Ebay Tax Exempt

For businesses and individuals selling on eBay, understanding the tax landscape is crucial. eBay's tax exemption policies are an essential aspect of this landscape, providing opportunities for eligible sellers to navigate their tax obligations more efficiently. This comprehensive guide aims to delve into the intricacies of eBay's tax exemption, offering an in-depth analysis of the process, eligibility criteria, and its broader implications for sellers.

Unraveling eBay’s Tax Exemption Policy

eBay’s tax exemption policy is designed to accommodate sellers who are eligible for tax-exempt status under various legal and regulatory frameworks. This policy allows these sellers to operate on the platform without being subject to certain sales and use taxes, a significant advantage for businesses and individuals alike.

The Mechanism of Tax Exemption on eBay

eBay’s tax exemption system operates on a straightforward principle: sellers who provide valid tax-exempt credentials can avoid the collection of sales tax from their buyers. This exemption is particularly beneficial for sellers dealing in specific product categories, such as books, educational materials, and certain food items, which often enjoy tax-free status in many jurisdictions.

Additionally, sellers engaged in business-to-business (B2B) transactions may also qualify for tax exemption if they can demonstrate that the purchase is exempt from tax due to its commercial nature. This aspect of eBay's tax exemption policy is particularly relevant for sellers catering to businesses, as it streamlines their sales processes and reduces administrative burdens.

The Process of Applying for Tax Exemption

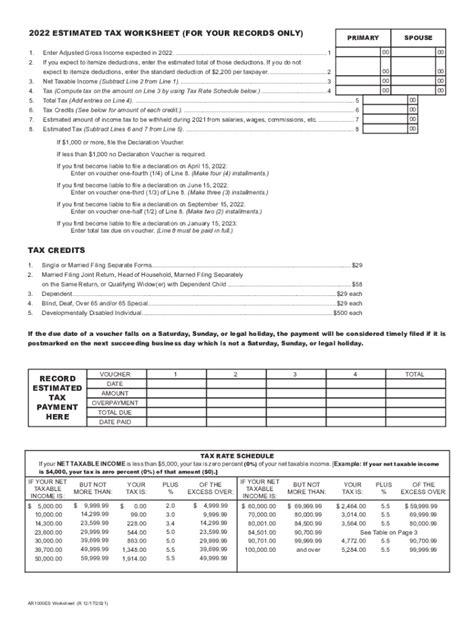

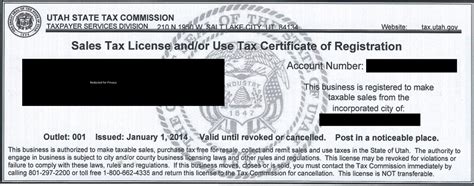

Obtaining tax-exempt status on eBay involves a few key steps. Firstly, sellers must possess valid tax-exempt credentials, typically in the form of a certificate issued by a government authority or a recognized tax agency. These certificates often contain specific details such as the seller’s business name, address, and tax-exempt number, all of which are crucial for verification purposes.

Once the seller has obtained the necessary documentation, they can proceed to upload these certificates onto their eBay seller account. This process usually involves accessing the tax settings within the account and following the prompts to upload the certificate. eBay's platform is designed to accommodate a range of certificate types, ensuring that sellers from various jurisdictions can easily navigate this process.

After uploading the certificate, eBay's system will review and validate the information provided. This process may take some time, and sellers are advised to allow for a reasonable period for the review to be completed. Once the certificate is approved, the seller will be granted tax-exempt status, and their account will be updated to reflect this change.

Eligibility Criteria: Who Qualifies for Tax Exemption on eBay

eBay’s tax exemption policy is not universally applicable. Sellers must meet specific criteria to qualify for this benefit. One of the primary eligibility factors is the seller’s legal status. Entities recognized as tax-exempt by law, such as charitable organizations, educational institutions, and certain government bodies, are typically eligible for tax exemption on eBay.

In addition to legal status, the nature of the products being sold also plays a significant role in determining eligibility. As mentioned earlier, certain product categories are often exempt from sales tax, and sellers dealing in these categories may be eligible for tax exemption. However, it's important to note that the eligibility criteria can vary significantly based on the jurisdiction in which the sale takes place.

For instance, a seller based in a state with a broad definition of tax-exempt entities may find it easier to qualify for tax exemption compared to a seller in a state with more stringent criteria. Similarly, the product categories that enjoy tax-free status can vary widely across different jurisdictions, making it essential for sellers to understand the tax landscape in their specific market.

The Impact of Tax Exemption on Seller Operations

Obtaining tax-exempt status on eBay can have a significant impact on a seller’s operations, both in terms of their financial obligations and administrative processes.

