Alexandria Property Tax

The topic of property taxes is of significant interest to homeowners and investors alike, as it directly impacts their financial obligations and planning. In this comprehensive article, we delve into the intricacies of property taxes in Alexandria, exploring the factors that influence tax assessments, the processes involved, and the strategies individuals can employ to navigate this complex landscape.

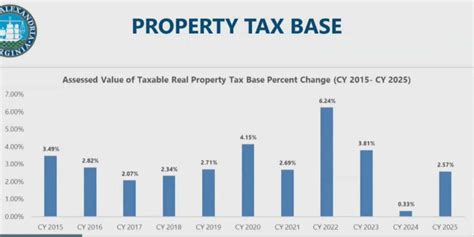

Understanding Alexandria’s Property Tax Landscape

Alexandria, a vibrant city known for its rich history and thriving community, presents a unique set of considerations when it comes to property taxes. With a diverse range of properties, from historic homes to modern developments, the tax assessment process in Alexandria is a nuanced affair. Let’s explore the key aspects that define this municipal tax system.

Factors Influencing Property Tax Assessments

Property tax assessments in Alexandria are determined by a combination of factors, each playing a crucial role in the overall calculation. These include:

- Property Value: The assessed value of a property is a primary determinant. In Alexandria, the City Assessor’s Office conducts regular evaluations to ensure tax assessments are fair and accurate. These evaluations consider market trends, property improvements, and other relevant factors.

- Location: The location of a property can significantly impact its tax assessment. Properties in prime locations, such as those with riverfront views or proximity to amenities, may attract higher tax rates.

- Improvements and Renovations: Any improvements or renovations made to a property can influence its assessed value. Adding a new wing, upgrading fixtures, or enhancing landscaping may lead to an increase in property taxes.

- Tax Rates: Alexandria, like many other municipalities, applies specific tax rates to different property types. These rates are determined by the local government and can vary based on factors such as zoning, usage, and the purpose of the property.

It's important to note that property tax assessments are not static; they can change annually, reflecting market fluctuations and other economic factors. This dynamic nature underscores the importance of staying informed and proactive in managing one's property tax obligations.

The Property Tax Assessment Process

The property tax assessment process in Alexandria follows a systematic approach, ensuring transparency and fairness. Here’s a step-by-step breakdown:

- Data Collection: The City Assessor’s Office collects data on properties within the city limits. This includes details such as property size, improvements, and recent sales figures.

- Market Analysis: Assessor’s staff analyze market trends and sales data to determine fair market values for properties. This step ensures that assessments are in line with the current real estate market.

- Assessment Notification: Property owners receive notification of their assessed values, along with detailed explanations of how the assessment was determined. This transparency allows homeowners to understand the factors contributing to their tax obligations.

- Appeal Process: If a property owner disagrees with the assessed value, they have the right to appeal. Alexandria provides a clear and accessible appeals process, allowing homeowners to present their case and potentially adjust their tax assessment.

- Tax Bill Generation: Once assessments are finalized and any appeals resolved, the City generates tax bills based on the assessed values and applicable tax rates. These bills outline the amount due and the payment schedule.

The property tax assessment process is designed to be fair and accurate, but it's essential for property owners to remain vigilant and engage with the system to ensure their assessments are reasonable.

Strategies for Managing Property Taxes

Navigating the complexities of property taxes in Alexandria requires a strategic approach. Here are some key strategies homeowners and investors can employ to effectively manage their tax obligations:

- Stay Informed: Keep abreast of local tax policies, assessment procedures, and market trends. Understanding the factors that influence tax assessments empowers individuals to make informed decisions.

- Regular Property Evaluations: Conduct periodic evaluations of your property to identify potential improvements or renovations that may impact tax assessments. Being proactive can help mitigate unexpected tax increases.

- Utilize Tax Incentives: Alexandria, like many cities, offers tax incentives for certain property types or improvements. Research and take advantage of these incentives to potentially reduce your tax burden.

