Federal Tax Id Reverse Lookup

The Federal Tax ID, also known as the Employer Identification Number (EIN), is a unique identifier assigned to businesses by the Internal Revenue Service (IRS) in the United States. It plays a crucial role in various financial and administrative processes, including tax filing, banking, and business operations. In certain scenarios, it becomes necessary to perform a Federal Tax ID reverse lookup, which involves retrieving essential information about a business entity using its EIN.

This article aims to delve into the process and importance of Federal Tax ID reverse lookup, shedding light on its applications, benefits, and the information one can obtain through this procedure. We will explore real-world examples, discuss the technical aspects, and provide a comprehensive guide for those seeking to conduct a Federal Tax ID reverse lookup efficiently and accurately.

Understanding Federal Tax ID Reverse Lookup

Federal Tax ID reverse lookup is a valuable tool for businesses, financial institutions, and individuals who need to verify the legitimacy and details of a business entity. It allows users to access critical information associated with a specific EIN, aiding in due diligence, risk assessment, and decision-making processes.

Applications and Benefits

The Federal Tax ID reverse lookup process has a wide range of applications, benefiting various stakeholders:

- Businesses: Companies can use reverse lookup to verify the identity and credentials of their business partners, suppliers, or clients. This ensures a secure and reliable business environment, reducing the risk of fraud or non-compliance.

- Financial Institutions: Banks and financial service providers rely on reverse lookup to assess the financial health and stability of businesses seeking loans or other financial services. It aids in credit risk evaluation and decision-making.

- Government Agencies: Government entities utilize reverse lookup to monitor and regulate business activities, ensuring compliance with tax laws and other regulations. It aids in fraud detection and enforcement of legal obligations.

- Individuals: Private individuals may need to perform reverse lookup when engaging in business transactions, such as investing or partnering with a company. It provides peace of mind and helps avoid potential scams or unethical practices.

By leveraging Federal Tax ID reverse lookup, stakeholders can make informed decisions, mitigate risks, and ensure the integrity of their interactions with business entities.

Information Retrieved through Reverse Lookup

When performing a Federal Tax ID reverse lookup, users can access a wealth of information about the business entity, including:

- Business Name: The official name of the business as registered with the IRS.

- Address: The physical location and mailing address of the business.

- Business Type: The legal structure of the business, such as sole proprietorship, partnership, corporation, or limited liability company (LLC).

- EIN: The unique 9-digit Federal Tax ID number.

- Date of Formation: The date the business was established.

- Industry: The primary industry or sector in which the business operates.

- Contact Information: Phone numbers, email addresses, and other contact details associated with the business.

- Tax Information: Details about the business’s tax obligations, such as tax classification, tax status, and filing requirements.

- Business Activity: A brief description of the business’s primary activities and operations.

- State of Incorporation: The state where the business was registered or incorporated.

This information provides a comprehensive overview of the business, enabling users to assess its credibility, financial stability, and operational capabilities.

The Federal Tax ID Reverse Lookup Process

Conducting a Federal Tax ID reverse lookup involves several steps, each designed to ensure accuracy and security. Here’s a detailed guide to the process:

Step 1: Determine the Purpose

Before initiating a reverse lookup, clearly define the purpose and objectives. Understanding the specific information needed will guide the subsequent steps and ensure efficient use of resources.

Step 2: Gather the EIN

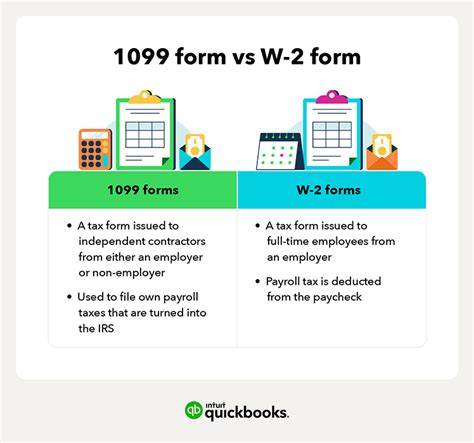

Obtain the Federal Tax ID number of the business entity you wish to investigate. This number is typically provided by the business itself or can be found on official documents, such as tax forms or business licenses.

Step 3: Choose a Reliable Lookup Service

Select a reputable and trusted service provider that offers Federal Tax ID reverse lookup services. Look for providers with a strong track record, positive reviews, and robust data security measures.