Financial Implications

From a financial perspective, tax exemption can result in substantial savings for eligible sellers. By avoiding the collection and remittance of sales tax, these sellers can reduce their tax liabilities, freeing up resources that can be reinvested into their business. This benefit is particularly notable for sellers with a large volume of transactions, as the cumulative effect of tax exemption can lead to significant savings over time.

Administrative Benefits

Tax exemption also simplifies the administrative processes associated with selling on eBay. Sellers no longer need to calculate and collect sales tax from their buyers, which can streamline their checkout and payment processes. This simplification can enhance the seller’s operational efficiency and improve the overall buyer experience, as transactions can be completed more swiftly and with fewer complexities.

Strategic Advantages

Furthermore, tax exemption can provide strategic advantages to sellers. For instance, it can make a seller’s products more competitively priced compared to those of their tax-paying counterparts. This pricing advantage can be particularly beneficial in highly competitive markets, where every edge can contribute to a seller’s success.

Additionally, tax exemption can enhance a seller's reputation and credibility, particularly among buyers who are conscious of tax obligations. By demonstrating their tax-exempt status, sellers can build trust and confidence with their customer base, potentially leading to increased sales and loyalty.

Navigating the Challenges of Tax Exemption

While eBay’s tax exemption policy offers significant benefits, it also comes with certain challenges and considerations that sellers should be aware of.

Documentation and Verification

One of the primary challenges lies in the documentation and verification process. Sellers must ensure they have the necessary tax-exempt credentials and that these credentials are valid and up-to-date. Failure to provide accurate and valid documentation can result in the rejection of their tax-exempt status application, leading to unnecessary delays and complications.

Jurisdictional Differences

Another challenge stems from the variability in tax laws across different jurisdictions. eBay operates in a global marketplace, and sellers must navigate the unique tax landscapes of various countries, states, or regions. This complexity can be daunting, as sellers need to understand and comply with the specific tax regulations applicable to their sales transactions.

Potential Audit Risks

Additionally, sellers should be mindful of potential audit risks. While eBay’s tax exemption policy is designed to accommodate legitimate tax-exempt entities, it does not shield sellers from audit scrutiny. Tax authorities may audit sellers to ensure compliance with tax laws, and sellers must be prepared to provide accurate records and documentation to substantiate their tax-exempt status.

eBay’s Support and Resources for Tax-Exempt Sellers

eBay recognizes the importance of tax exemption for eligible sellers and has implemented various support measures to assist them in navigating this complex landscape.

Comprehensive Tax Resources

eBay provides a wealth of resources and tools to help sellers understand their tax obligations and take advantage of tax exemption when eligible. These resources include detailed guides, webinars, and video tutorials, all designed to educate sellers about the tax implications of selling on eBay and how to leverage tax exemption effectively.

Dedicated Support Channels

In addition to educational resources, eBay offers dedicated support channels for tax-related queries. Sellers can access these channels to seek clarification on specific tax issues, understand the application process for tax exemption, and resolve any problems they encounter. The support team is well-equipped to handle a range of tax-related inquiries, ensuring that sellers receive accurate and timely assistance.

Regular Updates and Notifications

eBay also keeps its sellers informed about changes in tax regulations and policies. Regular updates and notifications are sent to sellers, ensuring they stay abreast of any modifications that may impact their tax obligations. This proactive approach helps sellers remain compliant and make informed decisions about their tax strategies.

Conclusion: Maximizing the Benefits of eBay’s Tax Exemption

eBay’s tax exemption policy presents a unique opportunity for eligible sellers to streamline their tax obligations and enhance their business operations. By understanding the eligibility criteria, navigating the application process, and leveraging the benefits of tax exemption, sellers can achieve significant financial savings and administrative efficiencies.

However, it's crucial for sellers to approach tax exemption with a comprehensive understanding of the policy, the documentation requirements, and the potential challenges. With the right knowledge and support, sellers can effectively harness the advantages of eBay's tax exemption policy, contributing to their long-term success on the platform.

How often should I review my tax exemption status on eBay?

+It is recommended to review your tax exemption status annually or whenever there are significant changes in your business structure, products sold, or jurisdiction. This ensures you remain compliant with the latest tax regulations and continue to benefit from tax exemption where applicable.

Can I apply for tax exemption if I sell both taxable and tax-exempt items on eBay?

+Yes, you can apply for tax exemption even if you sell a mix of taxable and tax-exempt items. However, it’s important to accurately categorize your items and ensure you meet the eligibility criteria for tax exemption on each item.

What happens if my tax-exempt status is revoked or my certificate expires while selling on eBay?

+If your tax-exempt status is revoked or your certificate expires, you will need to update your information on eBay to ensure compliance. Failure to do so may result in the collection of sales tax on your transactions, and you may face penalties for non-compliance.