Minnesota Retail Tax

Welcome to our comprehensive guide on the Minnesota Retail Tax, a crucial aspect of the state's revenue generation and economic landscape. In this article, we will delve into the intricacies of this tax system, exploring its history, structure, impact, and future implications. By the end of this piece, you'll have a thorough understanding of how the Minnesota Retail Tax functions and its significance within the state's fiscal framework.

Understanding the Minnesota Retail Tax

The Minnesota Retail Tax, officially known as the Sales and Use Tax, is a fundamental component of the state’s tax structure. Implemented to generate revenue for essential public services and infrastructure development, this tax has a direct impact on consumers and businesses alike. Let’s explore its key features and how it shapes the state’s economy.

History and Evolution

The roots of the Minnesota Retail Tax can be traced back to the mid-20th century. It was introduced as a means to stabilize the state’s finances and provide a reliable source of income for crucial government initiatives. Over the years, the tax system has undergone several modifications to adapt to changing economic conditions and emerging industries.

One significant milestone in the tax’s history was the introduction of the Destination-Based Sales Tax in 2017. This reform aimed to simplify tax collection for online retailers and promote fairness among businesses operating within the state.

Tax Structure and Rates

Minnesota’s Retail Tax operates on a multi-tiered structure, with varying tax rates applied to different goods and services. The state’s base sales tax rate stands at 6.875%, which is then subject to additional local taxes, bringing the total rate to an average of 7.1875% across the state.

However, it’s essential to note that certain goods and services are exempt from this tax. For instance, groceries, prescription drugs, and clothing items under $100 are exempt from the Retail Tax. Additionally, specific regions within the state offer tax incentives to promote economic growth, resulting in slightly lower tax rates in those areas.

| Tax Category | Rate |

|---|---|

| Base State Sales Tax | 6.875% |

| Average Total Rate (with local taxes) | 7.1875% |

| Tax-Free Items | Groceries, Prescription Drugs, Clothing under $100 |

Impact on Businesses and Consumers

The Minnesota Retail Tax influences both businesses and consumers in distinct ways. For businesses, especially those operating online, the tax system can present challenges in terms of compliance and tax calculation. However, the state provides resources and guidelines to assist businesses in navigating these complexities.

Consumers, on the other hand, directly experience the impact of the Retail Tax through the prices they pay for goods and services. The tax adds to the overall cost of living, influencing purchasing decisions and household budgets. Understanding the tax structure empowers consumers to make informed choices and plan their expenses accordingly.

Compliance and Administration

Ensuring compliance with the Minnesota Retail Tax is a critical aspect of the system’s success. The state’s Department of Revenue plays a pivotal role in administering and enforcing tax regulations. Let’s explore the key elements of compliance and the resources available to businesses and individuals.

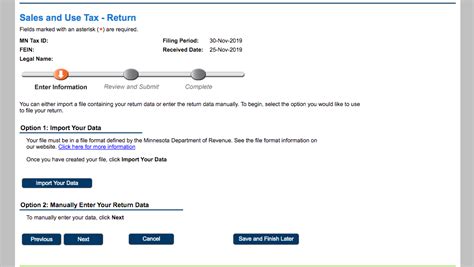

Registration and Filing

Businesses engaged in retail sales within Minnesota are required to register for a Sales and Use Tax Permit with the Department of Revenue. This permit authorizes them to collect and remit the tax to the state. The registration process involves providing essential business information and selecting a tax filing frequency, typically monthly, quarterly, or annually.

Once registered, businesses must file Sales and Use Tax Returns, detailing their taxable sales and purchases. These returns are due at regular intervals, depending on the filing frequency chosen during registration. The Department of Revenue provides online tools and resources to assist businesses in accurate tax filing.

Remittance and Enforcement

After filing their tax returns, businesses are responsible for remitting the collected tax to the Department of Revenue. This process involves paying the calculated tax amount by the due date to ensure compliance. Late payments or non-compliance may result in penalties and interest charges.

The Department of Revenue actively enforces tax regulations to ensure fair competition and protect the state’s revenue stream. It employs various strategies, including audits, to verify compliance. Businesses found in violation may face legal consequences and be required to rectify their tax practices.

Resources and Support

The state of Minnesota recognizes the complexity of tax compliance, especially for small businesses. To address this, the Department of Revenue offers a range of resources and support services. These include:

- Online Guides and Tutorials: Comprehensive guides and tutorials are available on the Department’s website, providing step-by-step instructions for tax registration, filing, and remittance.

- Help Desk and Customer Support: A dedicated help desk provides assistance to businesses and individuals with tax-related queries. Experts are available to offer guidance and clarify complex tax issues.

- Workshops and Seminars: The Department organizes educational workshops and seminars to help businesses understand their tax obligations and best practices for compliance.

