Tax.virginia.gove/Respond

In the world of government services and legal obligations, understanding the intricacies of tax-related matters is crucial. This comprehensive guide aims to navigate through the online tax response portal of Virginia, tax.virginia.gov/Respond, providing an in-depth analysis and step-by-step instructions for users. By delving into the specifics of this platform, we aim to demystify the process and empower individuals and businesses alike to efficiently manage their tax responsibilities.

Understanding tax.virginia.gov/Respond: A Comprehensive Overview

The tax.virginia.gov/Respond portal is a dedicated online interface designed by the Virginia Department of Taxation to streamline tax-related communications and interactions. It serves as a central hub for taxpayers to access various services, respond to tax notices, and manage their tax accounts efficiently.

This platform is particularly beneficial for individuals and businesses facing tax inquiries, notices, or assessments. It offers a user-friendly environment where taxpayers can find information, seek clarifications, and provide necessary responses to the department's queries.

Key Features and Services of tax.virginia.gov/Respond

The tax.virginia.gov/Respond portal boasts an array of features aimed at simplifying the tax response process. Here’s a glimpse of some of its key offerings:

- Notice Response Center: This section allows taxpayers to access and respond to tax notices they have received. Users can review the details of the notice, understand the nature of the inquiry, and provide the necessary information or documentation.

- Account Management: Taxpayers can log in to their accounts to view their tax history, current balances, and any outstanding obligations. This feature provides a transparent overview of their tax situation, enabling them to stay on top of their payments and deadlines.

- Payment Options: The portal offers a range of payment methods, including online payments, direct debit, and credit card payments. This flexibility ensures that taxpayers can choose the most convenient and secure option for remitting their taxes.

- Tax Form Access: Taxpayers can download and access a wide range of tax forms and instructions directly from the portal. This feature saves time and effort, as users no longer need to search for forms externally.

- Help and Support: The platform provides extensive help resources, including FAQs, tutorials, and contact information for tax professionals. This support system ensures that taxpayers can find answers to their queries quickly and efficiently.

Navigating the tax.virginia.gov/Respond Platform: A Step-by-Step Guide

To make the most of the tax.virginia.gov/Respond portal, here’s a detailed step-by-step guide to walk you through the process:

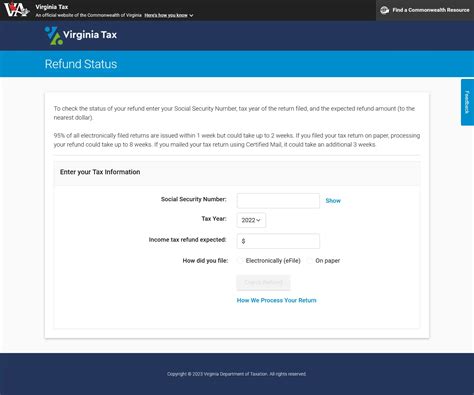

- Access the Portal: Begin by visiting the official website, tax.virginia.gov. From the homepage, locate and click on the "Respond" link or button, which will direct you to the dedicated response portal.

- Register or Log In: If you are a new user, you will need to register an account. Provide the required information, such as your name, contact details, and tax identification number. Once registered, you can log in using your credentials for future visits.

- Review Your Notices: After logging in, navigate to the "Notice Response Center" section. Here, you will find a list of all the tax notices you have received. Select the notice you wish to respond to and review the details carefully.

- Provide the Necessary Response: Depending on the nature of the notice, you may be required to provide additional information, documentation, or clarifications. Follow the instructions provided and ensure that your response is accurate and complete.

- Upload Documents (if required): If the notice requests supporting documents, you can easily upload them through the portal. Ensure that the files are in the accepted formats and sizes specified by the department.

- Submit Your Response: Once you have provided all the necessary information and uploaded any required documents, review your response before submitting. Double-check for accuracy and completeness to avoid any delays or complications.

- Monitor Your Account: Regularly log in to your account to monitor the status of your response. The portal will provide updates and notifications regarding the progress of your inquiry, allowing you to stay informed throughout the process.

- Make Payments (if applicable): If your tax notice requires a payment, you can conveniently make it through the portal. Choose your preferred payment method, enter the required details, and complete the transaction securely.

- Access Help and Support: If you encounter any difficulties or have further questions, utilize the help resources available on the portal. The FAQs, tutorials, and contact information for tax professionals will guide you through any challenges you may face.

Tips and Best Practices for a Smooth Tax Response Process

To ensure a seamless experience when using the tax.virginia.gov/Respond portal, consider the following tips and best practices:

- Read Notices Carefully: When receiving a tax notice, take the time to read and understand its contents thoroughly. Pay attention to the due dates, required actions, and any specific instructions provided.

- Respond Promptly: Timely responses are crucial to avoid delays and potential penalties. Respond to tax notices as soon as possible to ensure a swift resolution.

- Organize Your Documents: Keep your tax-related documents, such as receipts, invoices, and previous tax returns, well-organized and easily accessible. This will expedite the response process and ensure accuracy.

- Utilize Help Resources: The portal's help resources are designed to assist taxpayers. Don't hesitate to refer to the FAQs, tutorials, or reach out to tax professionals for guidance when needed.

- Secure Payment Methods: When making online tax payments, prioritize security. Choose trusted payment methods and ensure that your personal and financial information is protected.

- Stay Informed: Regularly check your account and the portal for updates and notifications. Being proactive and staying informed will help you stay on top of your tax obligations and avoid any surprises.

| Notice Type | Response Required |

|---|---|

| Assessment Notice | Yes, provide additional information or documentation |

| Collection Notice | Yes, make the required payment or arrange a payment plan |

| Penalty Notice | Yes, provide an explanation or take corrective actions |

Conclusion: Empowering Taxpayers with Efficient Responses

The tax.virginia.gov/Respond portal serves as a powerful tool for taxpayers, offering a streamlined and user-friendly approach to managing tax-related inquiries and obligations. By providing a centralized platform with comprehensive features and resources, the Virginia Department of Taxation has made it easier for individuals and businesses to navigate the tax response process.

With this guide, we hope to have demystified the tax.virginia.gov/Respond portal, empowering taxpayers with the knowledge and confidence to efficiently respond to tax notices and manage their tax accounts. Remember, staying informed, organized, and proactive is key to a smooth tax response journey.

Frequently Asked Questions

What happens if I don’t respond to a tax notice within the specified deadline?

+

Failing to respond to a tax notice within the given deadline may result in additional penalties, interest charges, or even enforcement actions. It is crucial to respond promptly to avoid any adverse consequences.

Can I track the status of my response on the tax.virginia.gov/Respond portal?

+

Yes, you can log in to your account on the portal and monitor the status of your response. The portal provides updates and notifications regarding the progress of your inquiry, ensuring transparency throughout the process.

Are there any fees associated with using the tax.virginia.gov/Respond portal for tax responses?

+

The use of the tax.virginia.gov/Respond portal for tax responses is generally free of charge. However, depending on the nature of your response and any associated payments, there may be specific fees or charges outlined by the Virginia Department of Taxation.

Can I seek professional tax assistance through the tax.virginia.gov/Respond portal?

+

While the tax.virginia.gov/Respond portal provides extensive help resources, it primarily serves as a self-service platform. If you require professional tax assistance, you can find contact information for tax professionals within the portal or seek external tax advisors.

How secure is the tax.virginia.gov/Respond portal for transmitting sensitive tax information?

+

The tax.virginia.gov/Respond portal employs robust security measures to protect the transmission of sensitive tax information. It utilizes encryption protocols and secure servers to ensure the confidentiality and integrity of your data.