Mansion Tax Nyc

Welcome to an in-depth exploration of the concept of a Mansion Tax in NYC, a topic that has sparked interest and curiosity among property owners, investors, and real estate enthusiasts alike. In this comprehensive article, we will delve into the intricacies of this unique tax, its implications, and its significance in the vibrant real estate landscape of New York City.

As one of the world's most iconic cities, New York City boasts a diverse and dynamic property market, ranging from cozy studios to luxurious mansions. The introduction of the Mansion Tax, a unique levy on high-value properties, adds an intriguing layer to the city's economic fabric. Join us as we navigate through the complexities, implications, and future prospects of this tax measure, offering a comprehensive guide for those eager to understand its impact.

Unraveling the Concept: What is the Mansion Tax NYC?

The Mansion Tax NYC, officially known as the Mansion Tax Law, is a property tax levied on the sale of residential properties above a certain threshold value within the five boroughs of New York City. This tax, implemented by the state of New York, aims to generate additional revenue for the city while addressing the increasing demand for affordable housing and other social needs.

The concept of a Mansion Tax is not unique to NYC. Several jurisdictions around the world, including the United Kingdom and some US states, have implemented similar measures to tax high-value properties. However, the NYC Mansion Tax stands out due to its specific thresholds, rates, and the unique dynamics of the city's real estate market.

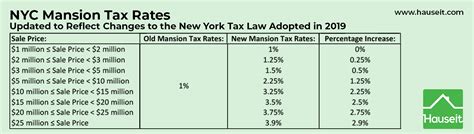

Thresholds and Rates: Understanding the Numbers

The Mansion Tax in NYC is applied to the sale of residential properties exceeding a certain threshold. As of my last update, the tax is triggered when the sale price of a property surpasses $1 million for contracts of sale signed on or after January 1, 2021. The tax rate varies depending on the sale price, as outlined in the table below:

| Sale Price | Mansion Tax Rate |

|---|---|

| $1,000,000 - $1,499,999 | 1% |

| $1,500,000 - $1,999,999 | 1.25% |

| $2,000,000 - $2,499,999 | 1.5% |

| $2,500,000 - $2,999,999 | 1.75% |

| $3,000,000 - $3,499,999 | 2% |

| $3,500,000 - $3,999,999 | 2.25% |

| $4,000,000 and above | 2.5% |

For example, if a residential property is sold for $2.5 million, the Mansion Tax would be calculated as follows: $2,500,000 x 1.75% = $43,750. This amount is due in addition to any other property-related taxes and fees.

Exemptions and Special Cases

It’s important to note that certain properties and transactions are exempt from the Mansion Tax. These include:

- Co-op apartments, as they are not typically sold but rather transferred through a share transfer.

- Condominiums converted from co-ops, provided the conversion took place before April 1, 2019.

- Certain types of transfers, such as those between spouses or for estate planning purposes.

- Properties that are part of a cooperative housing corporation, where shares are sold instead of the property itself.

Additionally, there are provisions for partial exemptions for properties sold within a specific timeframe after the owner's death. These partial exemptions can reduce the Mansion Tax liability.

Implications and Impact on the NYC Real Estate Market

The introduction of the Mansion Tax NYC has had a notable impact on the city’s real estate landscape. Here’s a closer look at some of the key implications:

Influencing Buyer Behavior

The Mansion Tax has encouraged buyers to consider properties just below the threshold to avoid the additional tax burden. This has led to a shift in demand, with properties priced just under $1 million becoming more desirable. As a result, there has been a noticeable increase in competition and bidding wars for these properties, especially in popular neighborhoods.

Conversely, properties priced above the threshold have seen a slight slowdown in sales, as buyers factor in the additional tax expense. This has created a more balanced market for high-end properties, with sellers sometimes adjusting their asking prices to remain competitive.

Impact on Affordability

One of the primary goals of the Mansion Tax was to generate revenue for affordable housing initiatives. The tax has indeed contributed to funding various social programs and infrastructure projects, helping to improve the overall housing situation in NYC. This has a positive ripple effect on the community, making housing more accessible for a wider range of residents.

