Orange County Ca Sales Tax

Orange County, located in the heart of Southern California, is renowned for its vibrant communities, thriving businesses, and bustling economy. With a diverse range of industries and a population of over three million residents, Orange County's economic landscape is dynamic and ever-evolving. One key aspect that influences business operations and consumer behavior within the county is its sales tax structure. Understanding the intricacies of Orange County's sales tax is crucial for businesses and individuals alike, as it directly impacts financial planning, budgeting, and overall economic growth.

Unraveling the Sales Tax Structure in Orange County

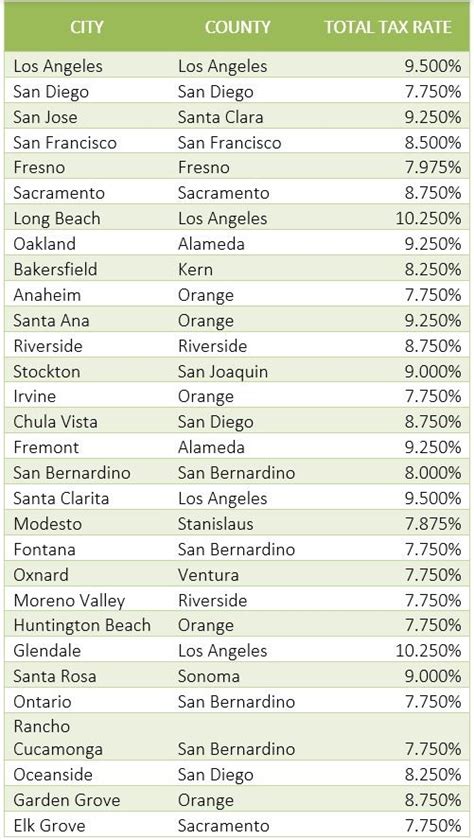

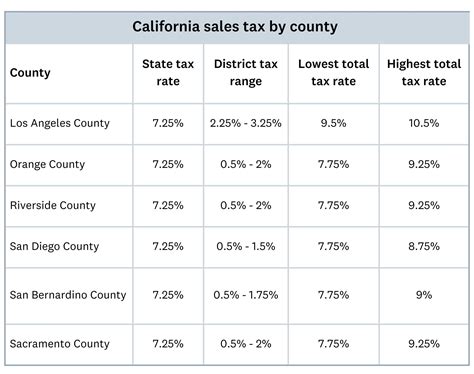

Sales tax in Orange County, like in many other parts of California, is a combination of state and local taxes. The state sales tax rate in California currently stands at 7.25%, which is applied uniformly across the state. However, it is the local or district sales tax rates that introduce variations and complexities within the county.

Orange County is divided into several sales tax districts, each with its own unique tax rate. These districts are established by the California Board of Equalization (BOE) and are based on geographic boundaries, often aligning with city or county borders. The local sales tax rates within these districts can vary significantly, ranging from 0% to 2.5%, on top of the state sales tax.

The Impact of Local Sales Tax Rates

The variation in local sales tax rates within Orange County can have a notable impact on businesses and consumers. For businesses, especially those with multiple locations or online sales, understanding and managing these rates is crucial for accurate pricing and tax compliance. The differences in tax rates can influence purchasing decisions and customer behavior, as consumers may opt to shop in areas with lower sales tax rates.

For instance, consider the city of Anaheim, which has a local sales tax rate of 1.25%, bringing the total sales tax to 8.5% (state tax plus local tax). On the other hand, the city of Irvine has a local sales tax rate of 1%, resulting in a total sales tax of 8.25%. While this might seem like a minor difference, it can significantly impact a business's bottom line, especially for high-volume retailers.

Furthermore, these variations in sales tax rates can also affect online businesses. With the rise of e-commerce, many businesses now cater to a wider audience, including customers from different sales tax districts within Orange County. Properly calculating and collecting the appropriate sales tax for each transaction is essential to avoid legal issues and maintain a positive relationship with the California Board of Equalization.

