Unfiled Tax Returns

Tax season is a critical time for individuals and businesses alike, as it's the period when financial obligations to the government are settled. However, for various reasons, some individuals may find themselves with unfiled tax returns, which can lead to a range of complications and consequences.

In this comprehensive guide, we will delve into the world of unfiled tax returns, exploring the reasons behind this scenario, the potential consequences, and most importantly, the steps you can take to rectify the situation and get back on track with your tax obligations.

Whether you're an individual who has missed a filing deadline or a business owner facing a more complex tax situation, understanding the implications and taking proactive measures is essential to avoid further complications and ensure compliance with tax regulations.

Understanding Unfiled Tax Returns

An unfiled tax return refers to a situation where an individual or entity fails to submit their required tax forms to the relevant tax authorities by the specified deadline. This could be for various reasons, such as oversight, complexity of the tax situation, or even intentional avoidance.

The consequences of having unfiled tax returns can be severe and far-reaching, impacting both personal finances and business operations. It's important to address this issue promptly to minimize potential penalties and ensure compliance with tax laws.

Reasons for Unfiled Tax Returns

There are several common reasons why individuals or businesses may find themselves with unfiled tax returns. Understanding these reasons can help identify the root cause and develop an effective strategy to resolve the issue.

- Lack of Organization and Planning: Many individuals and small businesses struggle with proper record-keeping and tax planning. Missing important documents, not understanding the filing requirements, or simply forgetting the deadline can lead to unfiled returns.

- Complexity of Tax Situation: For some, the tax system can be incredibly complex, especially for those with unique financial circumstances or multiple sources of income. Navigating complex tax laws and regulations can be challenging, leading to delays or errors in filing.

- Financial Difficulties: Financial struggles can make it difficult for individuals and businesses to prioritize tax obligations. When facing financial hardships, some may intentionally delay filing, hoping to resolve their financial issues before addressing their tax returns.

- Fear of Penalties: In some cases, individuals may avoid filing their tax returns due to fear of incurring penalties or having to pay substantial taxes. However, this approach often leads to more severe consequences down the line.

Consequences of Unfiled Tax Returns

The consequences of unfiled tax returns can be significant and can affect various aspects of your financial life. Here are some key implications to consider:

- Penalties and Interest: Failing to file your tax return by the deadline can result in substantial penalties and interest charges. These financial burdens can quickly add up and create a significant financial strain.

- Audit Risks: Having unfiled tax returns increases the likelihood of an IRS audit. Tax authorities may investigate your financial records to ensure compliance, which can be a time-consuming and stressful process.

- Legal Consequences: In severe cases, intentional failure to file tax returns can lead to legal repercussions, including fines and even criminal charges. It's crucial to address this issue promptly to avoid legal complications.

- Impact on Credit Score: Unpaid taxes and associated penalties can negatively impact your credit score. This can affect your ability to secure loans, mortgages, or even obtain certain job opportunities.

- Business Operations: For businesses, unfiled tax returns can disrupt operations and hinder growth. It may lead to loss of reputation, strained relationships with clients and partners, and even legal action from tax authorities.

Rectifying Unfiled Tax Returns

If you find yourself with unfiled tax returns, it's essential to take immediate action to rectify the situation and mitigate potential consequences. Here's a step-by-step guide to help you get back on track:

Step 1: Assess the Situation

Start by evaluating the extent of your unfiled tax returns. Determine how many years or tax periods are affected and identify the reasons behind the non-filing. Understanding the root cause will help you develop an effective strategy for resolution.

Step 2: Gather Relevant Documentation

Collect all necessary documents and records required for filing your tax returns. This may include pay stubs, investment statements, business receipts, and any other relevant financial information. Ensure you have access to all the data needed to complete your returns accurately.

Step 3: Seek Professional Assistance

Consider consulting a tax professional or Certified Public Accountant (CPA) who specializes in tax resolution. They can provide expert guidance, assist with the filing process, and help you navigate any complex tax situations. Their expertise can be invaluable in ensuring compliance and minimizing penalties.

Step 4: File Back Taxes

Once you have gathered the necessary documentation and sought professional advice (if needed), it's time to file your back taxes. Use the appropriate tax forms and ensure you complete them accurately. If you have multiple years of unfiled returns, prioritize filing the most recent tax period first.

