Do Churches Pay Taxes On Property

The taxation of church property is a complex and multifaceted topic, with varying regulations and practices across different countries and jurisdictions. This article aims to provide an in-depth analysis of the tax status of church properties, exploring the legal frameworks, exemptions, and implications for religious organizations worldwide.

Understanding the Tax Landscape for Religious Entities

Religious organizations, including churches, temples, mosques, and synagogues, often enjoy a unique position when it comes to taxation. The tax treatment of their properties can significantly impact their financial stability and ability to serve their communities. In this section, we will delve into the fundamental principles that govern the taxation of church properties.

The Historical Perspective

The concept of tax exemptions for religious entities is deeply rooted in history. Many countries have long-standing traditions of granting special status to churches and other religious institutions. These exemptions can be traced back to the recognition of the significant role that religion has played in society and the desire to support and preserve religious freedom.

For instance, in the United States, the First Amendment of the Constitution establishes a separation of church and state, and this principle has been interpreted to provide certain tax advantages to religious organizations. Similarly, in many European countries, the historical influence of Christianity has resulted in favorable tax policies for churches.

The Legal Framework

The tax status of church properties is governed by a combination of national and local laws, as well as international agreements and conventions. These legal frameworks vary widely, and it is essential to understand the specific regulations applicable to a particular jurisdiction.

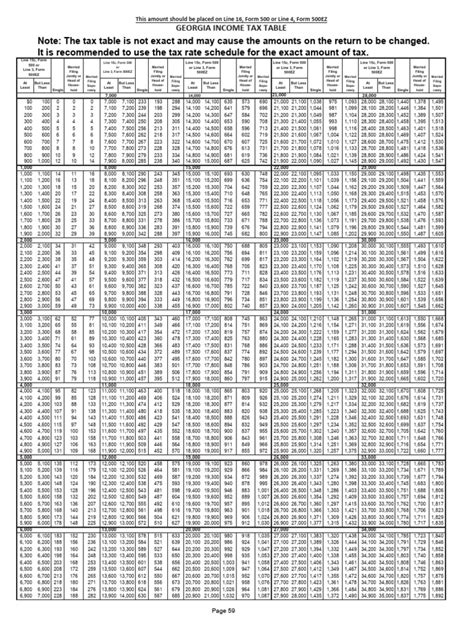

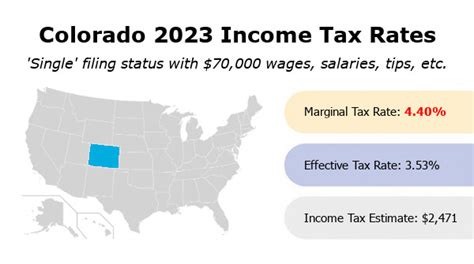

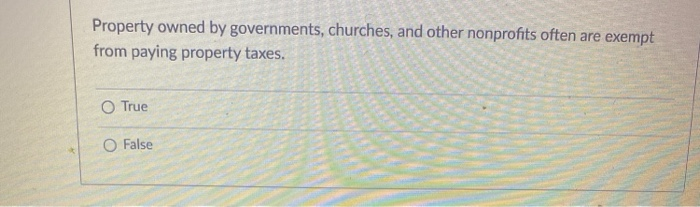

In some countries, religious organizations are granted blanket exemptions from all forms of property taxes. This means that the land, buildings, and other assets owned by the church are not subject to regular taxation. For example, in many U.S. states, churches are exempt from paying property taxes, ensuring that their financial resources can be dedicated to religious and charitable activities.

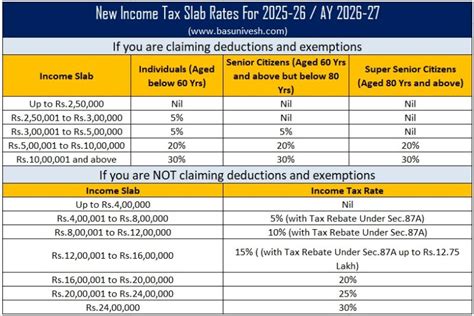

However, the situation becomes more complex when considering other types of taxes. Income taxes, sales taxes, and value-added taxes (VAT) may still apply to certain activities and transactions conducted by religious entities. The line between taxable and non-taxable activities can be fine, and it often requires careful interpretation of the law and guidance from tax authorities.

International Perspectives

The tax treatment of church properties also varies significantly across different countries. While some nations have a tradition of granting broad exemptions, others take a more nuanced approach. For instance, in certain European countries, churches may be exempt from property taxes, but they are subject to other forms of taxation, such as a special religious tax levied on their members.

