401K Tax Withdrawal Calculator

Maximizing Your Retirement Savings: Unraveling the 401(k) Tax Withdrawal Calculator

In the complex world of retirement planning, understanding the intricacies of your 401(k) is crucial. One of the key aspects to navigate is the tax implications when withdrawing funds. This is where the 401(k) Tax Withdrawal Calculator comes into play, offering a powerful tool to optimize your financial strategy. Let's delve into the world of this calculator, exploring its features, benefits, and how it can empower you to make informed decisions about your retirement savings.

The Importance of Tax-Efficient Withdrawals

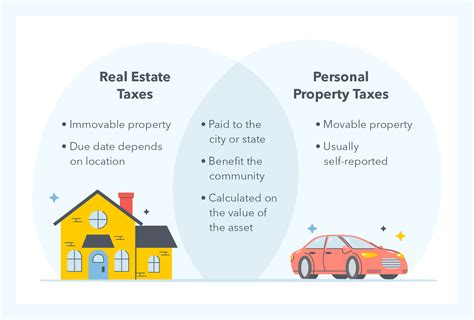

When it comes to retirement planning, taxes play a significant role. The 401(k) is a popular retirement savings vehicle, offering tax advantages during the contribution phase. However, when it's time to withdraw funds, the tax landscape changes, and understanding these implications becomes essential.

Traditional 401(k) plans are tax-deferred, meaning contributions are made with pre-tax dollars, and taxes are deferred until withdrawal. This strategy allows your investments to grow tax-free, but upon withdrawal, the entire distribution, including both contributions and earnings, becomes taxable. This is where the 401(k) Tax Withdrawal Calculator steps in to provide clarity and guidance.

Unveiling the 401(k) Tax Withdrawal Calculator

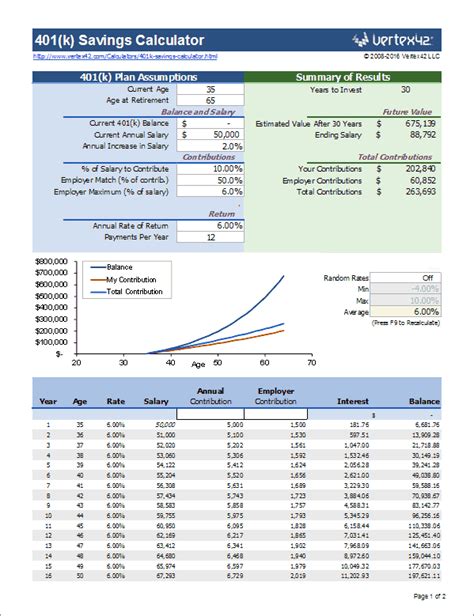

The 401(k) Tax Withdrawal Calculator is an advanced online tool designed to estimate the tax impact of withdrawing funds from your 401(k) account. It takes into account various factors, including your income, contribution history, and the tax brackets applicable to your situation.

By inputting your specific details, the calculator provides a personalized estimate of the taxes you'll owe on your 401(k) withdrawals. This information is invaluable, as it helps you plan and optimize your financial strategy, ensuring you're prepared for the tax implications of your retirement income.

Key Features and Benefits

The 401(k) Tax Withdrawal Calculator offers a range of features that make it an indispensable tool for retirement planning:

- Personalized Estimates: By inputting your unique circumstances, the calculator provides tailored estimates, ensuring accuracy and relevance to your financial situation.

- Real-Time Tax Calculations: It utilizes up-to-date tax brackets and regulations, ensuring you're aware of the current tax landscape and any potential changes that may impact your withdrawals.

- Scenario Analysis: The calculator allows you to explore different withdrawal scenarios, helping you understand the tax implications of various strategies and making informed decisions about your retirement income.

- Comparison Tools: Some advanced calculators offer comparative analysis, allowing you to see how different withdrawal amounts and timing affect your tax liability. This feature is particularly useful when considering early withdrawals or partial distributions.

- Educational Insights: Beyond calculations, the calculator often provides educational resources and tips, helping you understand the tax rules and strategies to minimize your tax burden.

