California 30 Cent Per Mile Tax

In the ever-evolving landscape of transportation and mobility, the state of California has recently introduced a groundbreaking initiative that aims to revolutionize the way we approach road infrastructure funding. The California 30 Cent Per Mile Tax is a bold step towards sustainable transportation and a fairer system for funding road maintenance and improvements.

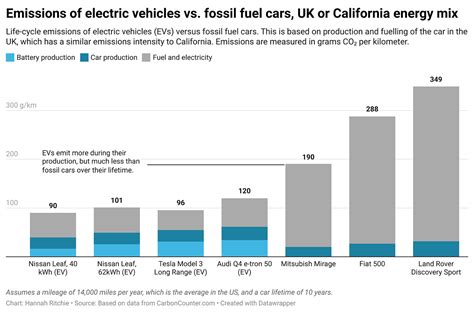

This innovative tax model, often referred to as a road usage charge, seeks to address the challenges posed by traditional fuel taxes and toll systems. As vehicles become more efficient and the use of electric cars rises, the traditional funding sources for road maintenance are under strain. The California 30 Cent Per Mile Tax offers a modern solution, ensuring that all road users contribute equitably, regardless of their vehicle's fuel type.

Understanding the California 30 Cent Per Mile Tax

The tax is a straightforward concept: for every mile driven within the state of California, motorists will be charged 30 cents. This charge is intended to cover the costs of maintaining and improving California's extensive road network, which includes highways, bridges, and local roads. By implementing this tax, the state aims to ensure a steady and reliable source of revenue for critical infrastructure projects.

The tax is designed to be fair and inclusive. Unlike fuel taxes, which are based on the amount of fuel purchased, the per-mile tax takes into account the actual use of the road. This means that those who drive more contribute more, while those who drive less or opt for alternative transportation methods are not overburdened. It's a user-pays system, ensuring that the cost of maintaining roads is shared proportionally among all road users.

How It Works

The implementation of the California 30 Cent Per Mile Tax involves several key steps:

- Registration and Onboarding: Motorists are required to register their vehicles for the tax. This process typically involves providing vehicle information, odometer readings, and setting up a payment method. Some states may offer options for automatic mileage tracking using GPS or onboard diagnostics.

- Mileage Reporting: Drivers are responsible for reporting their mileage regularly, often on a monthly or quarterly basis. This can be done manually or through automated systems. The reported mileage is then used to calculate the tax due.

- Tax Calculation and Payment: The tax is calculated by multiplying the reported mileage by the tax rate (30 cents per mile). Motorists then pay the tax through online portals, direct debits, or other payment methods provided by the state.

- Compliance and Enforcement: To ensure compliance, states may employ a range of enforcement strategies, including random audits, penalty systems for late or inaccurate reporting, and partnerships with vehicle manufacturers for automatic mileage tracking.

Benefits and Impact

The California 30 Cent Per Mile Tax offers several advantages over traditional funding methods:

- Sustainable Funding: By charging based on actual road usage, the tax provides a more stable and predictable funding source for road maintenance and construction. This ensures that the state can plan and execute infrastructure projects effectively.

- Equitable Contribution: The tax ensures that all road users, regardless of their vehicle type or fuel efficiency, contribute to the upkeep of roads. This fairness is particularly important as the number of electric vehicles on the road increases, reducing fuel tax revenues.

- Improved Road Conditions: With a dedicated and reliable funding stream, California can invest in much-needed road repairs, upgrades, and expansions. This leads to safer and more efficient travel for all road users.

- Incentives for Efficient Driving: The tax structure encourages motorists to consider their driving habits and may lead to more efficient and environmentally conscious choices, such as carpooling, using public transport, or opting for electric vehicles.

Challenges and Considerations

While the California 30 Cent Per Mile Tax presents a promising solution, it also comes with its own set of challenges and considerations:

Privacy and Data Security

Implementing a per-mile tax often involves collecting and storing sensitive data, such as vehicle locations and mileage. Ensuring the privacy and security of this data is crucial to maintaining public trust. States must develop robust data protection measures and transparency around data usage.

