Pay Maryland Income Tax Online

Maryland, like many states, offers its residents and businesses a convenient and secure way to pay their income taxes online. This service not only simplifies the tax payment process but also ensures compliance with state regulations. In this comprehensive guide, we will delve into the specifics of paying Maryland income tax online, exploring the various methods, benefits, and considerations associated with this process.

Understanding Maryland Income Tax

Before we dive into the online payment methods, let’s briefly understand the Maryland income tax system. Maryland imposes an income tax on residents and nonresidents who earn income within the state. The tax rates vary based on income brackets and are subject to annual adjustments. It’s essential to stay updated with the latest tax rates and regulations to ensure accurate filing and payment.

Maryland offers several payment options for income taxes, including online methods that we will explore in detail. These options provide flexibility and convenience, allowing taxpayers to choose the method that best suits their preferences and needs.

Online Payment Methods for Maryland Income Tax

Maryland has implemented multiple online payment systems to cater to different taxpayer preferences and needs. Here’s an overview of the primary methods:

1. Maryland Taxpayer Access Point (TAP)

The Maryland Taxpayer Access Point (TAP) is a comprehensive online portal that allows taxpayers to manage various aspects of their tax obligations. With TAP, individuals can:

- Register for a new account or log in to an existing one.

- Check their tax balance and payment history.

- Make secure online payments using a credit card, debit card, or electronic check.

- Access tax forms and instructions.

- Receive notifications and updates regarding their tax status.

To use TAP, taxpayers need to create an account by providing basic personal information and setting up a secure login. Once registered, the portal provides a user-friendly interface to manage tax-related tasks efficiently.

| Method | Credit/Debit Card | Electronic Check |

|---|---|---|

| TAP Payment Fee | 2.55% of the payment amount | Free |

2. Credit Card and Electronic Check Payments

Maryland also offers the flexibility to pay income taxes using credit cards and electronic checks (e-checks) directly on their official website. This method provides an alternative to TAP and is particularly useful for taxpayers who prefer a quick and straightforward payment process.

To make a payment using a credit card or e-check, taxpayers need to visit the official Maryland tax payment portal and follow the step-by-step instructions. The website provides a secure payment gateway, ensuring the protection of sensitive financial information.

| Method | Credit Card | Electronic Check |

|---|---|---|

| Payment Fee | 2.35% of the payment amount | Free |

3. Online Banking Payment

Many financial institutions and online banking platforms offer the option to pay Maryland income taxes directly from a taxpayer’s bank account. This method is convenient for those who regularly use online banking services and prefer a seamless integration with their existing financial management system.

To initiate an online banking payment, taxpayers need to log into their bank's website or mobile app and navigate to the bill pay section. They can then select the Maryland Comptroller of Maryland as the payee and enter the necessary details, such as the tax amount and payment due date.

It's important to note that the specific process may vary depending on the financial institution, so taxpayers should refer to their bank's instructions for a seamless payment experience.

Benefits of Online Payment

Paying Maryland income tax online offers several advantages to taxpayers:

- Convenience: Online payment methods eliminate the need for physical visits to tax offices or the hassle of mailing paper checks. Taxpayers can make payments from the comfort of their homes or offices at their convenience.

- Security: Maryland's online payment systems utilize advanced encryption technologies to protect taxpayers' financial information. This ensures that sensitive data remains secure during the payment process.

- Real-Time Updates: Online portals like TAP provide real-time updates on tax balances, payment history, and due dates. This helps taxpayers stay informed and avoid late payment penalties.

- Multiple Payment Options: Maryland offers a range of online payment methods, including credit cards, electronic checks, and online banking, allowing taxpayers to choose the option that aligns with their financial preferences.

- Fast Processing: Online payments are processed promptly, often within minutes. This ensures that taxpayers' payments are quickly applied to their tax obligations, reducing the risk of interest or penalty charges.

Considerations and Best Practices

While online payment methods offer numerous benefits, it’s essential to consider a few key points to ensure a smooth and secure process:

- Security Measures: When using online payment systems, taxpayers should always prioritize security. This includes using secure internet connections, avoiding public Wi-Fi for sensitive transactions, and regularly updating passwords and security settings.

