Georgia Income Tax Calculator

Welcome to this comprehensive guide on the Georgia Income Tax Calculator, a tool that plays a crucial role in understanding and managing your financial obligations as a resident of the state. As an expert in tax-related matters, I'll be your guide through this in-depth exploration of the calculator's features, its benefits, and how it can simplify the often complex world of income tax calculations.

The Importance of the Georgia Income Tax Calculator

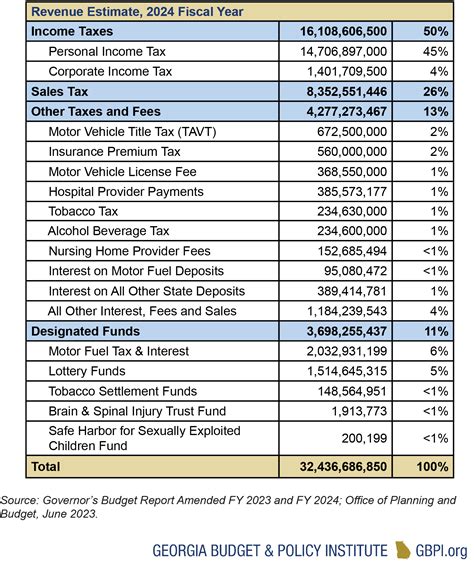

Georgia, like many other states, has its own unique tax system, which can vary significantly from the federal tax structure. The Georgia Income Tax Calculator serves as a vital tool for residents to navigate this complex landscape. By inputting relevant financial information, individuals and businesses can accurately determine their tax liability, ensure compliance with state regulations, and plan their financial strategies effectively.

Key Features and Functionality

The Georgia Income Tax Calculator offers a range of features designed to cater to different tax scenarios:

- Income Bracketing: The calculator takes into account Georgia's progressive tax structure, where tax rates vary depending on income levels. It accurately applies the appropriate tax rates to different income brackets, ensuring an accurate calculation.

- Deduction and Credit Calculations: Georgia offers various deductions and credits to taxpayers, such as the standard deduction, personal exemptions, and tax credits for specific expenses. The calculator factors in these deductions and credits to provide a more precise estimate of your tax liability.

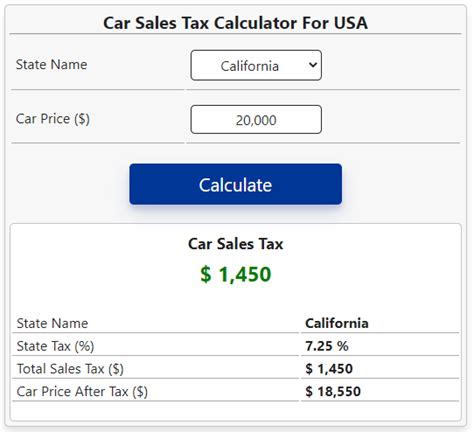

- Withholding Calculations: For those who have a job or multiple jobs, the calculator helps determine the correct amount of tax to be withheld from each paycheck, ensuring you're not over- or under-withholding throughout the year.

- Customizable Scenarios: The calculator allows users to input specific scenarios, such as different filing statuses (single, married filing jointly, etc.), number of dependents, and various income sources. This flexibility makes it a versatile tool for a wide range of taxpayers.

- Real-Time Updates: As tax laws and regulations can change annually, the Georgia Income Tax Calculator is regularly updated to reflect the latest tax rates, brackets, and any other relevant adjustments, ensuring its calculations remain accurate and up-to-date.

Benefits of Using the Calculator

The advantages of utilizing the Georgia Income Tax Calculator are manifold:

- Accuracy: By automating the often complex tax calculation process, the calculator minimizes the risk of errors, ensuring you pay the correct amount of tax.

- Convenience: Accessible online, the calculator can be used from the comfort of your home or office, eliminating the need for tedious manual calculations or visits to tax professionals for simple estimates.

- Planning and Strategy: With an accurate estimate of your tax liability, you can better plan your financial decisions throughout the year. This includes adjusting your withholding, optimizing deductions, and making informed investment choices.

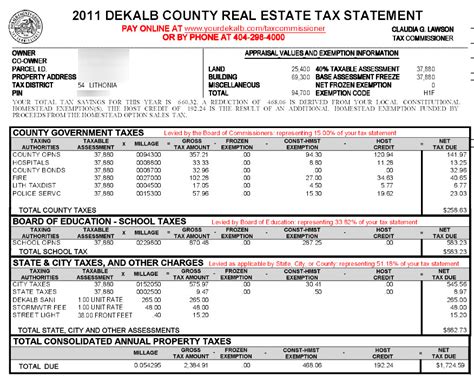

- Compliance: By using the calculator, you can be confident that your tax filings are in line with Georgia's tax regulations, reducing the risk of audits and penalties.