Compliance and Enforcement

Enforcing compliance with the tax can be complex. States need to develop effective systems for auditing and penalizing non-compliance. This may involve partnerships with vehicle manufacturers, insurance companies, and other stakeholders to ensure accurate mileage reporting.

Transition from Fuel Taxes

The shift from fuel taxes to a per-mile tax requires careful planning. States must consider the impact on existing revenue streams and develop strategies to phase out fuel taxes gradually while ensuring a smooth transition to the new system.

Impact on Low-Income Drivers

While the tax aims to be fair, it's essential to consider the potential burden on low-income drivers who may rely heavily on their vehicles for daily transportation. States should explore options for exemptions or subsidies to ensure the tax does not disproportionately affect this demographic.

Real-World Examples and Case Studies

Several states in the US have already implemented or are piloting road usage charge programs. These real-world examples provide valuable insights into the effectiveness and challenges of such systems.

Oregon's OReGO Program

Oregon was the first state to implement a road usage charge program, known as OReGO. The program, launched in 2015, offers drivers the choice between paying a per-mile tax or a fuel tax. Over 1,500 drivers have enrolled, providing valuable data for the state to refine its approach. The program has demonstrated the feasibility of per-mile charging and highlighted the need for user-friendly reporting systems.

| Program Name | Rate (Cents/Mile) | Enrolled Drivers |

|---|---|---|

| OReGO | 1.8 | 1,500 |

Washington's Road Usage Charge Pilot

Washington state conducted a successful road usage charge pilot program in 2019. The pilot involved over 2,000 participants and tested various technologies for mileage tracking, including GPS and OBD-II devices. The results showed high levels of participant satisfaction and a preference for automated mileage tracking methods.

California's Own Pilot

California itself has conducted extensive research and pilot programs on road usage charges. One notable pilot, the Road Usage Charge Feasibility Study, involved over 5,000 participants and explored different mileage tracking methods. The study provided valuable insights into consumer preferences, privacy concerns, and the potential revenue generated by such a system.

The Future of Road Funding: A National Perspective

The California 30 Cent Per Mile Tax is not just a local initiative; it's part of a larger national movement towards sustainable and equitable road funding. As more states explore road usage charge programs, a cohesive national strategy may emerge, offering the potential for a standardized system and shared best practices.

Potential Benefits of a National Approach

- Standardization: A national road usage charge program could streamline the process, making it easier for motorists to navigate different state systems.

- Shared Infrastructure: Collaboration between states could lead to the development of shared mileage tracking systems, reducing costs and improving efficiency.

- Data-Driven Decisions: With a national dataset, policymakers can make more informed decisions about infrastructure investments and prioritize projects based on real-world usage data.

Challenges and Collaboration

Implementing a national road usage charge system is not without challenges. It requires collaboration between states, vehicle manufacturers, and technology providers. Additionally, ensuring that the system is fair, secure, and transparent will be crucial for public acceptance.

FAQ

How does the California 30 Cent Per Mile Tax compare to traditional fuel taxes?

+The 30 Cent Per Mile Tax is designed to be a more equitable and sustainable alternative to fuel taxes. While fuel taxes are based on fuel consumption, the per-mile tax charges drivers based on actual road usage. This ensures that all road users contribute fairly, regardless of their vehicle’s fuel efficiency.

Is the tax applicable to all vehicles, including electric cars and motorcycles?

+Yes, the tax is intended to cover all vehicles, including electric cars, motorcycles, and other road-legal vehicles. This ensures that all road users contribute to the upkeep of California’s roads, regardless of their vehicle type.

How will the tax revenue be used?

+The tax revenue will be dedicated to funding road maintenance, repairs, and improvements across California. This includes projects like resurfacing highways, repairing bridges, and enhancing local road networks. The goal is to ensure safe and efficient travel for all motorists.

What happens if I drive only a few miles each month? Will I still be charged the full 30 cents per mile?

+Yes, the tax is applied to all miles driven, regardless of the total distance. So, even if you drive only a few miles, you will be charged accordingly. However, for those who drive less frequently, the overall tax burden may be lower compared to traditional fuel taxes.