Step 4: Verify the EIN’s Validity

Prior to initiating the lookup, verify the accuracy and validity of the EIN. This step ensures that the EIN is active and associated with a legitimate business entity, reducing the risk of errors or misinformation.

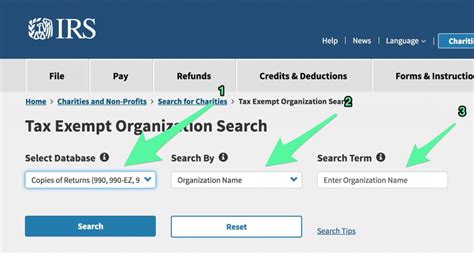

Step 5: Perform the Reverse Lookup

Utilize the chosen service provider’s platform or application to initiate the reverse lookup process. Provide the EIN and any other required information, such as the business name or location, to initiate the search.

Step 6: Review and Analyze the Results

Once the lookup is complete, carefully review the retrieved information. Cross-reference the data with other reliable sources to ensure accuracy and consistency. Analyze the findings to assess the business’s credibility, financial health, and potential risks.

Step 7: Take Appropriate Action

Based on the results of the reverse lookup, determine the next steps. This may involve further investigation, engaging in business transactions with caution, or taking necessary precautions to mitigate identified risks.

By following these steps, users can conduct a thorough and accurate Federal Tax ID reverse lookup, empowering them to make informed decisions and protect their interests.

Real-World Examples of Federal Tax ID Reverse Lookup

To illustrate the practical applications of Federal Tax ID reverse lookup, let’s explore a few real-world scenarios:

Scenario 1: Business Partnership Verification

A small business owner, Sarah, is considering partnering with a larger company for a joint venture. She performs a Federal Tax ID reverse lookup on the larger company’s EIN to verify its legitimacy, financial stability, and track record. The lookup reveals the company’s business name, address, and industry, confirming its credibility and enabling Sarah to proceed with confidence.

Scenario 2: Loan Application Assessment

A bank receives a loan application from a small business. The loan officer initiates a Federal Tax ID reverse lookup to assess the business’s financial health and tax compliance. The lookup provides valuable insights into the business’s tax status, industry, and financial performance, aiding the bank in making an informed lending decision.

Scenario 3: Supplier Due Diligence

A manufacturing company is sourcing raw materials from a new supplier. To ensure the supplier’s reliability and compliance, the company’s procurement team performs a Federal Tax ID reverse lookup. The lookup reveals the supplier’s business details, including its tax classification and date of formation, helping the company make a well-informed decision about the partnership.

Scenario 4: Fraud Detection

An investor, John, receives an unsolicited investment opportunity from an unknown company. Suspecting a potential scam, he performs a Federal Tax ID reverse lookup on the company’s EIN. The lookup reveals that the company does not exist or has a history of fraudulent activities, saving John from a potential financial loss.

These examples demonstrate how Federal Tax ID reverse lookup can be a powerful tool in various business and financial contexts, aiding in decision-making, risk mitigation, and fraud prevention.

Technical Specifications and Performance

The technical aspects of Federal Tax ID reverse lookup are intricate and designed to ensure accuracy, security, and efficiency. Here’s an overview of the technical specifications and performance considerations:

Data Sources

Federal Tax ID reverse lookup services typically draw data from a variety of sources, including:

- IRS Records: The primary source of information is the Internal Revenue Service (IRS), which maintains comprehensive records of all businesses that have obtained an EIN.