- Educational Tool: The calculator provides an excellent opportunity to understand the intricacies of Georgia's tax system. By seeing how different factors impact your tax liability, you can gain valuable insights into tax planning and management.

Performance Analysis and Real-World Examples

Let’s delve into some real-world scenarios to illustrate the practical application of the Georgia Income Tax Calculator:

Scenario 1: Single Filer with Multiple Income Streams

Consider a single individual, Sarah, who has a full-time job with a salary of 60,000 and also earns 10,000 annually from freelance work. By using the calculator, Sarah can input her income details, including the freelance earnings, to determine her total tax liability. The calculator takes into account the different tax rates applicable to her income brackets and provides an accurate estimate, helping Sarah understand her financial obligations and plan her savings accordingly.

Scenario 2: Married Couple with Dependents

John and Emily, a married couple with two children, have a combined annual income of $120,000. They utilize the calculator to estimate their tax liability, taking into account their filing status, the personal exemptions for themselves and their dependents, and any eligible tax credits. The calculator provides them with a clear picture of their tax situation, allowing them to make informed decisions about their financial strategies, such as adjusting their withholdings or exploring tax-advantaged savings options.

Scenario 3: Business Owner with Complex Deductions

Robert, a small business owner, has a unique tax situation with various deductions related to his business expenses. The Georgia Income Tax Calculator helps Robert navigate these complexities by allowing him to input specific deductions, such as office rent, travel expenses, and equipment costs. The calculator then applies these deductions to his overall income, providing an accurate tax estimate and helping Robert maximize his tax benefits.

Comparative Analysis: Georgia vs. Federal Tax System

While the federal tax system provides a uniform framework, state tax systems like Georgia’s introduce unique variations. Let’s explore some key differences:

| Tax Aspect | Federal Tax | Georgia Tax |

|---|---|---|

| Tax Rates | Seven brackets with rates ranging from 10% to 37% | Six brackets with rates from 1% to 6% |

| Deductions and Credits | Standard deduction, personal exemptions, and various credits | Similar deductions and credits, with some state-specific variations, such as the Georgia HOPE Scholarship Credit |

| Filing Status | Single, Married Filing Jointly, Head of Household, etc. | Same as federal, but with additional options like Widow(er) with Dependent Child(ren) |

| Withholding | Federal income tax is withheld from wages | State income tax is also withheld, with the calculator helping determine the correct amount |

Future Implications and Tax Planning Strategies

As tax laws are subject to change, staying informed about potential updates is crucial for effective tax planning. Here are some insights and strategies to consider:

- Keep Up with Tax Law Changes: Regularly check official sources like the Georgia Department of Revenue's website for any updates to tax rates, brackets, or deductions. This ensures you're aware of any changes that could impact your tax liability.

- Maximize Deductions and Credits: Understand the various deductions and credits available to you, such as the Georgia Individual Income Tax Credit or the state's Earned Income Tax Credit. By claiming all eligible deductions, you can minimize your tax liability.

- Adjust Withholdings Strategically: If you find that you're consistently over- or under-withholding, consider adjusting your withholdings to better align with your actual tax liability. This can be done by submitting a new W-4 form to your employer.

- Explore Tax-Advantaged Accounts: Consider contributing to tax-advantaged accounts like Georgia's 529 College Savings Plan or the state's Prepaid Affordable College Tuition (PACT) program. These accounts offer tax benefits and can help you save for specific financial goals.

- Consult a Tax Professional: For complex tax situations or if you have specific questions, consulting a certified tax professional can provide valuable guidance and ensure you're making the most of your financial strategies.

How often are the tax rates and brackets updated on the calculator?

+The Georgia Income Tax Calculator is typically updated annually to reflect any changes in tax rates and brackets. These updates are usually made before the start of the new tax year to ensure accuracy.

Can the calculator handle complex business tax scenarios?

+Yes, the calculator is designed to accommodate various business tax situations. It can handle different types of business income, expenses, and deductions, making it a valuable tool for small business owners and self-employed individuals.

Are there any limitations to the calculator’s accuracy?

+While the calculator provides accurate estimates, it’s important to note that it is a tool for estimation and not a substitute for professional tax advice. Complex tax situations, such as those involving international income or significant capital gains, may require the expertise of a tax professional.