How to Use the 401(k) Tax Withdrawal Calculator

Using the 401(k) Tax Withdrawal Calculator is a straightforward process. Here's a step-by-step guide:

- Access the Calculator: Visit a reputable financial website or use a dedicated calculator tool provided by your 401(k) administrator or financial institution.

- Gather Information: Collect the necessary details, including your current income, contribution history, and expected withdrawal amount. Having this information ready ensures a smooth calculation process.

- Input Data: Enter the required details into the calculator, being as accurate as possible. This includes your age, marital status, income, and the desired withdrawal amount.

- Review Results: The calculator will generate an estimate of your tax liability based on the information provided. It may also offer additional insights and recommendations, such as the most tax-efficient withdrawal strategy for your situation.

- Analyze and Adjust: Evaluate the results and consider the impact on your overall financial plan. If needed, adjust your withdrawal amount or timing to optimize your tax situation.

- Seek Professional Advice: While the calculator provides valuable estimates, it's always beneficial to consult a financial advisor or tax professional for personalized guidance based on your unique circumstances.

Real-World Examples and Case Studies

Let's explore some real-life scenarios to understand how the 401(k) Tax Withdrawal Calculator can make a difference:

Scenario 1: Early Withdrawal Considerations

Imagine John, a 55-year-old with a substantial 401(k) balance, is considering an early withdrawal to fund a business venture. By using the calculator, John discovers that an early withdrawal would result in a significant tax liability, potentially reducing his net income. This insight prompts him to explore alternative funding options and postpone the withdrawal until he reaches the traditional retirement age.

Scenario 2: Retirement Income Planning

Sarah, a 62-year-old planning her retirement, uses the calculator to estimate the tax impact of her desired annual withdrawals. The calculator helps her understand the optimal withdrawal strategy, ensuring she maximizes her retirement income while minimizing tax obligations. With this knowledge, Sarah can make informed decisions about her retirement spending and lifestyle.

Future Implications and Strategies

The 401(k) Tax Withdrawal Calculator is not just a tool for the present; it also provides insights into future tax planning. By understanding the tax implications of your 401(k) withdrawals, you can:

- Optimize your retirement income strategy, ensuring a comfortable and sustainable lifestyle.

- Explore tax-efficient withdrawal options, such as Roth conversions or partial withdrawals, to minimize your overall tax burden.

- Make informed decisions about when to begin withdrawals, considering factors like income tax brackets and potential tax law changes.

- Consider the impact of early withdrawals on your Social Security benefits and how to coordinate them for maximum advantage.

As you navigate the complex world of retirement planning, the 401(k) Tax Withdrawal Calculator emerges as a valuable ally. By leveraging its capabilities, you can make confident decisions, optimize your tax situation, and ensure a secure financial future.

FAQs

What happens if I make an early withdrawal from my 401(k)?

+

Early withdrawals from a traditional 401(k) before age 59½ may result in a 10% early withdrawal penalty, in addition to ordinary income taxes. The calculator can help estimate the total tax liability and potential financial impact.

Are there any tax-efficient strategies for 401(k) withdrawals?

+

Yes, strategies like Roth conversions or partial withdrawals can help minimize tax obligations. The calculator can assist in evaluating the tax impact of these strategies and determining the most suitable approach for your situation.

Can I use the calculator for retirement income planning?

+

Absolutely! The calculator is an excellent tool for retirement income planning. It helps estimate the tax liability of your desired withdrawal amounts, ensuring you plan for a sustainable retirement income while considering tax obligations.

How often should I use the 401(k) Tax Withdrawal Calculator?

+

It’s recommended to use the calculator periodically, especially when significant life changes occur, such as changes in income, retirement plans, or tax laws. Regular updates ensure your financial strategy remains aligned with your goals and the current tax landscape.

Can I trust the calculator’s estimates for my specific situation?

+

The calculator provides accurate estimates based on the information you input. However, for a comprehensive understanding of your unique situation, it’s advisable to consult a financial advisor or tax professional who can offer personalized guidance tailored to your circumstances.