- Appeal Assessments: If you believe your property’s assessed value is inaccurate, don’t hesitate to appeal. Gather supporting evidence and work with professionals to present a strong case for a reassessment.

- Consider Payment Plans: For larger tax bills, explore payment plan options offered by the City. This can help manage cash flow and ensure timely payments without incurring penalties.

Alexandria’s Property Tax System: A Case Study

To illustrate the practical application of Alexandria’s property tax system, let’s examine a case study involving a historic home in the city’s Old Town neighborhood.

The Smith Family’s Property Tax Journey

The Smith family has owned a charming historic home in Alexandria for over two decades. Their property, nestled in the heart of Old Town, has been a labor of love, with the family investing in various renovations and improvements over the years.

| Property Details | Assessed Value |

|---|---|

| Historic Home - 3 Bedrooms, 2 Bathrooms | $650,000 |

| Recent Improvements: Kitchen Renovation | $70,000 |

| Total Assessed Value (2023) | $720,000 |

In 2023, the Smith family received their annual property tax assessment, which included a detailed breakdown of the factors influencing their tax obligations.

The assessment revealed that the recent kitchen renovation, a significant improvement, had increased the property's value by $70,000. This led to a corresponding increase in their tax assessment, bringing the total assessed value to $720,000.

The Smith family decided to appeal the assessment, arguing that the renovation costs were higher than the resulting increase in property value. They engaged a local tax consultant who guided them through the appeals process, providing expert advice and support.

After a thorough review, the City's Assessor's Office agreed to a partial reduction in the assessed value, acknowledging the specific circumstances of the renovation. This resulted in a more favorable tax assessment for the Smith family, illustrating the importance of engagement and advocacy in the property tax landscape.

Future Outlook and Trends

As Alexandria continues to thrive and evolve, its property tax system is likely to undergo changes and adaptations. Here are some key trends and considerations for the future:

- Technology Integration: The City is exploring ways to leverage technology for more efficient property assessments. This may include digital mapping, remote sensing, and data analytics to streamline the assessment process.

- Green Initiatives: Alexandria is committed to sustainable practices, and this may extend to property tax incentives. Properties with energy-efficient features or eco-friendly renovations could potentially benefit from tax breaks in the future.

- Community Engagement: The City recognizes the importance of community input in shaping tax policies. Expect increased opportunities for public participation and feedback, ensuring that property tax decisions reflect the needs and aspirations of Alexandria’s residents.

The future of Alexandria's property tax system is promising, with a focus on fairness, efficiency, and community involvement. As the city continues to grow and adapt, property owners can anticipate a more transparent and responsive tax landscape.

Conclusion: Navigating Alexandria’s Property Tax Landscape

Understanding and effectively managing property taxes in Alexandria requires a combination of knowledge, vigilance, and strategic planning. By staying informed about local tax policies, engaging with the assessment process, and leveraging available resources, homeowners and investors can navigate this complex landscape with confidence.

As Alexandria continues to evolve, its property tax system will play a pivotal role in shaping the city's future. With a commitment to fairness and community engagement, the city is poised to create a sustainable and prosperous environment for its residents and businesses. Stay tuned for further insights and updates on Alexandria's dynamic property tax journey.

How often are property tax assessments conducted in Alexandria?

+Property tax assessments in Alexandria are conducted annually. The City Assessor’s Office evaluates properties to ensure that tax assessments are fair and accurate, taking into account market trends and property improvements.

Can I appeal my property tax assessment if I disagree with it?

+Absolutely! Alexandria provides a comprehensive appeals process for property owners who wish to challenge their assessments. It’s important to gather supporting evidence and engage with the City’s Assessor’s Office to present your case effectively.

Are there any tax incentives available for homeowners in Alexandria?

+Yes, Alexandria offers various tax incentives to encourage specific behaviors or improvements. These may include tax breaks for energy-efficient upgrades, historic preservation, or even incentives for first-time homebuyers. It’s worth exploring these incentives to potentially reduce your tax burden.