Market Stability and Long-Term Prospects

The Mansion Tax has played a role in stabilizing the NYC real estate market by discouraging speculative purchases and ensuring a more sustainable growth rate. By curbing excessive demand for high-value properties, the tax helps prevent potential market bubbles. This stability is beneficial for both buyers and sellers, fostering a more predictable and reliable real estate environment.

Looking ahead, the Mansion Tax is expected to remain a significant factor in the NYC real estate market. As the city continues to evolve and adapt to changing economic conditions, the tax will likely play a crucial role in shaping the future of the market, influencing pricing strategies, and ensuring a balanced approach to luxury real estate.

Navigating the Process: A Step-by-Step Guide

Understanding the Mansion Tax is one thing, but navigating the actual process can be complex. Here’s a step-by-step guide for property owners and buyers to ensure a smooth experience:

1. Determining Tax Liability

The first step is to calculate your potential Mansion Tax liability. This involves accurately assessing the sale price of the property and determining the applicable tax rate based on the table provided earlier. It’s crucial to consider all associated costs and fees to arrive at an accurate sale price.

2. Filing Requirements

Property owners and their representatives are responsible for filing the necessary tax forms and ensuring timely payment. The Department of Finance provides specific guidelines and forms for this purpose. It’s essential to keep detailed records of the sale, including the contract, any amendments, and proof of payment.

3. Timing and Due Dates

The Mansion Tax is due at the time of contract signing. It is the buyer’s responsibility to withhold the tax from the sale proceeds and remit it to the appropriate authorities. Failure to comply with the payment deadline can result in penalties and interest charges.

4. Exemptions and Documentation

If you believe your property is exempt from the Mansion Tax, it’s crucial to gather the necessary documentation to support your claim. This may include proof of transfer between spouses, estate planning documents, or evidence of a cooperative housing corporation transfer.

5. Professional Guidance

Given the complexity of real estate transactions and tax laws, seeking professional guidance is often beneficial. Real estate attorneys, accountants, and financial advisors can provide valuable insights and ensure compliance with all applicable regulations.

Frequently Asked Questions (FAQ)

What happens if the property is sold for less than 1 million, but the combined value of the property and other assets exceeds 1 million for estate tax purposes?

+In such cases, the property may still be subject to the Mansion Tax. The tax is triggered by the sale price, not the overall value of the estate. However, there are provisions for partial exemptions for properties sold within a certain timeframe after the owner’s death, which can reduce the tax liability.

Are there any plans to adjust the Mansion Tax thresholds or rates in the future?

+As of my knowledge cutoff, there were no official announcements regarding changes to the Mansion Tax thresholds or rates. However, it’s important to stay updated with any legislative changes or proposed amendments that may impact the tax structure.

Can the Mansion Tax be applied to multiple properties owned by the same person or entity?

+Yes, the Mansion Tax applies to each individual property sold, regardless of the owner’s other assets or properties. Therefore, if multiple properties are sold above the threshold, the tax would be calculated and applied separately for each sale.

Are there any plans to extend the Mansion Tax to commercial properties?

+As of my last update, there were no official discussions or proposals to extend the Mansion Tax to commercial properties in NYC. The tax is currently focused on residential properties only.

How does the Mansion Tax impact the overall affordability of NYC real estate for first-time homebuyers?

+The Mansion Tax primarily affects properties at the higher end of the market. For first-time homebuyers seeking more affordable options, the tax may have a minimal direct impact. However, by generating revenue for affordable housing initiatives, the tax indirectly contributes to improving housing accessibility for a wider range of residents.

The Mansion Tax NYC is a fascinating and impactful aspect of the city’s real estate landscape. By understanding its intricacies, implications, and navigation process, property owners and buyers can make informed decisions and ensure compliance with this unique tax measure. As NYC continues to thrive and evolve, the Mansion Tax will remain a key component of the city’s economic strategy, shaping the future of its vibrant real estate market.