Sales Tax Distribution and Revenue Allocation

The sales tax collected in Orange County is not solely directed towards state and local governments. A portion of the sales tax revenue is also allocated to specific funds and initiatives within the county. For example, a portion of the sales tax revenue is dedicated to the Orange County Transportation Authority (OCTA), which oversees public transportation services throughout the county.

| Sales Tax District | Local Sales Tax Rate | Total Sales Tax |

|---|---|---|

| Anaheim | 1.25% | 8.5% |

| Irvine | 1% | 8.25% |

| Newport Beach | 2.5% | 9.75% |

| Santa Ana | 1% | 8.25% |

| Huntington Beach | 1.25% | 8.5% |

Additionally, certain sales tax revenues are directed towards specific projects and infrastructure development within the county. This could include funding for road improvements, public safety initiatives, or even cultural and recreational facilities. Understanding how sales tax revenue is distributed can provide insights into the economic priorities and development plans of Orange County.

Navigating the Complexities: Strategies for Businesses

For businesses operating in Orange County, navigating the complexities of the sales tax structure is crucial for success. Here are some strategies and best practices to consider:

1. Implement Advanced Tax Calculation Systems

Investing in robust tax calculation software or platforms can streamline the process of determining the correct sales tax rate for each transaction. These systems can automatically calculate the applicable tax based on the customer’s location, ensuring accuracy and compliance.

2. Stay Informed on Tax Rate Changes

Sales tax rates can change periodically due to various factors, including legislative decisions and economic conditions. Businesses should subscribe to notifications or alerts from the California Board of Equalization to stay updated on any changes. This proactive approach ensures that pricing and tax collection practices remain aligned with the latest regulations.

3. Offer Competitive Pricing Strategies

Understanding the sales tax rates in different districts within Orange County can influence pricing strategies. Businesses can consider offering competitive pricing in areas with higher sales tax rates to offset the additional tax burden on customers. This approach can enhance customer loyalty and drive sales in those specific regions.

4. Utilize Tax Exemption Certificates

Certain businesses or transactions may be eligible for sales tax exemptions. For instance, businesses that resell products or services, or those involved in manufacturing or wholesale, can apply for tax exemption certificates. These certificates allow businesses to purchase goods without paying sales tax, which can significantly impact their bottom line.

5. Collaborate with Tax Professionals

The complexities of sales tax compliance can be daunting, especially for businesses with multiple locations or online operations. Engaging the services of tax professionals or consultants who specialize in sales tax can provide valuable guidance. They can ensure accurate tax collection, filing, and reporting, helping businesses avoid penalties and legal issues.

Future Implications and Potential Changes

The sales tax structure in Orange County, like many other jurisdictions, is subject to potential changes and reforms. As economic conditions evolve and technological advancements continue to shape the business landscape, sales tax policies may adapt to meet new challenges and opportunities.

One potential area of reform is the introduction of a uniform sales tax rate across Orange County. While this would simplify tax calculations and compliance for businesses, it could also lead to debates about fairness and revenue distribution. Some districts might argue for a higher rate to fund specific initiatives, while others might prefer a lower rate to encourage economic growth.

Additionally, with the rise of e-commerce and remote work, the concept of destination-based sales tax is gaining traction. This model would base the sales tax on the customer's location rather than the seller's location, which could significantly impact online businesses operating within Orange County. Such a shift would require careful consideration and collaboration between state and local governments to ensure a fair and efficient tax system.

Conclusion

Understanding the intricacies of Orange County’s sales tax structure is a crucial aspect of doing business within the county. From variations in local tax rates to the distribution of revenue, sales tax impacts both businesses and consumers. By staying informed, implementing strategic tax management practices, and staying adaptable to potential future changes, businesses can navigate the complexities of sales tax and thrive in Orange County’s dynamic economy.

What is the current state sales tax rate in California?

+The current state sales tax rate in California is 7.25%.

How often do sales tax rates change in Orange County?

+Sales tax rates can change periodically, typically due to legislative decisions or economic factors. It is essential to stay updated through official channels like the California Board of Equalization.

Are there any sales tax exemptions for specific industries in Orange County?

+Yes, certain industries or transactions may be eligible for sales tax exemptions. Examples include businesses involved in reselling, manufacturing, or wholesale operations. It is advisable to consult with tax professionals or the California BOE for specific details.