief Initiatives

Recognizing the financial strain that property taxes can impose on certain segments of the population, there are ongoing efforts to provide tax relief. Florida’s legislature and local governments are exploring initiatives to expand tax exemptions, enhance existing deferral programs, and introduce new relief measures. These initiatives aim to assist low-income seniors, disabled individuals, and other vulnerable groups by reducing their property tax obligations, making homeownership more accessible and sustainable.

Impact of Market Fluctuations

Florida’s real estate market is known for its volatility, with property values experiencing significant fluctuations over time. As a result, the property tax system must be adaptable to accommodate these market changes. The state’s assessment and tax rate structures play a crucial role in managing the impact of market fluctuations. By carefully monitoring market trends and adjusting assessment ratios and tax rates, local governments can ensure that property taxes remain fair and aligned with the current market conditions.

Conclusion

Property taxes in Florida play a vital role in funding essential services and infrastructure, shaping the state’s real estate market, and impacting the financial well-being of homeowners. By understanding the assessment process, tax rates, and available exemptions, property owners can navigate the property tax landscape with confidence. Additionally, staying informed about potential reforms and initiatives aimed at enhancing fairness and providing tax relief ensures that homeowners can make informed decisions and actively participate in shaping the future of Florida’s property tax system.

What is the average property tax rate in Florida?

+The average effective property tax rate in Florida is approximately 0.98%, which is lower than the national average. However, it’s important to note that tax rates can vary significantly across different counties and municipalities.

How often are property taxes assessed in Florida?

+Property taxes in Florida are assessed annually. The property appraiser conducts a comprehensive appraisal of all properties within their jurisdiction each year, determining the assessed value and taxable value.

Are there any tax relief programs for seniors in Florida?

+Yes, Florida offers several tax relief programs for seniors, including the Senior Citizen Exemption and the Low-Income Senior Exemption. These programs provide financial relief by reducing the assessed value of eligible seniors’ homestead properties.

Can I appeal my property’s assessed value in Florida?

+Absolutely! Property owners in Florida have the right to appeal their property’s assessed value if they believe it is incorrect or unfair. The appeal process is designed to be accessible and transparent, allowing homeowners to challenge assessments and seek a fair resolution.

What happens if I don’t pay my property taxes in Florida?

+Unpaid property taxes in Florida can result in significant penalties and interest charges. In extreme cases, failure to pay property taxes can lead to tax liens being placed on the property, potentially resulting in foreclosure.