Economic Impact and Analysis

The Minnesota Retail Tax plays a significant role in shaping the state’s economy, influencing various sectors and industries. Let’s analyze its economic impact and explore how it contributes to the state’s overall fiscal health.

Revenue Generation and Allocation

The Retail Tax is a substantial source of revenue for the state, accounting for a significant portion of its annual income. This revenue is crucial for funding essential public services, including education, healthcare, and infrastructure development.

The state allocates the tax revenue strategically, with a focus on addressing critical needs and promoting economic growth. A portion of the revenue is dedicated to specific initiatives, such as education funding, while the remainder is allocated to the general fund for flexible spending.

Industry Impact

The Retail Tax has a direct impact on various industries within Minnesota. Sectors heavily reliant on consumer spending, such as retail, hospitality, and e-commerce, are particularly influenced by the tax system. These industries must carefully manage their pricing strategies to remain competitive while complying with tax regulations.

Additionally, the tax system encourages businesses to explore innovative approaches to tax compliance. For instance, online retailers have adopted advanced tax calculation and reporting tools to streamline their operations and ensure accuracy.

Consumer Behavior and Spending

The Retail Tax influences consumer behavior and spending patterns within the state. Consumers often factor in the tax when making purchasing decisions, especially for higher-value items. This can lead to strategic shopping, with consumers seeking tax-free options or taking advantage of tax incentives in specific regions.

Moreover, the tax system promotes awareness among consumers regarding their tax obligations. This awareness encourages responsible spending and contributes to a more informed citizenry.

Future Outlook and Potential Reforms

As the economic landscape evolves, so too must the Minnesota Retail Tax system. Let’s explore the potential future of this tax and the reforms that may shape its trajectory.

Digital Economy and Online Sales

The rise of the digital economy and e-commerce presents unique challenges and opportunities for the Retail Tax system. With more transactions occurring online, the state must adapt its tax collection mechanisms to ensure fairness and compliance.

One potential reform is the expansion of the Destination-Based Sales Tax to include a broader range of online sales. This would simplify tax collection for online retailers and ensure a level playing field with traditional brick-and-mortar stores.

Simplification and Streamlining

Simplifying the tax system is often a priority for both businesses and consumers. The Minnesota Retail Tax could benefit from reforms that streamline the registration, filing, and remittance processes. This would reduce administrative burdens and enhance compliance.

Potential reforms include the introduction of a unified tax return for businesses, combining various tax obligations into a single form. Additionally, exploring digital tax filing and payment systems could improve efficiency and accuracy.

Equity and Fairness

Ensuring tax equity and fairness is crucial for the long-term sustainability of the Retail Tax system. Reforms could focus on addressing tax disparities and promoting fairness among different sectors and regions.

For instance, the state could consider tax relief programs for low-income households or small businesses facing financial challenges. Such initiatives would alleviate the tax burden on vulnerable segments of the population, promoting economic equity.

Tax Incentives and Economic Development

Minnesota has a history of using tax incentives to stimulate economic growth and attract businesses. Future reforms could build upon this strategy by offering targeted tax incentives to specific industries or regions.

By providing tax breaks or reduced rates for emerging sectors, such as clean energy or technology startups, the state can foster innovation and create jobs. This approach has the potential to drive economic transformation and position Minnesota as a leader in these industries.

How often do businesses need to file Sales and Use Tax Returns in Minnesota?

+The filing frequency for Sales and Use Tax Returns in Minnesota depends on the business’s registration. Businesses can choose to file monthly, quarterly, or annually during the registration process. It’s essential to adhere to the selected filing frequency to ensure compliance.

Are there any exemptions or special considerations for small businesses regarding the Retail Tax?

+Yes, small businesses in Minnesota may qualify for certain exemptions or reduced tax rates. For instance, some startup businesses may be eligible for a Small Business Tax Relief Program, which offers reduced tax rates during their initial years of operation. It’s advisable to consult the Department of Revenue for specific guidelines and eligibility criteria.

How does the Minnesota Retail Tax impact online retailers, especially those operating across state lines?

+Online retailers must comply with the Minnesota Retail Tax if they have a significant presence in the state or make sales to Minnesota residents. The Destination-Based Sales Tax reform simplifies tax collection for online retailers by requiring them to collect tax based on the customer’s location. This ensures fairness and compliance with the state’s tax laws.

Can individuals claim a refund for overpaid Retail Tax?

+Yes, individuals can claim a refund for overpaid Retail Tax if they have evidence of payment and meet the necessary criteria. The process involves filing a Retail Tax Refund Application with the Department of Revenue. It’s important to note that refunds are subject to review and approval by the Department.

What resources are available for businesses to stay informed about Retail Tax regulations and updates?

+The Department of Revenue provides a wealth of resources to assist businesses in staying updated on Retail Tax regulations. These include online guides, webinars, and a dedicated help desk. Additionally, businesses can subscribe to the Department’s email updates and follow their official social media channels for timely notifications.