| Tax Form | Description |

|---|---|

| Form 1040 | Standard tax form for individuals |

| Form 1040-ES | Estimated tax for individuals |

| Form 1120 | Corporate income tax return |

| Form 1065 | Partnership tax return |

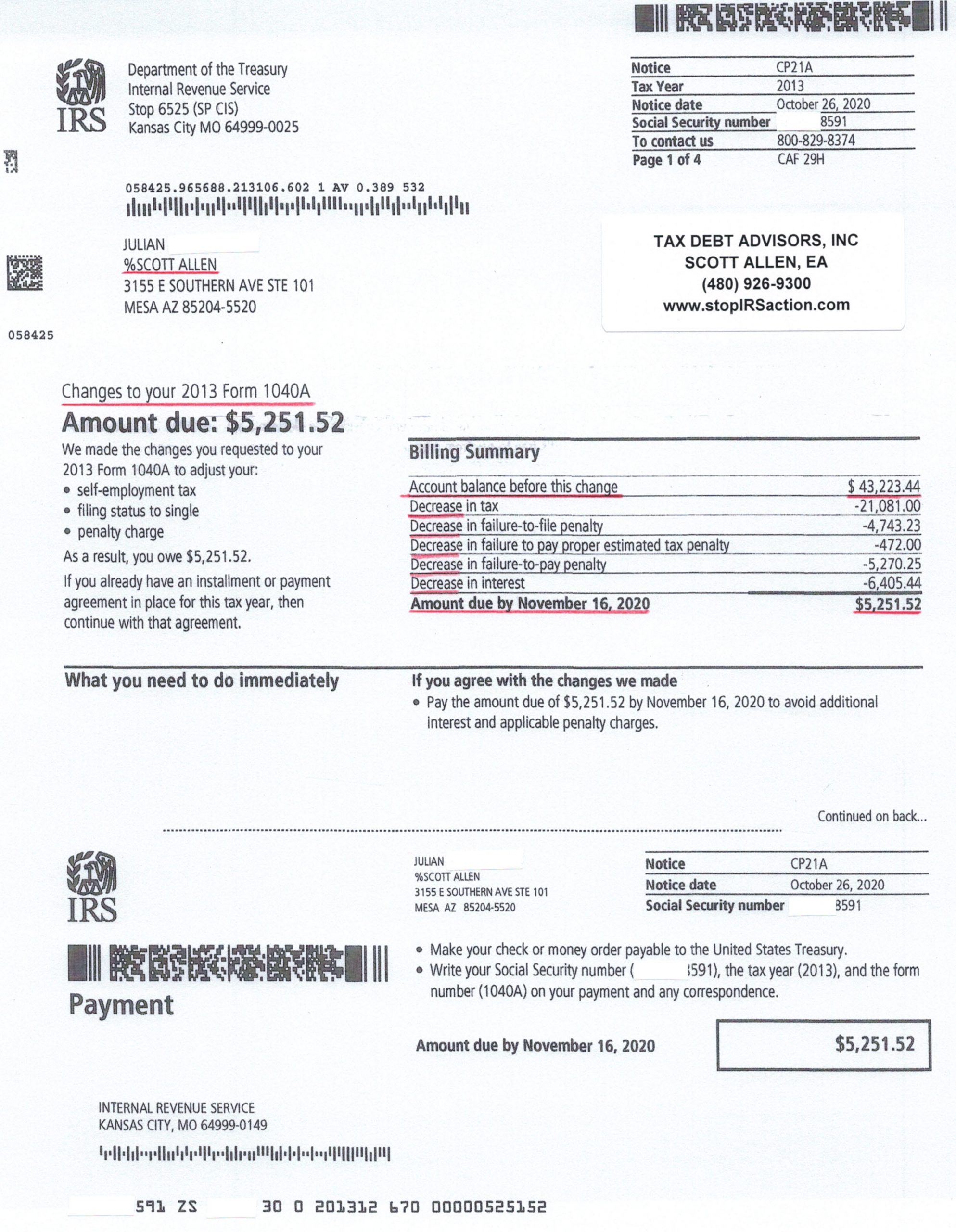

Step 5: Address Any Owed Taxes

If you owe taxes, it's important to address this promptly. Develop a repayment plan or consider setting up a payment arrangement with the tax authorities. Explore options such as installment agreements or offer in compromise to manage the repayment process effectively.

Step 6: Stay Informed and Proactive

Stay updated on tax laws and regulations, especially any changes that may impact your tax obligations. Being proactive in understanding and complying with tax requirements can help prevent future issues with unfiled returns.

Step 7: Maintain Proper Record-Keeping

Implement effective record-keeping practices to avoid future instances of unfiled tax returns. Keep all relevant financial documents organized and easily accessible. Consider using accounting software or hiring a professional to assist with record-keeping and tax planning.

Conclusion: Embracing Tax Compliance

Unfiled tax returns can be a challenging situation, but with the right approach and professional guidance, you can rectify the issue and ensure compliance with tax laws. Taking proactive steps to address unfiled returns not only helps avoid penalties and legal consequences but also demonstrates your commitment to financial responsibility.

By understanding the reasons behind unfiled tax returns and implementing strategies to resolve them, individuals and businesses can regain control of their financial well-being and avoid the pitfalls associated with non-compliance. Remember, tax obligations are an essential part of financial management, and seeking assistance from tax professionals can make the process more manageable and effective.

What are the penalties for unfiled tax returns?

+Penalties for unfiled tax returns can vary depending on the jurisdiction and the circumstances. Generally, you may face a failure-to-file penalty, which is a percentage of the unpaid tax amount. Additionally, interest may accrue on the outstanding tax liability. In some cases, there may also be penalties for late payment.

Can I file my back taxes on my own without professional help?

+It is possible to file your back taxes on your own, especially if your tax situation is relatively straightforward. However, tax laws can be complex, and seeking professional assistance from a tax expert or CPA can provide valuable guidance and ensure accuracy in your filings.

How long do I have to file my back taxes without incurring penalties?

+The time limit for filing back taxes without penalties varies by jurisdiction. In the United States, for example, the IRS generally allows you to file back taxes for the previous three tax years without facing penalties. However, it’s best to consult with a tax professional to understand the specific time limits and requirements in your region.