- Payment Fees: Be aware of the payment fees associated with each method. While some methods are free, others may incur convenience or processing fees. Choose the payment option that best aligns with your budget and preferences.

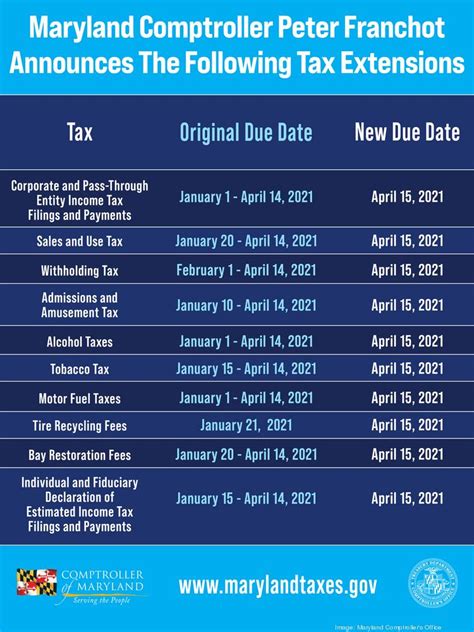

- Due Dates: Stay updated with the tax due dates to avoid late payment penalties. Online payment portals often provide reminders and notifications to help taxpayers stay on track.

- Record-Keeping: Maintain a record of your online payments, including transaction IDs and payment confirmations. These records can be useful for future reference and tax audits.

- Technical Support: If you encounter any issues or have questions during the online payment process, reach out to the Maryland Comptroller's Office for assistance. They can provide guidance and support to ensure a successful transaction.

Conclusion

Paying Maryland income tax online is a secure, convenient, and efficient way to fulfill your tax obligations. With multiple payment methods available, taxpayers can choose the option that best suits their needs and preferences. Whether through the Maryland Taxpayer Access Point (TAP), direct credit card or electronic check payments, or online banking, the online payment process simplifies tax management and ensures compliance with state regulations.

By understanding the various online payment options and following best practices, taxpayers can navigate the process with ease and peace of mind. Remember to stay informed about tax rates, due dates, and any updates to the online payment systems to ensure a seamless experience.

What are the tax rates for Maryland income tax?

+Maryland’s income tax rates are progressive, meaning they vary based on income brackets. As of the 2023 tax year, the rates range from 2% to 5.75%. It’s important to refer to the official Maryland tax tables or consult a tax professional for the most accurate and up-to-date information.

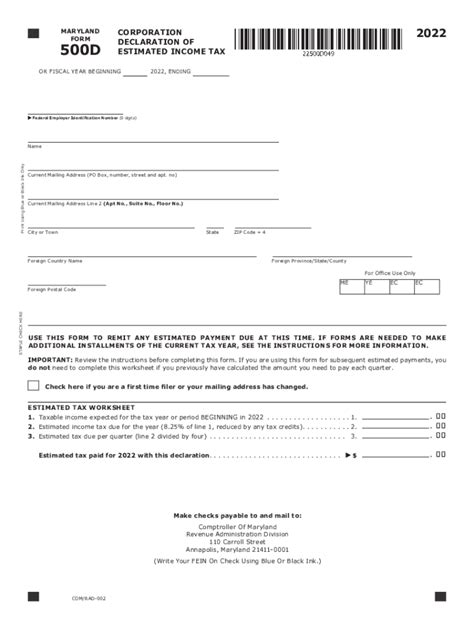

Can I pay my Maryland income tax in installments?

+Yes, Maryland offers an installment payment option for certain taxpayers. This option allows individuals to pay their tax liability in multiple installments over a specified period. To qualify and set up an installment plan, taxpayers need to meet certain criteria and apply through the Maryland Comptroller’s Office.

Are there any tax credits or deductions available in Maryland?

+Yes, Maryland offers a range of tax credits and deductions to eligible taxpayers. These include credits for education expenses, child and dependent care, and certain business-related deductions. It’s advisable to consult a tax professional or refer to the official Maryland tax guidelines to explore the available credits and deductions for which you may be eligible.