Maricopa County Az Taxes

Welcome to an in-depth exploration of Maricopa County, Arizona's tax landscape, a subject of great interest to residents, businesses, and anyone considering a move to this vibrant region. With a diverse population and a thriving economy, understanding the tax implications is crucial for making informed decisions about finances and investments.

Unraveling the Maricopa County Tax Structure

Maricopa County, nestled in the heart of Arizona, boasts a unique tax system that influences the economic landscape and daily lives of its residents. From property taxes to sales taxes and beyond, let’s delve into the intricacies of this tax structure.

Property Taxes: A Key Component

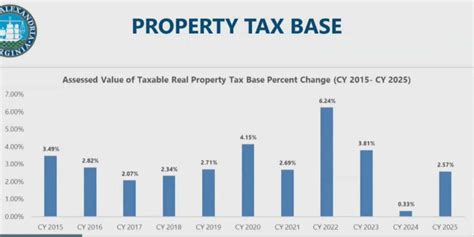

Property taxes are a significant source of revenue for Maricopa County. The assessed value of a property, which is determined by the Maricopa County Assessor’s Office, forms the basis for these taxes. This value takes into account factors like the property’s location, size, and recent sales of comparable properties.

The tax rate in Maricopa County is a combination of rates set by various entities, including the county itself, cities, school districts, and special taxing districts. For instance, in 2023, the average effective property tax rate was approximately 0.74%, which translates to a homeowner with a property valued at 250,000 paying roughly <strong>1,850 in annual property taxes.

| Entity | Tax Rate (%) |

|---|---|

| Maricopa County | 0.4940 |

| School Districts | Varies by district |

| Cities | Varies by city |

| Special Districts | Varies |

Sales and Transaction Taxes

In addition to property taxes, sales and transaction taxes are another critical aspect of Maricopa County’s tax system. The county levies a 2.5% transaction privilege tax (TPT) on most goods and services sold within its boundaries. This tax is often included in the price of goods, so it’s a factor that shoppers and businesses should consider.

For certain transactions, like the sale of a home, there are additional taxes. The document recording fee, which is based on the sale price, can vary depending on the city and the type of transaction. For instance, in the city of Phoenix, the document recording fee for a residential property is 4 per 1,000 of the sale price.

Business Taxes: A Competitive Advantage

Maricopa County’s tax structure also accommodates businesses, offering a competitive environment for economic growth. While the county levies a 0.9% privilege license tax on most businesses, there are exemptions and incentives that can reduce this burden.

One notable incentive is the Enterprise Zone Tax Credit, which provides a 10% tax credit for businesses that invest in designated enterprise zones within the county. This credit is applicable for a period of five years, offering a significant advantage for businesses looking to expand or relocate.

Vehicle Registration and Excise Taxes

Vehicle ownership also comes with its own set of taxes in Maricopa County. The vehicle registration fee varies based on the weight of the vehicle, with passenger cars typically paying a standard fee. Additionally, there’s an excise tax of 3.35% on the purchase price of new vehicles, which funds transportation infrastructure projects.

Other Taxes and Fees

Maricopa County also collects a range of other taxes and fees to support various services and initiatives. These include:

- Hotel/Motel Tax: A 12.58% tax on hotel and motel stays, with proceeds going towards tourism promotion.

- Food Tax: A 1.81% tax on food sales, with exemptions for certain prepared food items.

- Cigarette Tax: A $2 per pack tax on cigarettes, with proceeds supporting healthcare and prevention programs.

The Impact of Maricopa County Taxes

The tax system in Maricopa County plays a pivotal role in shaping the region’s economic landscape and the daily lives of its residents. Here’s a deeper look at how these taxes impact different aspects of life in the county.

Economic Development and Business Climate

The tax structure in Maricopa County is designed to foster economic growth and attract businesses. The competitive business tax rates and incentives, such as the Enterprise Zone Tax Credit, make the county an attractive location for companies looking to expand or establish operations.

The county’s focus on infrastructure development, funded in part by excise taxes on vehicles and other sources, ensures a robust transportation network, further enhancing its appeal as a business destination.

Property Ownership and Housing Market

Property taxes in Maricopa County are a significant consideration for homeowners and prospective buyers. The county’s tax rates and assessment processes can influence the affordability of homes and the overall housing market.

For instance, the county’s efforts to maintain competitive tax rates and provide transparent assessment processes contribute to a stable and predictable housing market. This stability can encourage homeownership and attract new residents.

Consumer Spending and Retail Sector

The sales and transaction taxes in Maricopa County have a direct impact on consumer spending and the retail sector. While these taxes can influence the affordability of goods and services, the county’s overall tax burden remains competitive compared to other regions.

The transaction privilege tax, for example, funds essential services and infrastructure projects, benefiting the community as a whole. This tax also provides stability for the retail sector, which relies on consistent consumer spending.

Community Services and Infrastructure

Maricopa County’s tax revenue is a crucial source of funding for various community services and infrastructure projects. From schools and healthcare facilities to road maintenance and public safety, tax dollars support the essential services that residents rely on daily.

The county’s commitment to maintaining a balanced tax structure ensures that these services remain accessible and of high quality. Additionally, the strategic use of tax incentives, like the Enterprise Zone Tax Credit, encourages economic development that can further enhance community services over time.

Future Outlook and Potential Changes

As Maricopa County continues to grow and evolve, its tax structure may also undergo changes to adapt to new economic realities and community needs. Here’s a glimpse into some potential future developments.

Technological Advancements in Tax Administration

Maricopa County, like many other jurisdictions, is embracing technological advancements to streamline tax administration. This includes the use of online platforms for tax payments, assessment information, and tax incentive applications.

The county’s move towards digital tax administration can enhance efficiency, reduce costs, and improve the overall taxpayer experience. It also opens the door to potential innovations like blockchain-based property ownership records and smart contract-based tax incentive programs.

Shifts in Tax Policy and Incentives

Tax policies and incentives are subject to change, often driven by economic conditions, community needs, and political priorities. Maricopa County may consider adjustments to its tax rates or the introduction of new incentives to support specific industries or community initiatives.

For instance, the county could explore tax incentives to encourage the adoption of renewable energy technologies or to support small businesses in underserved communities. These policy shifts can have a significant impact on the county’s economic trajectory and its appeal to different segments of the population.

Community Engagement and Tax Reform

Community engagement plays a crucial role in shaping the future of Maricopa County’s tax structure. As the county grows, it becomes increasingly important to involve residents and businesses in discussions about tax policies and their impact.

Through public hearings, surveys, and other engagement initiatives, the county can gather valuable feedback and insights. This feedback can inform tax reform efforts, ensuring that the tax system remains fair, transparent, and aligned with the community’s needs and aspirations.

What is the average property tax rate in Maricopa County, AZ?

+

The average effective property tax rate in Maricopa County is approximately 0.74% as of 2023.

Are there any tax incentives for businesses in Maricopa County?

+

Yes, Maricopa County offers the Enterprise Zone Tax Credit, providing a 10% tax credit for businesses that invest in designated enterprise zones.

How do sales taxes work in Maricopa County?

+

Maricopa County levies a 2.5% transaction privilege tax (TPT) on most goods and services. This tax is often included in the price of goods.

What are the vehicle registration fees in Maricopa County?

+

Vehicle registration fees vary based on the weight of the vehicle. Passenger cars typically pay a standard fee.

How does Maricopa County’s tax structure support economic development?

+

Maricopa County’s tax structure fosters economic growth through competitive business tax rates and incentives like the Enterprise Zone Tax Credit.