Oc Sales Tax

The world of sales tax can be complex and ever-evolving, especially when it comes to the state of California. With its diverse landscape, varying tax rates, and unique business environments, understanding and managing sales tax in the Golden State is crucial for businesses and consumers alike. In this comprehensive guide, we will delve into the intricacies of California sales tax, its rates, exemptions, and the impact it has on the state's economy.

Understanding California Sales Tax

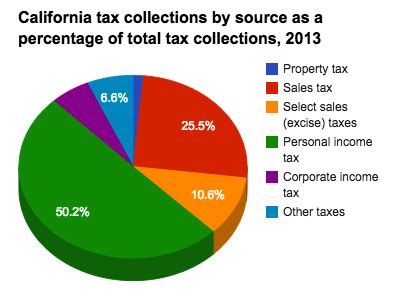

California, known for its vibrant cities, diverse industries, and vast natural wonders, has a sales tax system that reflects its complexity. The California sales tax is a consumption tax imposed on the sale of goods and some services within the state. It is a vital source of revenue for the state, contributing significantly to its economic infrastructure and public services.

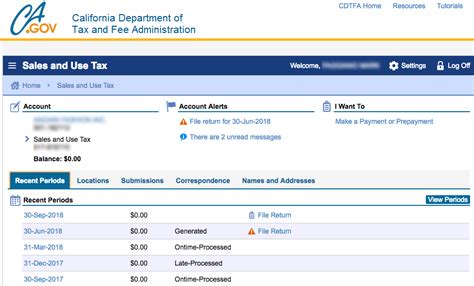

The sales tax in California is governed by the California Department of Tax and Fee Administration (CDTFA), which oversees tax collection, compliance, and enforcement. The CDTFA ensures that businesses collect and remit the appropriate taxes, while also providing guidance and resources to help businesses navigate the tax landscape.

Sales Tax Rates in California

One of the notable aspects of California’s sales tax system is its variability. The state sales tax rate is set at 7.25%, which is a combination of the state’s base rate and a local rate. However, this is just the starting point, as local jurisdictions, including cities and counties, have the authority to impose additional sales taxes, leading to a range of rates across the state.

To illustrate, let's consider a few examples. In the city of San Francisco, the total sales tax rate is 8.5%, which includes the state rate and a local rate of 1.25%. On the other hand, in Los Angeles County, the total rate is 10.25%, with a local rate of 3% added to the state's base.

| City/County | Total Sales Tax Rate | Local Rate |

|---|---|---|

| San Francisco | 8.5% | 1.25% |

| Los Angeles County | 10.25% | 3% |

| San Diego | 8.75% | 1.5% |

| Orange County | 7.75% | 0.5% |

These varying rates highlight the complexity of California's sales tax system and the importance of understanding the specific rates applicable to different regions.

Exemptions and Special Considerations

While sales tax is a widespread phenomenon in California, there are certain exemptions and special considerations to be aware of. Some goods and services are exempt from sales tax, such as:

- Prescription medications

- Certain food items (e.g., groceries)

- Non-prepared food for immediate consumption

- Certain agricultural products

- Residential rent (in most cases)

Additionally, California offers various sales tax incentives and programs aimed at promoting specific industries or economic development. For instance, the California Competes Tax Credit program provides tax credits to businesses that create jobs or invest in the state.

The Impact of Sales Tax on California’s Economy

California’s sales tax plays a pivotal role in the state’s economic ecosystem, contributing significantly to its overall prosperity. The revenue generated from sales tax funds a range of essential public services and infrastructure projects.

Revenue Generation and Allocation

In the fiscal year 2021-2022, California’s sales and use tax revenue amounted to $74.6 billion, a substantial increase from previous years. This revenue is allocated to various state funds, with the General Fund receiving the majority, which is then distributed to support education, healthcare, transportation, and other critical services.

| Fund | Allocation Percentage |

|---|---|

| General Fund | 70% |

| Local Transportation Fund | 20% |

| Other Funds (e.g., Air Quality Improvement Fund) | 10% |

The distribution of sales tax revenue ensures that the state can invest in its future, maintain its infrastructure, and provide high-quality public services to its residents.

Economic Impact and Consumer Behavior

Sales tax also influences consumer behavior and economic activity. Higher sales tax rates can impact purchasing decisions, with consumers potentially opting for online purchases or traveling to neighboring states with lower tax rates. This dynamic can affect local businesses and the overall economic health of regions.

Furthermore, the sales tax system encourages businesses to consider tax implications when making strategic decisions. Businesses may choose to locate in areas with more favorable tax rates or explore tax-efficient strategies to enhance their bottom line.

Future Outlook and Trends

California’s sales tax landscape is expected to evolve in response to changing economic conditions and policy priorities. The state has demonstrated a willingness to adjust tax rates and policies to address emerging needs. For instance, in recent years, there have been discussions and proposals to modify sales tax structures to accommodate the growing e-commerce sector.

Additionally, with the increasing focus on sustainability and environmental initiatives, California may explore innovative ways to use sales tax revenue to fund green projects and support the transition to a more sustainable economy.

Conclusion: Navigating California’s Sales Tax Landscape

California’s sales tax system is a dynamic and integral part of the state’s economic fabric. From understanding the varying rates to recognizing the impact on revenue generation and consumer behavior, a comprehensive grasp of sales tax is essential for both businesses and consumers.

By staying informed about sales tax rates, exemptions, and incentives, businesses can make strategic decisions to thrive in California's competitive market. Consumers, too, can make more informed choices, understanding the impact of sales tax on their purchases and the broader economy.

As California continues to evolve and adapt to new challenges and opportunities, its sales tax system will play a crucial role in shaping the state's economic future. Whether you're a business owner, a consumer, or simply an interested observer, staying informed about California's sales tax is a wise investment in understanding the state's economic landscape.

How often are sales tax rates updated in California?

+Sales tax rates in California are typically updated annually, often with changes taking effect on January 1st of each year. However, local jurisdictions may propose and implement changes at different times throughout the year, so it’s essential to stay updated with local tax authorities.

Are there any online tools to help calculate sales tax in California?

+Yes, there are several online sales tax calculators available, including those provided by the CDTFA and third-party tax software providers. These tools can help businesses and consumers quickly estimate sales tax based on specific locations and purchase amounts.

How can businesses stay compliant with California’s sales tax regulations?

+Businesses can ensure compliance by staying informed about sales tax laws, registering with the CDTFA, collecting and remitting taxes accurately, and keeping detailed records. Regular consultations with tax professionals can also provide valuable guidance and support.