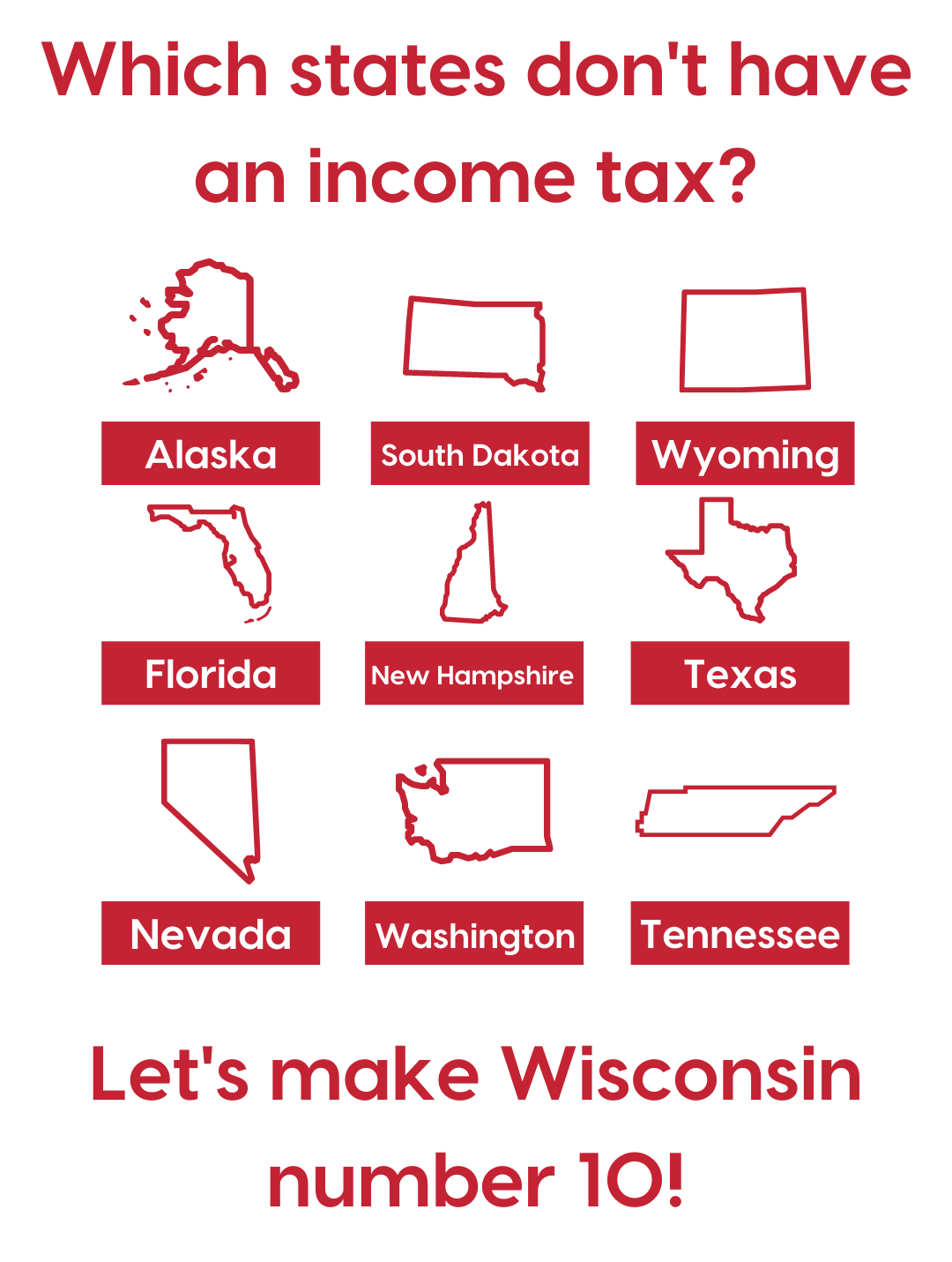

- State Business Registries: Many states in the US maintain their own business registries, which provide details about locally registered businesses, including their EINs and other relevant information.

- Public Records: Publicly available records, such as court filings, corporate filings, and business licenses, can provide additional insights into a business’s history and operations.

- Industry Databases: Industry-specific databases and directories can offer valuable information about a business’s industry, competitors, and market position.

Data Collection and Verification

Reverse lookup service providers employ sophisticated data collection and verification processes to ensure the accuracy and reliability of the information they provide. These processes may involve:

- Automated Data Extraction: Using advanced algorithms and machine learning techniques, service providers can automatically extract relevant data from various sources, including official government websites and databases.

- Manual Data Verification: Human reviewers play a crucial role in verifying the accuracy and consistency of the extracted data. They cross-reference information from multiple sources and conduct additional research to ensure the data’s integrity.

- Data Cleaning and Standardization: Service providers employ data cleaning techniques to remove errors, inconsistencies, and outdated information. They standardize the data to ensure uniformity and ease of use for their clients.

Data Security and Privacy

Given the sensitive nature of the information involved, data security and privacy are paramount in the Federal Tax ID reverse lookup process. Reputable service providers implement robust security measures, including:

- Secure Data Storage: All data is stored in secure, encrypted databases, accessible only to authorized personnel.

