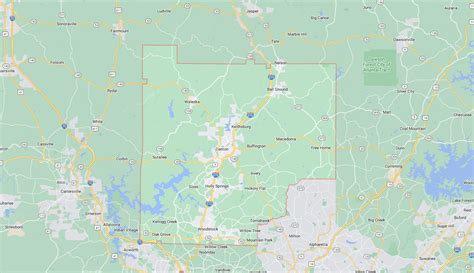

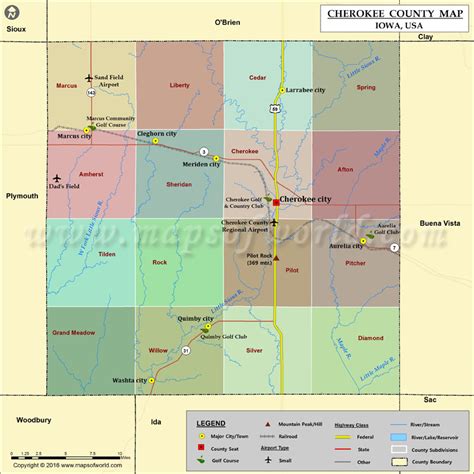

Cherokee County Tax Office

In the heart of Cherokee County, Texas, the Cherokee County Tax Office stands as a vital administrative hub, serving as the primary authority for a wide range of tax-related services and transactions. This governmental institution plays a crucial role in the financial and administrative landscape of the county, offering a comprehensive suite of services that impact both individuals and businesses within its jurisdiction.

A Comprehensive Overview of the Cherokee County Tax Office

The Cherokee County Tax Office, nestled in the vibrant community of Rusk, Texas, is more than just a governmental body; it’s a dynamic entity that facilitates the smooth operation of the local economy and administration. Its services are diverse and critical, touching upon various aspects of financial management and legal compliance for the county’s residents and businesses.

Core Services and Their Impact

At the core of its operations, the Cherokee County Tax Office provides an extensive array of services that cater to the diverse needs of its constituents. This includes the collection and management of various taxes, such as property taxes, which form a significant portion of the county’s revenue. The office ensures that property owners are aware of their tax obligations and provides a streamlined process for payment, offering both traditional and online methods for convenience.

Beyond property taxes, the office also handles vehicle registration and titling, a critical service for the county's vehicle owners. This service ensures that all vehicles operating within Cherokee County are appropriately registered and titled, adhering to state regulations. The office provides efficient and timely processing of these registrations, allowing vehicle owners to comply with legal requirements without undue hassle.

Furthermore, the Cherokee County Tax Office plays a vital role in the collection of sales taxes, a crucial source of revenue for the county. By ensuring that businesses operating within the county remit their sales taxes accurately and timely, the office contributes significantly to the financial health and stability of the county.

| Service Category | Description |

|---|---|

| Property Taxes | Efficient management and collection of property taxes, offering both in-person and online payment options for convenience. |

| Vehicle Registration & Titling | Streamlined process for vehicle registration and titling, ensuring compliance with state regulations and providing a seamless experience for vehicle owners. |

| Sales Taxes | Collection of sales taxes from businesses operating within Cherokee County, contributing to the county's financial stability and development. |

Community Engagement and Outreach

The Cherokee County Tax Office doesn’t operate in isolation; it actively engages with the community, offering educational programs and resources to enhance tax literacy among residents. This initiative is particularly beneficial for first-time homeowners, small business owners, and those new to the county, providing them with the knowledge and tools to navigate the complex world of taxation.

Additionally, the office often organizes community events and workshops, creating a platform for residents to interact with tax professionals, ask questions, and gain a better understanding of their tax responsibilities. These outreach programs foster a sense of transparency and trust between the tax office and the community, ensuring that residents feel supported and informed.

Technological Advancements and Online Services

In its commitment to efficiency and accessibility, the Cherokee County Tax Office has embraced technological advancements, integrating digital tools into its operations. This has resulted in the development of a user-friendly online portal, which offers a wide range of services, from tax payment to the retrieval of tax records, all at the click of a button.

The online platform is particularly beneficial for those who prefer the convenience of digital services, allowing them to manage their tax obligations from the comfort of their homes or offices. It also provides a secure and efficient method for businesses to remit their sales taxes, reducing the administrative burden and streamlining the process.

The Impact of Cherokee County Tax Office on Local Development

The role of the Cherokee County Tax Office extends beyond the collection and management of taxes; it plays a pivotal role in the overall development and progress of the county. The revenue generated through various tax collections is reinvested into the community, funding essential services and infrastructure projects that enhance the quality of life for residents.

Funding Community Initiatives and Projects

A significant portion of the tax revenue collected by the Cherokee County Tax Office is allocated towards community development projects. These projects can range from the improvement of local schools and healthcare facilities to the development of recreational areas and cultural centers, all aimed at enriching the lives of county residents.

For instance, property tax revenues often contribute to the maintenance and enhancement of local roads and public transportation systems, ensuring safe and efficient travel for residents and visitors alike. Similarly, sales tax revenues can be directed towards funding local arts and cultural initiatives, fostering a vibrant and diverse community.

Economic Growth and Business Development

The efficient management and collection of taxes by the Cherokee County Tax Office create a stable and reliable revenue stream for the county. This financial stability is crucial for attracting new businesses and investors, as it signals a well-managed and fiscally responsible community.

The office's commitment to supporting local businesses, through initiatives such as tax incentives and streamlined registration processes, encourages entrepreneurship and economic growth. This, in turn, leads to job creation and a thriving local economy, benefiting the entire community.

A Look into the Future: Digital Transformation and Beyond

As technology continues to advance, the Cherokee County Tax Office is poised to leverage these advancements to further enhance its services. The integration of AI and machine learning could revolutionize the way tax data is processed and analyzed, leading to more efficient and accurate tax assessments.

Furthermore, the development of mobile applications and further digitization of services could make tax management even more accessible and convenient for residents and businesses. This digital transformation would not only improve the user experience but also free up resources for the tax office to focus on more complex and strategic initiatives, ultimately benefiting the community as a whole.

What are the operating hours of the Cherokee County Tax Office?

+The office is typically open from 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding public holidays. However, it’s advisable to check their official website or contact the office directly for any updates or special holiday hours.

How can I pay my property taxes online?

+To pay your property taxes online, you can visit the Cherokee County Tax Office’s official website and navigate to the ‘Online Payments’ section. You’ll need your account details and a valid payment method to complete the transaction.

What resources does the Tax Office provide for tax education and assistance?

+The Cherokee County Tax Office offers a range of educational resources, including online guides, workshops, and community events. They also provide direct assistance through their customer service team, who can answer queries and provide guidance on tax-related matters.