In addition, international agreements and treaties can further complicate the tax landscape for religious organizations. For example, the Double Taxation Convention, an agreement between two countries to prevent double taxation of income, may have specific provisions for religious entities. These conventions can impact the tax status of church properties when the church operates across international borders.

The Benefits and Challenges of Tax Exemptions

The tax exemptions granted to church properties can provide significant advantages to religious organizations, but they also come with certain challenges and responsibilities.

Financial Benefits

One of the most apparent benefits of tax exemptions is the financial savings for religious entities. By not having to pay property taxes, churches can allocate more resources to their core mission, whether it is providing spiritual guidance, offering social services, or supporting community development projects.

For example, a church in a large urban area with valuable real estate holdings can save substantial amounts in property taxes annually. These savings can be directed towards funding charitable initiatives, improving facilities, or supporting mission trips and outreach programs.

Challenges and Responsibilities

While tax exemptions offer financial advantages, they also come with certain obligations and challenges. Religious organizations must ensure they meet the criteria set by the tax authorities to maintain their exempt status.

For instance, in the United States, churches and other religious organizations must comply with the Internal Revenue Code to retain their tax-exempt status. This includes maintaining proper accounting practices, filing annual information returns, and avoiding certain political and lobbying activities.

Additionally, tax-exempt status may limit the church's ability to engage in certain commercial activities. While some income-generating activities may be permissible, others could result in the loss of tax-exempt status. This can be a delicate balance, as churches often need to generate revenue to sustain their operations.

Case Studies: Examining Real-World Examples

To better understand the practical implications of tax exemptions for church properties, let’s explore some real-world case studies.

The Catholic Church in Italy

In Italy, the Catholic Church enjoys a unique tax status. While it is exempt from paying property taxes on its religious buildings, the Church is also subject to a special agreement with the Italian government known as the Concordat.

Under this agreement, the Italian government provides financial support to the Catholic Church, and in return, the Church agrees to certain restrictions on its activities. This includes a commitment to remain non-political and to provide religious services to the community.

The Church of England

The Church of England, also known as the Anglican Church, is one of the largest religious institutions in the United Kingdom. While it does not enjoy blanket tax exemptions, it has a unique relationship with the British government.

The Church of England receives an annual grant-in-aid from the government, which is used to support its activities and maintain its historic buildings. In exchange, the Church provides religious services and pastoral care to the nation. This arrangement ensures that the Church remains financially stable while serving its community.

The Future of Church Property Taxation

As society evolves and the role of religion continues to adapt, the tax status of church properties is likely to undergo changes and reforms.

Trends and Emerging Issues

In recent years, there has been increasing scrutiny of the tax exemptions granted to religious organizations, particularly in the context of growing secularization and changing societal values.

Some countries have started re-evaluating their tax policies, considering the potential impact on government revenues and the principle of fairness. For instance, certain European nations have debated whether churches should contribute more to the public purse, especially in times of economic hardship.

Potential Reforms and Recommendations

As the debate around church property taxation continues, several potential reforms and recommendations have emerged.

- Modified Exemptions: Some experts propose modifying the current tax exemptions to ensure a more balanced approach. This could involve limiting exemptions to specific types of properties or activities, or introducing a fairer distribution of tax burdens.

- Voluntary Contributions: Another suggestion is to encourage religious organizations to make voluntary contributions to the government, either as a replacement for taxes or as a way to support public services.

- Clarification of Tax Laws: Many religious entities face challenges due to the complexity and ambiguity of tax laws. Simplifying and clarifying these laws could help churches better understand their tax obligations and maintain compliance.

Conclusion

The taxation of church properties is a multifaceted issue that touches on religious freedom, societal values, and economic considerations. While tax exemptions have been a longstanding tradition, the evolving landscape of religion and society may prompt further discussions and reforms.

As we navigate these complex issues, it is crucial to strike a balance between supporting religious organizations and ensuring fairness in tax policies. The future of church property taxation will likely involve a careful examination of these principles, guided by a deep understanding of the unique role that religious entities play in our communities.

Are all churches exempt from property taxes worldwide?

+No, the tax status of churches varies widely across different countries and jurisdictions. While some nations grant blanket exemptions, others have more nuanced approaches, subjecting churches to certain types of taxation.

What are the main benefits of tax exemptions for churches?

+Tax exemptions allow churches to allocate more financial resources towards their core mission, whether it’s providing religious services, offering social support, or engaging in community development.

Do tax-exempt churches have any obligations or restrictions?

+Yes, to maintain their tax-exempt status, churches must comply with specific legal requirements, such as proper accounting practices and avoiding certain political activities. They may also have restrictions on their commercial activities.