- Access Controls: Strict access controls ensure that only authorized users can access the data, preventing unauthorized disclosure or misuse.

- Data Encryption: Data transmitted between users and service providers is encrypted to protect against interception and unauthorized access.

- Privacy Policies: Service providers adhere to strict privacy policies, ensuring that user information and lookup results are kept confidential and used only for the intended purpose.

By prioritizing data security and privacy, service providers maintain the integrity of the information they provide and protect the interests of their users.

Performance Analysis and Comparison

When choosing a Federal Tax ID reverse lookup service, it’s essential to consider its performance and reliability. Here’s a comparative analysis of key performance indicators to help users make informed decisions:

| Performance Indicator | Description |

|---|---|

| Lookup Speed | The time taken to complete a reverse lookup, from initiating the search to retrieving the results. Faster lookup speeds are crucial for efficient decision-making. |

| Data Accuracy | The reliability and consistency of the information provided. Service providers with a track record of high data accuracy are preferred. |

| Data Coverage | The extent to which the service provider covers businesses across different industries and geographic locations. A broader data coverage ensures a more comprehensive lookup experience. |

| User Interface | The ease of use and navigation of the service provider's platform. A user-friendly interface simplifies the lookup process and enhances the user experience. |

| Customer Support | The responsiveness and expertise of the service provider's customer support team. Timely and knowledgeable support is essential for addressing any queries or issues that may arise. |

| Pricing Structure | The cost of the service, including any subscription fees, lookup fees, or additional charges. Users should consider their specific needs and budget when evaluating pricing structures. |

By carefully evaluating these performance indicators, users can select a Federal Tax ID reverse lookup service that aligns with their requirements and offers the best value for their needs.

Future Implications and Trends

The landscape of Federal Tax ID reverse lookup is continually evolving, driven by technological advancements and changing regulatory environments. Here are some key future implications and trends to consider:

Data Integration and Analytics

As more businesses move their operations online and generate digital data, there is a growing opportunity for service providers to integrate diverse data sources and employ advanced analytics techniques. This integration can enhance the accuracy and depth of information retrieved through reverse lookup, providing users with more comprehensive insights.

Enhanced Security Measures

With the increasing prevalence of cyber threats and data breaches, service providers are likely to invest in further enhancing their data security measures. This may include adopting cutting-edge encryption technologies, implementing multi-factor authentication, and leveraging blockchain-based solutions to ensure the integrity and security of the data.

AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) technologies are expected to play a more significant role in Federal Tax ID reverse lookup. These technologies can automate data extraction, verification, and analysis processes, improving efficiency and accuracy. Additionally, AI-powered natural language processing can enhance the user experience by providing more intuitive and conversational interactions.

Regulatory Compliance

As regulations surrounding data privacy and security continue to evolve, service providers will need to adapt to comply with changing legal requirements. This may involve implementing new data protection measures, such as anonymization techniques and consent management systems, to ensure compliance with privacy laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

Expansion of Services

With the growing demand for business information and due diligence, service providers may expand their offerings to include additional services beyond Federal Tax ID reverse lookup. This could include business credit reports, financial analysis tools, and industry-specific insights, providing users with a more holistic view of businesses and their operations.

By staying abreast of these future implications and trends, users can anticipate the evolving landscape of Federal Tax ID reverse lookup and leverage the advancements to their advantage.

What is the purpose of a Federal Tax ID reverse lookup?

+A Federal Tax ID reverse lookup is used to retrieve essential information about a business entity, including its name, address, industry, and tax details. It aids in due diligence, risk assessment, and decision-making processes.

How can I obtain a business’s Federal Tax ID for a reverse lookup?

+You can obtain a business’s Federal Tax ID from official documents such as tax forms, business licenses, or by directly contacting the business entity.

Are Federal Tax ID reverse lookup services secure and reliable?

+Yes, reputable Federal Tax ID reverse lookup service providers prioritize data security and privacy. They employ robust security measures to protect user information and the integrity of the data.

How long does a Federal Tax ID reverse lookup typically take?

+The time taken for a reverse lookup can vary depending on the service provider and the complexity of the request. Some providers offer instant lookups, while others may take a few minutes or hours to complete the process.

Can I perform a Federal Tax ID reverse lookup for free?

+While some basic information may be available for free through government websites, comprehensive Federal Tax ID reverse lookup services often require a subscription or fee-based model to access detailed and accurate data.